Company Overview: Telstra Corporation Limited (Telstra) is a telecommunications and technology company. Its principal activity is to provide telecommunications and information services for domestic and international customers. The Company operates through four segments. The Telstra Retail segment provides telecommunication products, services and solutions across mobiles, fixed and mobile broadband, telephony and Pay television/Internet Protocol television and digital content. The Global Enterprise and Services segment provides sales and contract management for business and government customers. The Telstra Operations segment offers overall planning, design, engineering and architecture and construction of Telstra networks, technology and information technology solution. The Telstra Wholesale segment provides a range of telecommunication products and services delivered over Telstra networks and associated support systems to other carriers, carriage service providers and Internet service providers.

.png)

TLS Details

Robust Customer Growth Aided Telstra’s FY 2018 Performance: Telstra Corporation Limited (ASX: TLS) happens to operate in the telecommunication industry and is having the market capitalization of around $37.94 billion as of 31 January 2019. The company operates through five main business verticals, i.e., Telstra Consumer and Small Business, Telstra Enterprise, Telstra Wholesale, Telstra Operations, and Others which contributed around 51%, 28%, 10%, 4%, and 7%, respectively in total income, in FY18. During the year, the company witnessed robust momentum in the subscriber growth with regards to fixed as well as mobile. The company stated that, in FY 2018, there was healthy customer growth and the company’s productivity program was also ramped up. However, the company’s NPAT, as well as EBITDA, witnessed some negative impacts due to further nbn roll out as well as lesser ARPU (or Average Revenue Per User). Moreover, the company introduced T22 strategy which would be providing 6 important outcomes related to simplification, customer experience, employees, network superiority, strengthening of the balance sheet as well as a reduction of the costs. Further, the company has also worked towards the operating model, the leadership team and new organizational structure. Talking about the company’s expected performance, the company is expected to witness challenging trading conditions in FY 2019. The company’s ARPU, as well as the rollout of nbn network, is expected to impact the company performance. However, the company happens to possess a decent position with respect to the margins. Over the past few years, the company has witnessed roller coaster ride when it comes to the stock performance on the back sectorial headwind, macroeconomic factors, nbn impact, stiff competition, etc. At CMP of $3.11, the stock of the company is trading at P/E 13.64x of FY20E EPS. In our view, the company is structurally placed among the telecom players with its diversified presence across the country along with increasing sport live pass users, increasing active 24/7 App users, enhanced 307 new mobile base stations in FY18 under the Federal Government’s Mobile Black Spot Program and bringing total to more than 450 in FY18 which include 5G innovation centres. Keeping the view of a decent outlook in the business along with mixed challenges, we have valued the stock using the Relative valuation method, P/E and EV/Sales and 1-year Forward P/E market multiples to FY20E consensus EPS of $0.228 and have arrived at target price upside of about single-digit growth (in %), while NBN is being estimated to pull down on earnings level in FY19 to some extent. Key Risks related to rating include regulations, impact of nbn network, data security risk, highly competitive market, softened demand for fixed line, saturation in the Australian mobile market, etc.

Key Financial Metrics:

.png)

Source: Company Report, Thomson Reuters

Decent Margins Amid Increased Competition: The net margin of Telstra Corporation Limited stood at 13.6% in FY 2018 which happens to be higher than the industry margin of 10.1%. This reflects that the company has been efficiently following the disciplined cost management strategies as compared to the broader industry which might prove to be a catalyst for the long-term driver of the company. Moreover, the company has consistently generated value for the shareholders with ROE for FY18 at 24.1% compared to the industry average of 13.2%.

.png)

Margins Performance Trend (Source: Company Reports)

Mobile Revenues Rose Marginally YoY: In FY 2018, Telstra Corporation Limited’s mobile revenue witnessed the rise of 0.4% on the YoY basis and the same stood at $10,145 million. There was a fall in the Post-paid handheld ARPU of 3.4%, and thus, in FY 2018, it stood at $65.41 because of lesser out of bundle revenue as well as higher competition. However, the Machine to Machine revenue witnessed a rise of 13%, and thus, in FY 2018, it stood at $165 million. The group continues to see growth in the mobile division with the synergistic acquisition of MTData and VMtech and the implementation of new solutions with regards to utilities, logistics, financial services, and health.

.png)

Mobile Product Performance (Source: Company Reports)

Fixed Revenues Witnessed A Fall YoY: The fixed revenue of Telstra Corporation Limited witnessed the fall of 9.2% and thus, in FY 2018, it stood at $5,812 million. The higher rate of the nbn migration as well as competition has weighed over the fixed revenue. However, these negative impacts got partly offset by the improvement with regards to retail bundle momentum of H2 2018. As demonstrated by the company’s annual report FY 2018, the company with regards to nbn market, reported for 1,946,000 total nbn connections. Its market share, at the end of FY 2018, with respect to nbn happens to be 51% (excluding satellite).

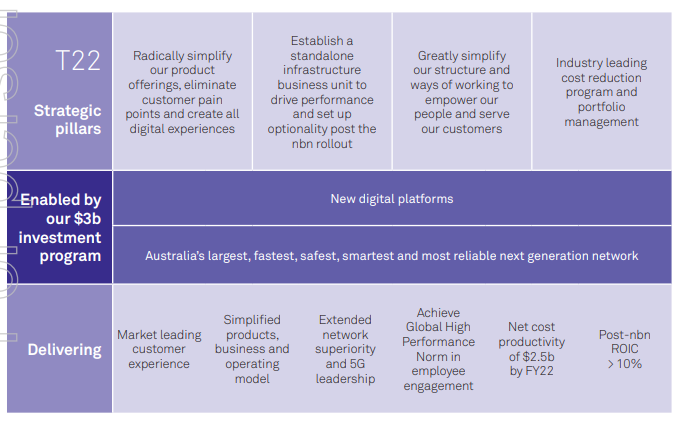

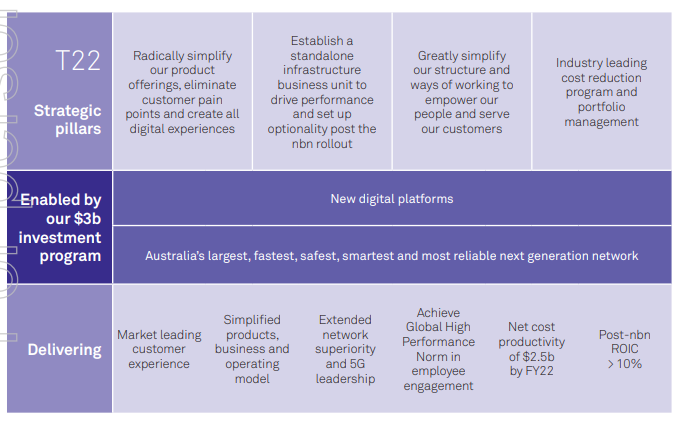

How Telstra2022 Strategy Might Support TLS Moving Forward: In June 2018, TLS had made an announcement related to the Telstra2022 strategy which is expected to support the company in the changing environment. The simplification of the products set as well as operations, reduction with respect to the cost base as well as improvement of the customer experience would support Telstra Corporation. The company stated that the deployments which the company has made support the delivery with respect to T22 strategy. The strategy would support the company and it can eliminate the customers’ pain points.

The company strategy happens to revolve around four pillars. First, the strategy focuses on the simplification of product offerings as well as the creation of digital experiences. Second, the strategy aims towards the establishment of a standalone infrastructure business unit as well as the setting up of optionality after the rollout of nbn. Third, the strategy is inclined towards the simplification of the structure as well as the ways of working so that people can be empowered, and the customers can be served. Finally, the strategy revolves around giving the cost-reduction programs as well as portfolio management.

T22 Strategy (Source: Company Reports)

TLS Deploys $386 Million Reflecting 5G Commitment: Not so long ago, TLS has successfully secured between 30-80 MHz with respect to 3.6 GHz spectrum auction which was conducted by Australian Communications and Media Authority. The company had deployed $386 million so that its national 5G rollout can be supported. Including the company’s existing holdings, Telstra Corporation Limited happens to have 60 MHz of the contiguous 5G spectrum with respect to the major cities of capital. However, with respect to the regional areas, the company has between 50-80 MHz of contiguous 5G spectrum (considering the existing holdings). The company’s top management had stated that sealing the spectrum reflects that the company has been playing an important role towards bringing the capabilities of 5G as well as super-fast connections to the people of Australia with respect to cities as well as regional areas.

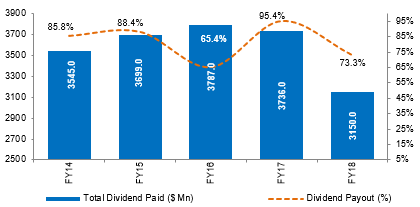

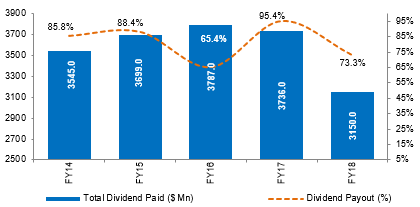

Higher Dividend Yield as Compared to Industry Average: Telstra Corporation Limited happens to be in strong position when it comes to dividend yield. The company is having the annual dividend yield of 4.7% while the broader industry average dividend yield stood at 2.4% on trailing twelve months basis. This reflects that the company is in the strong position when seen from the perspective of dividend paying capacity. This might attract the market players moving forward. The company has reset its dividend policy in FY18 which illustrated to disburse 70-90% of underlying earnings and 75% of the one-off payments from the nbn going forward.

Dividend Paid and Payout Ratio (Source: Company Reports)

TPG Telecom Decided to Cease the rollout of its mobile network- an opportunity for TLS: Recently, TPG Telecom Limited had made an announcement that they won’t be rolling out the mobile network in Australia because of the factors which are beyond the control of the company. The company stated that they were implementing as well as designing the mobile network mainly based on the small cell architecture. The principal equipment vendor who was chosen for the use with respect to the network was Huawei. The primary reason that the company chose Huawei was that there happens to be a simple upgrade path with regards to 5G with the help of Huawei equipment. The company added that Government had made an announcement in August 2018 regarding the prohibition of the Huawei equipment used in the 5G networks which blocks the upgrade path. This decision would provide competitive advantage to Telstra Corporation and might support the company in increasing the market share.

What Could Affect Telstra Corporation Moving Forward: The company had stated that the competitive environment might be further increased moving forward. The broader telecommunications market of Australia is expected to witness challenges because of the higher competition as well as the transition towards nbn network. The company has been taking significant steps towards the workforce as they stated that their workforce would be smaller as well as knowledge-based. Telstra Corporation had stated that there are expectations that they would be creating 1,500 new roles and, on the other hand, and there is anticipation that there would be a net reduction of 8,000 jobs in the time span of next 3 years. Overall, in FY 2019, the company is expected to experience additional restructuring costs amounting to circa $600 million.

Moving forward, the company would be working towards the products simplification as well as towards eliminating the pain points of customers. They would be focusing on the activities which could provide the people of Australia flexibility to personalize the home as well as mobile packages.

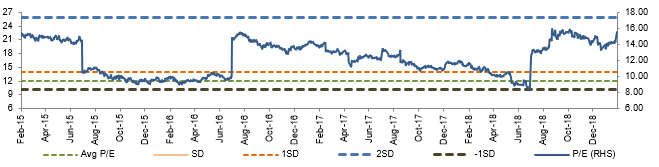

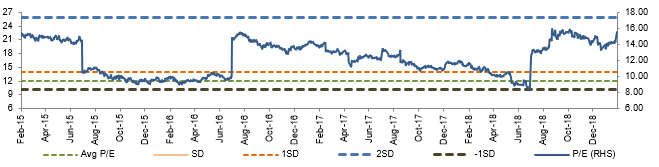

Historical PE Band (Source: Company Reports)

Stock Recommendation: On the daily chart of TLS, Moving Average Convergence Divergence or MACD has been applied and default values were used for the purposes. After careful observation, it was noticed that the MACD line has crossed the signal line and is trending in the upward direction. This is a bullish sign and there are expectations that the company might witness upward movement moving forward.

Fundamentally, the company is expected to get benefited by its decent position with regards to the net margins as it reflects the company’s focus towards the cost management strategies. Its performance would also be supported by the decision of TPG Telecom which reflects that they won’t be rolling out the mobile network in Australia. Keeping the view of a decent outlook in the business along with mixed challenges, we have valued the stock using the Relative valuation method, P/E and EV/Sales and 1-year Forward P/E market multiples to FY20E consensus EPS of $0.228 and have arrived at target price upside of about single-digit growth (in %), while NBN is being estimated to pull down on earnings level in FY19 to some extent. Based on the aforesaid facts, we give a “Buy” recommendation on the stock at the current market price of $3.110 (down 2.508% on 31 January 2019).

.png)

TLS Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.

Past performance is not a reliable indicator of future performance.

AU

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...