1.1: Company Overview: Treasury Wine Estates Limited (ASX: TWE) is a vertically integrated wine business that encompasses three principal activities: grape growing and sourcing, wine production, and wine marketing, sales, and distribution. With a diverse portfolio of premium brands, TWE operates globally, catering to a wide range of consumer preferences. Its three divisions are Penfolds, Treasury Premium Brands, and Treasury Americas. Kalkine’s Investor Report covers the Investment Highlights, Management Insights, Key Financial Metrics, Risks, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

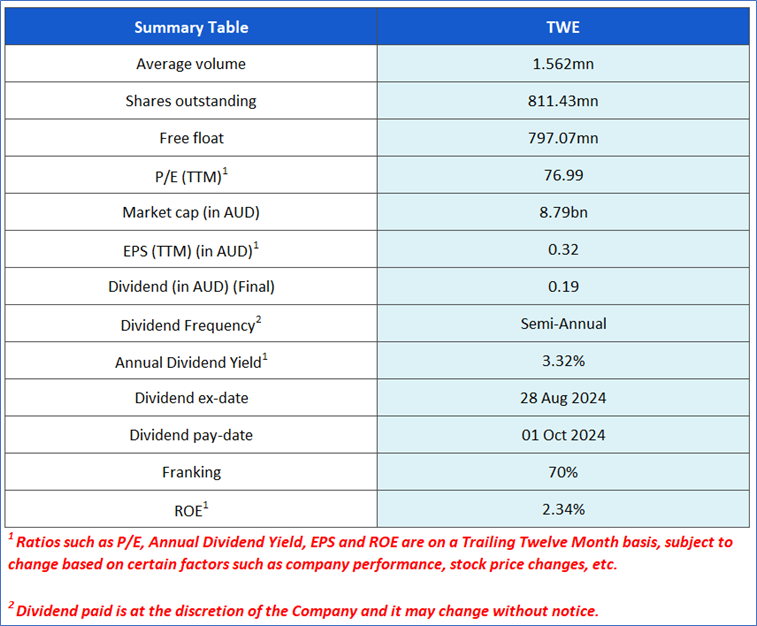

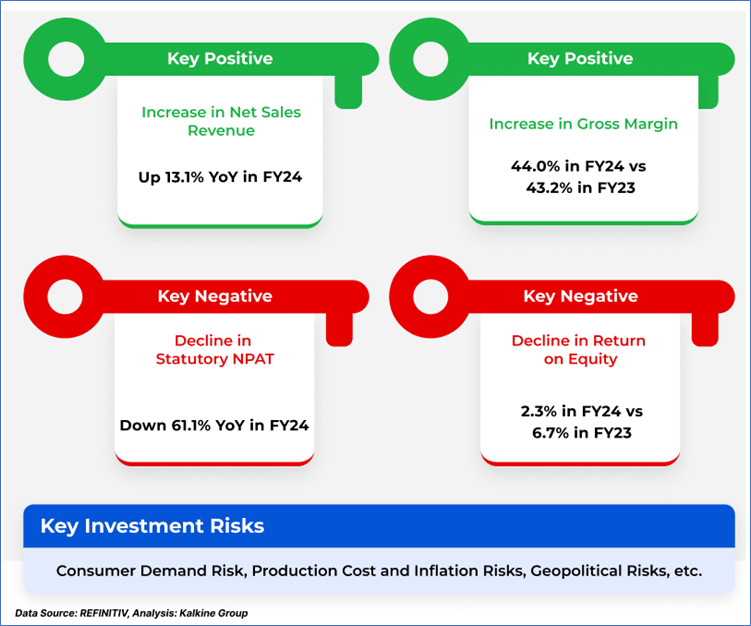

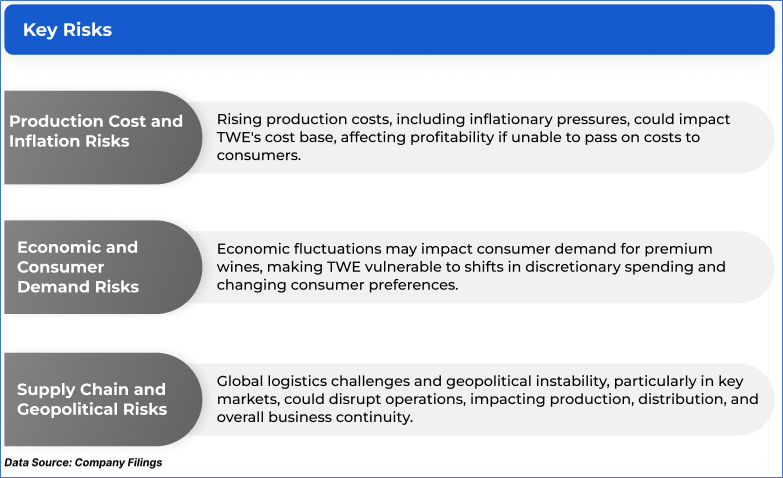

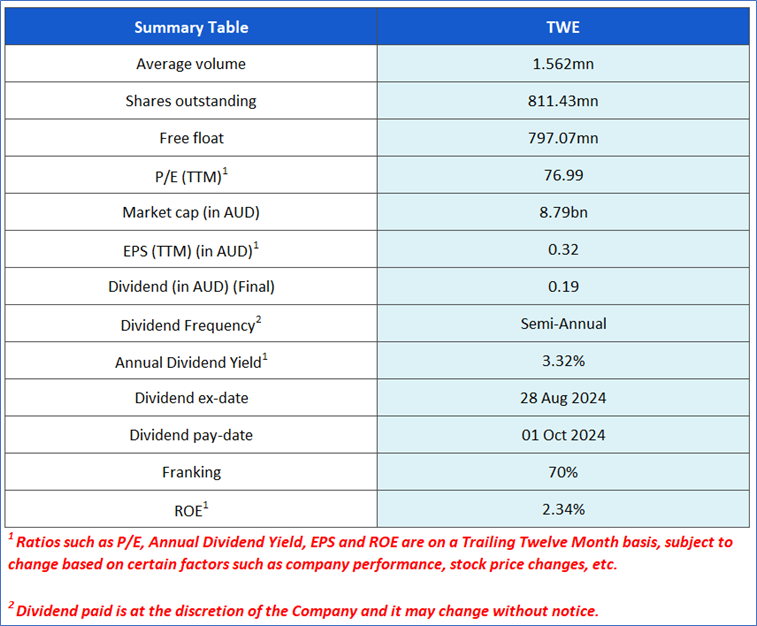

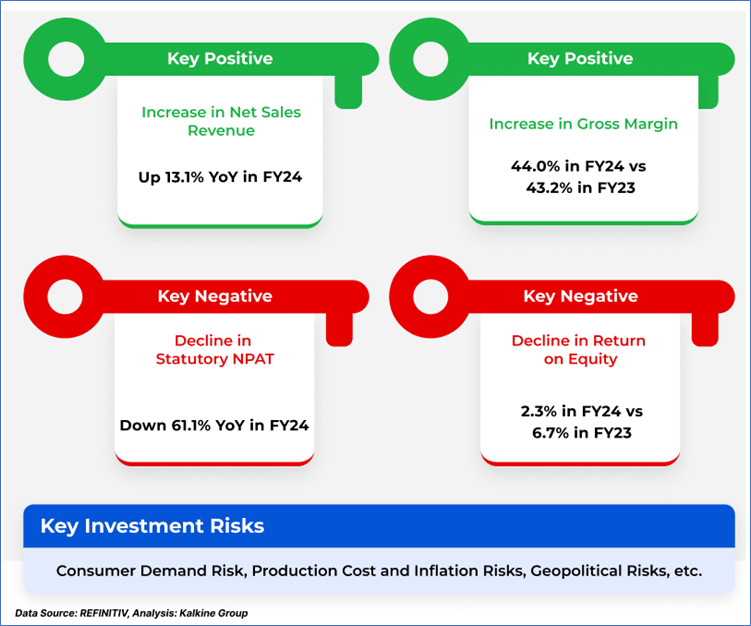

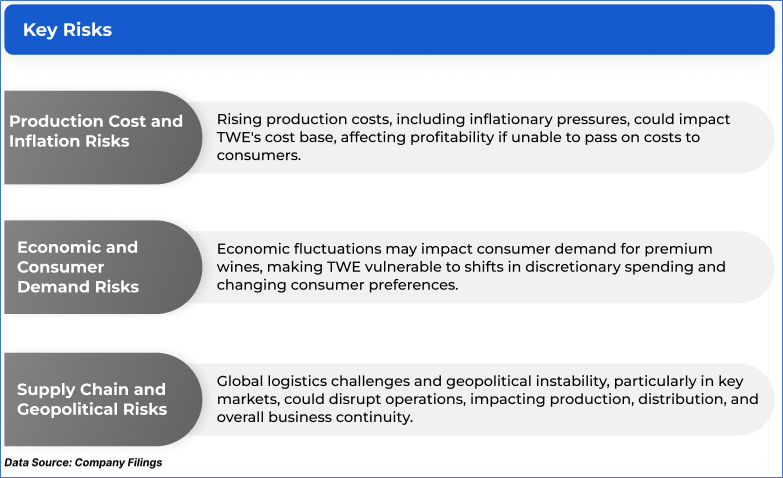

1.2: The Key Positives, Negatives, Investment Highlights, and Risks:

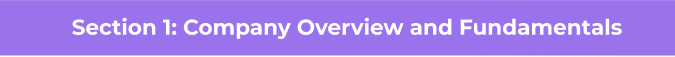

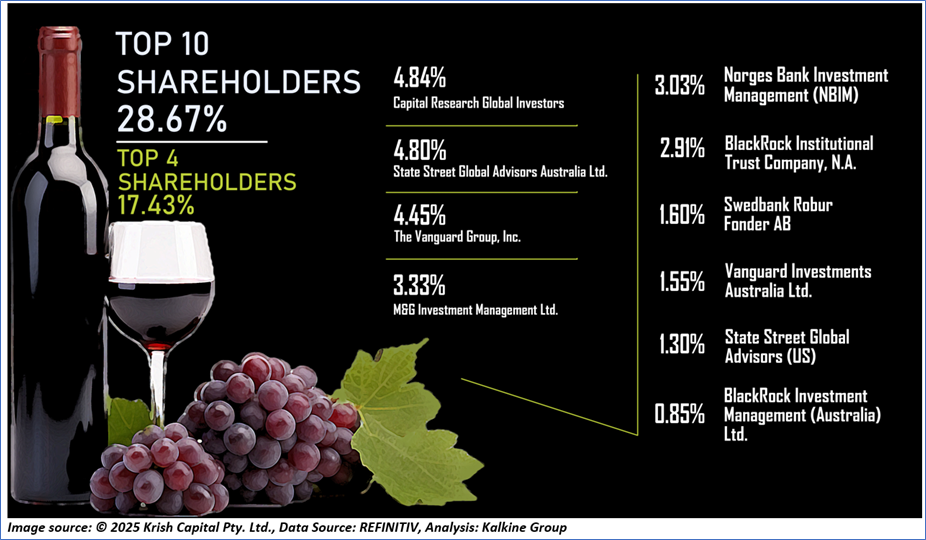

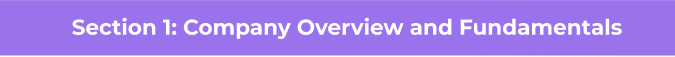

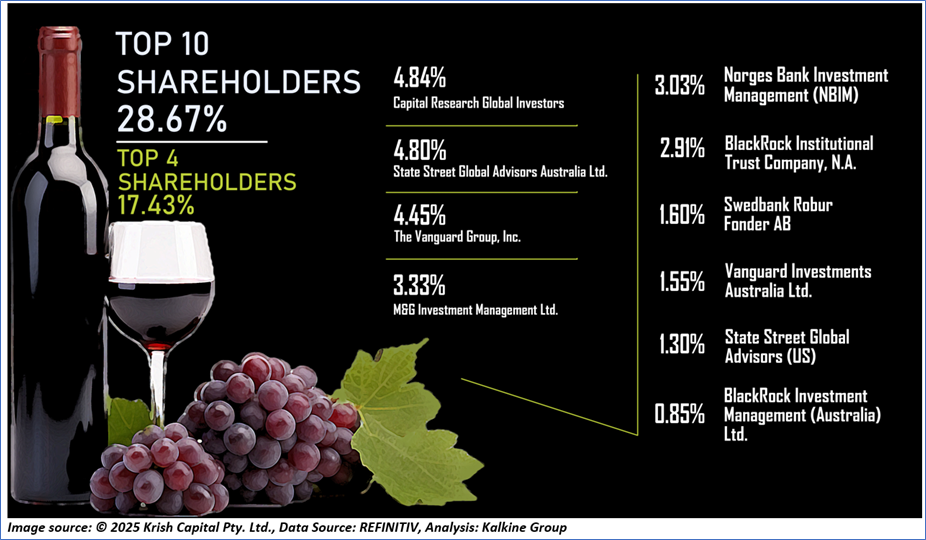

1.3: Top 10 Shareholders: The top 10 shareholders together form ~28.67% of the total shareholding. Capital Research Global Investors and State Street Global Advisors Australia Ltd. are holding maximum stakes in the company at ~4.84% and ~4.80%, respectively.

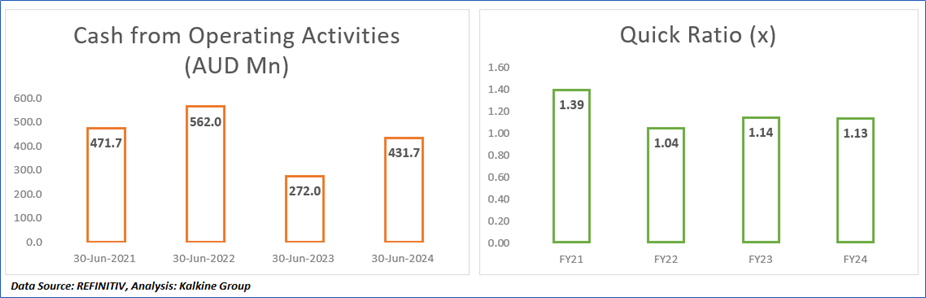

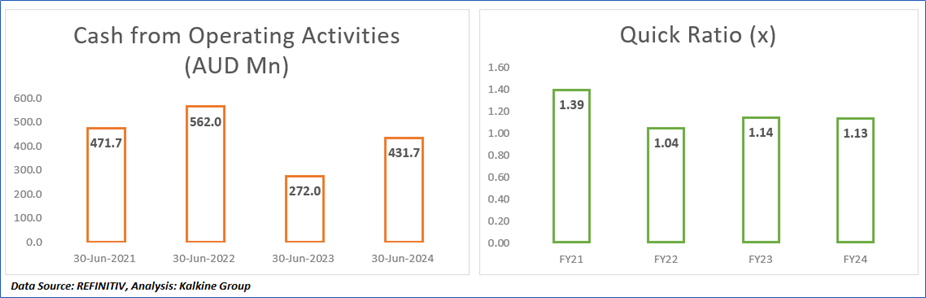

1.4: Key Metrics: TWE registered a fixed asset turnover ratio of 1.33x in FY24 compared with 1.24x in FY23. Below is captured the metrics showing the trend of cash from operating activities and quick ratio since FY21:

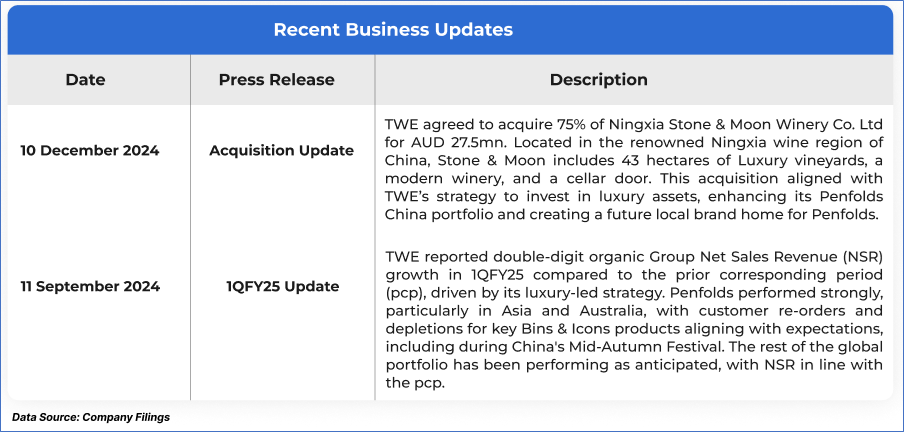

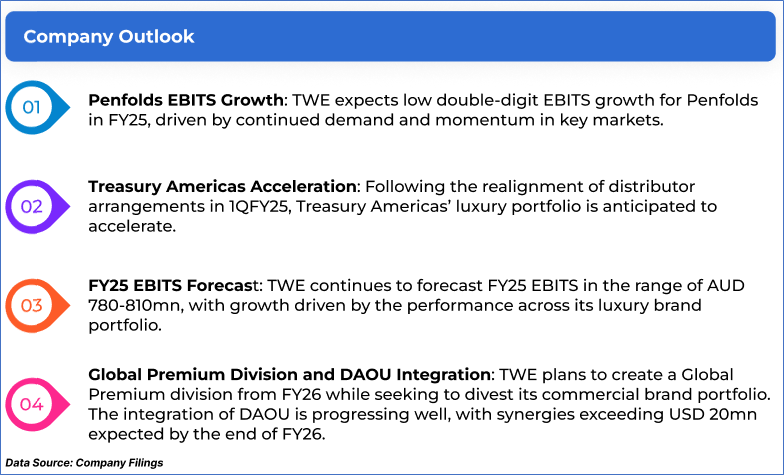

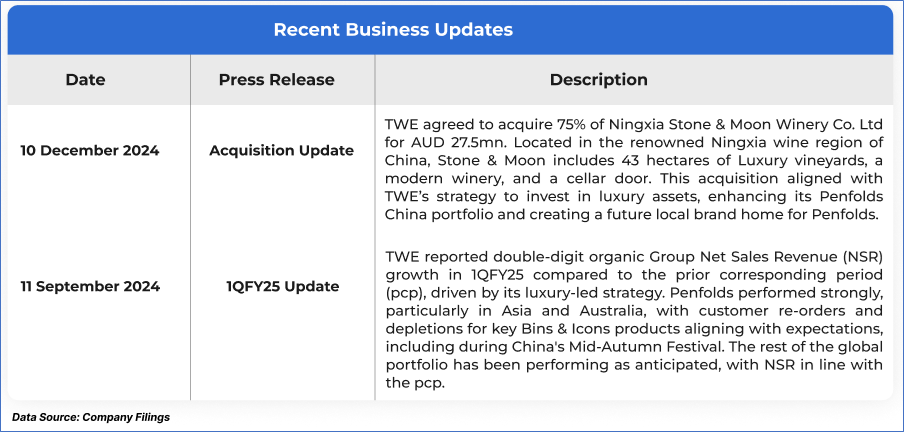

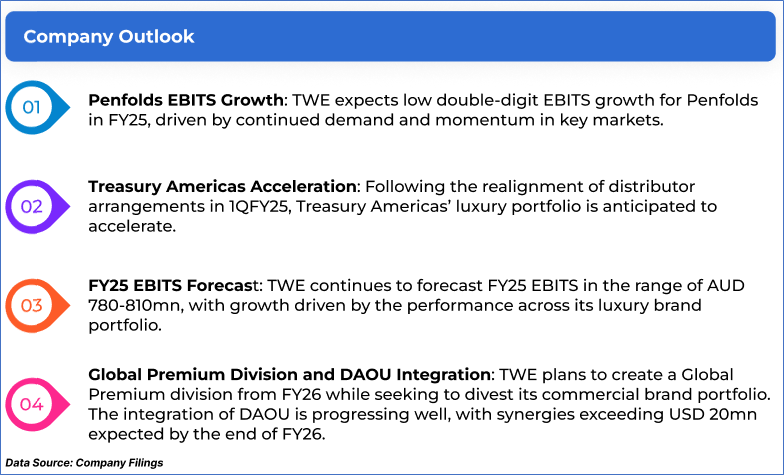

2.1: Recent Business Updates:

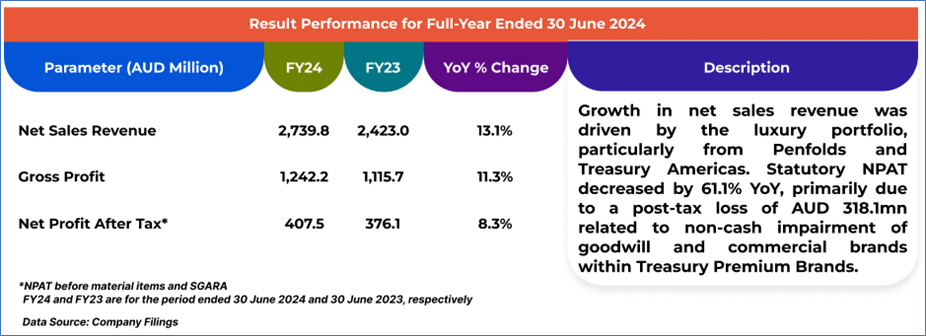

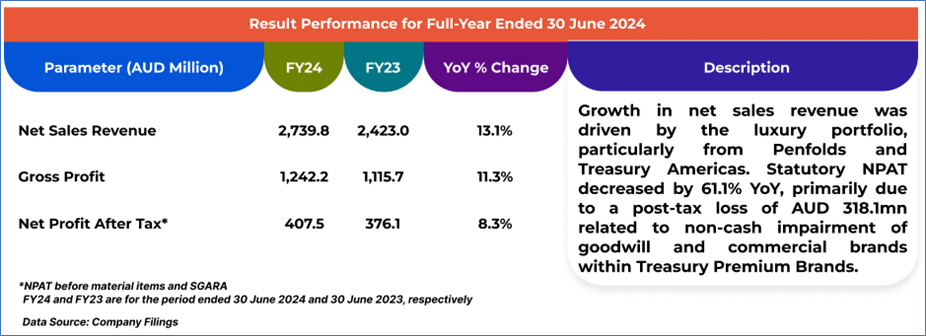

2.2: Financial Insights:

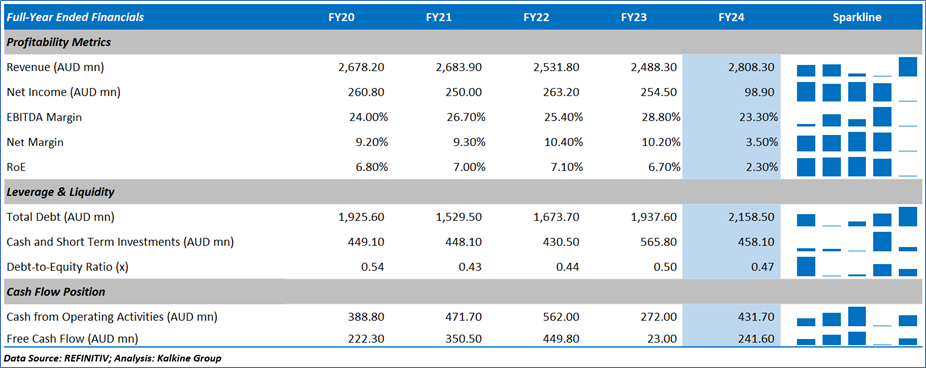

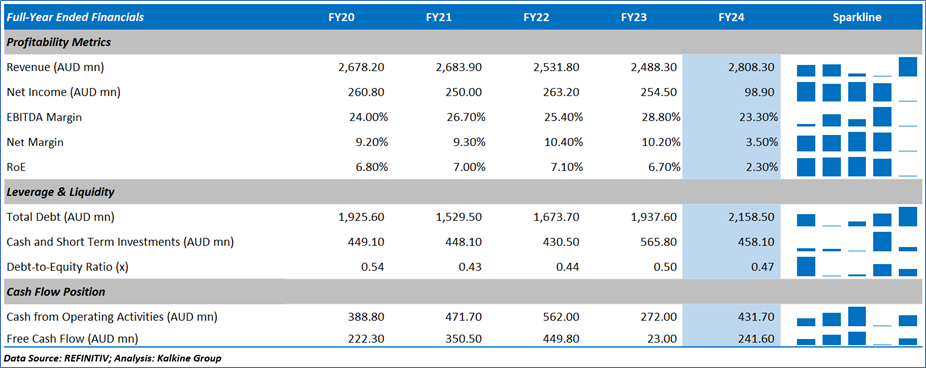

2.3: Historical Financial Trend:

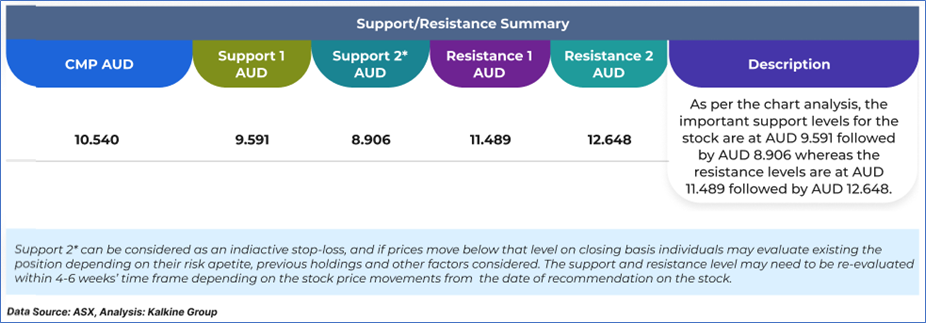

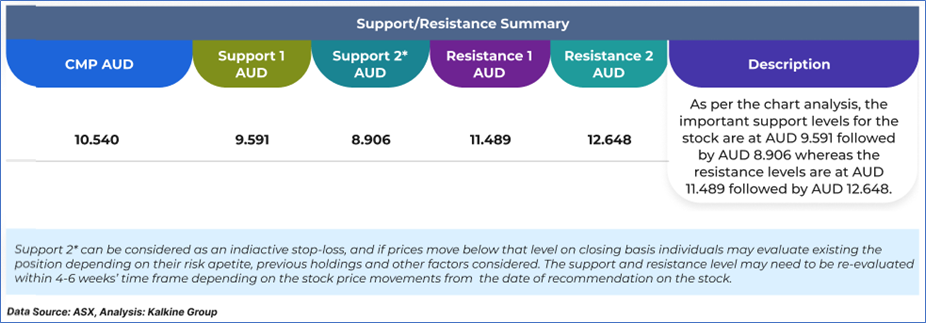

4.1: Price Performance and Technical Summary

The stock price has gone down by ~10.22% in the last one month and over the last 6 months, stock prices declined by ~14.86%. The stock has a 52-week low and 52-week high of AUD 10.060 and AUD 13.010, respectively, and is currently trading below the mid-range of the 52-week-high-low levels. TWE was last covered in a report dated ‘16 December 2024’.

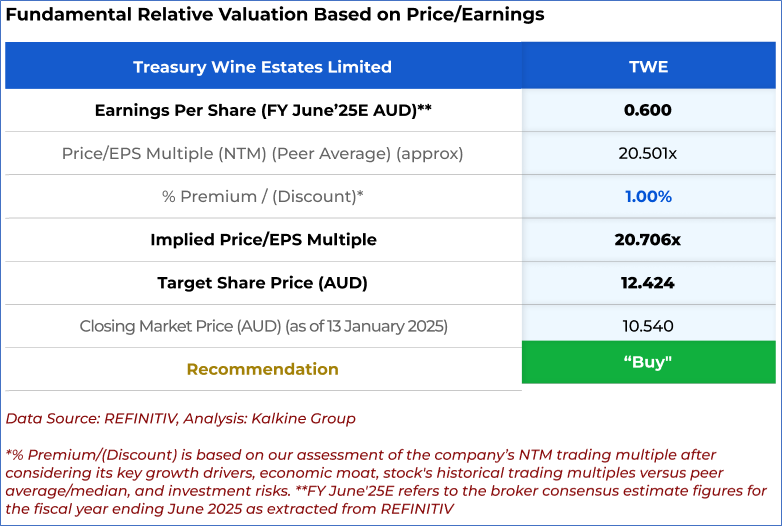

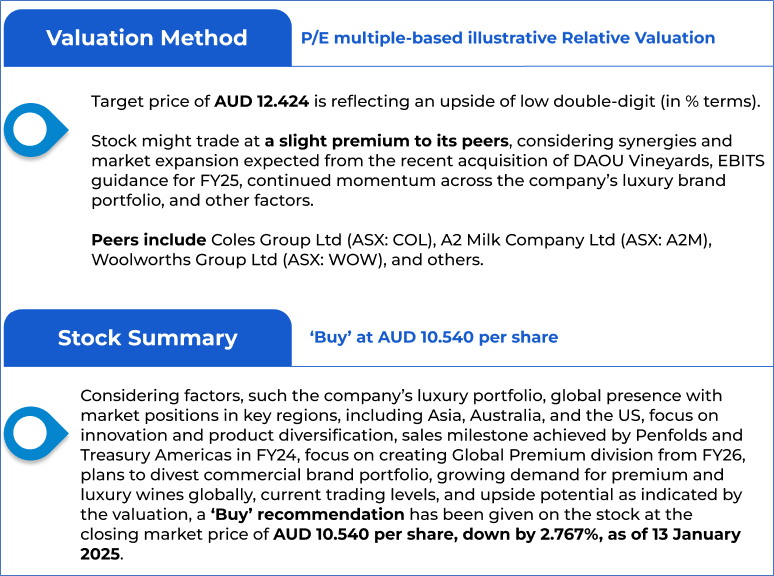

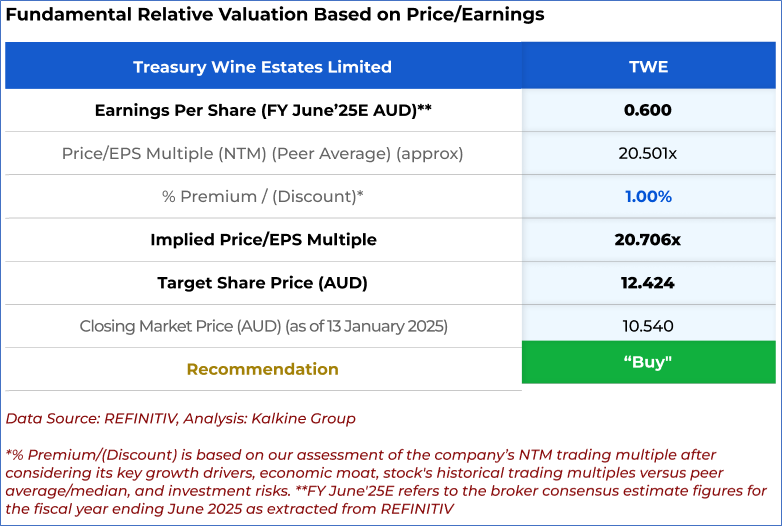

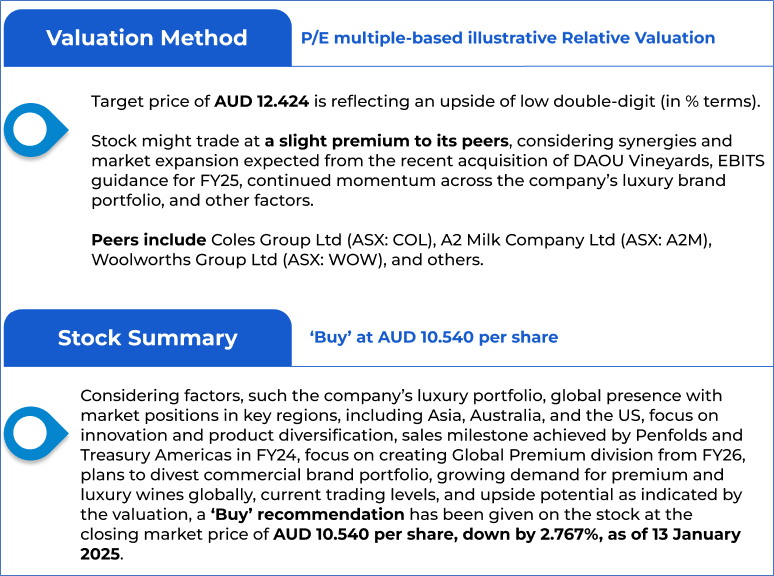

4.2: Fundamental Valuation

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 13 January 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Note 5: Kalkine reports are prepared based on the stock prices captured either from REFINITIV or Trading View. Typically, REFINITIV or Trading View may reflect stock prices with a delay which could be a lag of 25-30 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...