Company Overview - Southern Cross Media Group Limited is engaged in the creation and broadcasting of content on free to air commercial radio (frequency modulation and digital), television (TV) and online media platforms across Australia. Free to air broadcasting consists of the commercial radio and television broadcast licenses held throughout Australia. The Company’s Today Network is broadcasted in Sydney, Melbourne, Brisbane, Adelaide and Perth. The Company’s Triple M Local Works is broadcast through two different music offers-Triple M for rock and Local Works for variety. The Company’s subsidiaries include Tasmanian Digital Television Pty Ltd, Darwin Digital Television Pty Ltd, Central Digital Television Pty Limited, Eastern Australia Satellite Broadcasters Pty Ltd, Canberra FM Radio Pty Ltd, Black Mountain Broadcasters Pty Ltd, Sydney FM Facilities Pty Ltd and Melbourne FM Facilities Pty Ltd.

Analysis - SXL delivered a broadly in line 1H14 operating result, however FY14 guidance was below market largely driven by cost reinvestment needs against a competitive backdrop. We are attracted to the resilient radio assets and see upside potential for regional TV over the medium term. The metro radio market grew 2.8% in 1H14 as compared the previous corresponding period. Importantly for SXL given its geographical exposure the combined Sydney and Melbourne market grew 3.4% in 1H14 compared to the previous corresponding period. Melbourne grew at 4.2%, Sydney at 2.6%, Brisbane at 2.1% and Perth at 4.40% all registering growth while Adelaide declined 1.6% over the same period. In the month of December the market grew 1.8% as compared to the previous corresponding period.

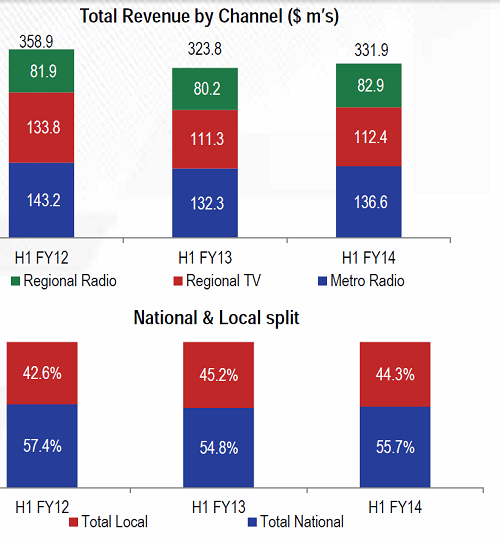

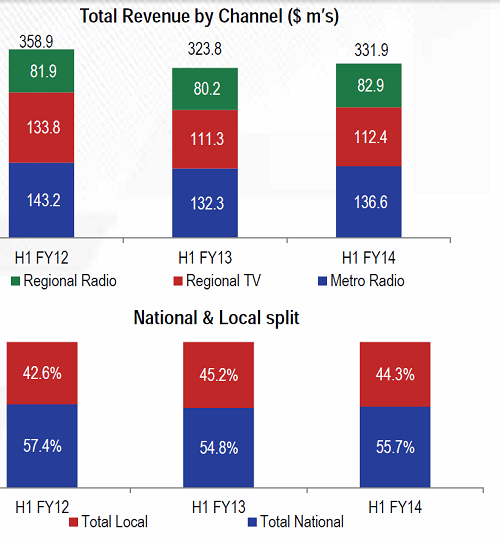

We highlight the appeal of its 6% dividend yield. We like SXL because of the resilient nature of the radio coupled with our view that SXL has been oversold based on the perceived risks at today FM. In the regional areas there was strong result with 6% Earnings before Income Tax, Depreciation and Amortization (EBITDA) growth to $65m on 2% revenue growth to $195m. Revenue growth comprised 1.0% TV growth to $112m and 3.4% Radio growth to $83m. SXL was pleased with the return to growth in TV revenue, attributable to successful sales of TEN’s Big Bash Cricket.

T3he metro radio division reported 1.6% revenue growth to $137m however 6% cost growth drove EBITDA down 7% to $42m. Selling, General and Administrative expenses were up 14.5% with employee costs 23% higher than the previous corresponding period. Metro radio maintained 34.4% in a stronger market. Triple M continues to strengthen partly offsetting the revenue decline in Today FM.

Some of the headline achievements for the group were: Reported revenue were up 1.3%, underlying revenues were up 1.8%. Reported EBITDA was up 0.8%, underlying EBITDA was up 0.5%. Reported Net Profit after Tax (NPAT) was up 1.8% to $45.9m underlying NPAT was up 1.1%. Earnings per share (EPS) stable at 6.5 cents per share, dividend declared of 4.5 cents per share. Successfully negotiated the refinancing of $650m debt facility.

Source - Company Reports

Source - Company Reports

SXL had No.1 FM breakfast shows in Melbourne, Sydney, Gold Cost and Perth. With over 900,000 listeners FOX FM Melbourne Remains Australia’s most listened to station. Triple M continues to dominate as No.1 network for males between 25-54 age group. It also had No.1 regional stations in Newcastle and the Gold Coast. SXL also secured all new star line up for Sydney and Melbourne breakfast shows for 2014. All these rankings were provided by Nielsen Metro and Regional Radio Survey.

With regards to the TV share, Gap between audience and commercial share has improved due to the local sales effort around special events and renewed confidence in CH10 programming. Big Bask cricket league has had strong client interest and we believe would lay a foundation for a better 2014.

SXL Daily Chart (Source – Thomson Reuters)

SXL Daily Chart (Source – Thomson Reuters)

|

Price |

Price % Change |

|

Close: |

1.415 (24-Feb-2014) |

3M: |

(12.42%) |

|

52 Wk High: |

1.92 (12-Sep-2013) |

6M: |

(18.02%) |

|

52 Wk Low: |

1.29 (14-Jun-2013) |

1Y: |

0.36% |

|

Dividend |

|

Yield |

6.315789 |

FY |

|

|

6.939408 |

5yr Av |

|

Payout Ratio |

33.00247 |

FY |

|

|

68.93095 |

5yr Av |

SXL expects underlying FY14 NPAT to be broadly in line with the previous corresponding period. Metro radio markets were described as steady with management noting that initial signs from the new content line up are positive and all new shows are receiving strong sponsorship interest. SXL further noted that Metro revenues are performing as expected to the end of February 2014. Regional radio markets have been consistent at the local level however national revenues remain challenged. Regional TV was described as short and choppy. SXL highlighted sales success of Big Bash Cricket and Sochi Winter Olympic games has provided a good start to 2H14 regional TV, however a sustained rating improvement is required to maximize the benefits of these events in the near term. The company expects 2H14 benefits to flow from operational cost efficiencies with $6m in annualized saving and the recent refinancing allowing $8m in annualized saving, enabling further investment in marketing and content.

|

SXL AUD, Millions |

2013 |

2012 |

2011 |

2010 |

2009 |

|

Total Revenue |

642.6 |

687.3 |

492.8 |

406.9 |

395.7 |

|

Gross Profit |

538.2 |

571.5 |

371.8 |

296.2 |

291.5 |

|

Total Operating Expense |

457.4 |

491.4 |

356.8 |

330.6 |

347.4 |

|

Operating Income |

185.2 |

195.9 |

136.1 |

76.4 |

48.4 |

|

Net Income Before Taxes |

133.3 |

126.3 |

87.2 |

24.2 |

(15.7) |

|

Provision for Income Taxes |

37.2 |

31.3 |

23.2 |

4.3 |

(34.4) |

|

Net Income After Taxes |

96.1 |

95.0 |

64.1 |

19.9 |

18.6 |

There are a number of downside risks to the SXL stock price with a metro radio or regional market slowdown may reduce SXL’s advertising revenue which on a high fixed cost base would be amplified at the bottom line. There is risk from the TEN affiliate agreement, programming risk as SXL relies on TEN for content and risk around the agreement (fees). SXL’s revenue is strongly linked to its ability to deliver ratings performance in a competitive market and downside risks exists if SXL loses market share.

|

SXL |

Industry Median |

2013 |

2012 |

2011 |

2010 |

2009 |

|

Profitability |

|

|

|

|

|

|

|

Gross Margin |

55.6% |

83.8% |

83.2% |

75.9% |

74.0% |

74.1% |

|

EBITDA Margin |

26.3% |

32.9% |

32.9% |

29.8% |

31.8% |

31.9% |

|

Operating Margin |

21.6% |

28.8% |

28.5% |

27.6% |

18.8% |

12.2% |

|

Earning Power |

|

|

|

|

|

|

|

Pretax ROA |

10.2% |

5.4% |

5.2% |

4.6% |

1.4% |

(0.8%) |

|

Pretax ROE |

19.4% |

8.6% |

8.3% |

6.9% |

2.6% |

(1.7%) |

|

Liquidity |

|

|

|

|

|

|

|

Current Ratio |

1.61 |

1.19 |

1.08 |

1.12 |

1.80 |

1.54 |

|

Cash Cycle (Days) |

17.4 |

24.0 |

21.8 |

52.3 |

52.1 |

64.5 |

|

Leverage |

|

|

|

|

|

|

|

Assets/Equity |

1.68 |

1.57 |

1.61 |

1.59 |

1.35 |

2.39 |

|

Debt/Equity |

0.30 |

0.44 |

0.46 |

0.47 |

0.28 |

1.22 |

SXL delivered a broadly in line 1H14 operating result, however FY14 guidance was below market largely driven by cost reinvestment needs against a competitive backdrop. We remain attracted to the resilient radio assets and see upside potential for regional TV. We also highlight the appeal of its 6% dividend yield. We will be putting a buy on SXL at the current price of $1.415.

Disclaimer

Kalkine provides general advice on securities. Kalkine does not provide advice that takes into account your, or anybody else’s investment objectives, financial situation or needs. We strongly suggest that you should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. Employees and/or associates of Kalkine Pty Ltd may hold one or more of the stocks reviewed on this website. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

Please wait processing your request...

Please wait processing your request...