Company Overview: Facebook, Inc. is focused on building products that enable people to connect and share through mobile devices, personal computers and other surfaces. The Company's products include Facebook, Instagram, Messenger, WhatsApp and Oculus. Facebook enables people to connect, share, discover and communicate with each other on mobile devices and personal computers. Instagram enables people to take photos or videos, customize them with filter effects, and share them with friends and followers in a photo feed or send them directly to friends. Messenger allows communicating with people and businesses alike across a range of platforms and devices. WhatsApp Messenger is a messaging application that is used by people around the world and is available on a range of mobile platforms. Its Oculus virtual reality technology and content platform offers products that allow people to enter an interactive environment to play games, consume content and connect with others.

.png)

FB Details

Investments to be Continued to Drive Value Proposition: Facebook Inc. (NASDAQ: FB) connects people to build the community and brings the world closer through mobile devices, personal computers and other surfaces. The company enables people to connect through Facebook, Instagram, Messenger, WhatsApp, Oculus, etc. In FY18, the company posted total revenue of $55,838 million, an increase of 37.35% compared to $40,653 million in FY17. The Management, in FY18, focused on main revenue growth priorities which were – (a) helping marketers use the company’s products to connect with consumers where they are (b) making ads more relevant and effective. The year was also highlighted by a decent increase in Daily Active Users (DAUs) at 1.52 billion on average, up 9% on yoy and Monthly Active Users (MAUs) at 2.32 billion, up 9% on yoy as December 2018. Capex during the period was incurred at $13.92 billion. The period ended with cash and cash equivalent, and marketable securities of $41.11 billion and headcount of 35,587 as of December 2018. Facebook Inc. witnessed a CAGR growth of ~45.48% in revenue over the period of FY14-FY18 while net income recorded a stellar CAGR growth of ~38.77% during the same period. Free cash flow at $15,359 million in FY18 also improved substantially from $5,495 million in FY14. The business is based upon constant innovative offerings, including products that are social by design. The products are designed to place people and their social interactions at the core of the product experience. The growth of the user base is directly linked with growing engagement with video, photos which are shared via Facebook’s platform.

As per the roadmap, the company intends to continue to invest in most developed ecosystems, Facebook and Instagram, driving growth across the products which have significant user bases. The company anticipates additional investments in the areas that will continue to drive significant growth in FY19, includes, expanding data center capacity, network infrastructure, headcount to support growth, investments in safety and security, marketing, video content, and long-term technology initiatives. Going forward, with investment across new technologies and plans for further expansion of the business, the company is well-positioned to achieve its mission to provide people the power to build community and bring the world closer through.

.png)

Financial Snapshot During 2014-2018 (Source: Company Reports)

Revenue Model: The company generates its revenue by selling advertising placements to marketers. The advertisements enable marketers to reach people based on a different factor like age, gender, location, interests, and consumer behaviors. Marketers purchase ads that can appear in multiple places, including on Facebook, Instagram, Messenger, and third-party applications and websites. FB is investing in other consumer hardware products and several longer-term initiatives, such as connectivity efforts, artificial intelligence (AI), and augmented reality, to develop technologies that the company believes, will benefit the consumer in various ways in the course of choosing the right product.

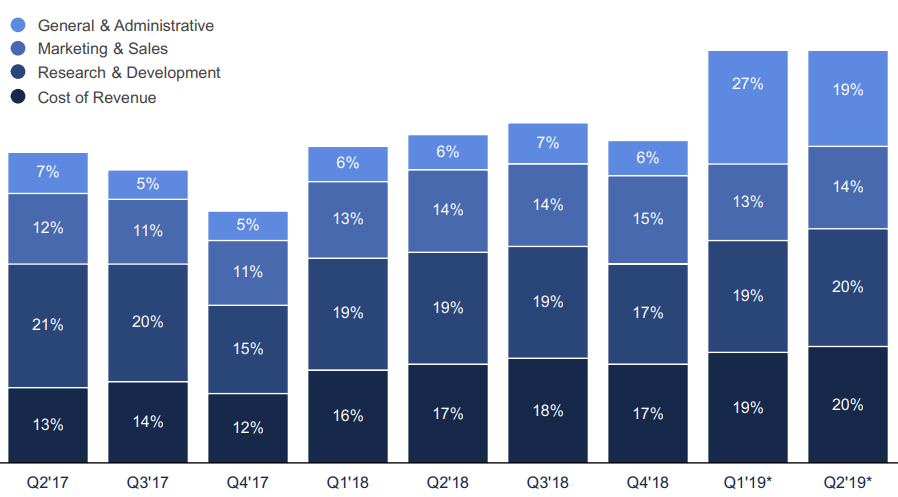

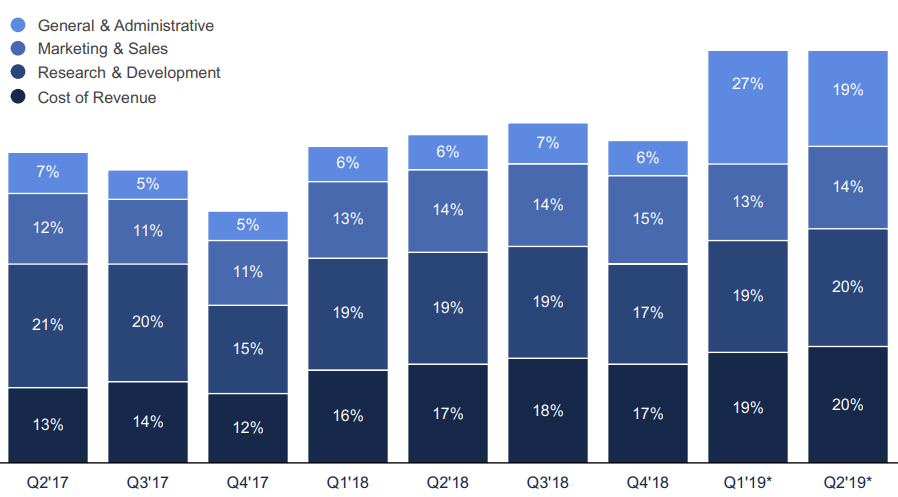

Q2FY19 Operating Highlights for the period ending 30 June 2019: Facebook, Inc. declared its Q2FY19 results wherein, the company reported revenue at $16,886 million, an increase of 28% on pcp while net income came in at $2,616 million as compared to $5,106 million in Q2FY18. Operating margin, during the quarter, stood at 27% due to a higher cost of revenue which stood at 20% of total revenue from 17% of total revenue during Q2FY18, followed by higher general and administrative expenses.

.png)

Income from Operation Highlights (Source: Company Reports)

.png)

Operating Margin Highlights (Source: Company Reports)

Cost of revenue: The expenses related to the delivery and distribution of products including expenses related to the operation of the data centers, such as facility salaries, benefits, and share-based compensation for employees on the operations teams, equipment depreciation and energy and bandwidth costs. Cost of revenue also includes expenses associated with traffic acquisition and content acquisition costs, credit card, and other transaction fees related to processing customer transactions, and cost of consumer hardware devices sold. During the quarter, the company reported a cost of revenue at $3,307 million as compared to $2,214 million in the previous corresponding quarter.

Marketing & Sales: During Q2FY19 Marketing and sales expenses stood higher at $2,414 million, representing 14% of the total revenue as compared to $1,855 million in the previous corresponding period. Marketing and sales expenses included salaries, share-based compensation, and benefits related to the employees engaged in sales, sales support, marketing, business development, and customer service functions.

Research and Development (R&D): The company saw R&D expenses of $3,315 million, representing 20% of total revenue as compared to $2,523 million in Q2FY18. Under this expense head, the company categorized expenses like salaries & benefits, share-based compensation, facilities related costs for employees in the engineering and technical teams, dedicated to product R&D and product innovations.

General and Administrative: General and administrative expenses consist of salaries, legal-related expenses and benefits, share-based compensation for all employees, finance and human resource department, corporate communications and policy, and other administrative employees, and professional services. The company reported general and administrative expenses at $3,224 million as compared to $776 million in the previous corresponding period.

Snapshot of Individual Expense Head in terms of Revenue (Source: Company Reports)

.png)

Income Statement during Q2FY19 (Source: Company Reports)

Bifurcation of Revenue: The company has mainly two revenue streams viz. Advertising, and Payments and other fees. Advertising derives 98.45% of the total revenue, while the remaining 1.55% of the revenue comes from payments and other fees.

.png)

Revenue Segments during Q2FY19 (Source: Company Reports)

Geographic Contribution: During the quarter, the US & Canada represented 45.20% of the total revenue to $7,632 million as compared to $5,982 million in the previous corresponding period while Europe contributed $4,097 million, which equates 24.26% of the total revenues. Asia-Pacific segment and Rest of World reported revenues of $3,628 million and $ 1,529 million, representing 21.49% and 9.05% of the total revenue, respectively.

.png)

Q2FY19 Revenue bifurcation Geography-wise (Source: Company Reports)

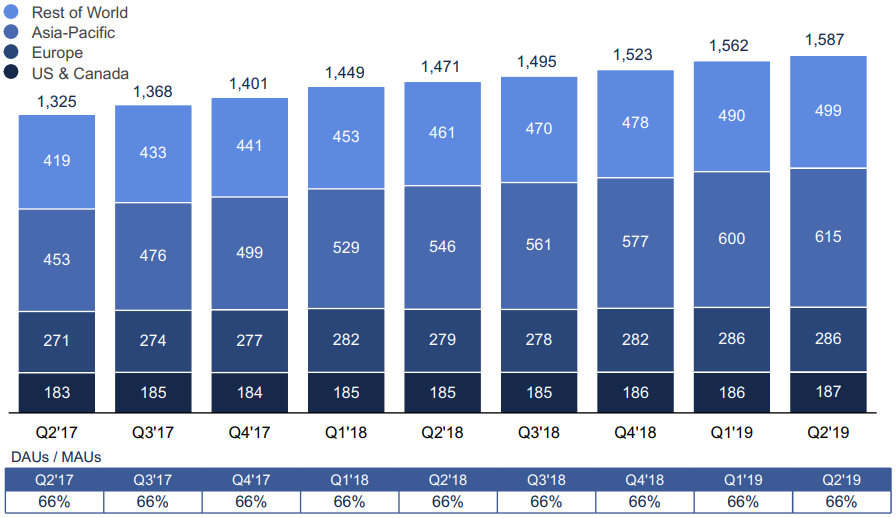

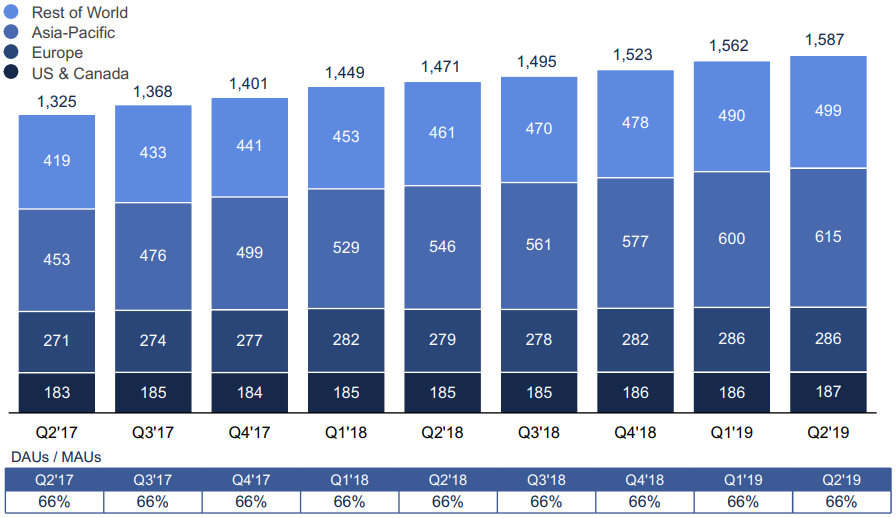

Highlights of User Metrics during Q2FY19: The company reported daily active users (DAUs) at 1.59 billion on average for June 2019, up 8% on pcp while monthly active users (MAUs) came in at 2.41 billion as of June 30, 2019, an increase of 8% on pcp basis. Users in India, Indonesia, and the Philippines represented key sources of growth in DAUs and MOUs during June 2019, as compared to the previous corresponding period.

Snapshot of User Metrics (Source: Company Reports)

Six-months' Performance Highlights: FB reported H1FY19 revenue at $31,963 million as compared to $25,197 million during the first half of FY18, followed by net income at $5,045 million, lower than $10,092 million in H1FY18. Cost of revenue stood at $6,123 million as compared to $4,141 million in previous corresponding half. Research and development, and general & administrative, during the half came in at $6,175 million and $7,288 million as compared to $4,761 million and $1,532 million in the first half of FY18. The company reported marketing and sales expenses at $4,434 million as compared to $3,450 million on pcp.

Key Competitors: The company directly competes with Apple in messaging, Google and YouTube in advertising and videos, Tencent in messaging and social media, and Amazon in advertising. To win the competition and sustain market share, the company consistently offers or acquires new products. The company invests in technology heavily to improve existing products and services, and to develop new ones along with additional investment in protecting the security and integrity of a platform to strengthen the system against abuse.

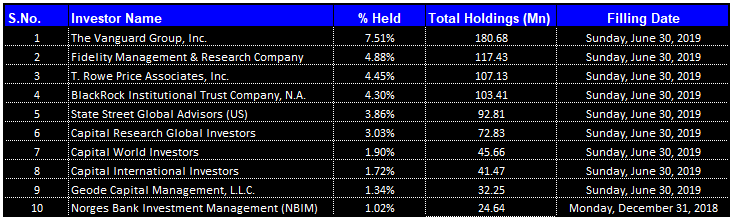

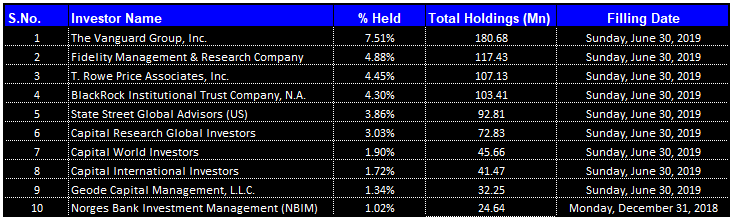

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table, which together form around 34.02% of the total shareholding. The Vanguard Group, Inc. and Fidelity Management & Research Company hold the maximum interests in the company at 7.51% and 4.88%, respectively.

Top 10 Shareholders (Source: Thomson Reuters)

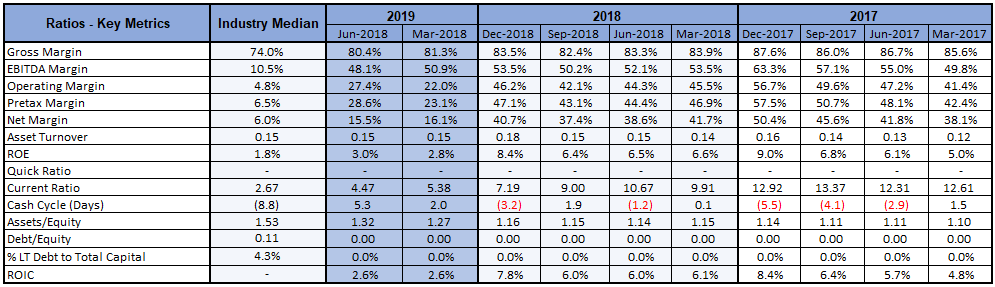

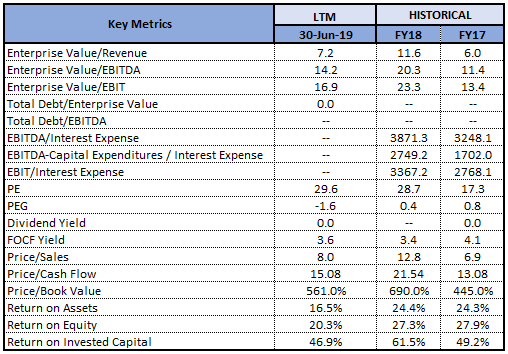

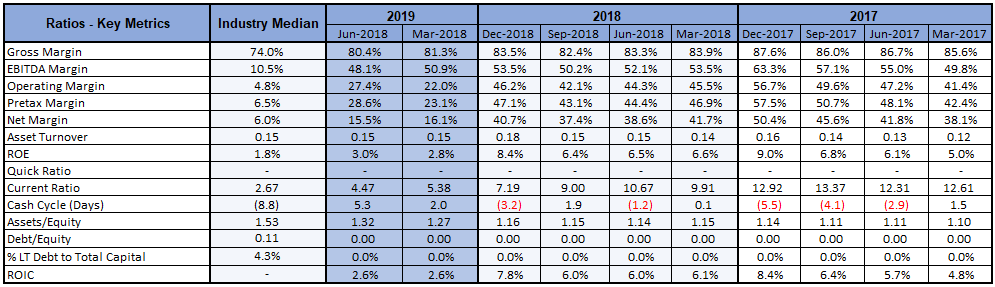

Key Metrics: The company posted decent margins in the second quarter of FY2019. Gross margin for Q2FY19 stood at ~80.4%, higher than the industry median of 74%. EBITDA and net margin for 2QFY19 came in at ~48.1% and ~15.5%, higher as compared to the industry median of ~10.5% and ~6%, respectively. Return on Equity (ROE) stood at ~3% in Q2FY19, improved from ~2.8% on QOQ basis, and stood higher than the industry median of 1.8%.

Key Metrics (Source: Thomson Reuters)

Key Risks: The business is exposed to certain risks which include – (1) failure to retain existing users or addition of new users, (2) loss of marketers or reduction in spending by marketers (3) dependency on users’ operation with mobile operating systems, networks, technologies, products, and standards that are not in the company’s control, (4) highly competitive market, presenting threat to the business, and etc.

Outlook: The Management expects an increase in FY19 total expenses by 56-61% over FY18 while 16% of the total expenses constitute $5 Bn accruals that were recorded during the first half of FY19, relating to the U.S. Federal Trade Commission (FTC) settlement. Q3FY19 expenses are likely to remain within the range of Q2FY19, excluding the $2 billion accrual expenses. The Management has lowered its FY19 capital expenditure outlook from its previous guidance of $17 billion-$19 billion to $16 billion - $18 billion. The primary constituents of capital expenditures are related to the investment in data centers and servers.

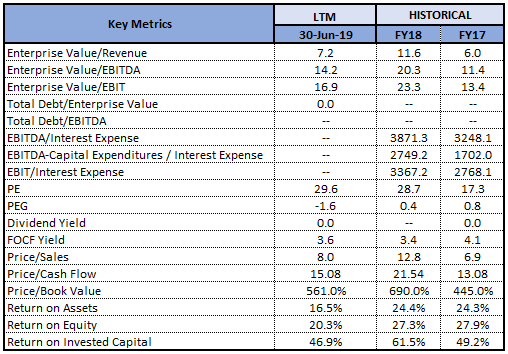

Key Valuation Metrics (Source: Thomson Reuters)

Valuation Methodologies:

Method 1: Price to Earnings Value Multiple Approach:

(12).png)

PE Multiple Valuation (Source: Thomson Reuters)

Method 2: Price to Cash Flow Multiple Approach:

(4).png)

P/CF Multiple Valuation (Source: Thomson Reuters)

Method 3: Enterprise Value to Sales Multiple Approach:

.png)

EV/Sales Multiple Valuation (Source: Thomson Reuters)

Note: All forecasted figures and peers have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: The stock is trading at a market price of $174.6 with a price to earnings multiple of 29.59x. The market capitalization of the stock stands at ~$498.125 billion. The company has delivered gross margin and net margin at 80.4% and 15.5% in 2QFY19, higher than the industry median of 74% and 6%, respectively. In the coming years, the Management intends to increase the investments to make the products more lucrative and in turn, retain the market share. The quarter was marked with decent growth in topline along with DAUs and MAUs, a number of optimizations and product wins in the 2QFY19, along with further investment in technologies, etc. The company is constantly aiming at further growth of the business by connecting the community while continuing significant investments in privacy, safety and security. Considering the aforesaid facts, we have valued the stock using three relative valuation methods, i.e., Price to Earnings multiple, Price to Cash Flow multiple and Enterprise Value to Sales multiple and arrived at a target price in a range of $188.05 to $207.75 (high single-digit to low double-digit growth (in %)). Hence, we recommend a “Buy” rating on the stock at the current market price of $174.6, down 0.69% on 02 October 2019.

.jpg)

FB Daily Technical Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.

Past performance is not a reliable indicator of future performance.

AU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

(12).png)

(4).png)

.png)

.jpg)

Please wait processing your request...

Please wait processing your request...