In today’s daily we have covered stock research on

Newcrest Mining (BUY). To view

3 Undervalued Stocks to Buy click here

S&P 500 was down by 12.25 points or 0.65% to 1872.83 on Tuesday. U.S. stocks fell on Tuesday as retailers' shares dropped after earnings from

TJX Companies and

Staples halted the market's two-day winning streak. TJX Cos Inc shares slumped 7 percent to $54.34 and ranked as the biggest drag on the S&P 500 after the owner of off-price chain stores TJ Maxx and Marshalls reported lower-than-expected quarterly revenue.

Staples tumbled 13.1 percent to $11.64 after the office supply retailer posted first-quarter earnings and forecast a decline in sales in the current quarter. Equities have pulled back more than 1 percent since the Dow and the S&P 500 hit record closing highs on May 13 as investors look for signs confirming an acceleration in the U.S. economy that many had hoped to see at this point in the year.

S&P 500 Daily Chart (Source – Thomson Reuters)

S&P ASX 200was up by 11.4 points or 0.21% on Tuesday and closed at 5420.4 points.

Iron Ore price below $US 100 mark might be attributed to a weak Chinese property market as well as Chinese iron ore traders dumping iron ore stocks ahead of a June deadline to repay bank loans.

Spark Infrastructure has raised $200m to fund its 14% stake in the

Duet Group.

Treasury Wine Estatesshares went up more than 17% on Tuesday after revealing that they have been in talks with the private equity group

KKR about a takeover offer.

Genworth’s shares rallied more than 13% on the first day of its trading on the ASX.

S&P ASX 200 Daily Chart (Source – Thomson Reuters)

The

top gainers on ASX 200 were:-

Stock of the Day – Newcrest Mining (NCM)

Stock of the Day – Newcrest Mining (NCM)

Third Quarter fiscal 2014 production was largely as expected, declining 11% to 552,000 ounces. Newcrest should deliver at the top end of fiscal 2014 guidance of 2.0 to 2.3 million ounces. Cash costs increased to AUD 723 per ounce from AUD 695, with lower output due to maintenance and reduced plant through put. Operating costs remain on a downward trend with aggregate site costs again falling.

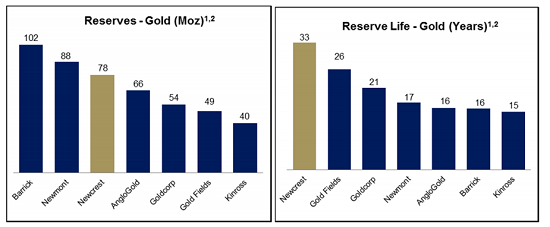

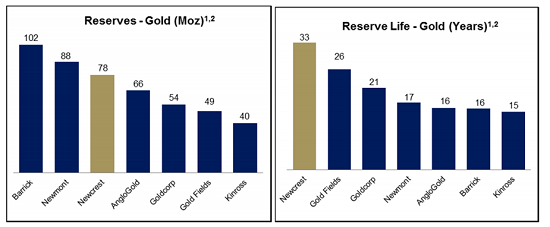

Fiscal 2014 all in sustaining costs should be should be at or below the bottom end of guidance of AUD 2.73 to 2.45 billion. Management commentary around ongoing productivity efforts and cost controls is pleasing. Newcrest says much improvement and optimization is still to go, particularly at Lihir. The long reserve and resource life is a key differentiator and supports future growth. The market is disinterested in the large reserve base but it provides valuable options long term.

Source - NCM Company Reports

The renewed focus on productivity and costs is welcome but further steps are required to sustainably improve the cost position and the balance sheet. During the March quarter Newcrest produced 551.6koz of Gold and 21.0kt of Copper at an AISC of A$988/oz. Gold production for FY14 YTD now sits at 1,795koz (or 76% of annual guidance) at an AISC of A$988/oz. This was very much in line with the company’s most recent outlook that 2H14 would be softer than the strong 1H14.

NCM Daily Chart (Source - Thomson Reuters)

Exploration spend remains on track for lower end of guidance. Newcrest has reduced the number of active drill rigs from 16 to 5 over FY14. Further demobilization is likely with the current drill program at Wafi Golpu now complete for FY14. We expect Newcrest to meet FY14 guidance with some potential to the upside given the ore processing disruptions across top three operations, Cadia Valley, Lihir and Telfer during the march Quarter. On the basis that a similar production performance is achieved in the June Quarter, production would come in slightly above 2.30Moz and AISC looks like coming below guidance at A$980 – 1,020/oz. We believe NCM is undervalued and reiterate our BUY on the stock at the current price of $9.95.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.

Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).

The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.

Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.

The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide.

AU

Please wait processing your request...

Please wait processing your request...