This report is an updated version of the report published on 8 July 2024 at 3:13 PM AEST.

Company Overview: Corporate Travel Management Limited (ASX: CTD) is an Australia-based firm that offers business travel management services. Its primary activities include coordinating the buying and delivery of travel services for its clients. The company's segments comprise Australia and New Zealand, North America, Asia, and Europe. Accent Group Ltd (ASX: AX1) is an ASX-listed digitally integrated retailer and distributor of footwear. The company operates approximately 786 stores and 35 websites across different retail banners, and distribution rights for 17 international brands across Australia and New Zealand. Kalkine’s Market Event Report covers the Investment Summary, Event Summary, Data Insights & Analysis, Key Financial Metrics, Risks, Outlook, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

Investment Summary

Event Highlights

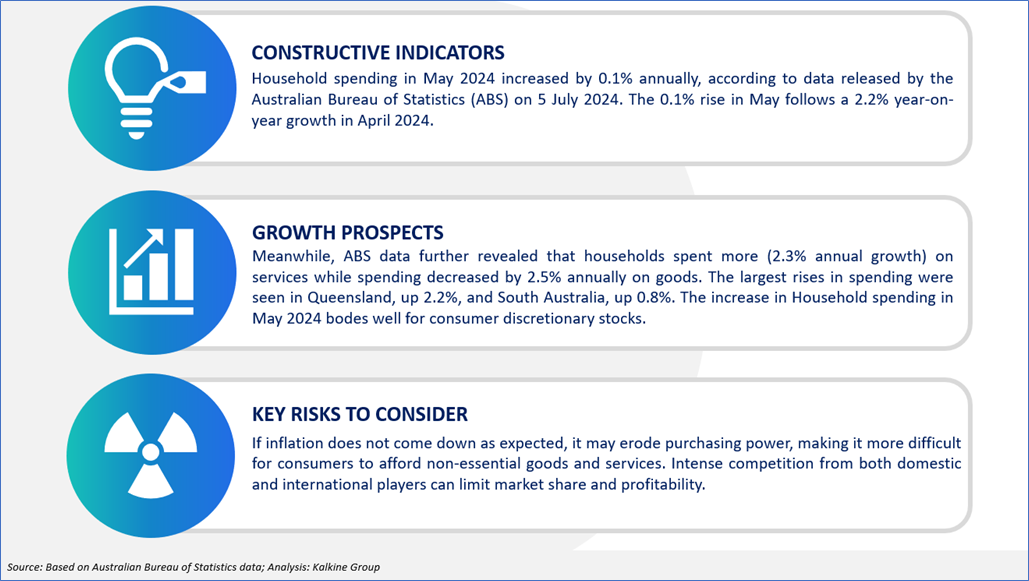

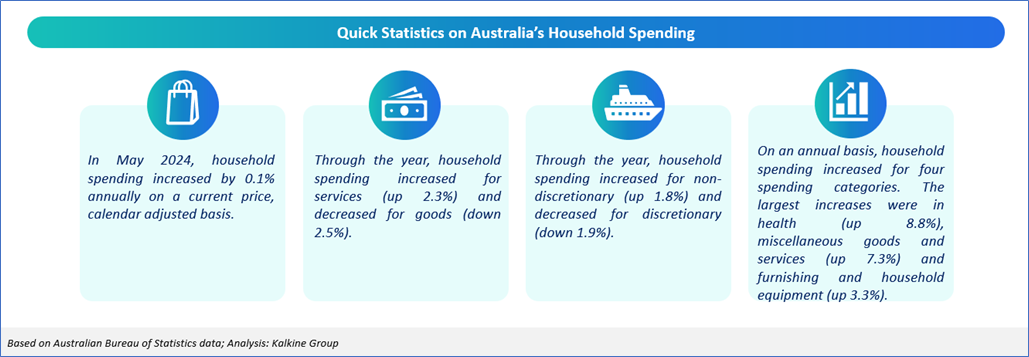

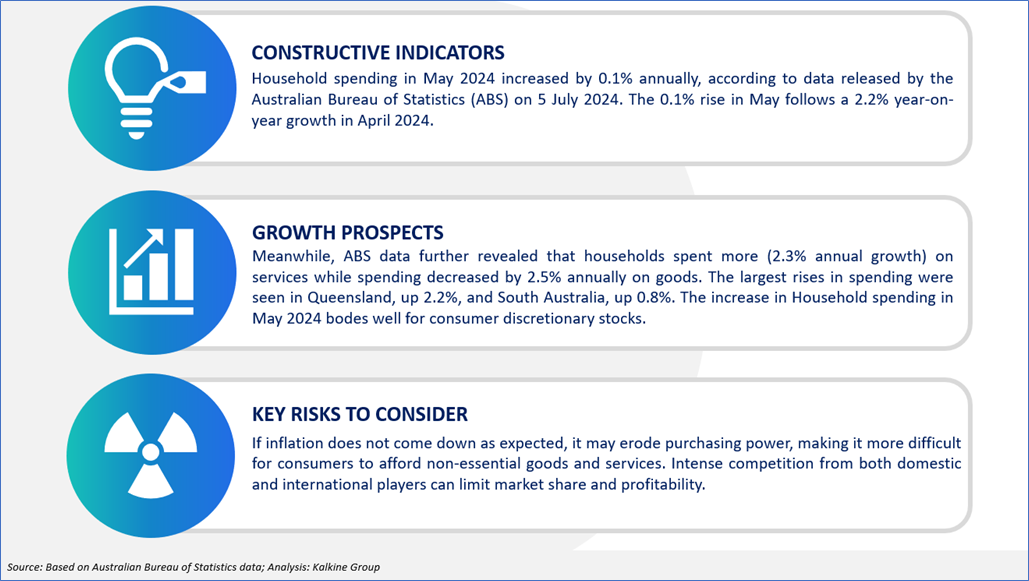

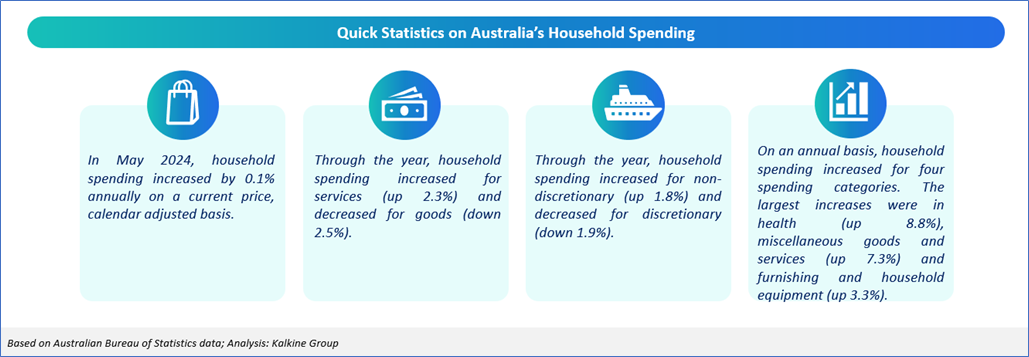

Data Insights and Analysis

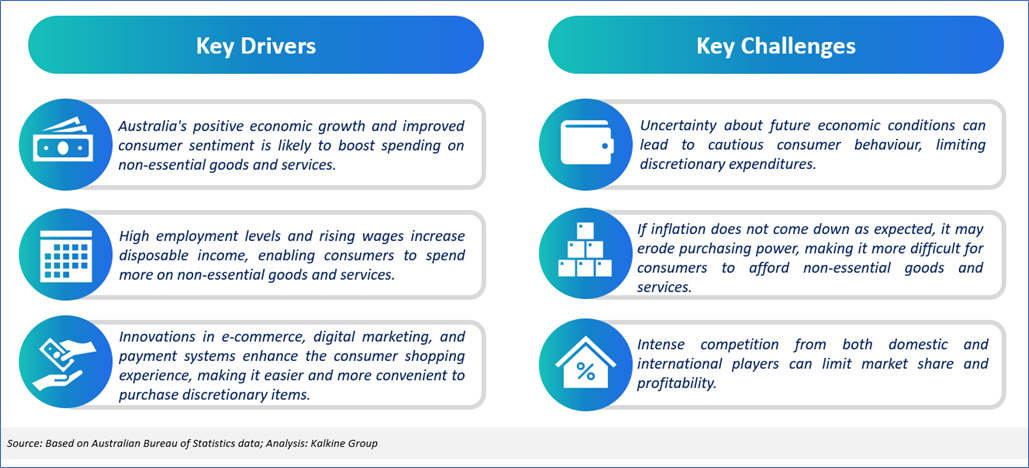

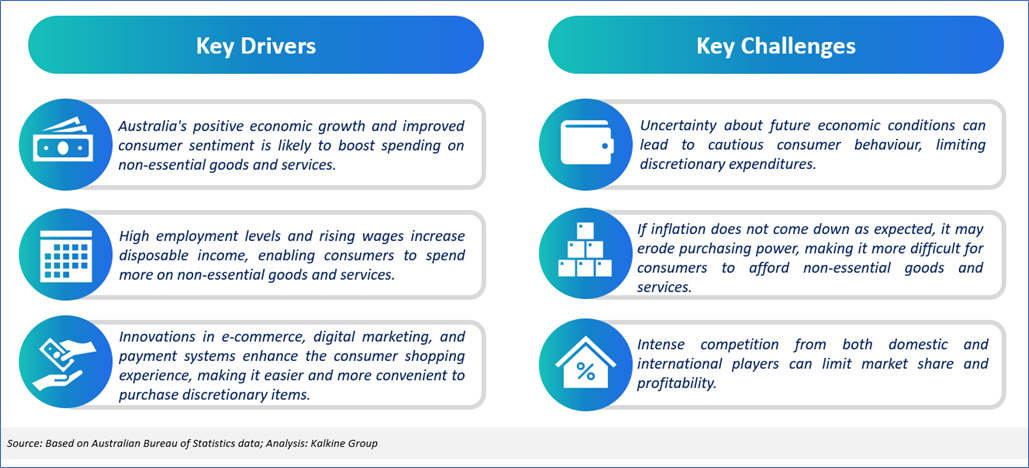

Key Drivers versus Key Challenges

Based on the above data, two ASX stocks have been identified to showcase the momentum.

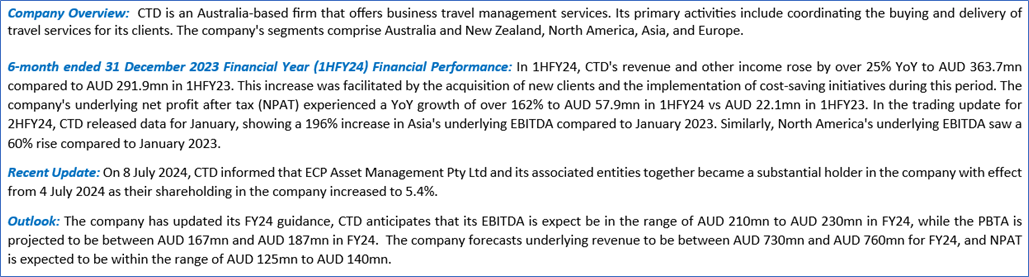

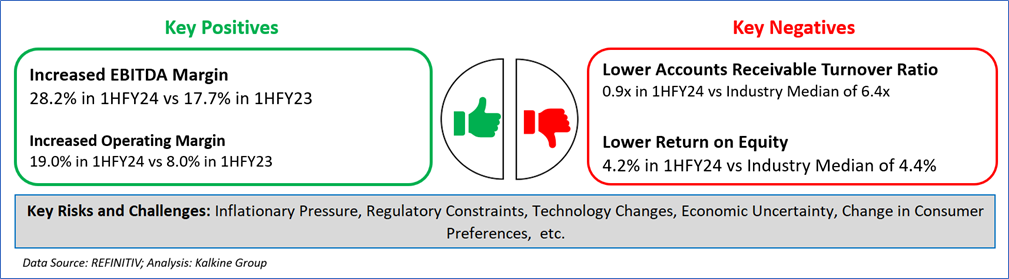

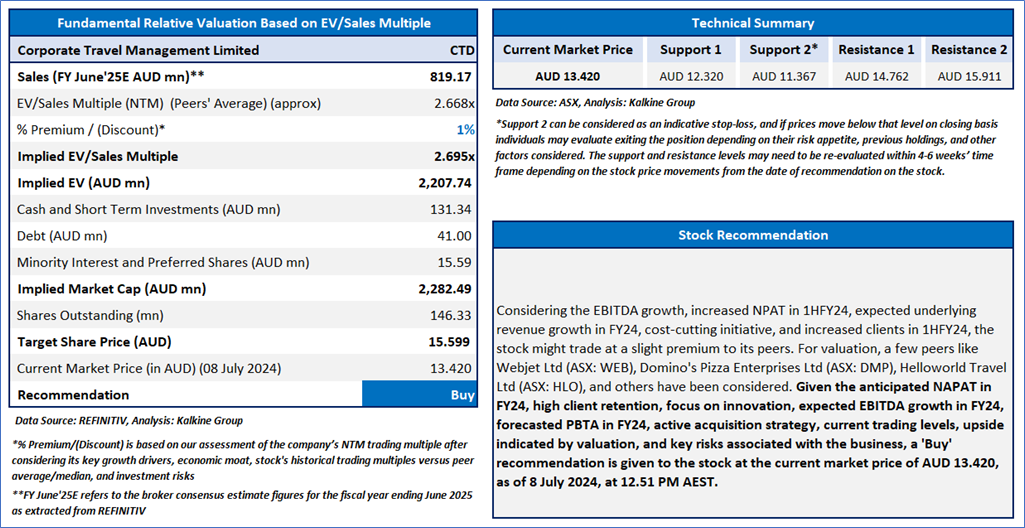

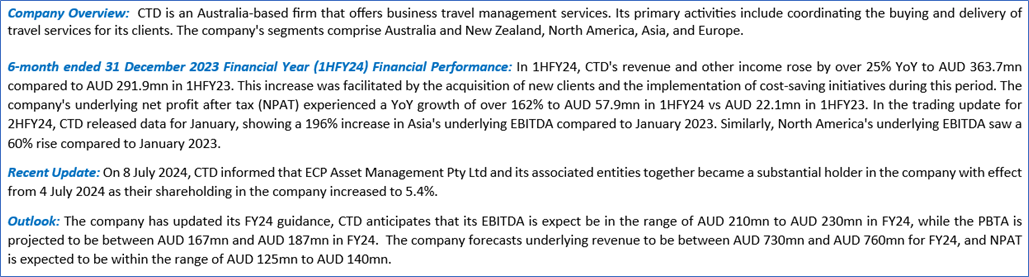

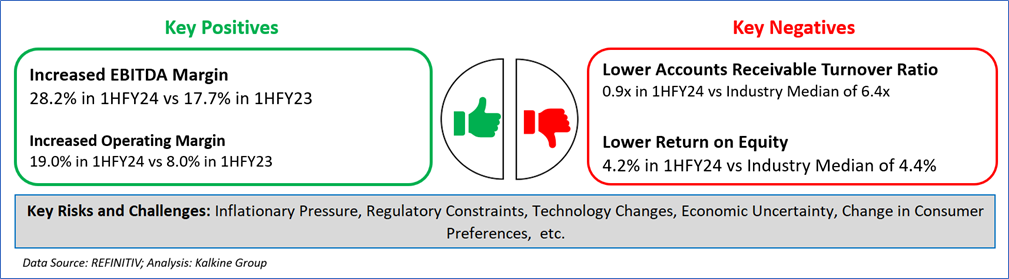

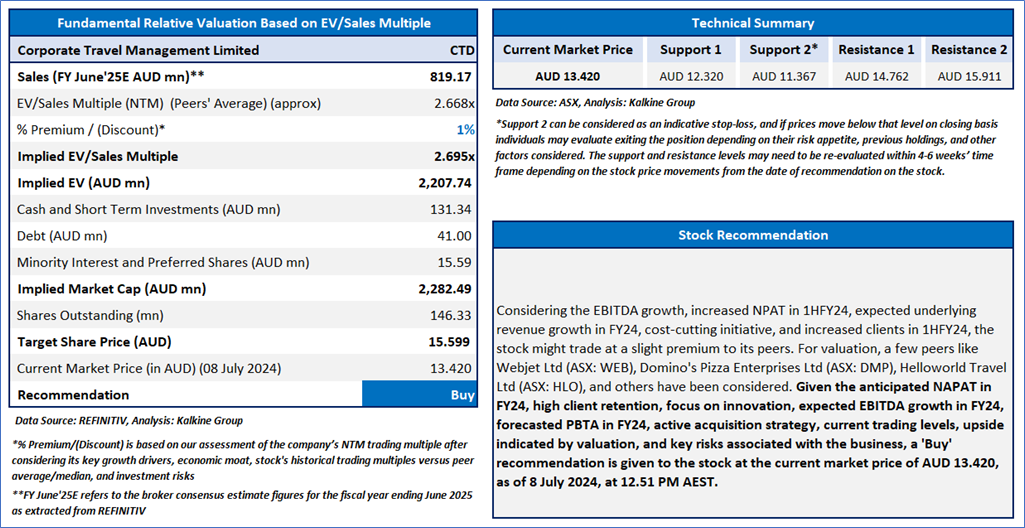

1) Corporate Travel Management Limited (ASX: CTD) (Recommendation: ‘Buy’ at AUD 13.420, Potential Upside: Low Double-Digit) (M-cap: AUD 2.01bn)

The stock has witnessed a correction of ~19.12% in last three months, and over the past one year, it decreased by ~25.62%. The stock has a 52-week low and 52-week high of AUD 12.840 and AUD 21.490, respectively, and is currently trading below the 52-week high-low average. CTD was last covered in a report dated ‘20 June 2024’.

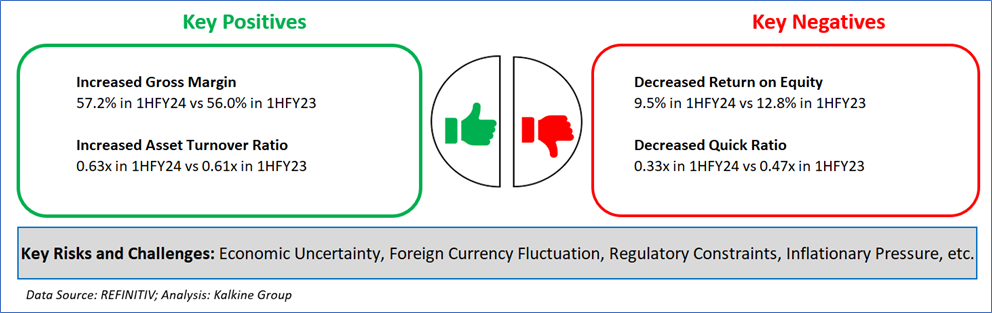

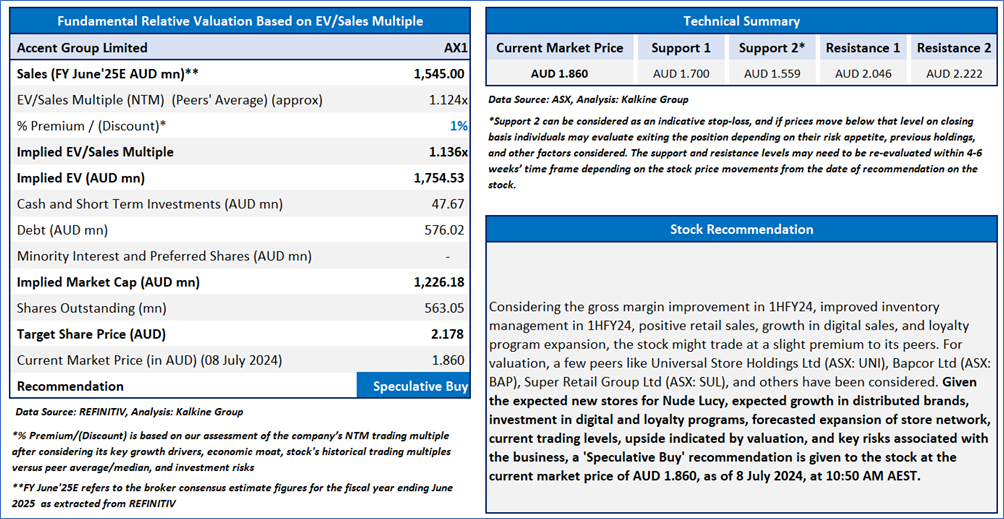

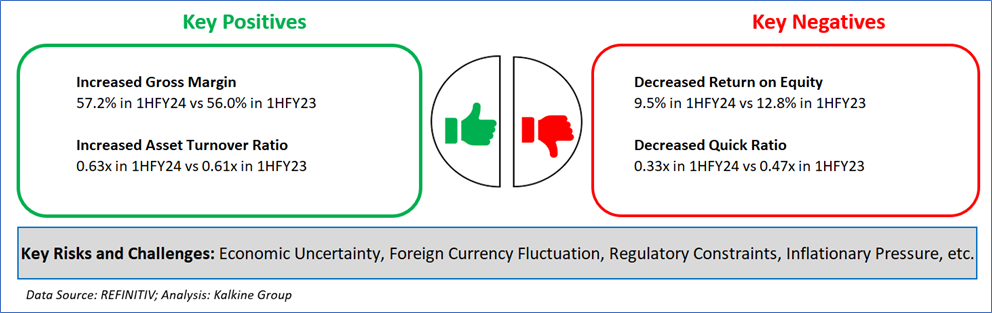

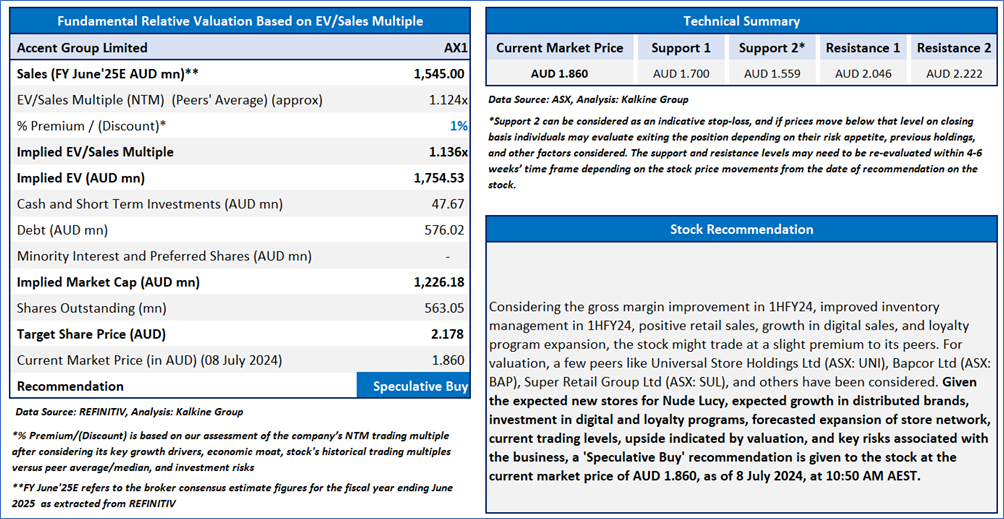

2) Accent Group Ltd (ASX: AX1) (Recommendation: ‘Speculative Buy’ at AUD 1.860, Potential Upside: Low Double-Digit) (M-cap: AUD 1.04bn)

The stock has witnessed correction of ~4.03% in last 1 month, and over the last 3 months, it has decreased by ~2.81%. The stock has a 52-week low and 52-week high of AUD 1.620 and AUD 2.360, respectively and is currently trading below the 52-week high-low average. AX1 was last covered in a report dated ‘06 June 2024’.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 8 July 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual’s appetite for upside potential, risks, holding duration, and any previous holdings. An ‘Exit’ from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...