In today’s daily we have covered stock research on Fortescue Metals (HOLD).

The S&P 500 was up by 28.10 points or 1.35% on Friday and closed at 2116.10 points. U.S. stock indexes ended more than 1 percent higher on Friday after strong jobs data indicated U.S. economic growth was picking up momentum, but not enough to raise concerns about an earlier-than-expected interest-rate rise by the Federal Reserve. U.S. job growth rebounded last month and the unemployment rate dropped to a near seven-year low, suggesting underlying strength in the economy at the start of the second quarter after growth hit a soft patch in the first.

The S&P 500 gained 28.10 points, or 1.35 percent, to 2,116.10 and the Nasdaq Composite added 58 points, or 1.17 percent, to 5,003.55. For the week, the Dow was up 0.9 percent, the S&P 500 was up 0.4 percent and the NASDAQ was down 0.04 percent. Microsoft rose 2.25 percent to close at $47.75 after Reuters reported that the company was not weighing an offer for Salesforce.com. Salesforce.com fell 2.85 percent to $72.40. AOL surged 10.23 percent to end at $43.42 after reporting revenue above analysts' expectations.

Microsoft Daily Chart (Source - Thomson Reuters)

S&P ASX 200 was down by 11.10 points or 0.20% on Friday and closed at 5634.60 points. NAB's2015 first-half cash profit - up 5.4 per cent to $3.3 billion - showed that NAB's performance was "back in line with its peers" . Energy shares finished lower on Friday after the oil price dropped 3 per cent overnight. Woodside finished 3.6 per cent lower on the day and 4.1 per cent lower during the week to close at $33.80, Oil Search dived 3.3 per cent on the day and 7.6 per cent for the week to $7.57. Santos lost 4.9 per cent for the day but gained 2.4 per cent for the week to finish at $8.59.

Among the miners, BHP sank 1.8 per cent on the day and and 3.7 per cent for the week to $31.30 and Rio Tinto lost 0.2 per cent on the day but gained 0.2 per cent for the week to close at $58.43 Fellow blue-chip Telstra gained 0.3 per cent on the day but fell 1.1 per cent for the week to close at $6.17. PanAust accepted a sweetened $1.85 a share takeover bid from Chinese investment firm Guangdong Rising Assets Management late on Friday. SAI Global jumped 4.6 per cent on the day and 3.8 per cent for the week to $4.09.

SAI Global Daily Chart (Source - Thomson Reuters)

Top Stocks ASX 200 :-

Top Stocks ASX 200 :-

Get up to 2 Years of free subscription by inviting your friends to KALKINE!

For every friend of yours who joins KALKINE, we'll give you 3 months of free subscription (up to a limit of 24 months free subscription). If you recommend 3 friends and they join within a month of you referring them, you get 1 year free subscription to KALKINE reports added to your account (up to a limit of 24 months free subscription). Simply reply to this email with their name, e-mail and phone number.

FMG VIDEO

FMG VIDEO

Stock Of The Day - Fortescue Metals (HOLD)

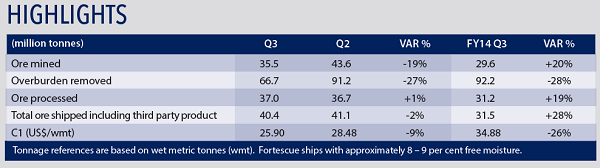

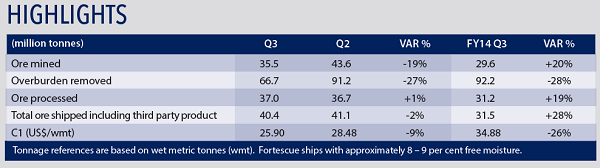

Fortescue Metals Group Limited (ASX: FMG) as its March quarter of 2015 updates reported a 28% rise in total ore shipped to 40.4 wet metric tonnes (wmt) as compared to 31.5 wmt for the same period in previous year. Moreover, the company could improve its C1 costs of $25.90/wmt, by 9% as compared to the previous quarter, and 26% as compared to March quarter of 2014. For the Chichester Hub and Solomon Hub, the strip ratios averaged 2.5 and 1.0, respectively.

March Quarter 2015 Highlights (Source: Company Reports)

However, falling iron ore price in March 2015 has impacted the company’s underlying contractual 62% Platts CFR price to an average $55/dmt from $62/dmt. For the realization on final contractual basis in March quarter, FMG sustained 85% or $48/dmt while it intends to realize in the range of 85-90% of the 62% Platts index in the future.

58% MBIO (P) Realization to the 62% Platts CFR Index (Source: Company Reports)

58% MBIO (P) Realization to the 62% Platts CFR Index (Source: Company Reports)

Meanwhile, the Construction of 270km, 16 inch Fortescue River Gas Pipeline linking the Solomon Power Station to the Dampier to Bunbury Pipeline was finished in March 2015 as per the schedule. In addition, the 1.5mtpa Iron Bridge Joint Venture Stage 1 OPF project was also completed and first ore was sent through pipeline to the concentrate handling facility. In addition, FMG successfully completed AP5 berth at Port Hedland with over A$50 million below the budget. The company has limited its exploration works to planning in the March quarter at Brownfield and Greenfield drilling programs, while the Chichester Hub’s resource update was issued in January.

Operating Performance (Source: Company Reports)

Operating Performance (Source: Company Reports)

Quite recently, FMG announced for the issuance of US$2,300 million of Senior Secured Notes wherein the net proceeds will be used to redeem 2017 and 2018 Senior Unsecured Notes, swap some 2019 Notes with new Senior Secured Notes and redeem other outstanding debts which will mature in 2019. As of March 2015, the company has a cash of $1.8 billion, while net debt decreased to $7.4 billion from $9.1 billion of the previous quarter.

FMG’s Pro Forma Debt Maturity Profile (Source: Company Reports)

FMG’s Pro Forma Debt Maturity Profile (Source: Company Reports)

FMG is seeking for operational efficiency, reducing C1 costs while enhancing processing and lower strip ratios to offset the impact of lower iron ore market prices. However, the first half of fiscal year 2015 underlying EBITDA decreased to US$1.4 billion as compared to $3.2 billion for the first half of fiscal year of 2014.

1HFY15 EBITDA (Source: Company Reports)

1HFY15 EBITDA (Source: Company Reports)

Meanwhile, management forecasts a better production and lower C1 costs going forward. FMG estimates the FY15 shipping guidance in the range of 160 to 165mtpa. The company is also seeking to decrease its C1 costs further, as a part of its cost savings initiative, and expects C1 costs of $18/wmt while the shipping guidance is estimated at 165mtpa for fiscal year of 2016 and a range of $23-24/wmt as the C1 costs for the June quarter of 2015. For the entire fiscal year 2015, FMG improved its C1 cost guidance to the range of $26-27/wmt, from its previous guidance of $28-29/wmt. FMG is also seeking to get maximum production from existing assets, and expects a $330 million (excluding exploration expenditure) or US$2/wmt capital expenditure for the fiscal year of 2016. The company intends to keep its cash balance above $1.5 billion for the June quarter of 2015. Moreover, FMG has also benefitted from the exchange rate sensitivities during the quarter, as it incurs most of the C1 operating costs in Australian dollar. The average US to Australian dollar exchange rate in the March quarter was 0.79, as compared to 0.86 in the prior quarter.

FY16 Guidance Breakeven Price (Source: Company Reports)

FY16 Guidance Breakeven Price (Source: Company Reports)

While lower Aussie dollar, cost reduction and lower strip ratio efforts might give some short term respite, lowering iron ore prices will continue to challenge FMG going forward with supply outstripping the demand.

Resource Portfolio Supports Asset Base (Source: Company Reports)

Resource Portfolio Supports Asset Base (Source: Company Reports)

At the same time, there are speculations about the company being open to asset sales irrespective of the debt pile revamping with regards to the repayments.

FMG Daily Chart (Source - Thomson Reuters)

FMG Daily Chart (Source - Thomson Reuters)

Based on the foregoing and given a mix of sentiments, we recommend a

HOLD for this stock at the current price of $2.50.

Level 13 167 Macquarie Street

Sydney NSW 2000 Australia

E-Mail - [email protected]

Phone - 02 8667 3147

Note - You can also view this daily in the special reports section.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.

Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).

Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).

The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.

Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.

The link to our  Terms & Conditions has been provided please go through them and also have a read of the

Terms & Conditions has been provided please go through them and also have a read of the  Financial Services Guide.

Financial Services Guide.

AU

Please wait processing your request...

Please wait processing your request...