Company Overview

Pilbara Minerals Limited (ASX: PLS) is a pure-play lithium company based in Australia. It is engaged in the exploration, development, and mining of minerals in Australia. Incitec Pivot Limited (ASX: IPL) caters to the resources and agriculture sectors via its two business segments. Incitec Pivot Fertilisers is a bulk commodity supplier while Dyno Nobel is a provider of industrial explosives and blasting services. The Kalkine’s Sector Report covers the Investment Summary, Sector Overview & Supporting Catalysts, Data Insights & Analysis, Financial Metrics, Financial Commentary, Risks, Outlook, Technical Analysis along with the Valuation, Target Price, and Recommendation on selected stocks.

Investment Summary

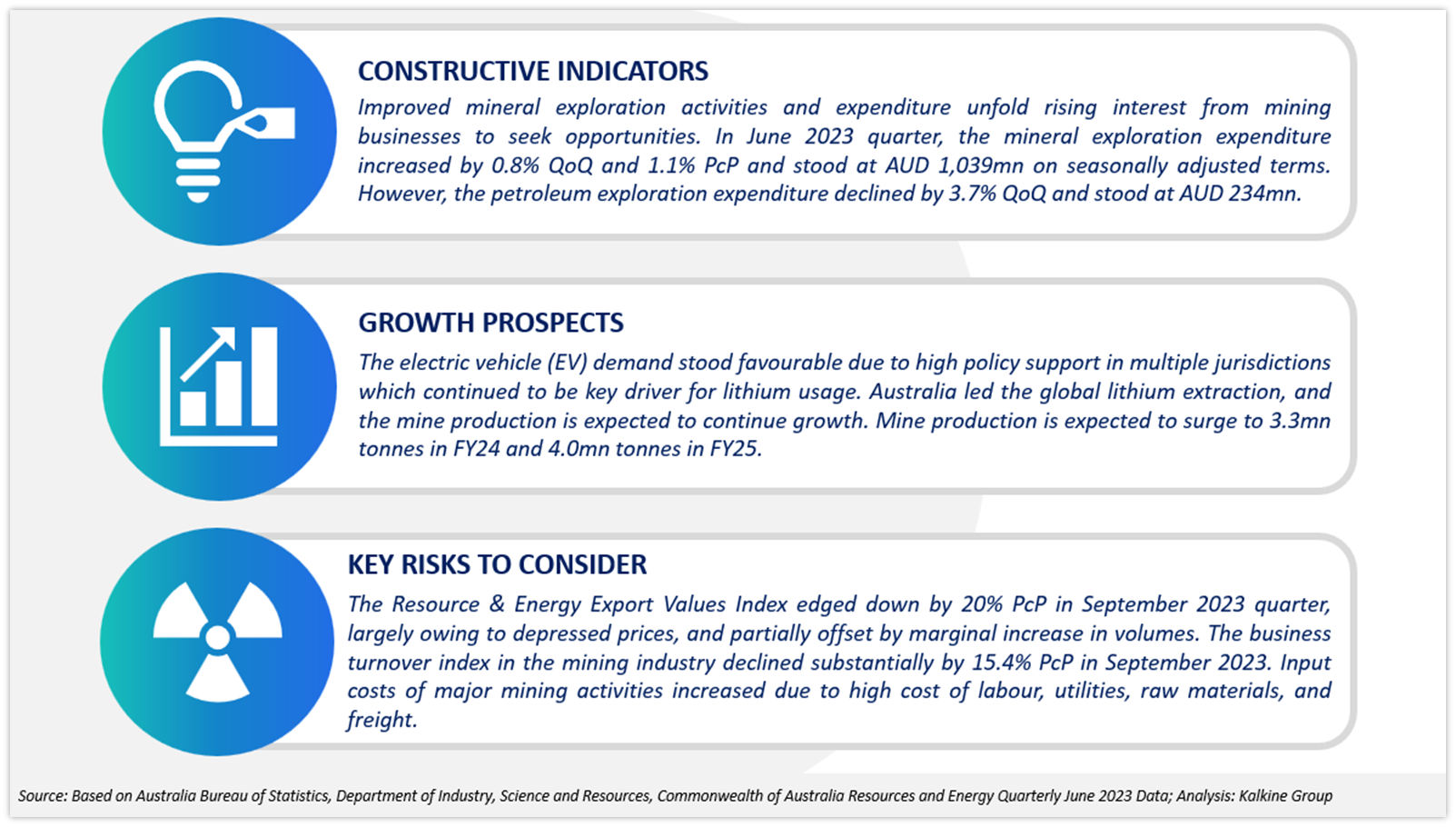

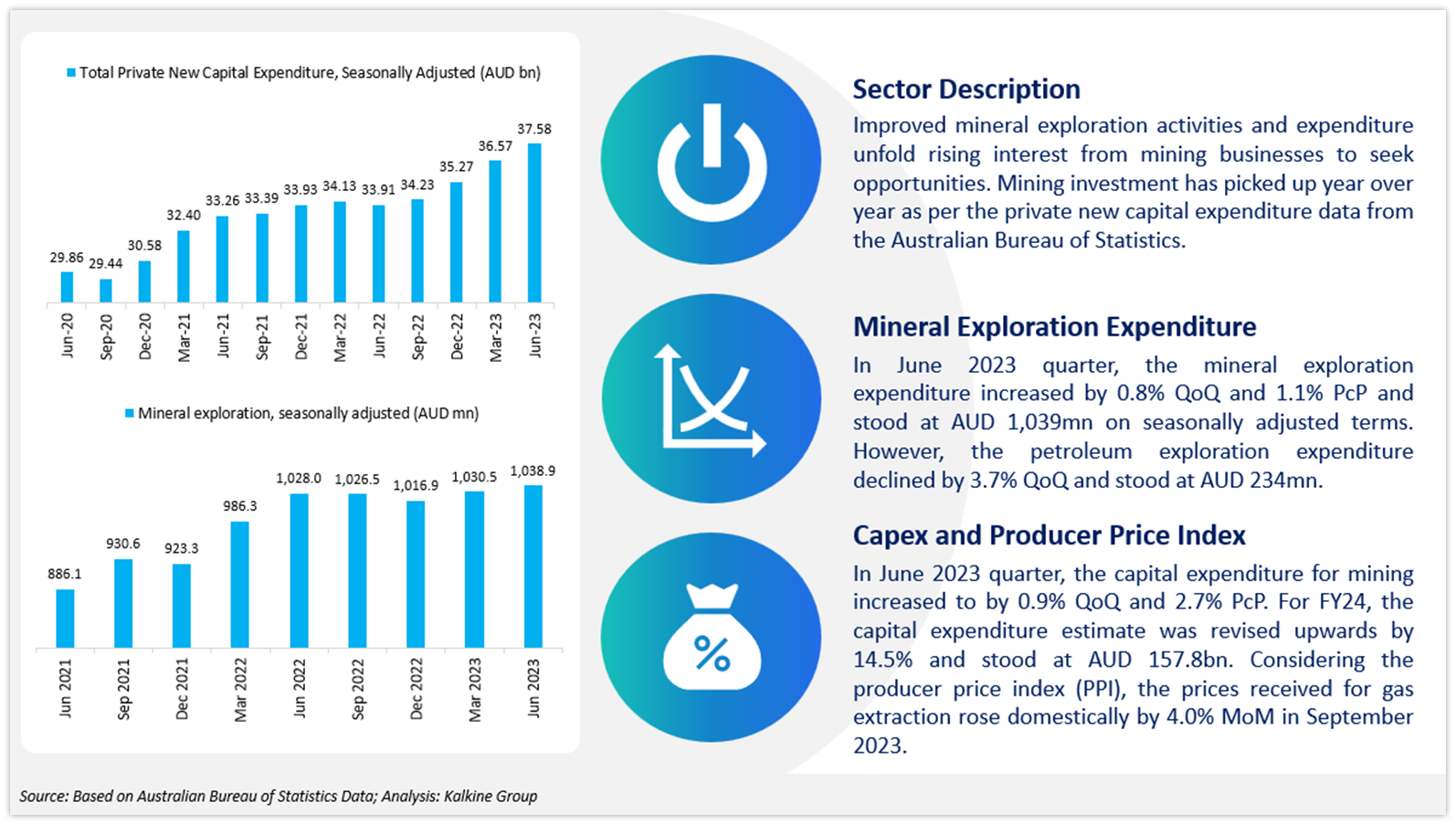

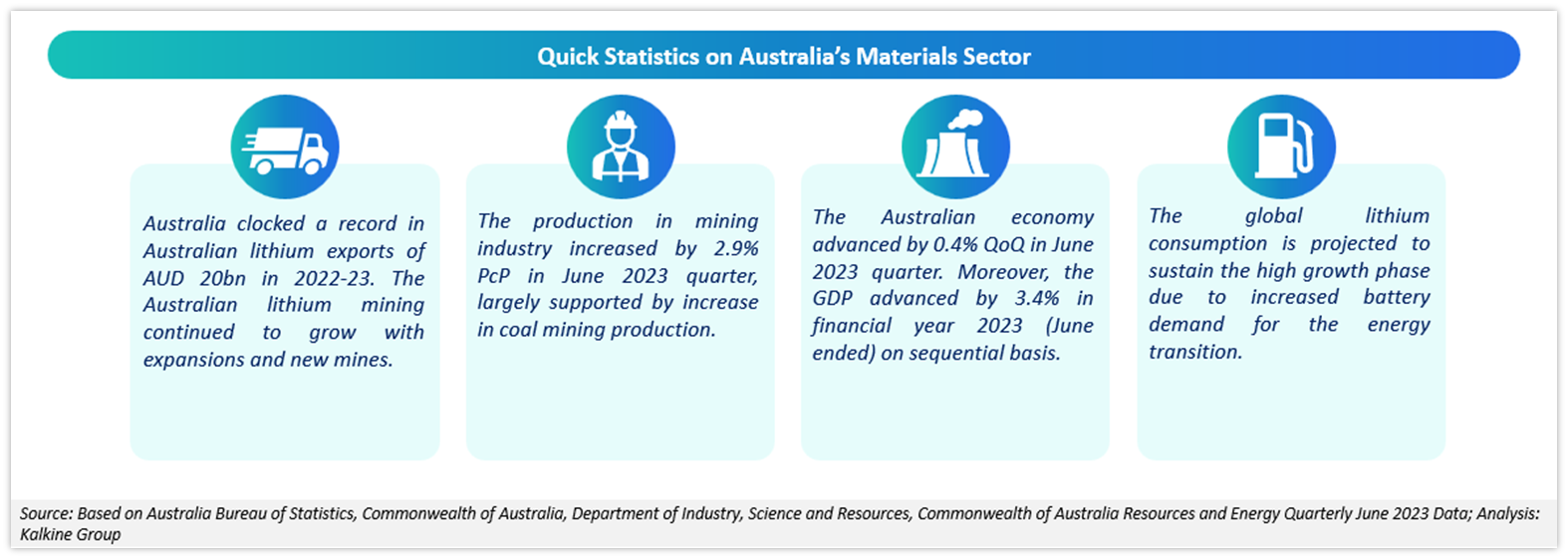

Sector Overview and Supporting Catalysts

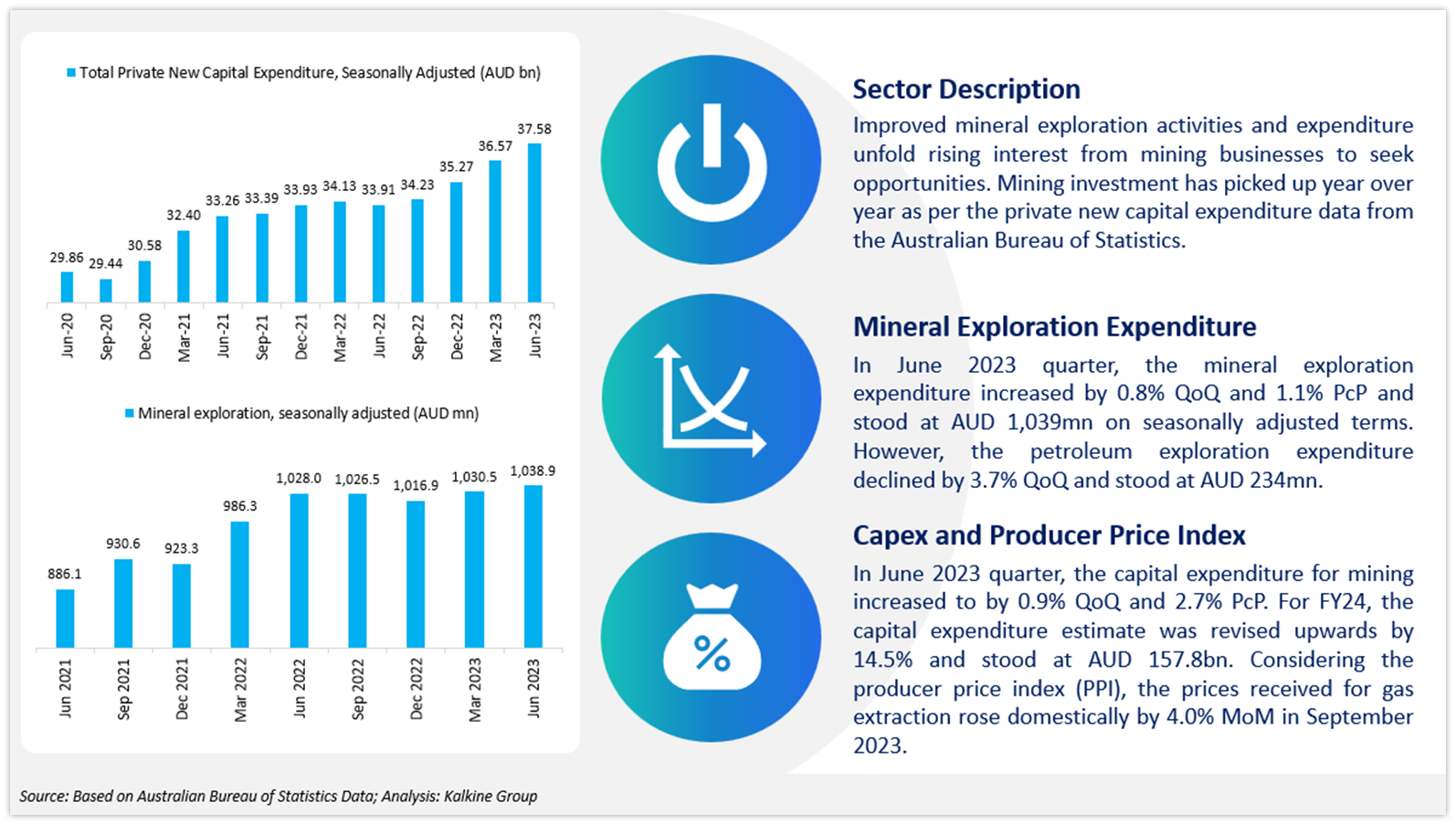

Data Insights and Analysis

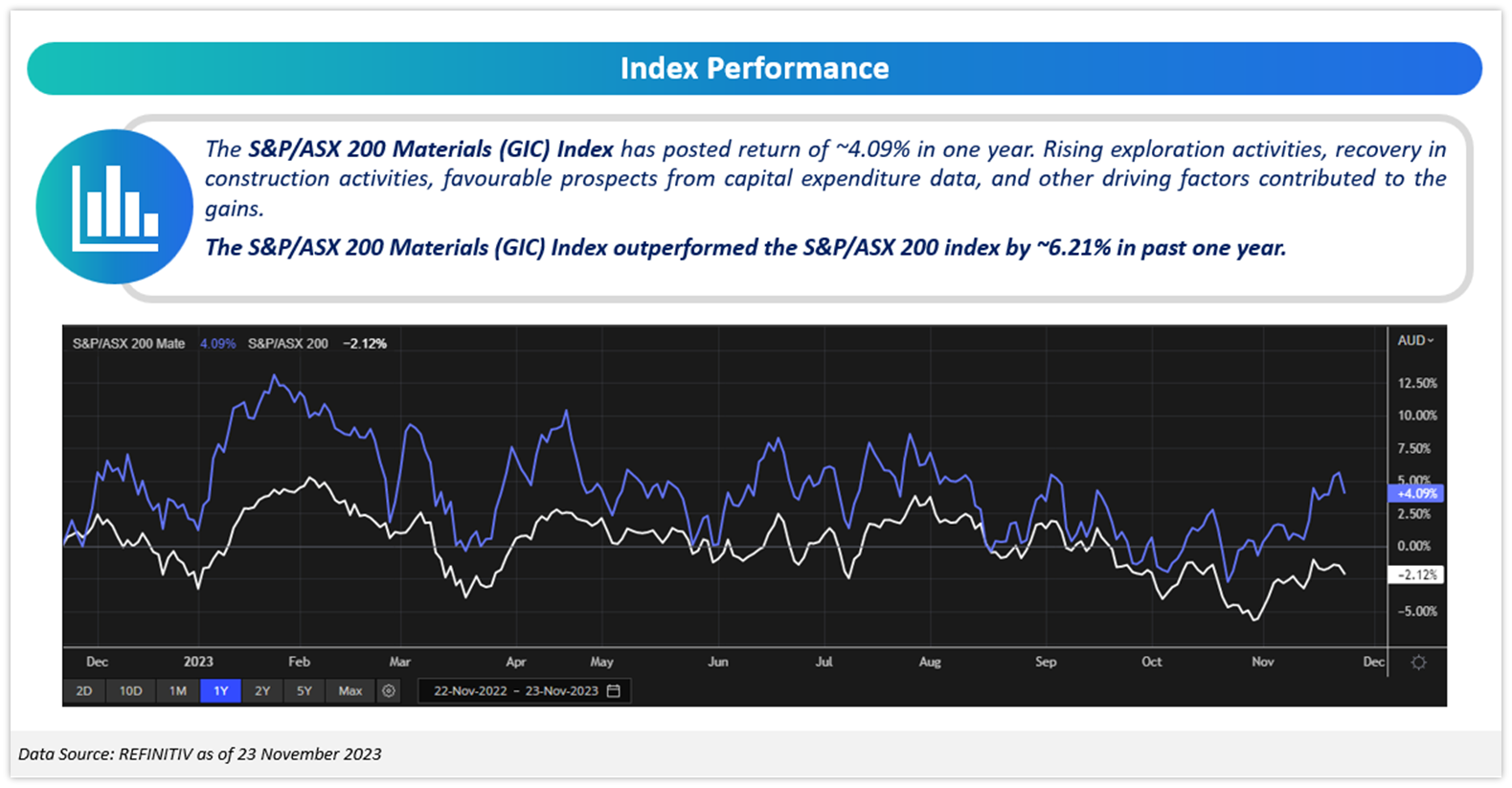

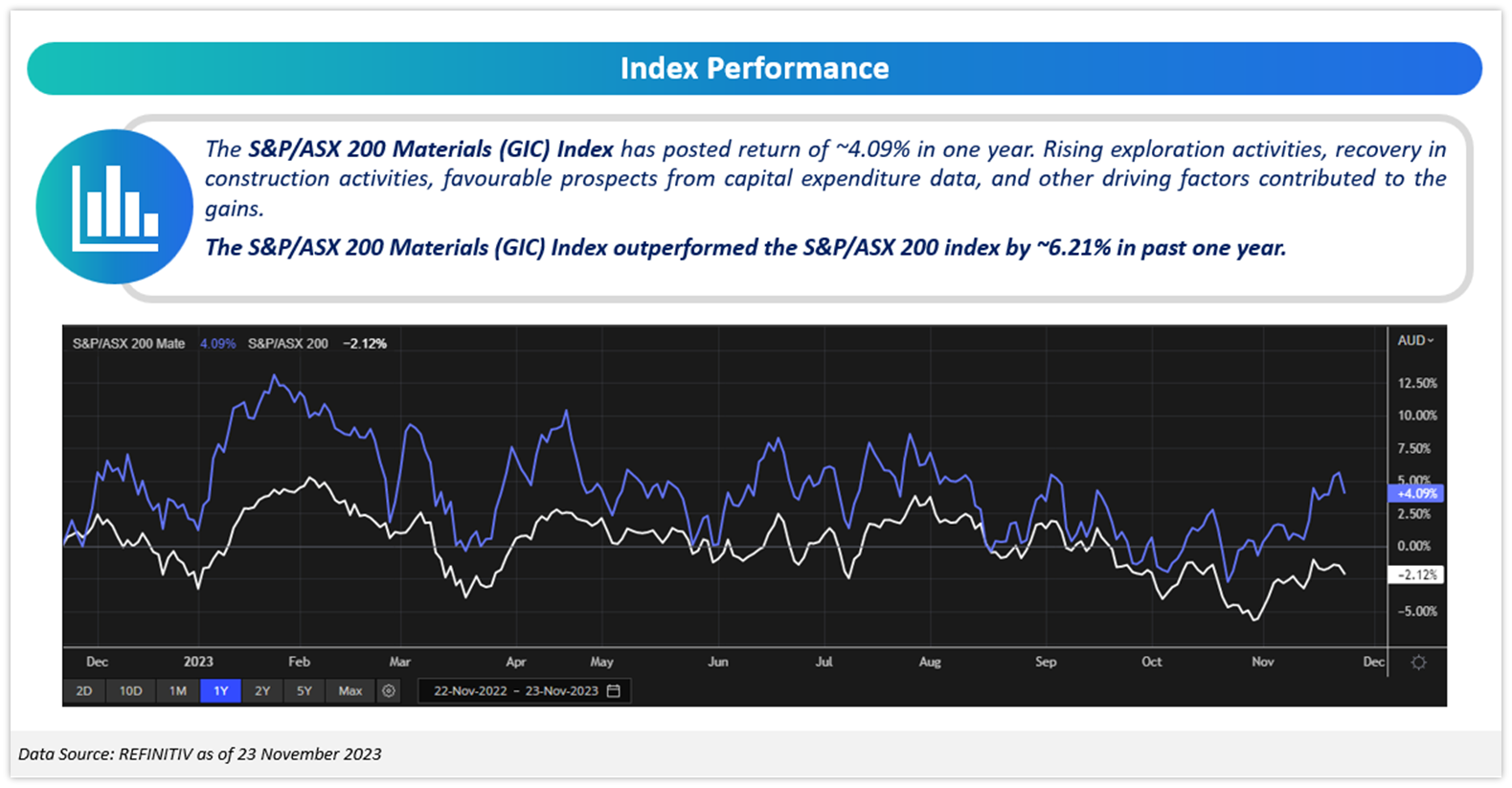

Index Performance

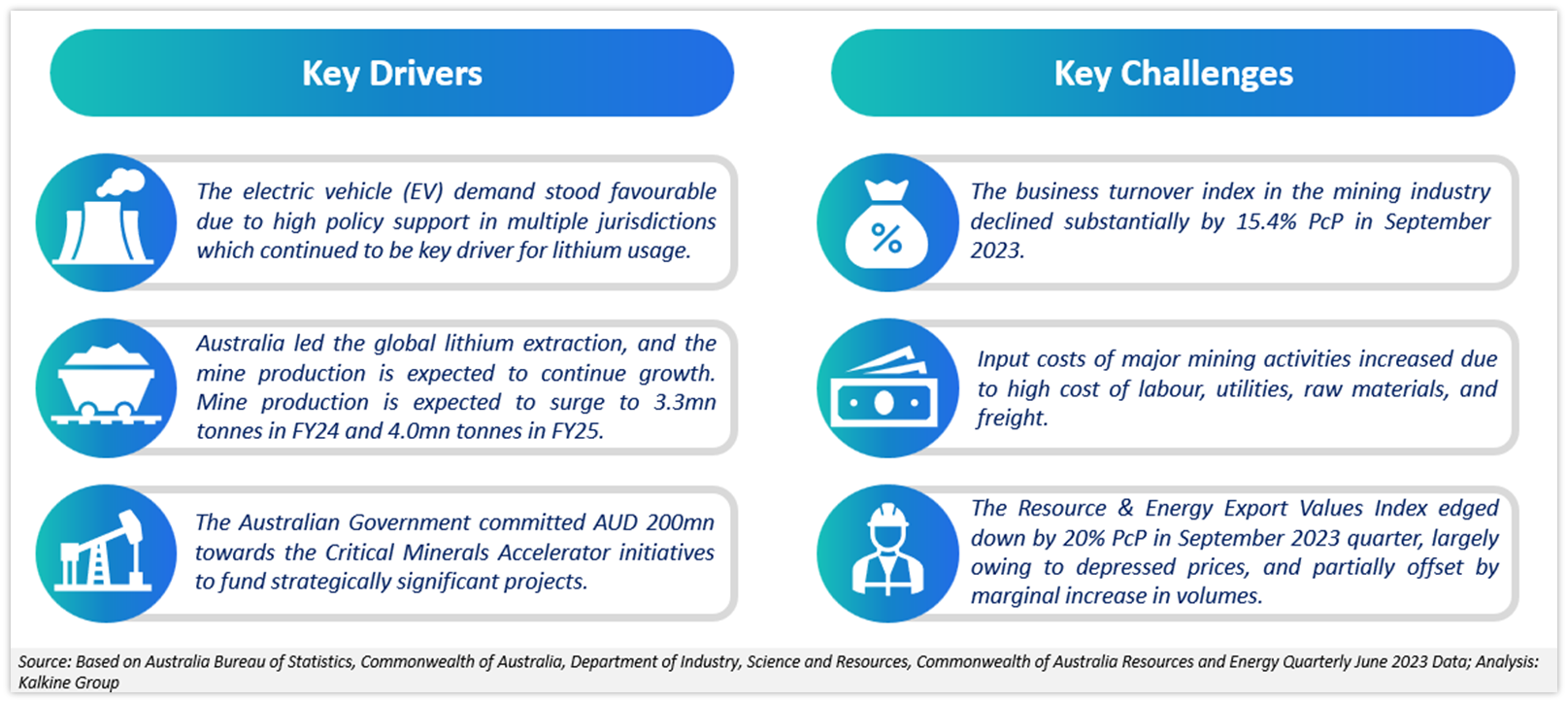

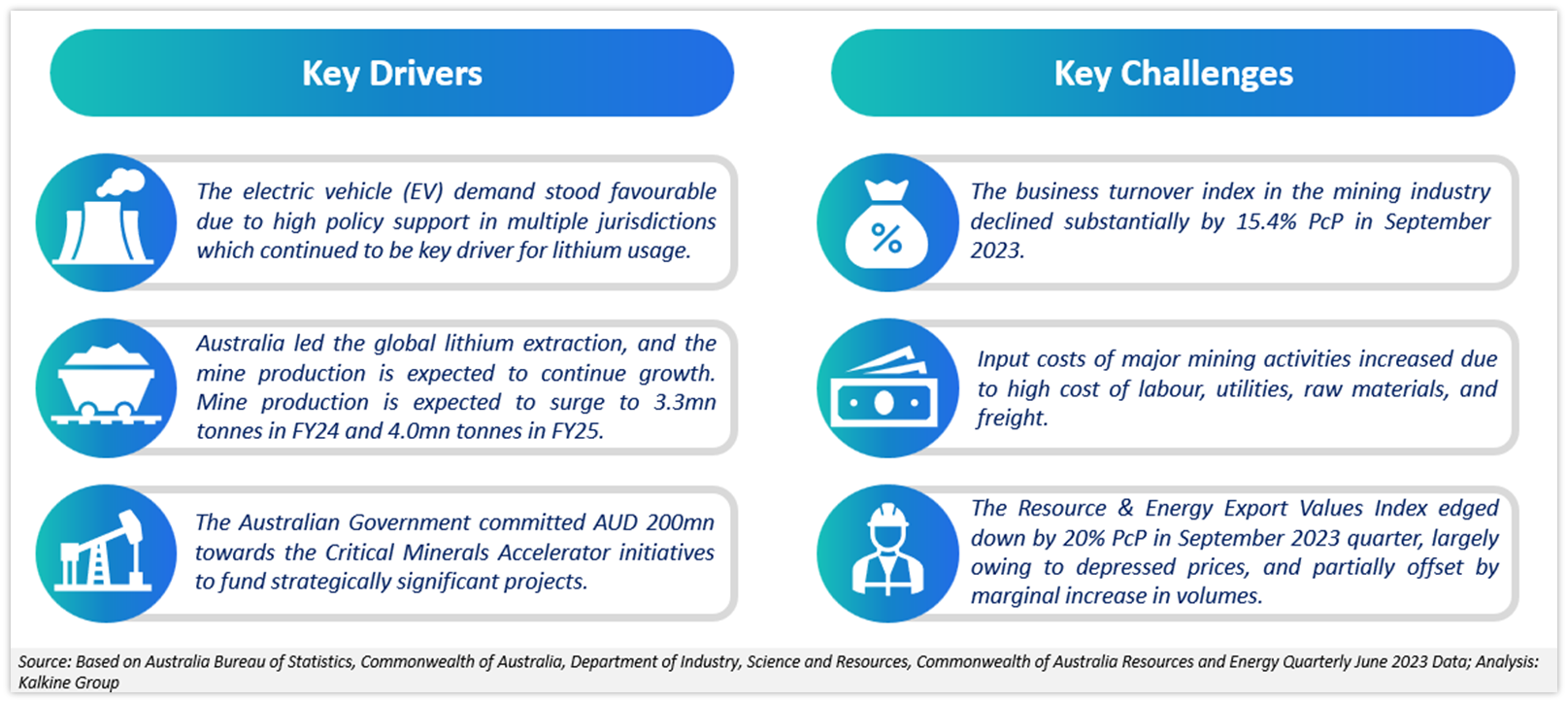

Key Drivers versus Key Constraints

Investment theme and stocks under discussion (PLS, IPL)

After understanding the sector, let us now look at two companies listed on the ASX. The price potential of the companies under discussion has been analysed based on the EV/Sales valuation multiple method.

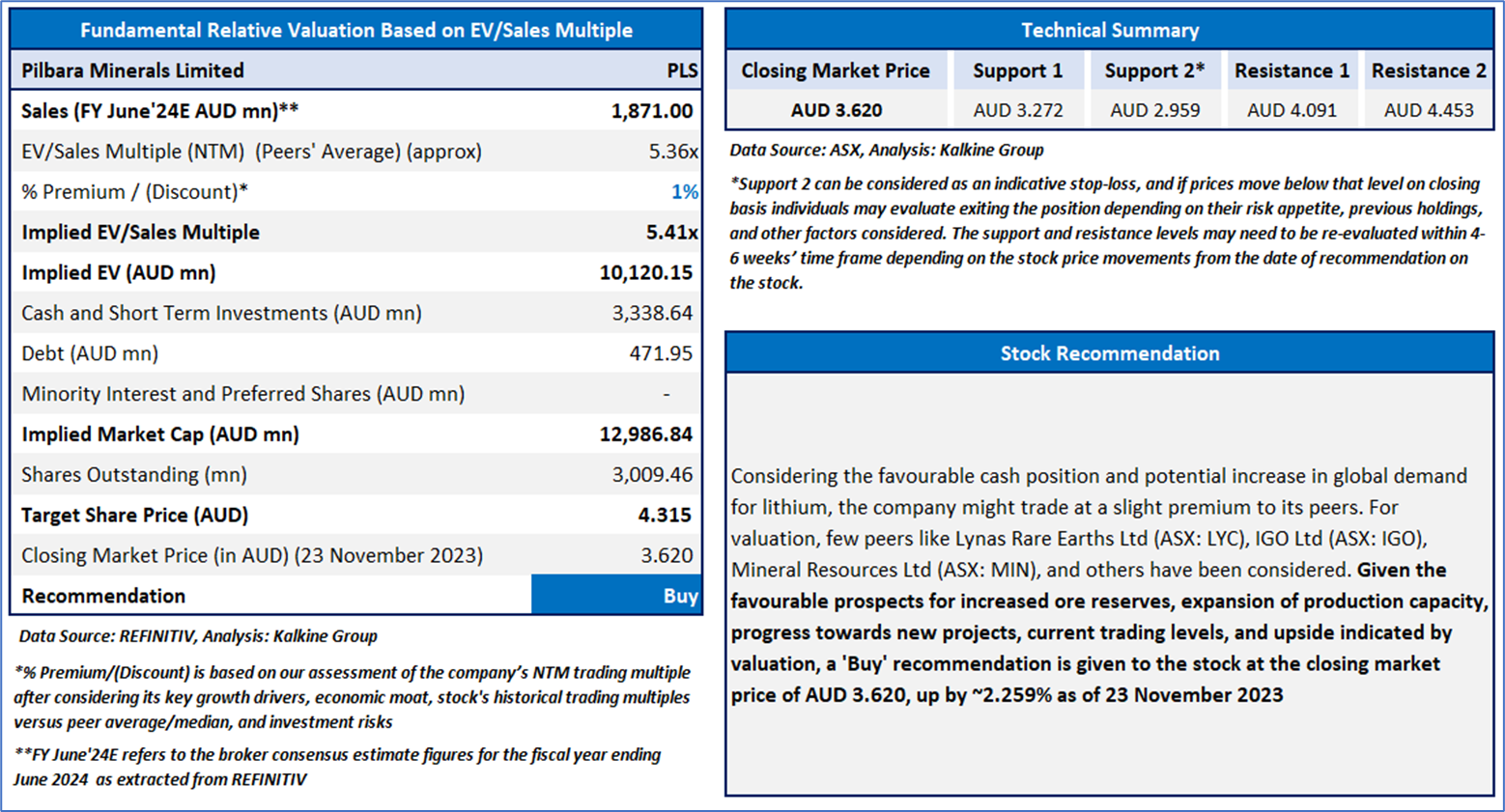

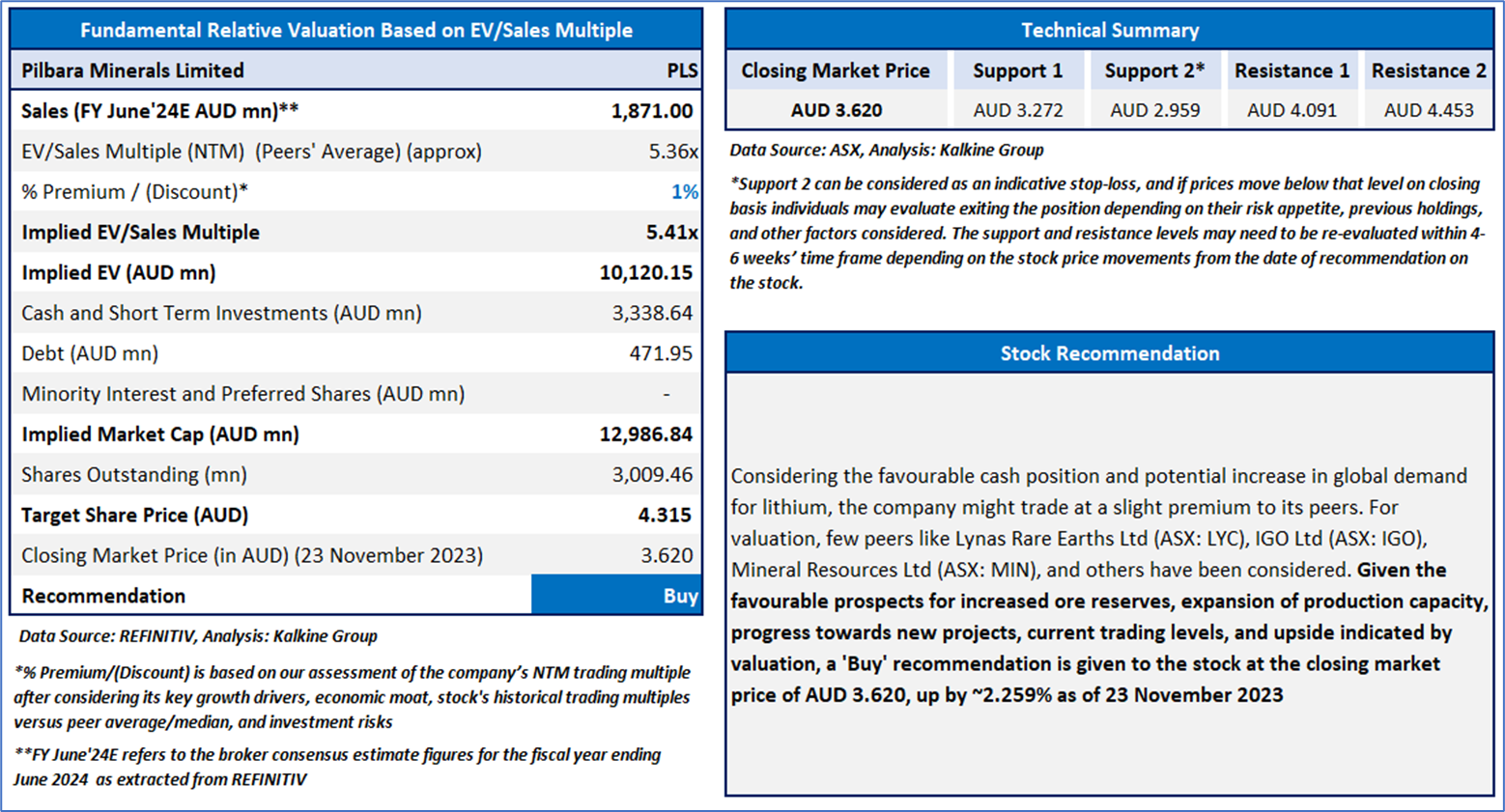

1. ASX: PLS (Pilbara Minerals Limited)

(Recommendation: Buy, Potential Upside: Low Double-Digit, Mcap: AUD 10.65bn)

PLS is a pure-play lithium company based in Australia. It is engaged in the exploration, development, and mining of minerals in Australia.

Insights & Outlook

3-month ended financial period September 2023 (1QFY24) Highlights: The production declined by 2% PcP to 144.2k tonnes. However, the sales advanced by 6% PcP and stood at 146.4mn tonnes. The cash balance increased to AUD 3.0bn from AUD 1.4bn in 1QFY23. The unit operating cost (CIF) stood at AUD 1,004/tonne, down by 11% PcP, favouring favourable cost-saving parameters.

Outlook: Ore reserves surged by nearly 35%, supporting the study of further expansion of production capacity beyond 1mn tonnes per annum, which is expected to culminate by 4QFY24. The POSCO JV chemical plant in South Korea rendered its first shipment of spodumene concentrate. P1000 expansion project and the Mid-Stream Demonstration Plant progressed well and stood on schedule.

Key Risks: Inflationary pressures and high labour costs are material risks associated with PLS.

The stock has witnessed a dip of ~29.16% in the last 3 months, and over the last 6 months, it has declined by ~21.81%. The stock has a 52-week low and 52-week high of AUD 3.355 and AUD 5.430, respectively and is currently trading below the 52-week high-low average. PLS was last covered in a report dated ’2 November 2023’.

PLS Daily Technical Chart; Data Source: REFINITIV

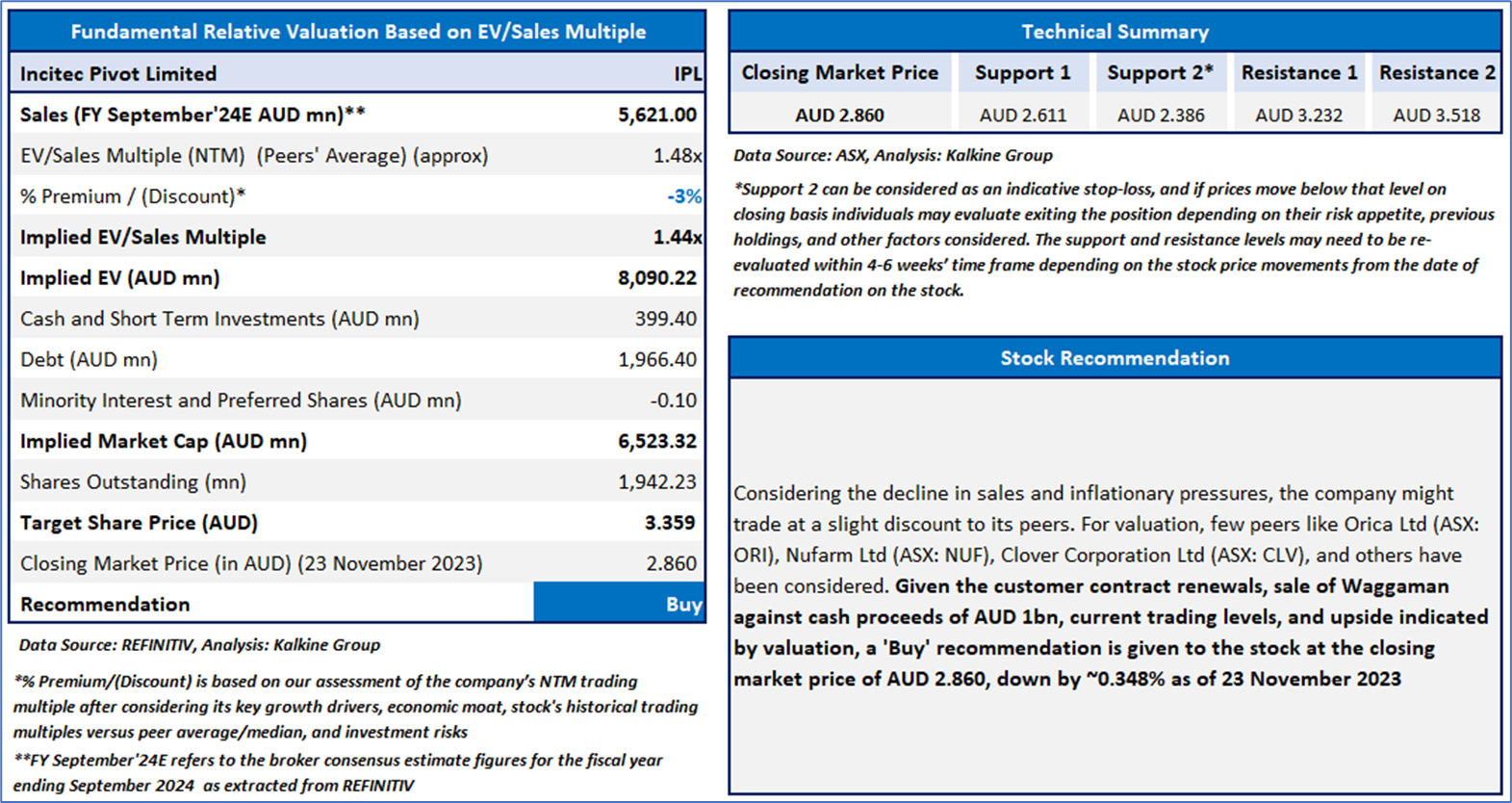

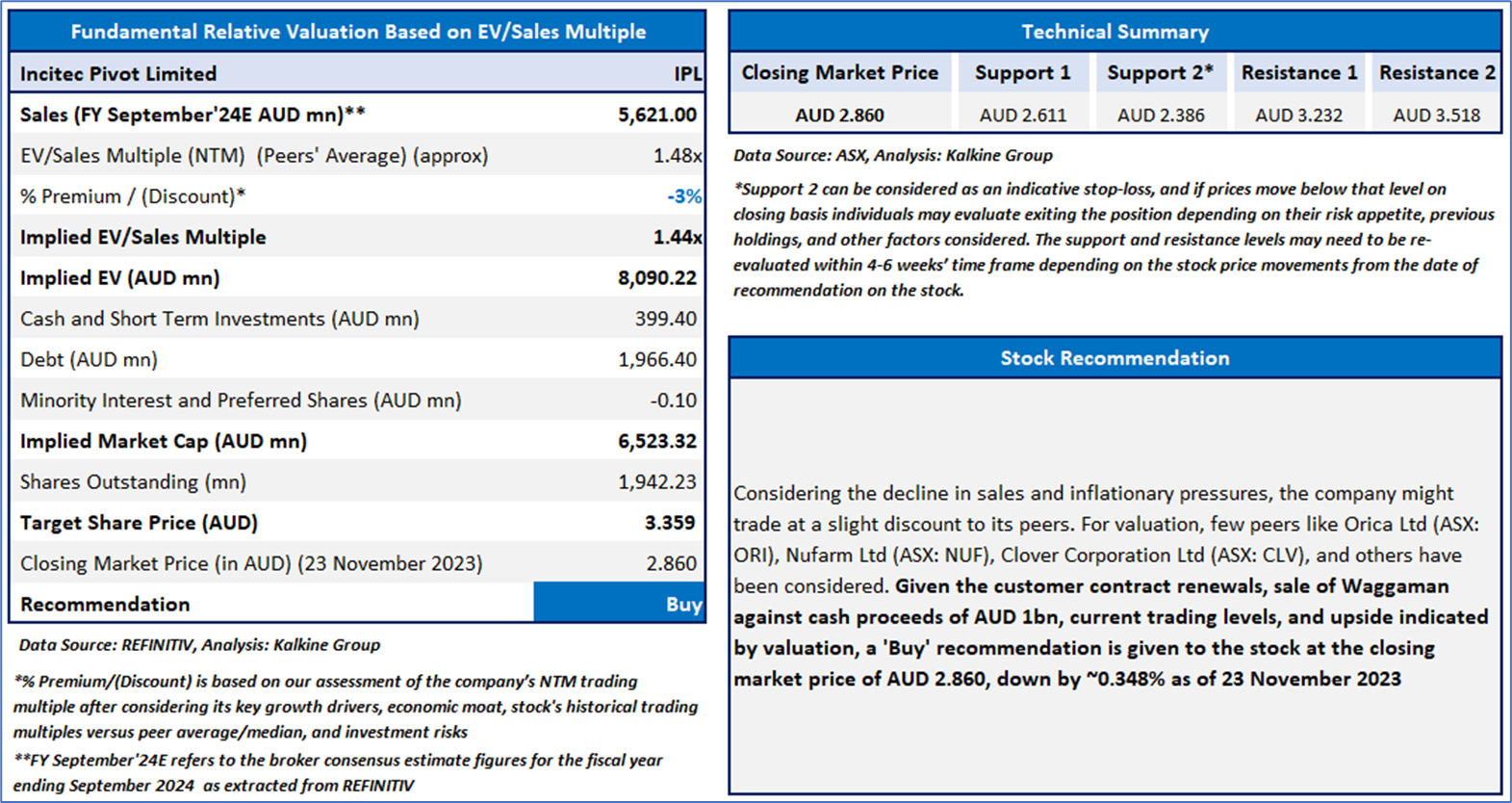

2. ASX: IPL (Incitec Pivot Limited)

(Recommendation: Buy, Potential Upside: Low Double-Digit, Mcap: AUD 5.57bn)

Incitec Pivot Limited (ASX: IPL) caters to the resources and agriculture sectors via its two business segments. Incitec Pivot Fertilisers is a bulk commodity supplier while Dyno Nobel provides industrial explosives and blasting services.

Insights & Outlook

12-month ended financial period June 2023 (FY23) Highlights: The total revenue declined to AUD 6,008.1mn, down by 5% YoY and the group EBIT ex. IMIs (excluding individually material items). The EBIT in Agriculture & Industrial Chemicals increased to 28.2% from 4.9% in FY22, offsetting the margin decline in Explosives and Waggaman. FY23 NPAT declined substantially to AUD 560.0mn from AUD 1,013.7mn in FY22 (down by 45% YoY), largely affected by the sale impact of WALA operations.

Business Update: On 16 November 2023, the US anti-trust regulatory review period was completed, supporting the sale of Waggaman against cash proceeds of AUD 1bn.

Outlook: The customer contract renewals stood under process in Australia alongside major contracts executed in FY23 (for example, with FMG). The remainder of the customer book is expected to renew or expire in FY24 and 1HFY25.

Key Risks: Inflationary pressures and regulatory constraints are material risks for IPL. Moreover, the Moranbah production forecast was expected to be nearly 330k metric tonnes in FY24 relative to 372k metric tonnes in FY23, primarily affected by the closure of Gibson Island.

The stock has witnessed a dip of ~2.72% in the last 3 months, and over the last 1 year, it has declined by ~30.92%. The stock has a 52-week low and 52-week high of AUD 2.580 and AUD 4.150, respectively and is currently trading below the 52-week high-low average. IPL was last covered in a report dated ’17 August 2023’.

IPL Daily Technical Chart; Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 23 November 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual’s appetite for upside potential, risks, holding duration, and any previous holdings. An ‘Exit’ from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services. Please note past performance is neither an indicator nor a guarantee of future performance.

Please also read our Terms & Conditions and Financial Services Guide for further information.

Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...