Company Overview: Chevron Corporation (Chevron) manages its investments in subsidiaries and affiliates, and provides administrative, financial, management and technology support to the United States and international subsidiaries that engage in integrated energy and chemicals operations. The Company operates through two business segments: Upstream and Downstream. Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; liquefaction, transportation and regasification associated with liquefied natural gas; transporting crude oil by international oil export pipelines; processing, transporting, storage and marketing of natural gas, and a gas-to-liquids plant. Downstream operations consist primarily of refining of crude oil into petroleum products; marketing of crude oil and refined products; transporting of crude oil and refined products, and manufacturing and marketing of commodity petrochemicals.

.png)

CVX Details

Chevron Corporation (NYSE: CVX) through its subsidiaries, is engaged in integrated energy, chemicals, and petroleum operations all over world; and operates through Upstream and Downstream segments. The Upstream segment is engaged in the exploration, development, and production of crude oil and natural gas, and the Downstream segment is engaged in the refining of crude oil into petroleum products, marketing crude oil and refined products, etc. The group reported a solid 3Q result owing to support from Permian and Australian LNG. It has also contained its spending for quite some years now and free cash flow has been decent with US upstream (production and margins) and US downstream (margins) progressing as per expectations. While oil price volatility will keep on playing a role, long term view on the stock is positive given the improving fundamentals.

.png)

Permian Value (Source: Company Reports)

Net Profit Doubled in the third quarter of FY 18: CVX has beaten analysts' earnings expectations on the back of strong oil and gas production that boosted the company's bottom line and the company forecast strong full-year output growth. The company also benefitted from running 20 drilling rigs in the Permian basin during the third quarter and the new well designs that have boosted output. CVX’s net profit has doubled to $4.0 billion for third quarter 2018, compared with $2.0 billion in the third quarter of 2017. This includes the current quarter write-off, an asset impairment, and a non-recurring contractual settlement aggregating to $930 million in the upstream segment, and a gain of $350 million on the sale of southern Africa refining, marketing and lubricant assets. Foreign currency fluctuations had decreased the earnings in the 2018 third quarter by $51 million, compared with a decrease of $112 million a year earlier. CVX in the third quarter of FY 18 has reported the adjusted earnings per share of $2.11, beating the analysts’ estimates for the adjusted earnings per share of $2.06. The company had reported the adjusted revenue growth of 21 percent to $43.99 billion in the third quarter of FY 18, which slightly missed the analysts’ estimates for revenue of $46.67 billion. Moreover, the company reported for 3 million barrels per day of oil equivalent that it has ever produced in a single quarter and the ramped up production came in from its Wheatstone liquefied natural gas project in Australia with support also coming in from wells in the Permian Basin. That helped to accelerate about seven-fold jump from third-quarter 2017 earnings in Chevron's oil and gas exploration and production business.

.png)

Financial Performance (Source: Company Reports and Thomson Reuters)

Chevron's other major business segment, namely refining and marketing fuels like gasoline and diesel, was down 24 percent in terms of profits, as CVX's international refining business witnessed lower profit margins and the company sold fewer assets against last year. The peak profit margins in the overseas refining business also impacted the bottom line while earnings witnessed an improvement. Moreover, the company has posted the cash flow from operations in the first nine months of FY 18 of $21.5 billion, compared with $14.2 billion in the corresponding 2017 period. Excluding working capital effects, the cash flow from operations in 2018 is of $23.3 billion, compared with $14.8 billion in the corresponding 2017 period. CVX has also recorded the capital and exploratory expenditures in the first nine months of 2018 of $14.3 billion, compared with $13.4 billion in the corresponding 2017 period. The amounts comprised of $4.1 billion in 2018 and $3.3 billion in 2017 for the company’s share of expenditures by affiliates, which did not require cash outlays by the company. Expenditures for upstream forms 88 percent of the companywide total in the first nine months of 2018.

.png)

Third Quarter 2018 Performance (Source: Company Reports)

Strong Upstream Performance in the third quarter: For the third quarter 2018, CVX’s Worldwide net oil-equivalent production was 2.96 million barrels per day, compared with 2.72 million barrels per day from a year ago.US Upstream Operations made the turnaround in the third quarter, as it earned $828 million in third quarter 2018, compared with a loss of $26 million a year earlier. The business improved due to higher crude oil realizations and production, which was partially offset due to higher depreciation and exploration expenses, which primarily reflects a $550 million write-off of the Tigris Project in the Gulf of Mexico. The company has realized the average sales price per barrel of crude oil and natural gas liquids of $62 in third quarter 2018, which is up from $42 a year earlier. The average sales price of natural gas was $1.80 per thousand cubic feet in third quarter 2018, that remained unchanged from the prior year’s third quarter. In the third quarter, the net oil-equivalent production is of 831,000 barrels per day, which is up 150,000 barrels per day from a year earlier. The production expanded from shale and tight properties in the Permian Basin in Texas and New Mexico and base business in the Gulf of Mexico were partially offset by the impact of asset sales of 19,000 barrels per day. Further, in the third quarter, International upstream operations earned $2.55 billion compared with $515 million a year ago. This increase in earnings was mainly on the back of higher crude oil and natural gas realizations, and higher natural gas sales volumes. The average sales price for the third quarter 2018 for crude oil and natural gas liquids was $69 per barrel, which rose from $48 a year earlier. The average sales price of natural gas was $6.73 per thousand cubic feet in the third quarter of 2018, compared with $4.76 in last year’s third quarter.

Decent Downstream Performance in the third quarter: During the third quarter, U.S. downstream operations earned $748 million in third quarter 2018, compared with earnings of $640 million a year earlier. The increase was primarily due to higher equity earnings from the 50 percent-owned Chevron Phillips Chemical Company LLC and lower tax expense, partially offset by higher operating expenses. In third quarter 2018, Refinery crude oil input decreased 2 percent to 915,000 barrels per day from the year-ago period. Refined product sales of 1.23 million barrels per day remained unchanged from third quarter 2017. Further, in third quarter 2018, International downstream operations earned $625 million compared with $1.17 billion a year earlier. The decline in earnings was mainly due to lower gains on asset sales. The absence of third quarter 2017 gains on asset sales more than offset the current quarter gain from the southern Africa asset sale. The lower margins on refined product sales had also led to the decline, which is partially offset by lower operating expenses. The sale of the company’s Canadian assets in third quarter 2017 had led to the lower margins and operating expenses. The total refined product sales of 1.44 million barrels per day fell 8% in third quarter 2018 from the year-ago period, primarily due to lower diesel, gasoline and jet fuel sales partially offset by higher fuel oil sales.

Mergers & Acquisitions and other updates: As per market speculation, Chevron is in talks to buy a Pasadena, Texas refinery, which would be its first Houston-area facility. This refinery is expected to give Chevron control of a processing facility relatively close to its Permian wells and position it near the Gulf of Mexico exporting hub. CVX has also appointed Steven W. Green as the president of Chevron North America Exploration and Production, effective from March 1, 2019. He has succeeded Jeff Shellebarger, who will be retiring from Chevron after 38 years of its service in the company.

.png)

Cash Flow Improvement (Source: Company Reports)

Dividend and Future Outlook: CVX has declared a quarterly dividend of one dollar and twelve cents ($1.12) per share, which is payable on December 10, 2018, to all holders of common stock as shown on the transfer records of the Corporation at the close of business November 16, 2018. CVX expects its oil and gas production to grow by about 7 percent in 2018, which is at the upper range of its previously released projection of 4 percent to 7 percent. The company plans to hold to its full-year capital spending budget of between $18 billion and $20 billion, despite investing approximately $450 million more than it anticipated year-to-date. The outlook seems to maintain a good dividend stream.

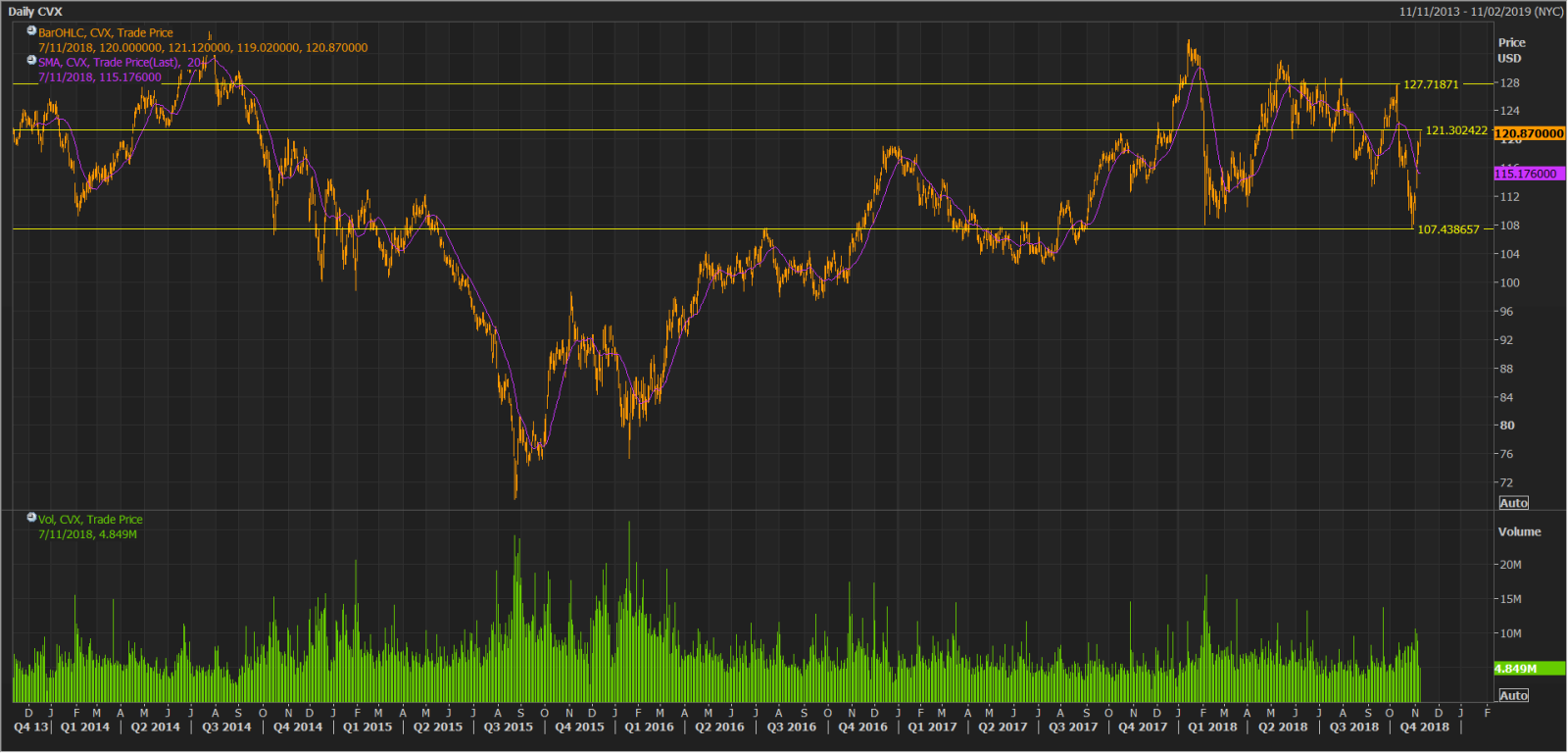

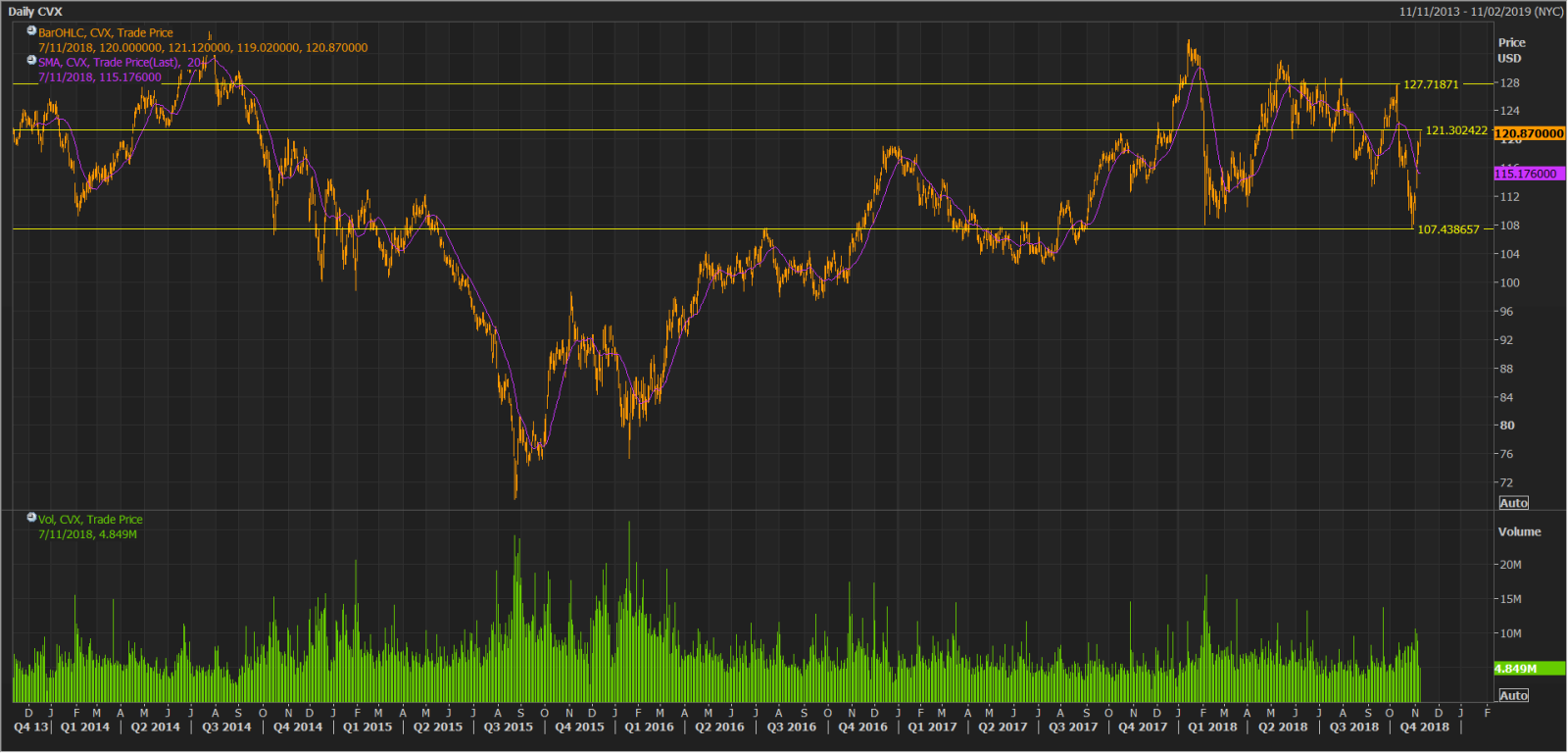

Stock Recommendation: CVX is expected to witness a single to low double digit stock price rise (%) in near to medium term and is trading at a price level of $120.87, with support at $108 and resistance around $130. The company has been benefitting from the crude price; and after a strong performance by CVX for the third quarter of 2018, the company is expected to have better performance going forward. Permian production has been on track and a year ahead of plan from the March analyst day with better design and efficiencies. The group raised its full-year 2018 capex guide by about 5% given inflation and oil price scenario, however, the group expects to stay within its capex range of $18-20 billion. The group is expected to return capital to shareholders through the cycle as before and have a net cash position by year 2021 with multi-year FCF improvement. We give a “Buy” on the stock at the current price of $ 120.87.

CVX Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...