Company Overview: Johns Lyng Group Limited (ASX: JLG) is an Australia-based company engaged in building construction, restoration, and providing energy services nationally and globally. NRW Holdings Limited (ASX: NWH) provides diversified contract services to the resources and infrastructure sectors in Australia. The company operates through three segments: Civil, Mining, and Minerals, Energy & Technologies. Kalkine’s Market Event Report covers the Investment Summary, Event Summary, Data Insights & Analysis, Key Financial Metrics, Risks, Outlook, Technical Analysis along with the Valuation, Target Price, and Recommendation on the stock.

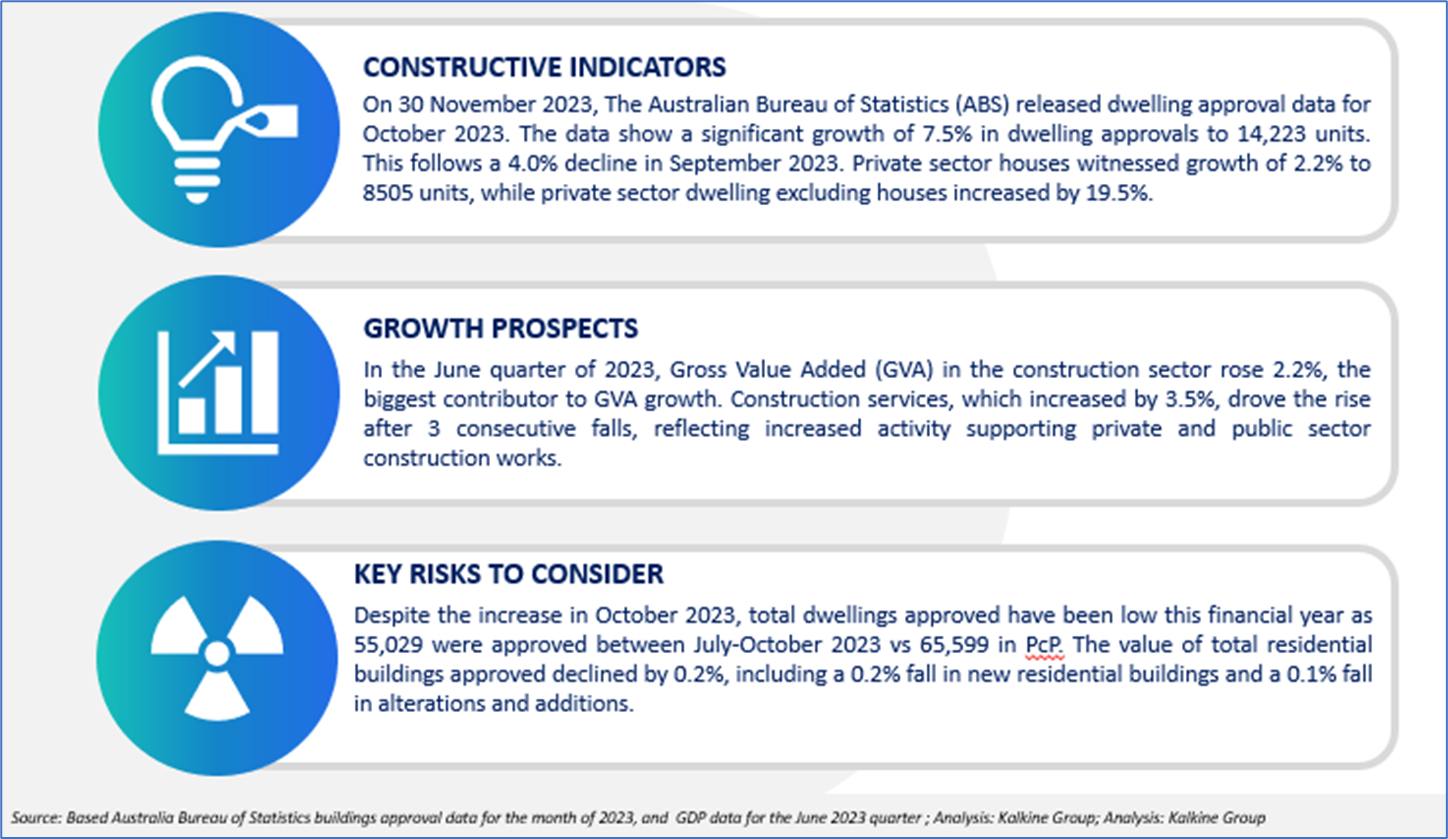

Investment Summary

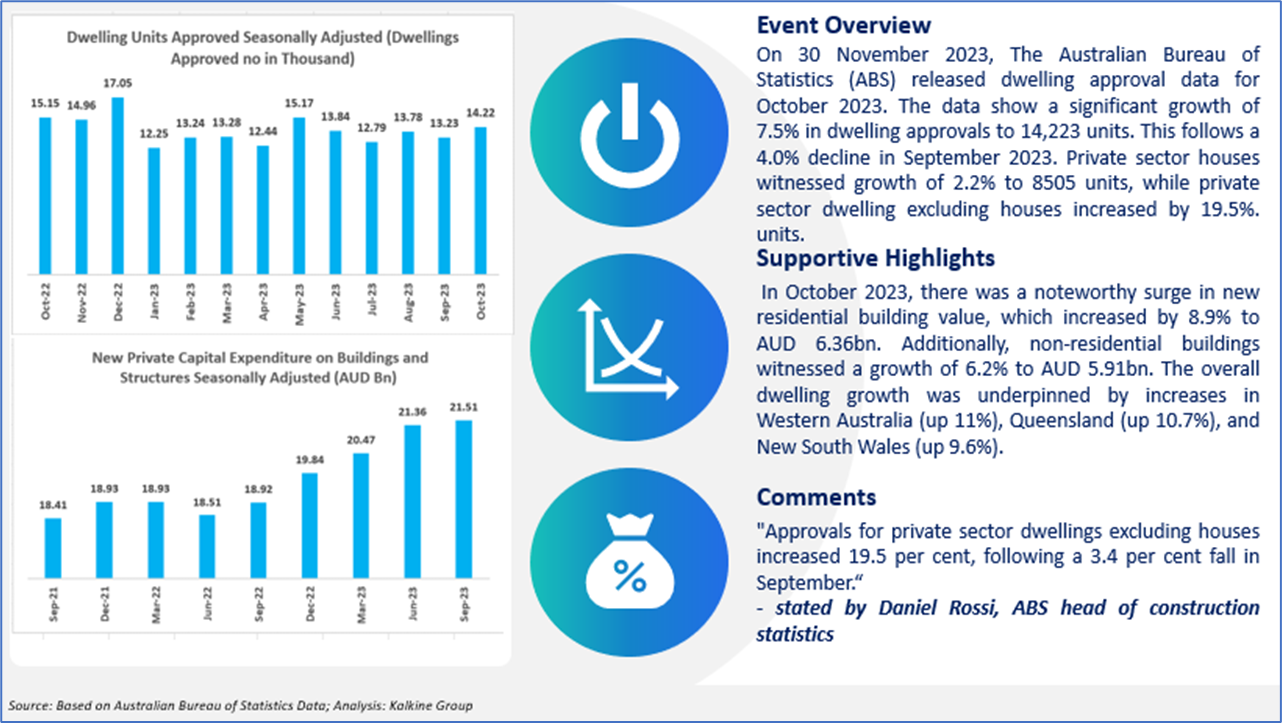

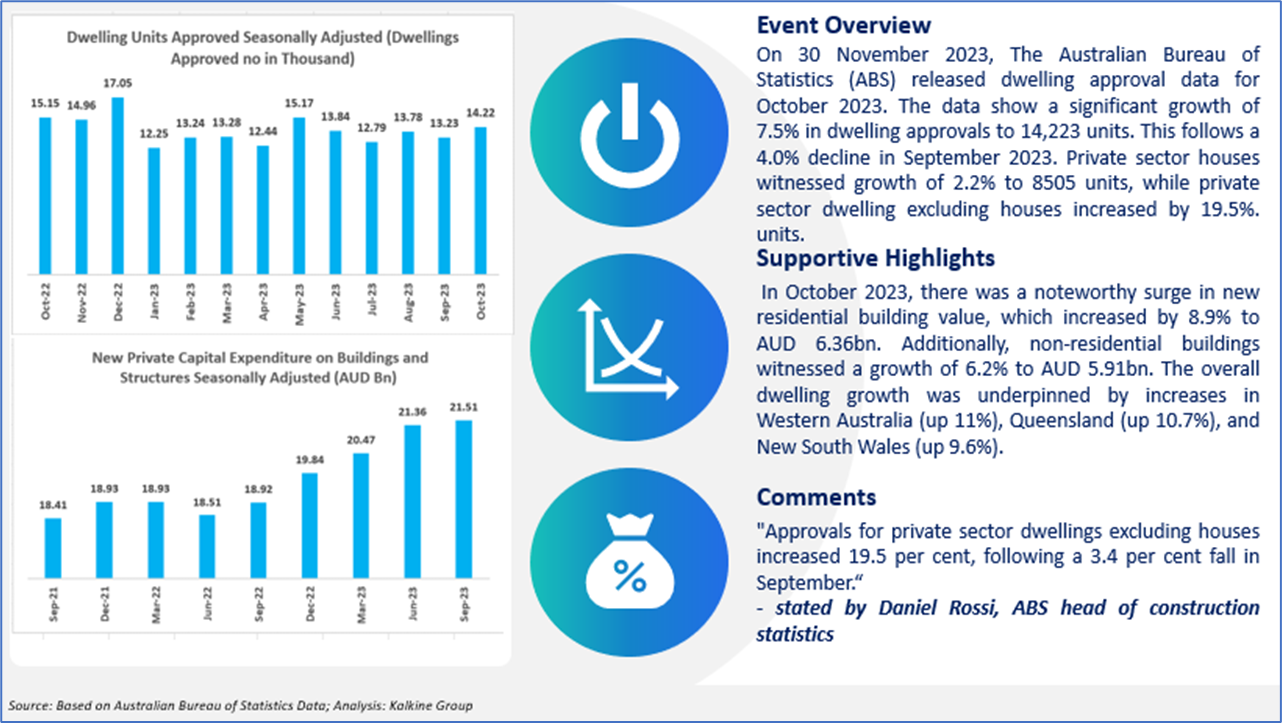

Event Highlights

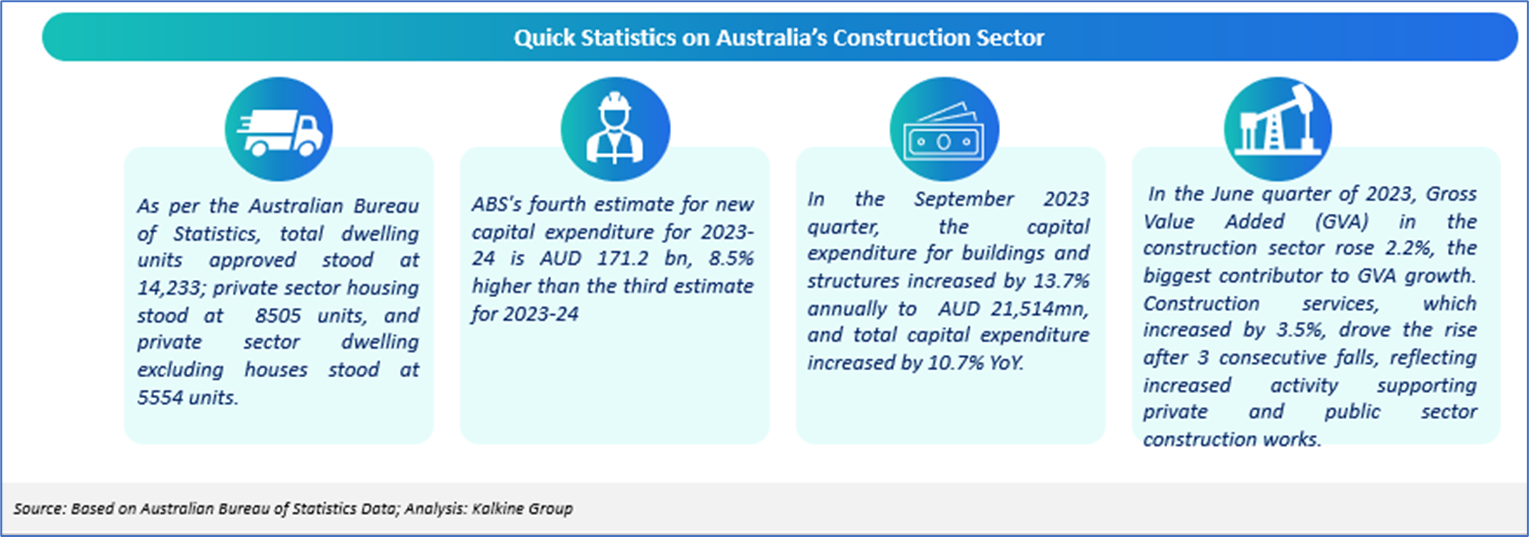

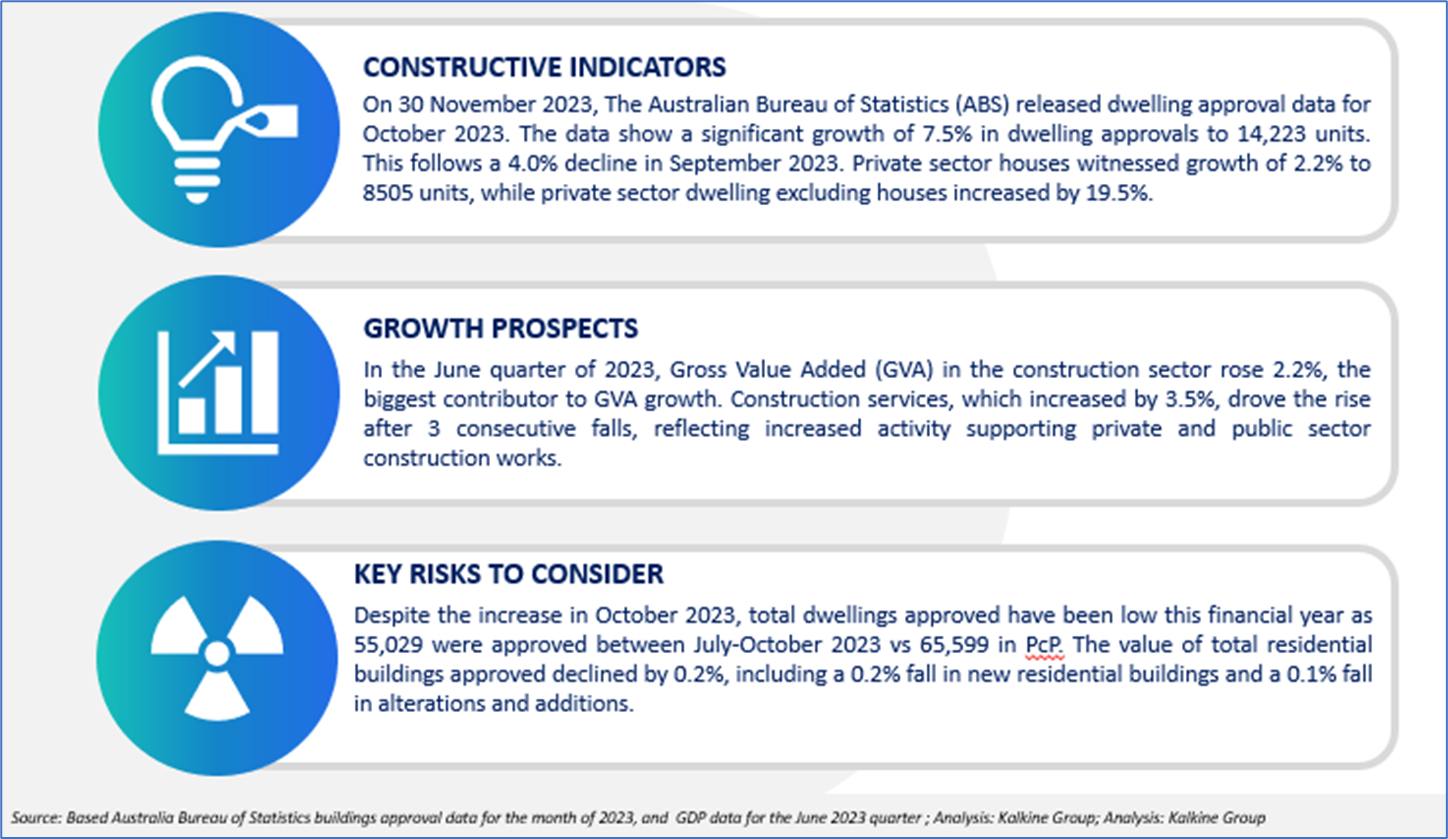

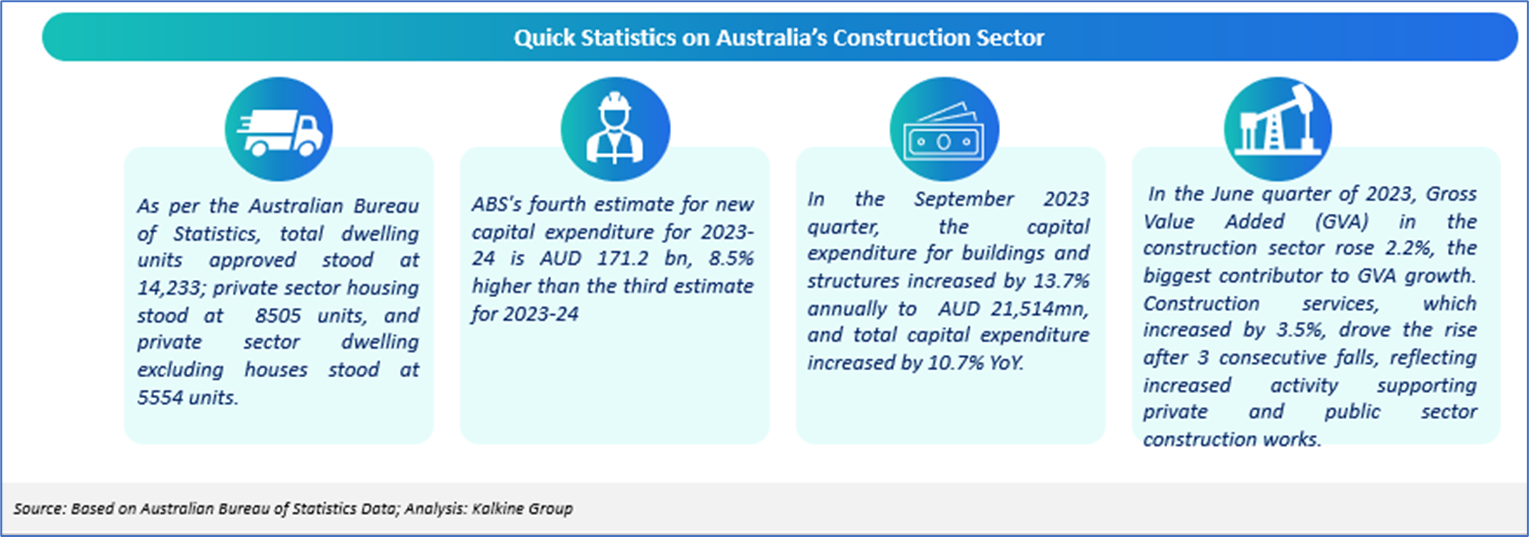

Data Insights and Analysis

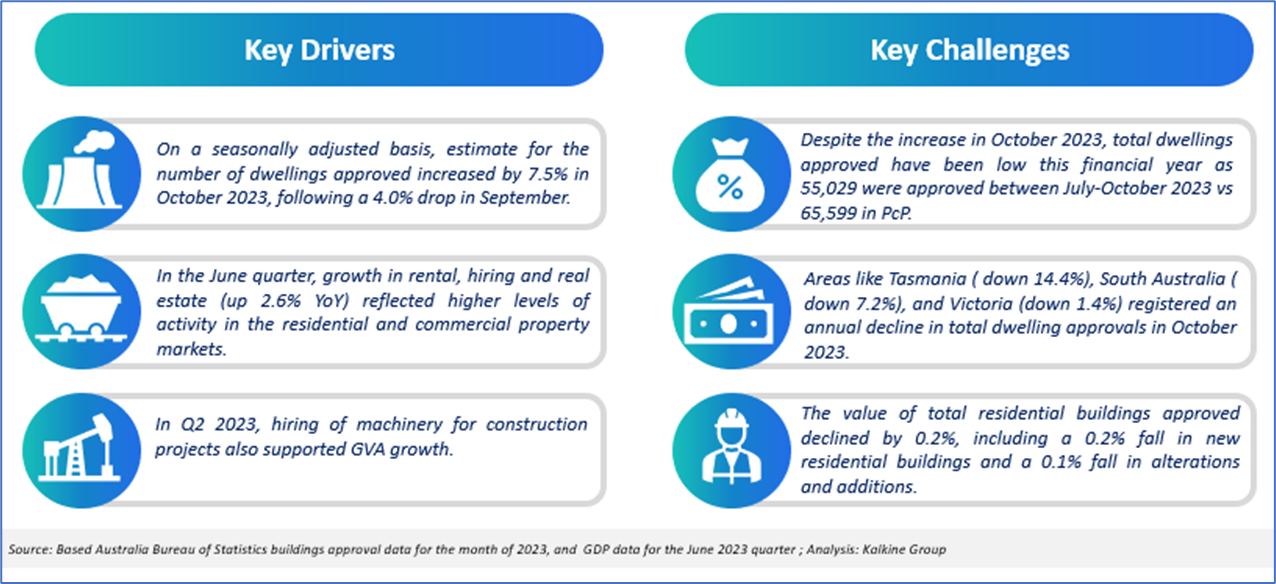

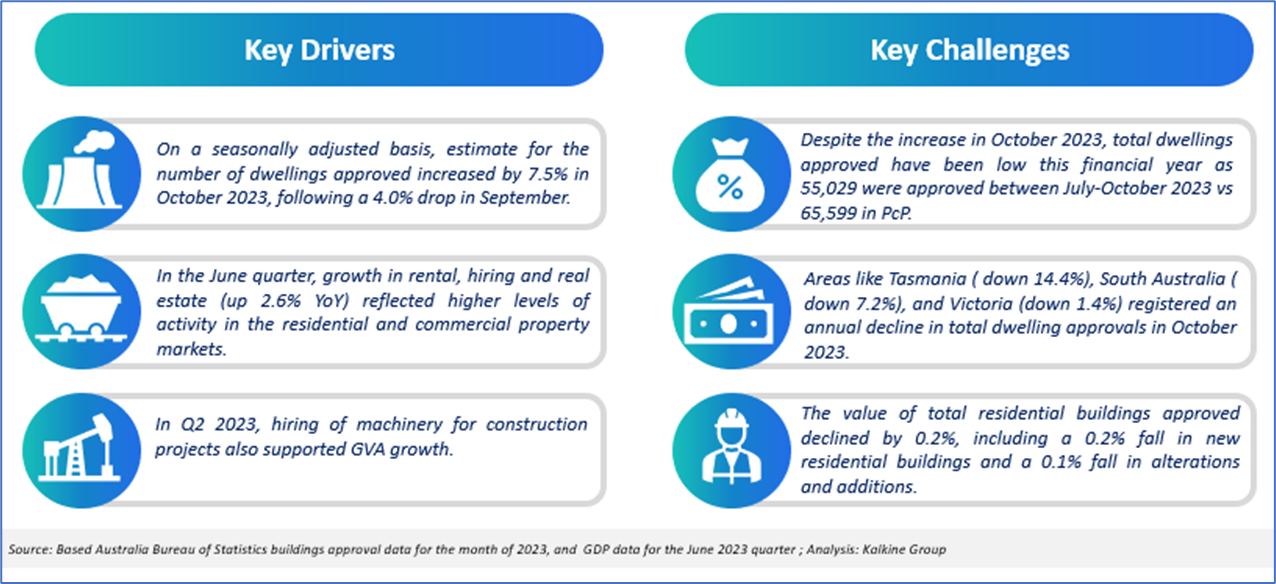

Key Drivers versus Key Challenges

Based on the above data, two ASX stocks have been identified to showcase the momentum.

(1) Johns Lyng Group Limited (ASX: JLG)

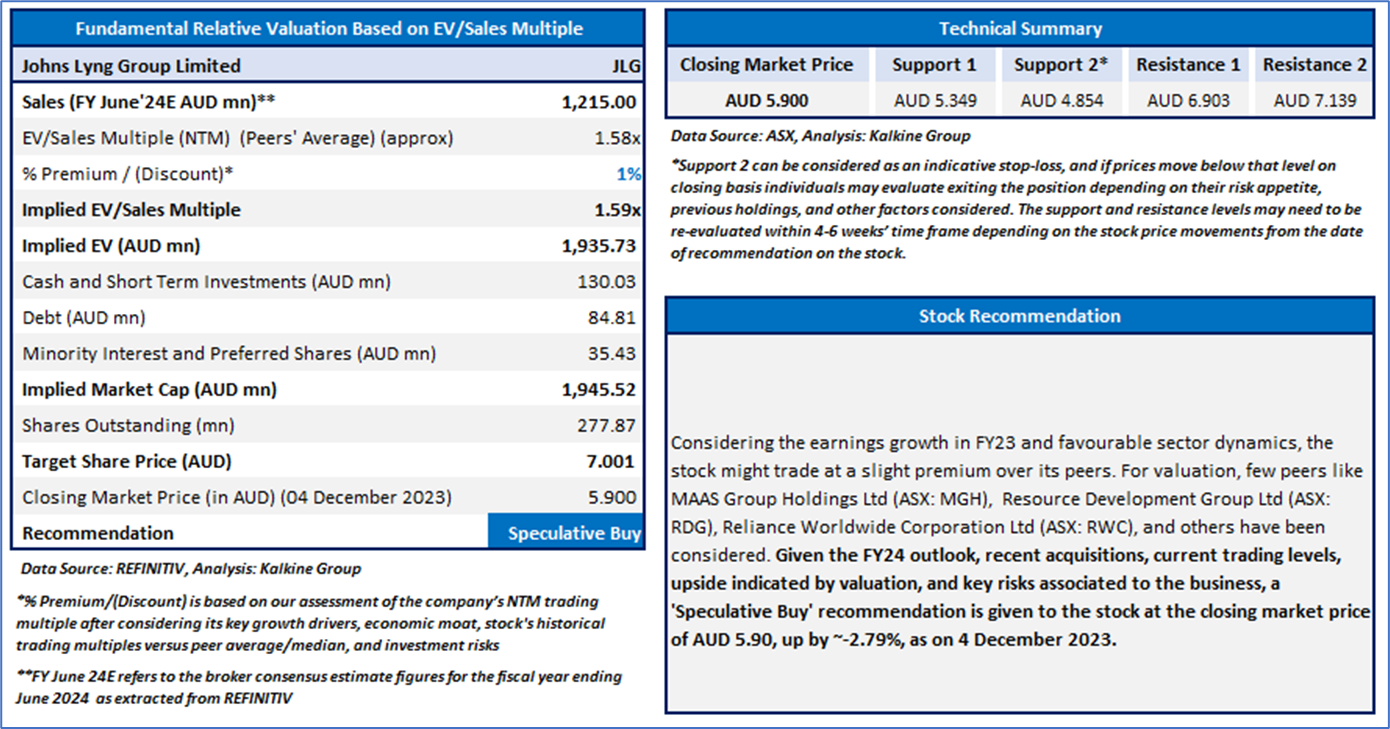

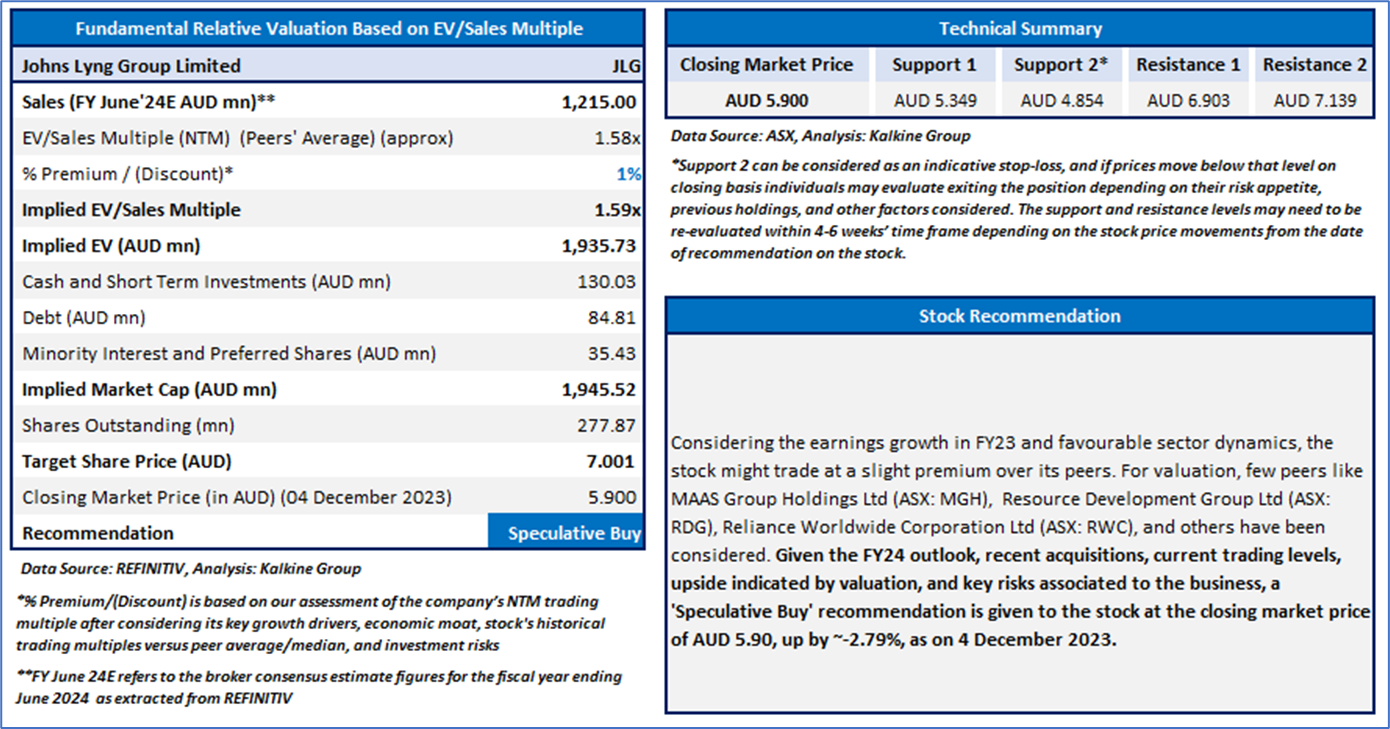

(Recommendation: ‘Speculative Buy’ at AUD 5.900, Potential Upside: Low Double-Digit)

(M-cap: AUD 1.70bn)

Company Overview: JLG is an Australia-based integrated buildings company engaged in building construction, restoration, strata, and energy services nationally and globally.

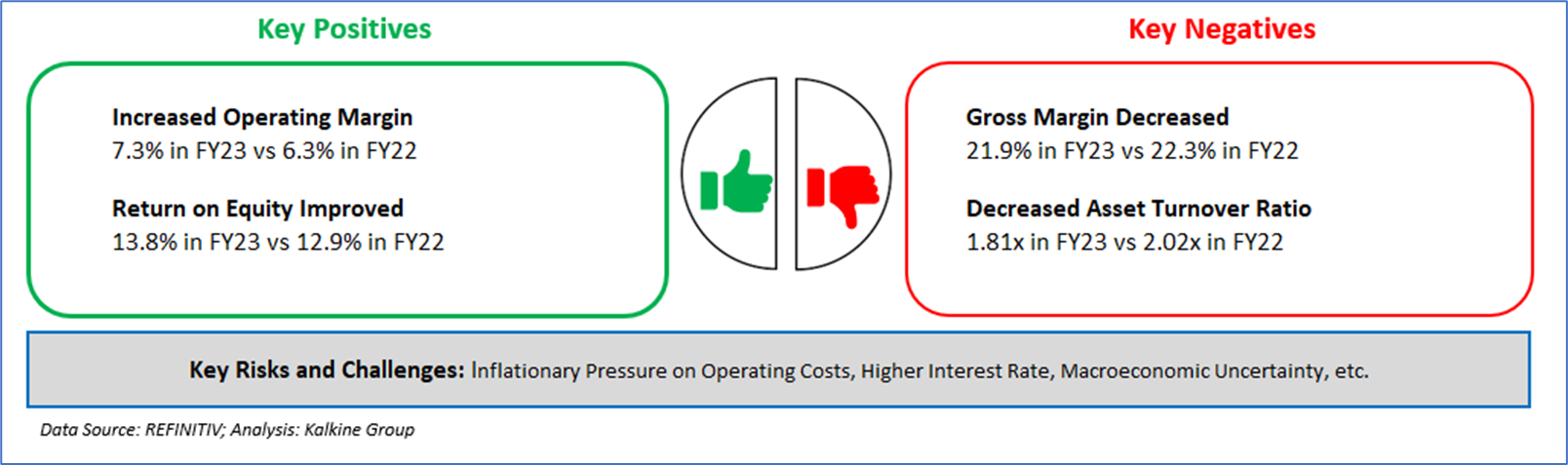

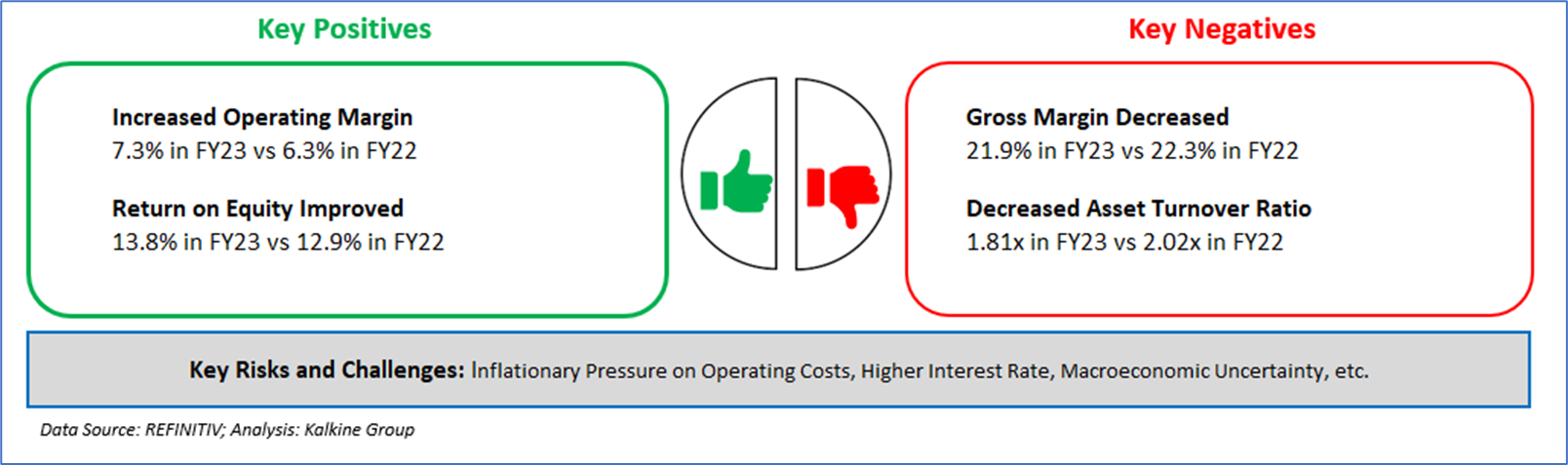

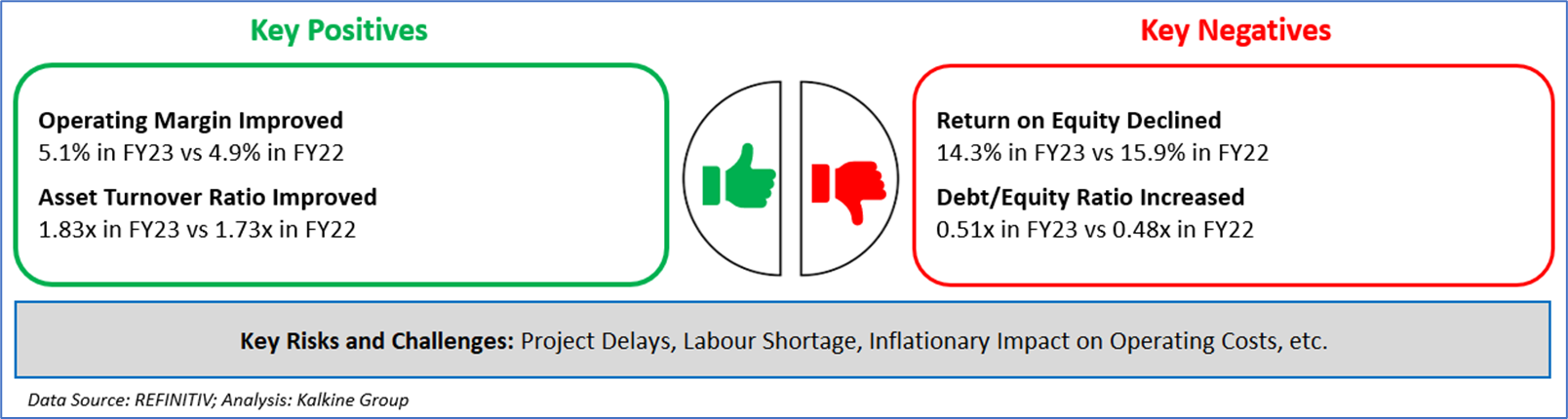

12-month ended 31 March 2023 Financial Year (FY23) Financial Performance: JLG’s revenue grew by 43.3% annually to AUD 1.281 billion in FY23. Group EBITDA showed growth of 42.9% annually and stood at 119.4mn. Net profit after tax stood at AUD 62.8mn, grew by 64.3% YoY in FY23.

Business Update: JLG announced the Acquisition of Smoke Alarms Australia (SAA) and Link Fire Holdings (Linkfire) which is expected to support JLG’s 5th Essential Home Services strategic growth pillar. JLG USA launched makesafe and express builder service line in FY23.

Outlook: Management expects strong momentum in FY24. JLG expects Group revenue to reach at AUD 1.176bn and EBITDA to reach at AUD 128mn in FY24.

The stock has witnessed a dip of ~8.52% in last three months, and over the last one year, it decreased by ~19.72%. The stock has a 52-week low and 52-week high of AUD 4.940 and AUD 7.370, respectively, and is currently trading below the 52-week high-low average. JLG was last covered in a report dated ‘30 August 2023’.

(2) NRW Holdings Limited (ASX: NWH)

(Recommendation: ‘Speculative Buy’ at AUD 2.820, Potential Upside: Low Double-Digit)

(M-cap: AUD 1.15bn; Annual Dividend Yield: 5.95%)

Company Overview: NWH provides diversified contract services to the resources and infrastructure sectors in Australia. The company operates through three segments: Civil, Mining, and Minerals, Energy & Technologies.

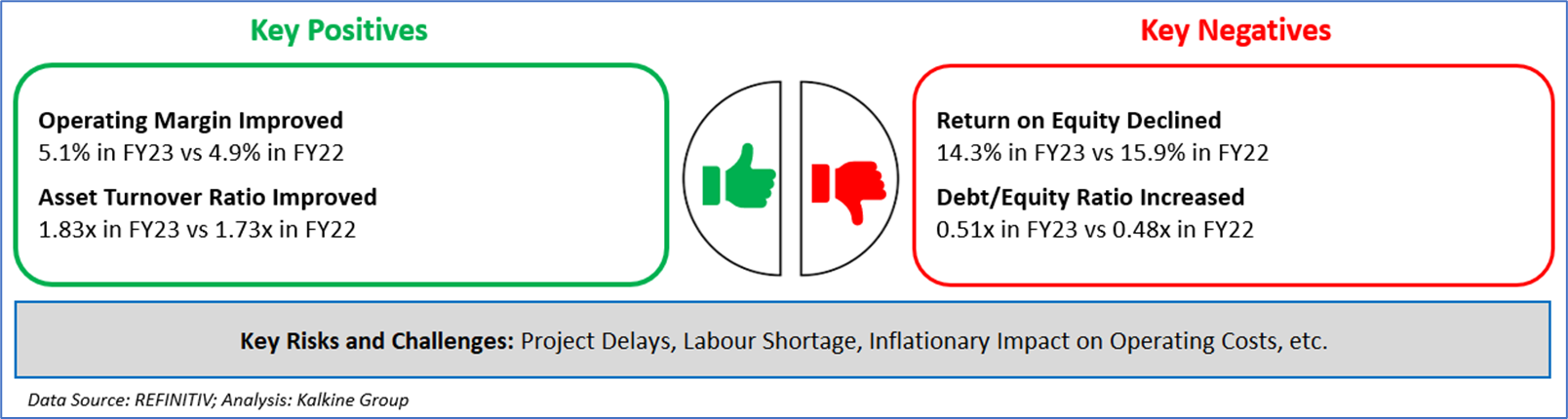

12-month ended 30 June 2023 Financial Year (FY23) Financial Performance: Revenue increased by 11.4% YoY to AUD 2,669.3mn as the Civil business continued to do well across the key markets of resources and public infrastructure. In the reported period, EBITDA surged by 10.2% annually to AUD 288.8mn, in line with guidance. The company secured new orders worth AUD 2.7 bn for FY24; its total order book stood at AUD 5.9bn.

Recent Update: On 27 November 2023, NWH announced that its wholly owned subsidiary, Golding Contractors Pty Ltd signed a four-year extension to the existing Contract Mining Agreement (CMA) with Aberdare Collieries Pty Ltd, a subsidiary of CS Energy Pty Ltd (CS Energy). As per the terms of the CMA the term is extended until 30 June 2030, with an option for CS Energy to extend the contract up to a further 2 years. The value of the 4-year extension including mine plan scope changes is approximately AUD 245mn.

Outlook: NRW believes both Civil and Golding businesses are well positioned for FY24 with prominent existing projects and a pipeline of current opportunities. The company's urban business is benefiting from the continuous growth in the Southeast Queensland residential market.

The stock has witnessed a surge of ~13.71% in last one month, and over the last six months, it has increased by ~28.77%. The stock has a 52-week low and 52-week high of AUD 2.030 and AUD 3.150, respectively and is currently trading above the 52-week high-low average. NWH was last covered in a report dated ‘10 October 2023’.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 4 December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual’s appetite for upside potential, risks, holding duration, and any previous holdings. An ‘Exit’ from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services. Please note past performance is neither an indicator nor a guarantee of future performance.

Please also read our Terms & Conditions and Financial Services Guide for further information.

Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...