Company Overview: Predictive Discovery Limited (ASX: PDI) is an exploration and development company, based in Australia. The company is involved in the mineral exploration with the goal of classifying and developing economic reserves in West Africa and Australia. It mainly deals in the exploration of Gold through its projects such as Bankan, Kankan, Nonta, Kaninko and Boroto Projects, etc. The company started trading on ASX in December 2010.

.png)

PDI Details

Gold Intersection at Bankan Project:

- 5m @ 5.2g/t Au got intersected after the seven holes Diamond Drilling program (totaling 4,668m) got completed at its Bankan Project, situated in Guinea. Currently, the project has an inferred resource of 72.8 million tonnes at 1.56g/t Au for 3.65 million ounces of gold. The company will undergo an aggressive drilling program over next 12 months to increase the resource base.

3QFY22 Highlights:

- Quarterly Rebalance: As per the announcement on 4th March 2022, PDI was added to the “All Ordinaries” Index, effective from 21st March 2022.

- Geochemical targets within 3km of the NE Bankan deposit were found in the third quarter. The results from regional exploration that also included the drilling testing ten structural targets identified by the 2021 aeromagnetic survey, also came during that period.

- On the corporate side, an experienced exploration geologist and noted West African mine builder, Andrew Pardey was appointed as a Managing Director in the company.

- Cash Activities: With the Nil cash receipts from customers during 3QFY22, the company reported $4.76 million as its cash outflow, where the maximum amount was contributed under the exploration and evaluation head of $3.55 million. The cash balance at the end of third quarter as on 31st March 2022, clocked in at $12.92 million versus $17.48 million in previous quarter ending 31st December 2021.

Key Metrics (Source: Analysis by Kalkine Group)

Top 10 Shareholders:

The top 10 shareholders together form around 45.97% of the total shareholding, while the top 4 constitute the maximum holding. Capital DI Ltd and Van Eck Associates Corporation are holding a maximum stake in the company at 10.20% and 5.49%, respectively, as also highlighted in the chart below:

.png)

Top 10 Shareholders (Source: Analysis by Kalkine Group)

Key Metrics: PDI’s current ratio was reported at 8.97x, which has reduced over the years but still maintains an uptick as compared to the industry median of 2.26x. Moreover, the company shows a decent balance sheet with a cash balance of $17.48 million and nil debt at the end of 31st December 2021.

Liquidity Profile (Source: Analysis by Kalkine Group)

Key Risks:

- COVID-19 Pandemic: Travel restrictions and lockdowns due to COVID-19 might hold down its operations of mining and thereby affecting its earnings, cash flow and financial position.

- Commodity Risk: As the company’s business involves commodity prices, it might get affected by the changes in demands, currency fluctuations and commodity price differences.

- Regulatory Risk: The company is exposed to a more complex regulatory environment; any failure in the same could lead the business to fines, penalties, etc.

- Technology & Labor Risk: The business is quite dependent on the technology it applies and availability of labors. Hence, failure of regular upgradation and labor costs might affect the operations and profitability.

- Profitability Risk: The company faces a risk related to non-profitability and has suffered losses in the past five years due to no revenue generation till date and high administrative and exploration costs.

Outlook: The company has its major projects in West Africa and Australia, where West Africa is considered as 1st region for most gold discoveries over the past decade, 2nd for global gold producing region in 2020 and 4th for global gold exploration spending in 2020. For its June Quarter, PDI has planned to complete regional power auger and aircore target definition programs for its Bankan Project. It also has plans of ramping up its drilling activities with a minimum of four diamond drill rigs. Both current and ongoing drilling activities will underpin an updated Mineral Resource Estimate, which is expected to be completed in September 2022 quarter.

The next West African Tier-1 gold mine involves banker deposit (3.7Moz MRE) of 72.8 million tonnes at 1.56g/t as inferred and the mine holds further potential to increase the resource base. The company is well-positioned to claim Guinea's largest gold producer title within 5 years, alongside complete backing of Guinean Government. After CY22, global gold consumption is forecasted to rise at an annual average rate of 4.0%, clocking 4,925 tonnes by 2027, as curtailed gold prices promote jewellery demand and retail investment. Therefore, the expected gold demand in future puts the company into a cushioning comfort and allows it to see a positive foreseeable future.

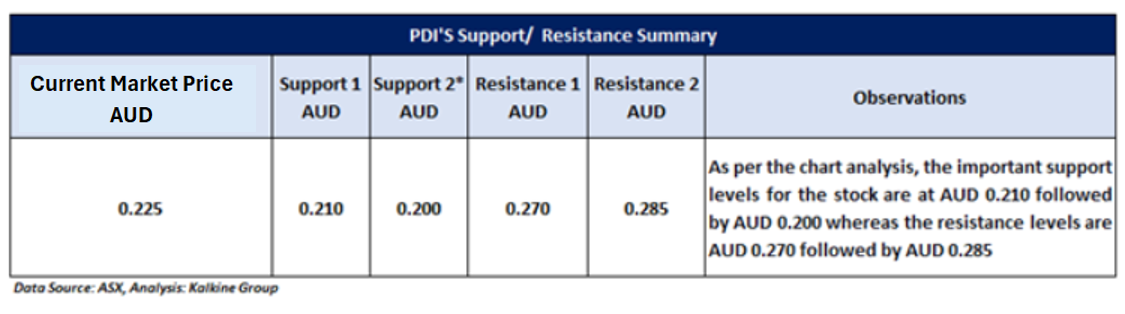

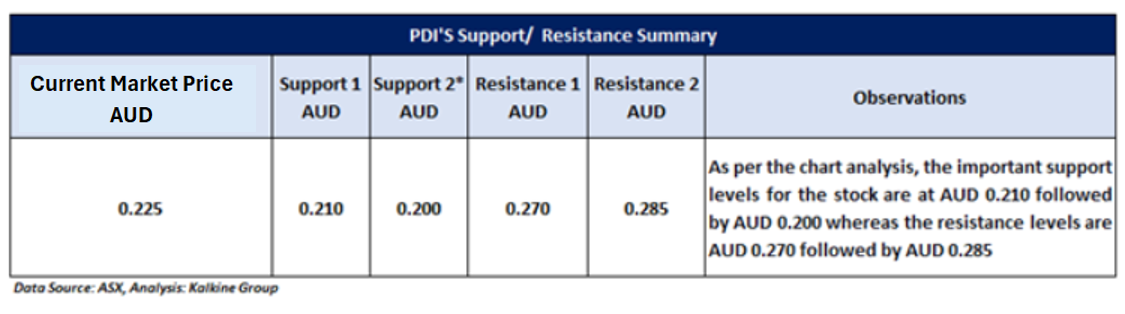

Technical Analysis: PDI prices broke the downward sloping trend line by upside with volume support and the prices are sustaining above the same from the past two weeks. Prices are also trading above its 50-period SMA that also supports the bullish stance in the stock. The momentum indicator, RSI (14-period) is hovering at ~54.047 on a daily chart that indicates the stock is trading in a bullish momentum. Immediate support levels are AUD 0.200 and AUD 0.182, while immediate resistance levels are AUD 0.270 and AUD 0.285.

Stock Recommendation: The company is trading higher than its 52-week low-high average of $0.074 - $0.295, respectively. The stock of PDI has given a positive return of ~53.33% in the last nine months and ~6.97% in the past one month. Considering the decent liquidity position, nil debt-to-equity ratio, expected ~4% upside in gold consumption, technical levels provided above, its recent Au intersection, well positioning to claim Guinea's largest gold producer title within 5 years, profitability and key risks associated with the business, we recommend a ‘Speculative Buy’ rating on the stock at the current price of $0.225, as of 3rd May 2022, ~11:30 AM (GMT+10), Sydney, Eastern Australia. Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

.png)

PDI Daily Technical Chart, Data Source: REFINITIV

Note 1: The reference data in this report has been partly sourced from REFINITIV

Note 2: Investment decisions should be made depending on the investors’ appetite on upside potential, risks, holding duration, and any previous holdings. Investors can consider exiting from the stock if the Target Price mentioned as per the analysis has been achieved and subject to the factors discussed above alongside support levels provided.

Technical Indicators Defined: -

Support: A level where-in the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level where-in the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine and its related entities do not hold interests in any of the securities or other financial products covered on the Kalkine website unless those persons comply with certain safeguards, procedures, and disclosures.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.

AU

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...