AVITA Medical Ltd

Addition to S&P/ASX 300 Index:AVITA Medical Ltd (ASX: AVH) develops, manufactures and distributes innovative products for regenerative medicine and respiratory markets. It has a market capitalisation of ~A$1.1 Bn as on 2nd October 2019. AVH recently announced that Mitsubishi UFJ Financial Group, Inc. has ceased to become a substantial holder in the company on 25th September 2019. It also issued 1,230,000 and 1,196,250 unlisted options involving an exercise price of $0.59 per share and $0.082 per share, respectively. The unlisted options have been issued as part of the employees’ long-term incentive plan. In another release on ASX, the company announced that its American Depositary Shares has approved to list on the Nasdaq Capital Market, under the ticker symbol “RCEL”. This step will build the established ASX shareholder base and provides broader access to investors in the United States and worldwide.

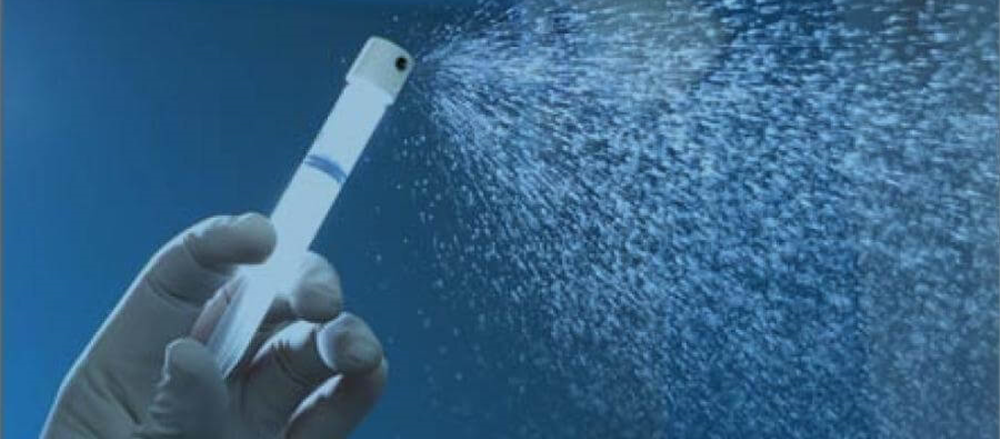

Besides this, the company updated the market with the data which was published in Aesthetic Plastic Surgery by the Department of Plastic Surgery at Peking Union Medical College Hospital exploring the use of the RECELL® Autologous Cell Harvesting Device in combination with dermabrasion to treat facial acne scars. It added that the retrospective study analyzes the healing time as well as the rate of postoperative complications of 78 patients with acne scars treated using dermabrasion with and without the RECELL System, revealing a statistically significant difference in healing time (P\ 0.001) between the two treatment regimens.

In another update, the company announced that it has received approval for its Investigational Device Exemption application to conduct a pivotal trial evaluating the safety and effectiveness of RECELL® Autologous Cell Harvesting Device from the US FDA. Recently, the company announced that it has appointed Ms Tamara Barr of Mertons Corporate Services Pty Ltd as Joint Company Secretary of the company after the resignation of Ms Katherine Goland, of Mertons, from this position. The company further stated that Mr Mark Licciardo, also of Mertons, continues to act as Joint Company Secretary of AVH.

As per the release dated 6th September 2019, the company announced that it would be added to S&P/ASX 300 index, which will be effective upon the market open on 23rd September 2019. It added that inclusion to S&P/ASX 300 index reflects increased market capitalization and trading liquidity the company has achieved this year while advancing the development and commercialization of its innovative regenerative medicine technology platform.The company stated that operations for 1H of the fiscal year ended 30 June 2019 were mainly focused on preparation for the January 2019 U.S. market launch of the RECELL System. The sales and marketing expenses for the year ended 30 June 2019 amounted to $17,576,754, reflecting a rise of 97% over the $8,936,441 recognized during fiscal 2018. This increase was mainly because of the recruitment, hiring and training of the U.S. sales force and the associated product launch sales and marketing materials and activities.

Revenues and Expenses (Source: Company Reports)

What to Expect:The company stated that as a result of the U.S. national launch of RECELL System in January 2019, and the expansion of research and development, operating expenses would rise in the future. These expenses are anticipated to be partially offset by increased sales of goods and income under the BARDA (Biomedical Advanced Research and Development Authority) contract. As per the release dated 31st July 2019, for fiscal 2020, the company anticipates pivotal trials commencing to establish the safety and effectiveness of the RECELL System for early intervention treatment of pediatric scald wounds and for trauma/soft tissue repair.

Stock Recommendation:For fiscal 2021, the company expects to commence a pivotal study of RECELL System for the treatment of vitiligo and anticipates, in collaboration with COSMOTEC, an M3 Group company, securing marketing approval and reimbursement of RECELL System in Japan. The current ratio of the company stood at 5.50x in FY19 as compared to the industry median of 4.43x. This reflects that AVH is in a decent position to meet its short-term obligations as compared to the broader industry. Currently, the stock is trading closer to its 52-week high levels of $0.630. Therefore, considering the above-stated facts and current trading levels, we give a “Hold” recommendation on the stock at the current market price of A$0.560 per share (down 4.274% on 2 October 2019).

Healius Limited

Positive Momentum in All Three Divisions:Healius Limited (ASX: HLS) is a service company for medical, para-medical and related services. It also acts as a day surgery operator and has a market capitalisation of ~A$2.02 Bn as on 2nd October 2019. Recently, the company announced that Sally Evans has made a change to the holdings in the company by acquiring 15,000 fully paid ordinary shares at the price of $3.259993 per share on 13th September 2019. The company recently announced that National Australia Bank Limited and its associated entities became an initial substantial holder in the company with the voting power of 5.418% on 22nd August 2019. When it comes to financial performance, the company reported underlying EBIT amounting to $167.3 Mn in FY19 as compared to $ 160.1 Mn in FY18. This increase reflects positive momentum in all three divisions. It added that Imaging and Medical Centres has recorded double-digit growth for the year, while rebounded strongly in 2H, with a rise of 46% post subdued result in 1H. With respect to emerging businesses, Dental revenue amounted to $35.2 Mn with a rise of 4.8% in FY19. The company further stated that the division is launching an innovative fixed?price general dentistry offering in order to meet the growing need in the community.

.png)

Financial Summary (Source: Company Reports)

Future Prospects:The company is expecting underlying NPAT for FY20 to be higher than A$93.2 Mn of FY19, which is subject to market conditions as well as any changes occurring from the implementation of AASB 16 on leases. The company stated that strategic initiatives and organisational redesign are being undertaken, which targets to deliver a business characterised by clinical excellence, simple consumer-friendly access as well as cost?efficiency in a community setting. This would support consumer well?being along with disease prevention and early intervention, core to the future of good healthcare in Australia

Stock Recommendation:The Board of the company has declared a final dividend amounting to 3.4 cps. Together with an interim dividend of 3.8 cents per share, the full-year dividend came in at 7.2 cents per share. The net margin of the company stood at 3.1% in FY19, reflecting YoY growth of 2.9%, which represents that the company has improved its capability to convert its top line into the bottom-line. On the stock’s performance front, it produced returns of 7.64% and 19.56% in the time frame of three months and six months, respectively. Currently, the stock is trading closer to its 52-week high levels of $3.315 with PE multiple of 35.22x and an annual dividend yield of 2.22%. Hence, considering the above-stated facts and current trading levels, we give a “Hold” recommendation on the stock at the current market price of A$3.120 per share (down 3.704% on 2 October 2019).

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

Please wait processing your request...

Please wait processing your request...