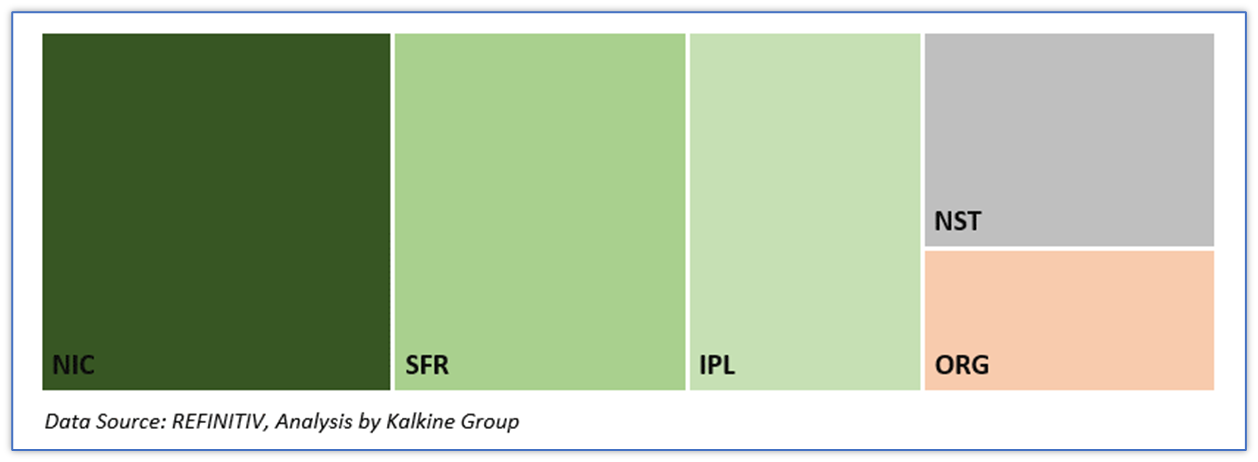

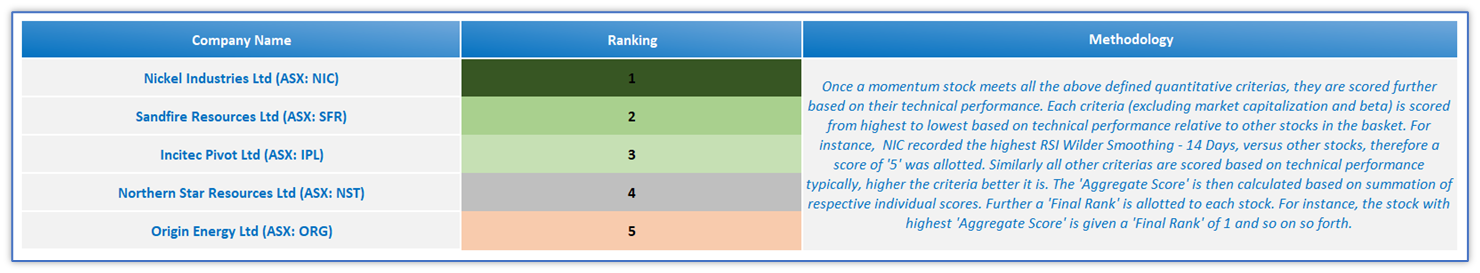

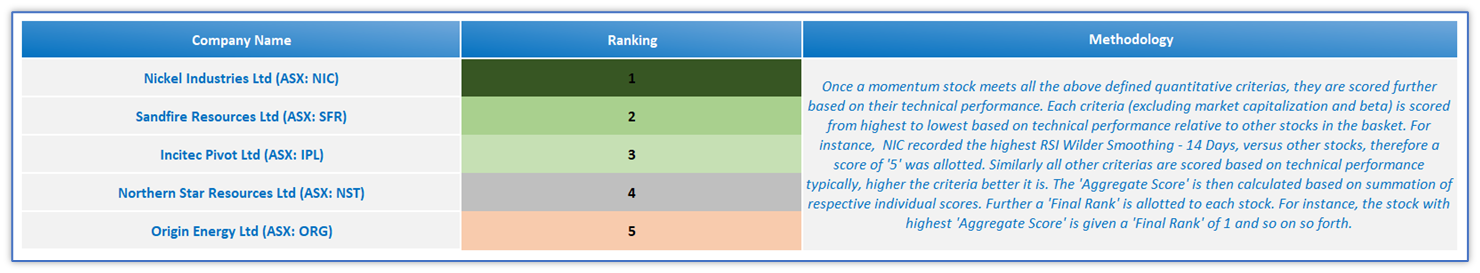

Section 1: Kalkine’s Rank on Identified Momentum Stocks

Kalkine’s Momentum Stocks ranking report aims to reflect the companies trading with positive momentum. These companies have witnessed an upward price momentum from the technical analysis standpoint alongside other metrics defined below.

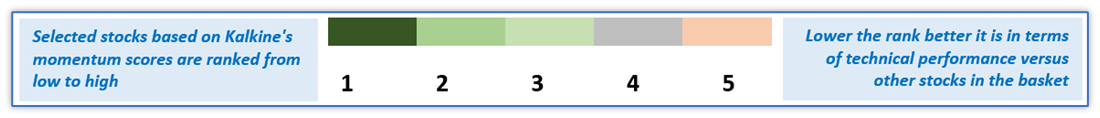

Note: Selected Momentum Stocks are ranked from low to high using Kalkine’s unique ranking methodology, where-in low rank implies better technical metrics performance versus other stocks in the basket. Refer to Section 5 for more details on metrics used in ranking the Momentum Stocks from low to high.

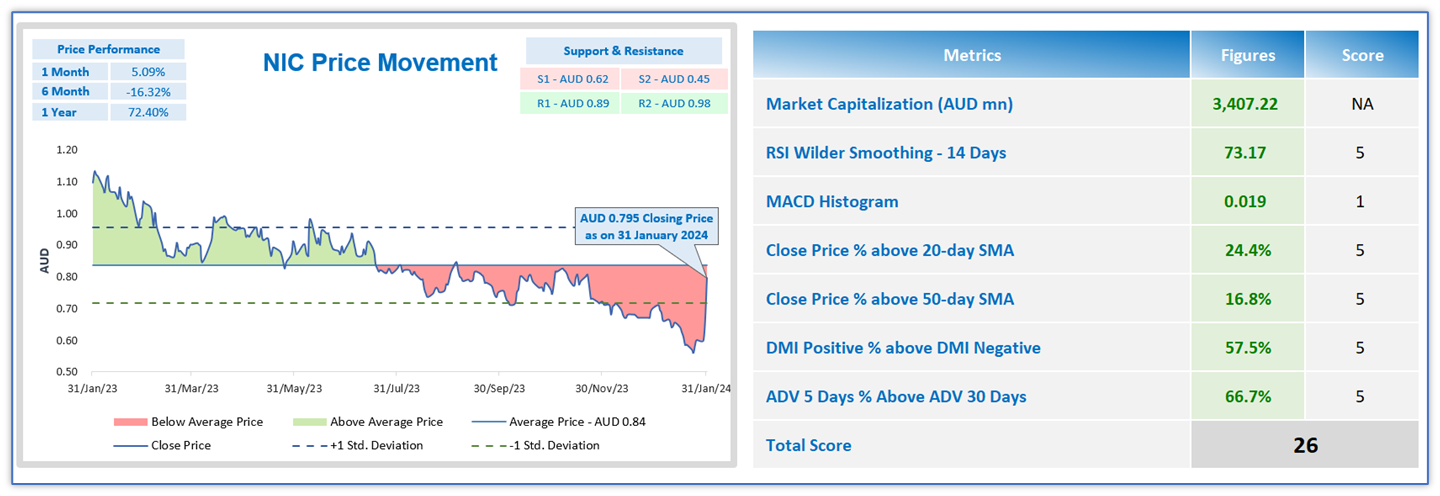

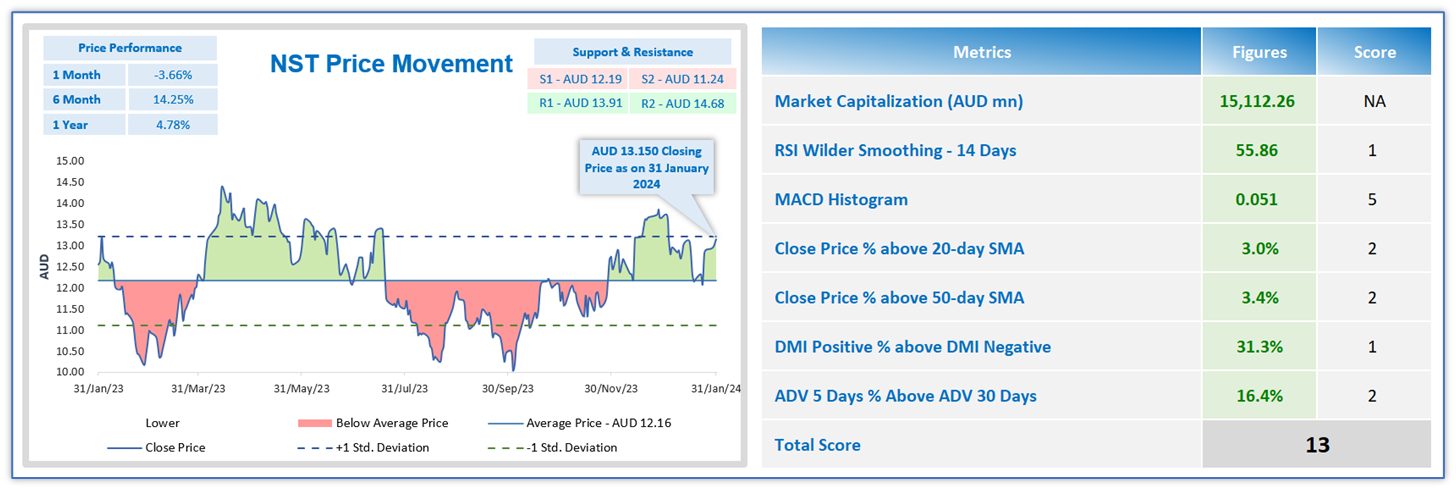

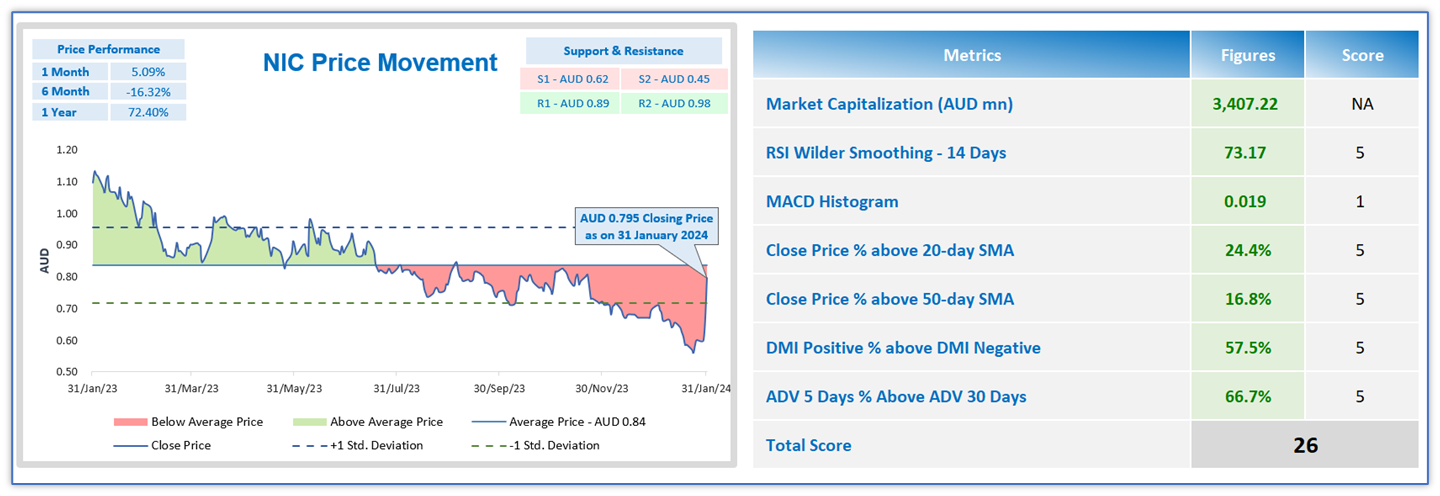

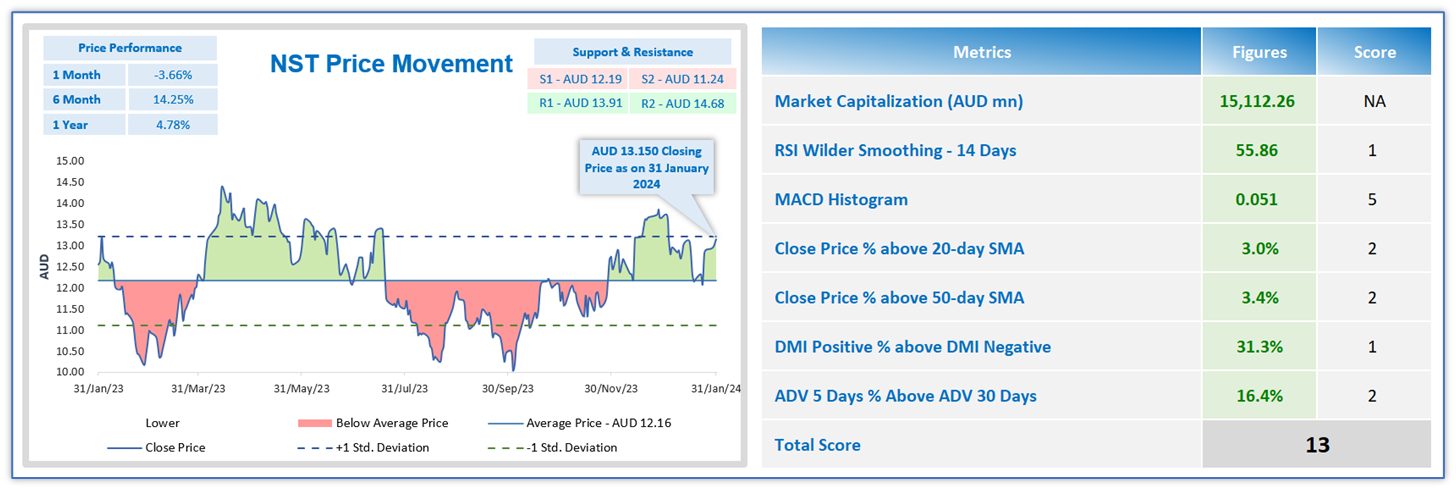

Section 2: Stock Price Performance, Key Financial and Technical Highlights

Data Source: REFINITIV; Analysis by Kalkine Group

Note: SMA refers to Simple Moving Average; RSI refers to Relative Strength Index; MACD refers to Moving average convergence divergence; ADV refers to Average Daily Volume; DMI refers to Directional Movement Index

Section 3: Key Broker Consensus Data on Momentum Stock

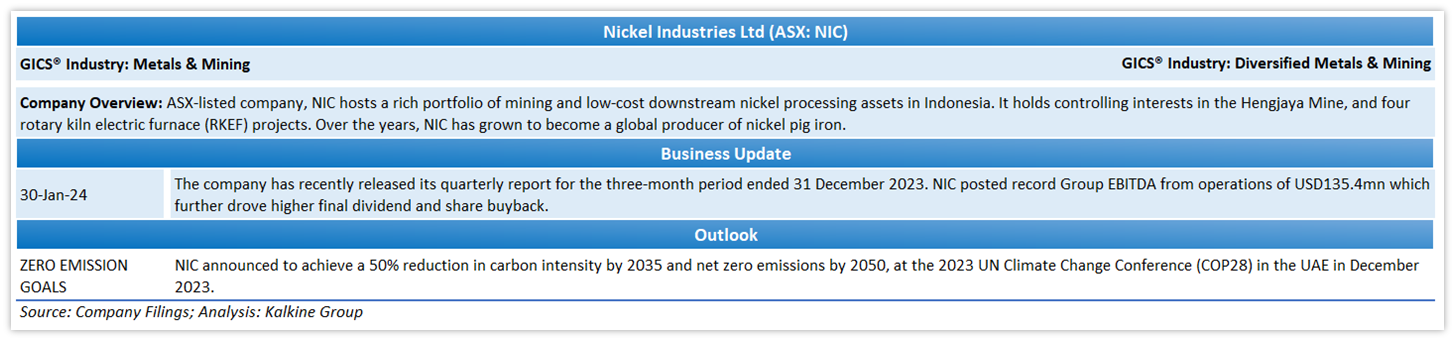

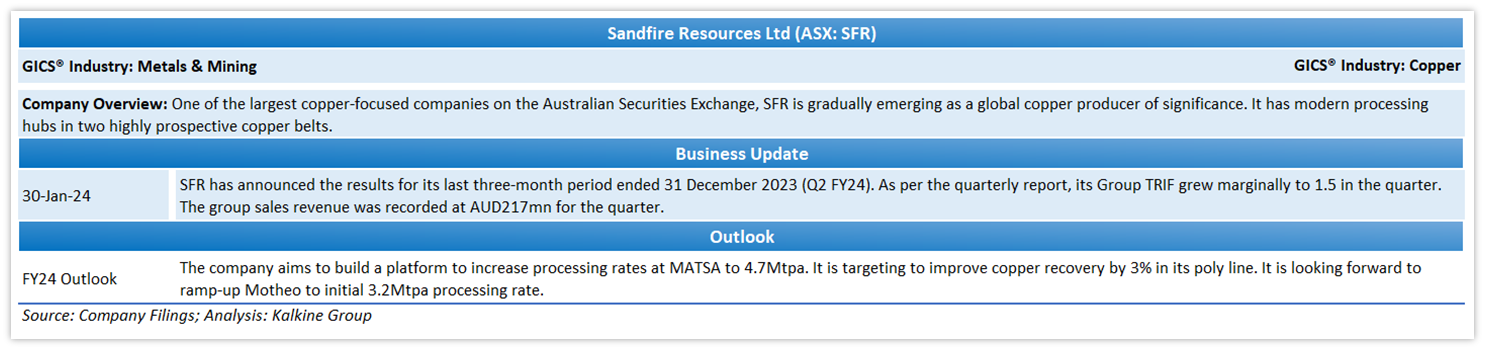

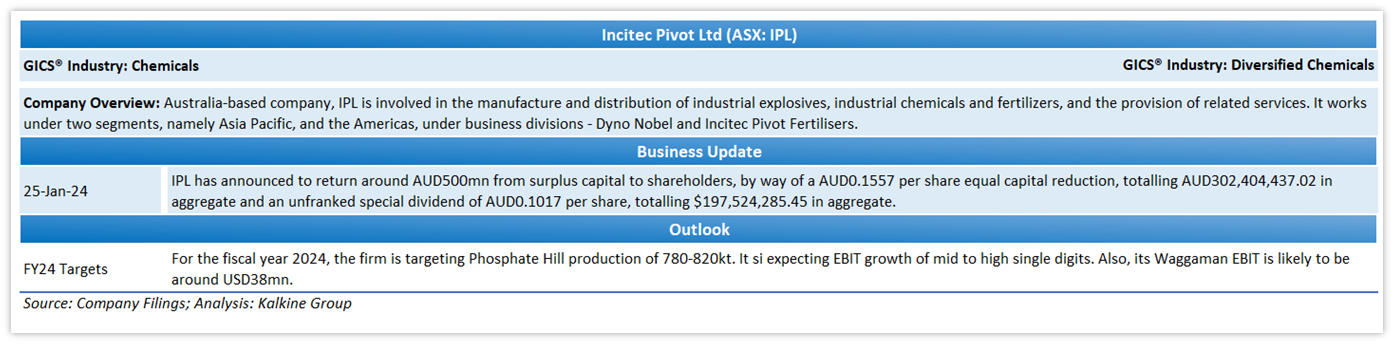

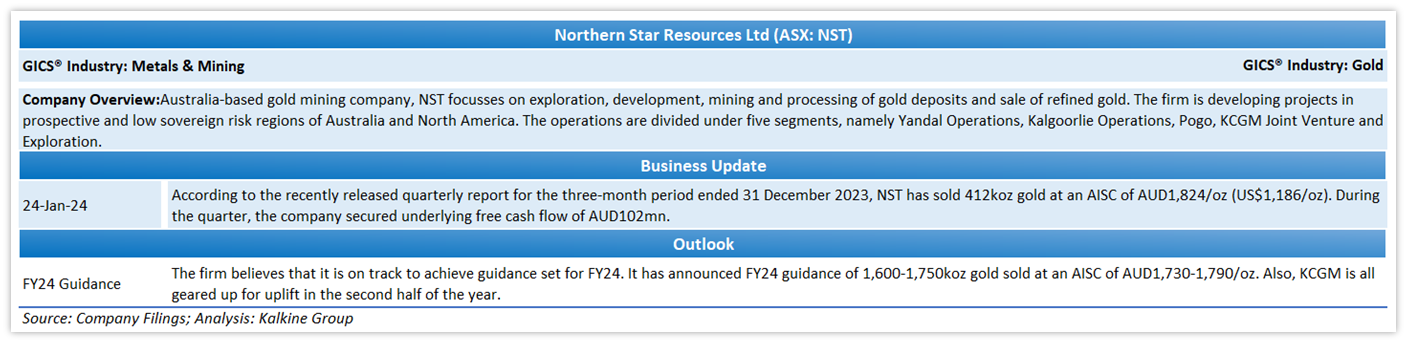

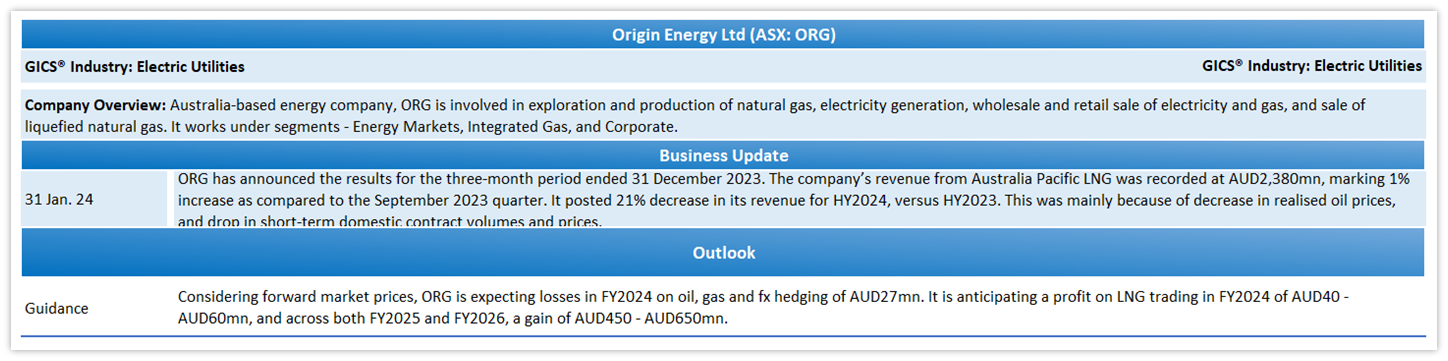

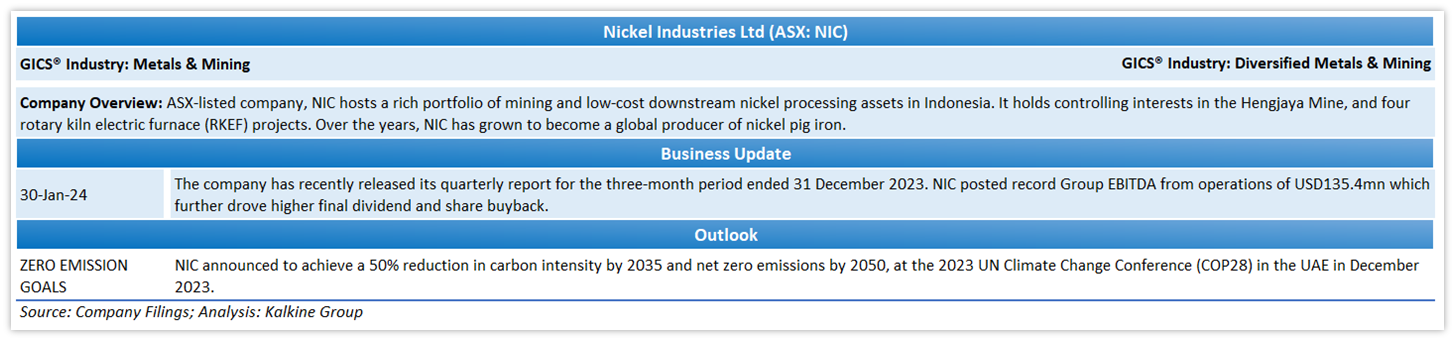

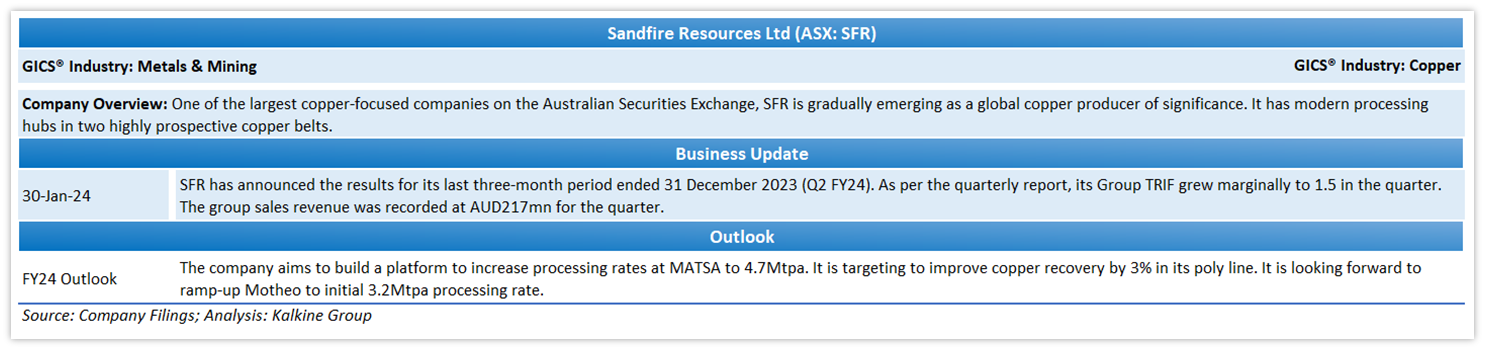

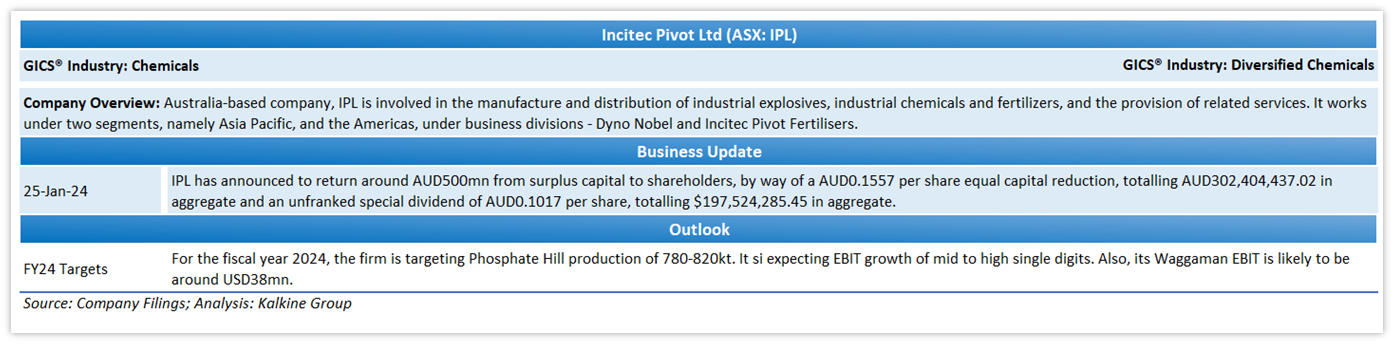

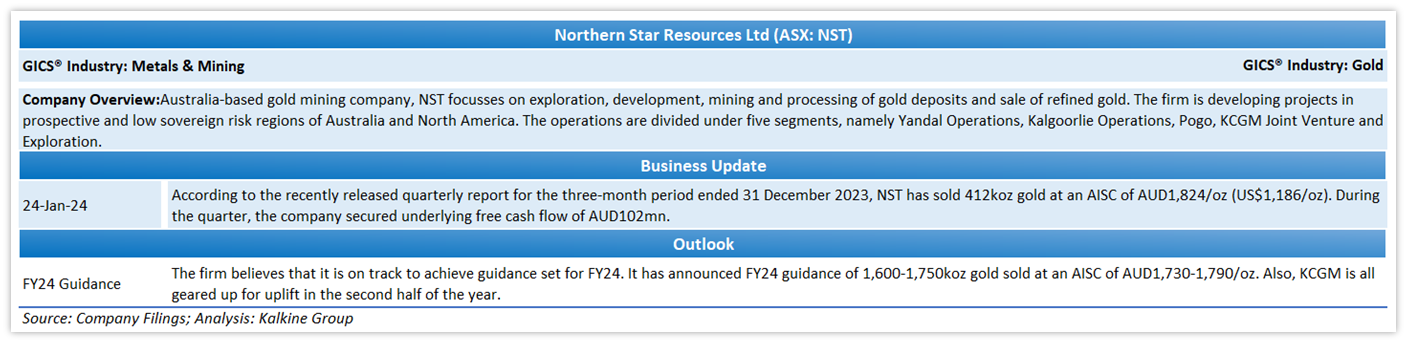

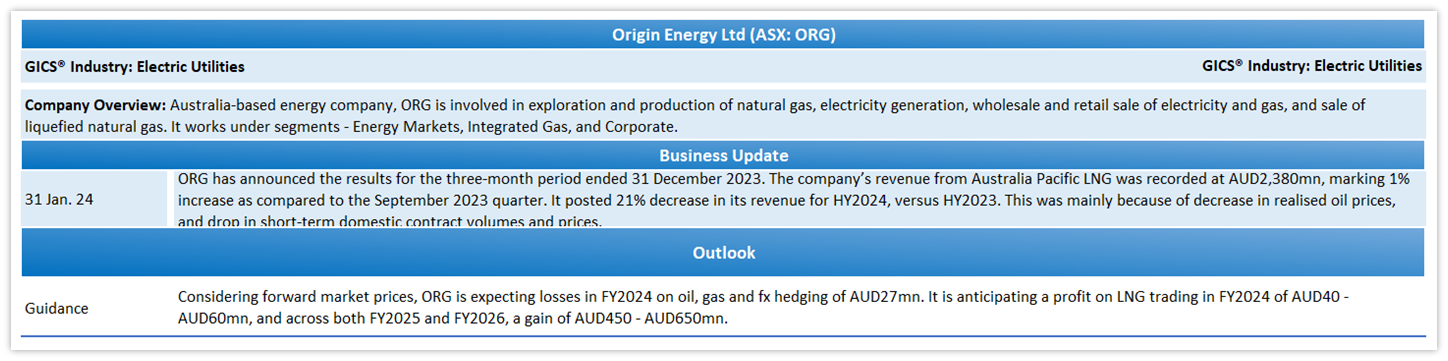

Section 4: Recent Business Updates and Outlook of Momentum Stocks

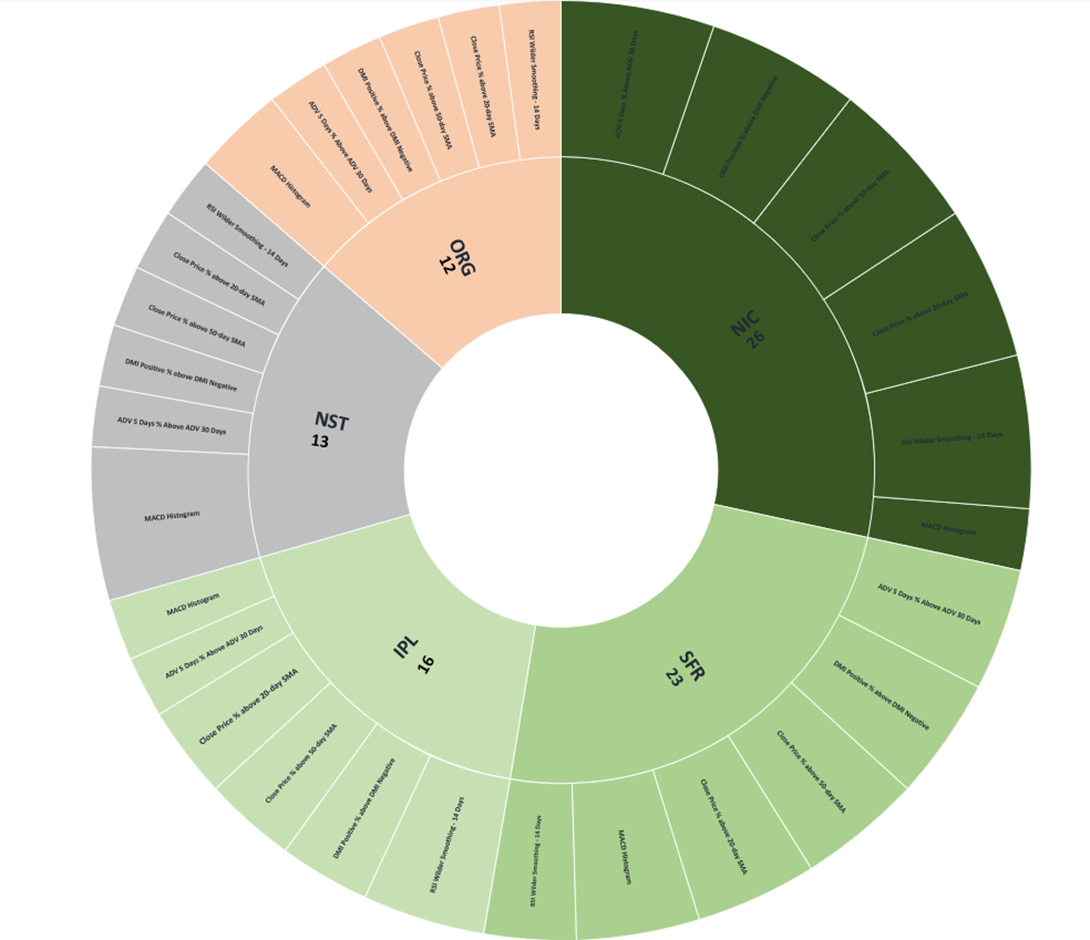

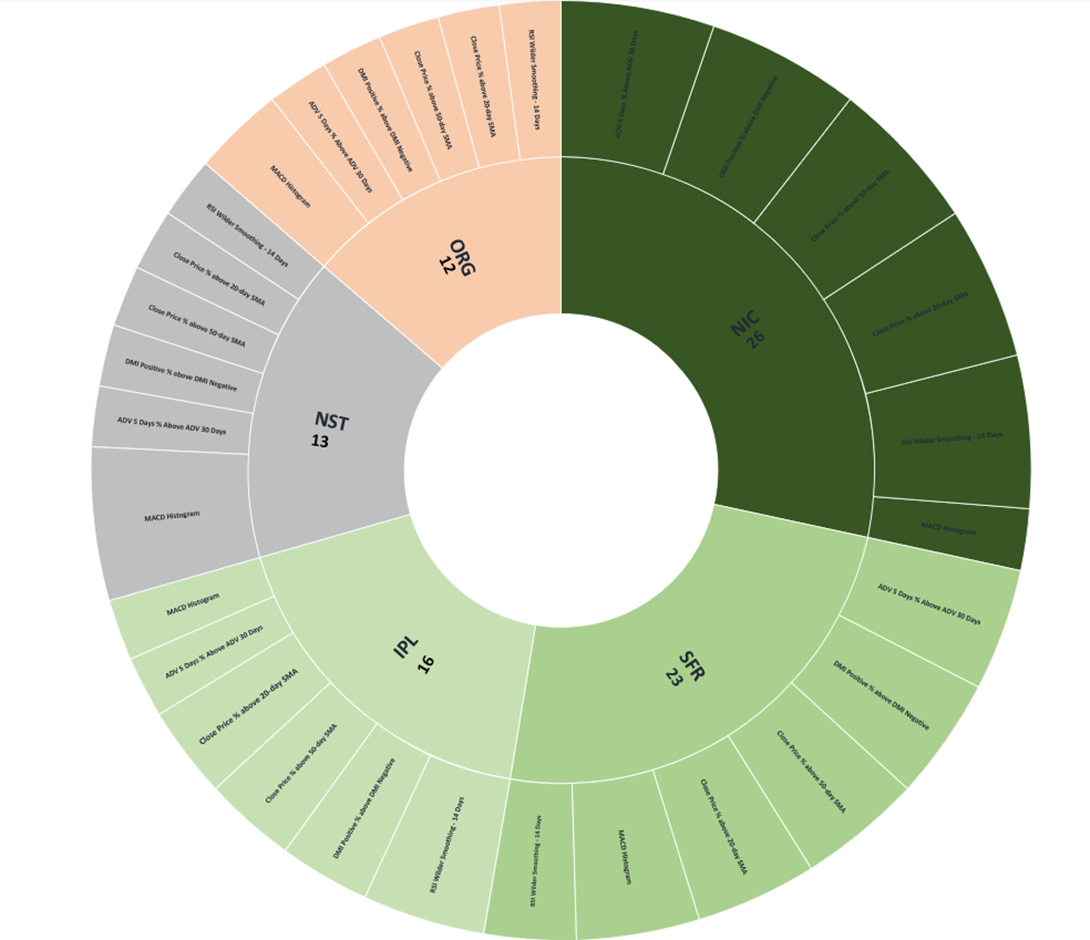

Section 5: Kalkine’s Unique Momentum Stocks Ranking Method

ASX-listed Momentum Stocks are scored based on the below set of quantitative technical criteria’s as per Kalkine’s unique scoring methodology. The objective is to screen the companies with an upward price momentum with volume greater than 500 thousand. Only stocks that scored highest and met the selection criterias based on all of the above quantitative technical metrics were further scored. The scoring was done among all the screened stocks based on their technical performance relative to the stock basket selected.

As a next step, the stocks are ranked from low to high, where-in lower the rank, the better it is, considering the better financial performance versus other stocks identified.

Kalkine’s Momentum Score Break-Up

Source: Kalkine Group; Copyright © 2024 Krish Capital Pty. Ltd.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 31 January 2024. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

AU

Please wait processing your request...

Please wait processing your request...