Transurban Group

.JPG)

TCL Details

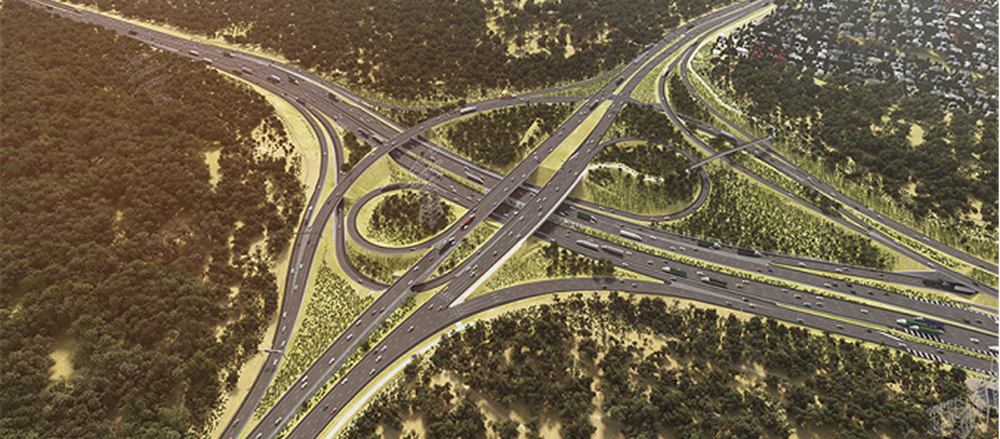

Transurban Group (ASX: TCL) has announced that it has reached financial close on the US$475 million 395 Express Lanes project. The project will extend the 95 Express Lanes for 13 kilometers north to the Washington DC border, converting two existing high-occupancy vehicle lanes to three high-occupancy toll lanes to provide customers with direct access to Washington DC. The project was approved in February 2017 by the Virginia Department of Transportation, and construction was commenced in July 2017 and is expected to be complete in late 2019. Debt financing for the project includes approximately US$233 million in private activity bonds (par amount) and a US$45 million loan from the Virginia Transportation Infrastructure Bank. Moreover, the 395 Express Lanes project will extend the benefits customers have experienced on the 95 Express Lanes and provide much needed congestion relief in the I-395 corridor. Further, the company has announced that Transurban Finance Company Pty Ltd (TFC) has obtained consent to amend certain provisions of its corporate debt Security Trust Deed. Given the increasing spend on infrastructure and robust project pipeline,we maintain a “Buy” recommendation at the current market price of $11.59

TCL Daily chart; (Source: Thomson Reuters)

Sydney Airport Holdings Pty Ltd

SYD Details

During June 2017, Sydney Airport has reported 9.7% growth in its International traffic versus the prior corresponding period (pcp), and represents strongest monthly result this year. Domestic traffic also grew strongly at 3.6% above the pcp, contributing to overall traffic growth of 5.8% for the month. Moreover, International and domestic traffic continues to be driven by higher load factors and larger aircraft. The company’s international markets continue to perform well, particularly to China, and follows the Open Skies agreement between the two countries in December 2016. Further, Sydney Airport is well placed to benefit from continued passenger growth from China, with a recent study showing that Australia has risen to the fourth most desirable leisure destination for Chinese nationals to visit in coming years. For the six months ended 30 June 2017, company reported a strong international growth of 7.7% as compared to the pcp, and will report financial results associated with the half year on 22 August 2017. We maintain an “Expensive” recommendation at the current market price of $6.83

SYD Daily chart; (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.JPG)

Please wait processing your request...

Please wait processing your request...