Company Overview: Centuria Capital Group (ASX: CNI) is engaged in the marketing and management of investment products including investment bonds and property investment funds as well as direct interest in property funds and other liquid investments. The company reports its performance in 4 segments, namely Property Funds Management, Investment Bonds Management, Co-Investments and Corporate. The Centuria Diversified Property Fund is an open-ended unlisted property fund of the company which offers monthly tax effective income and long-term capital growth by investing in a diversified portfolio of property assets located within Australia.

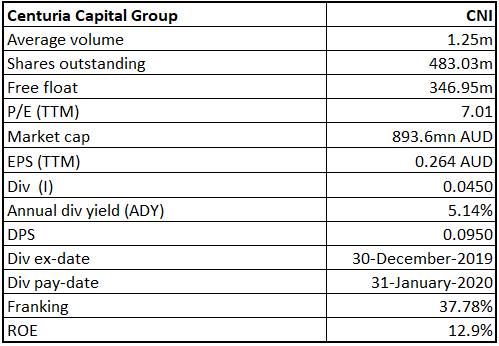

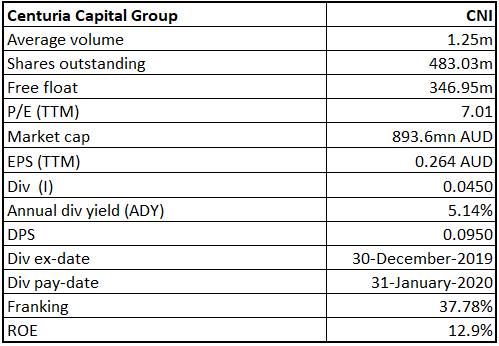

CNI Details

.png)

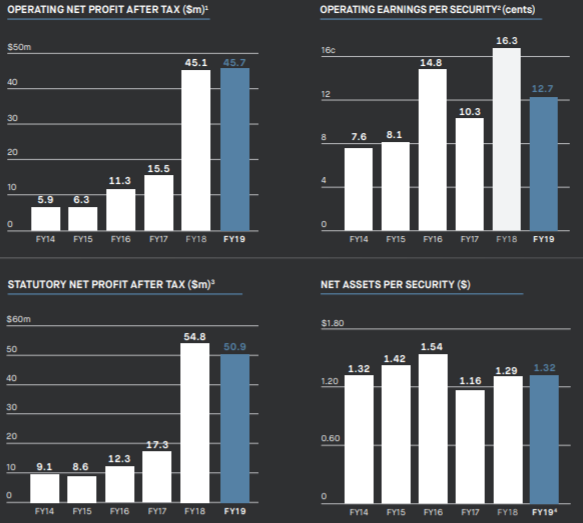

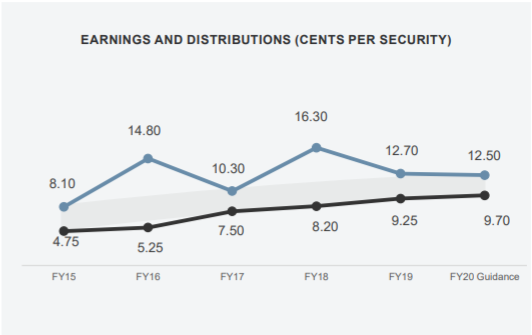

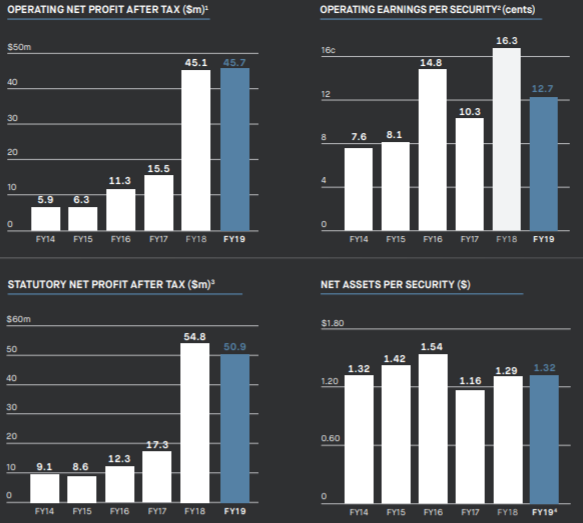

Expansion of Real Estate Platform and Increasing Returns to Shareholders: Centuria Capital Group (ASX: CNI) is engaged in the marketing and management of investment products including investment bonds and property investment funds as well as direct interest in property funds and other liquid investments. As on 1 June 2020, the market capitalization of the company stood at ~$893.6 million. CNI is the fourth largest investment bond operator in Australia, comprising a large property funds management business. 2019 marked a successful year for Centuria with pleasing results and continued investment in the growth of the business. At the end of FY19, Centuria Capital Group’s property funds platform grew by 27% to $6.2 billion in assets under management. With the expansion in CNI’s platform, the company experienced growing support from domestic and international equity fund managers. Centuria’s strong security appreciation in price, along with consistent distributions, generated a total security return of 34.4% in FY19 and has given an averaged return of over 24% p.a. in the past five years. During FY19, group revenues exceeded $100 million and CNI recorded a net operating profit of $45.7 million, up from $45.1 million in the preceding year with operating earnings of 12.7 cents per stapled security. In the same time span, profit from property funds management went up by 13% to $25.1 million, reflecting the expansion of the company’s real estate platform. Recurring profits have also been supplemented by co-investments, which totaled to $419 million and generated a strong annualized total return of 26.6%. The board retained a strong focus on reliable, growing distributions with total distributions of 9.25 cps, reflecting an increase of 12.7% on FY18. During the year, the company also reported a decent balance sheet with cash in hand of $87.8 million, providing funds for transaction initiatives and future growth opportunities.

During 1H20, the company had a transformational period with an increased focus on a dual strategy of organic and inorganic expansion. 1HY20 was a record period with organic real estate acquisitions of $1.2 billion across its listed and unlisted divisions.

The Centuria real estate platform has specialized in commercial and industrial sectors and has also expanded into the healthcare real estate funds management sector with the creation of Centuria Heathley. The newly established partnership will pave the path for CNI’s growth in the healthcare real estate sector. The company has the potential to expand its asset footprint, grow its recurring revenues and offer investors strong and stable returns through a range of wholesale and retail unlisted healthcare real estate funds.

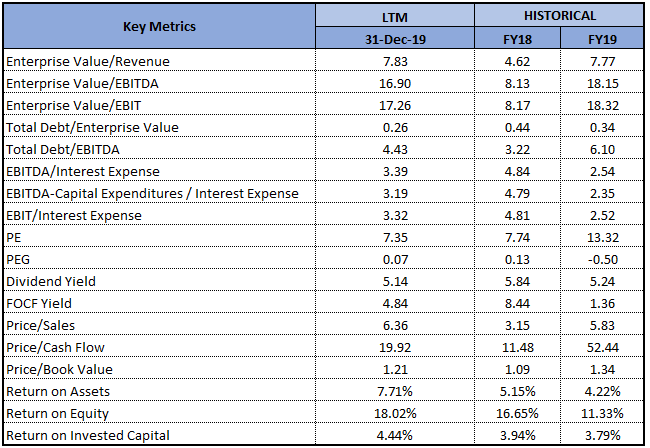

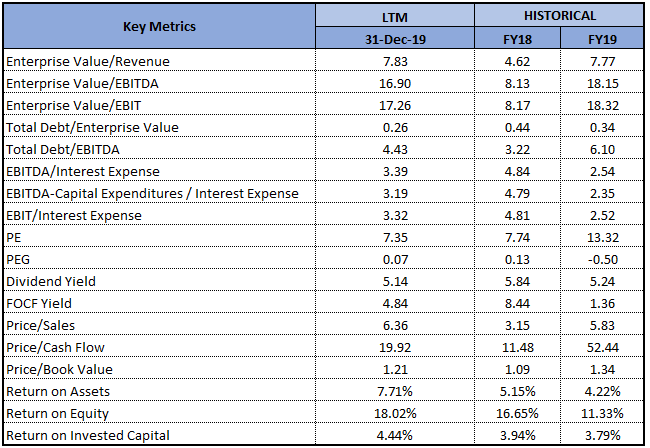

FY19 Financial Metrics (Source: Company Reports)

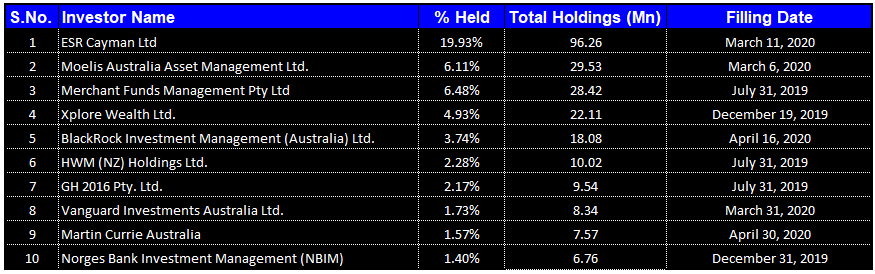

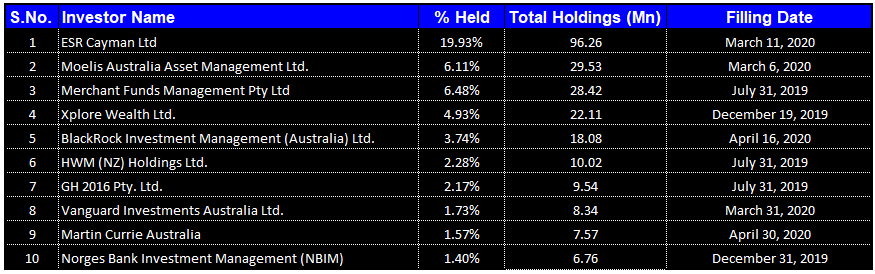

Details of Top 10 Shareholders: The following table provides an overview of the top 10 shareholders of Centuria Capital Group.

Top 10 Shareholders (Source: Refinitiv, Thomson Reuters)

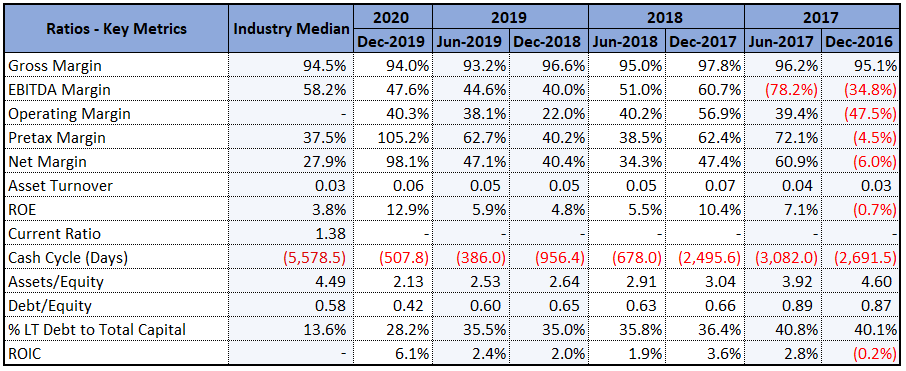

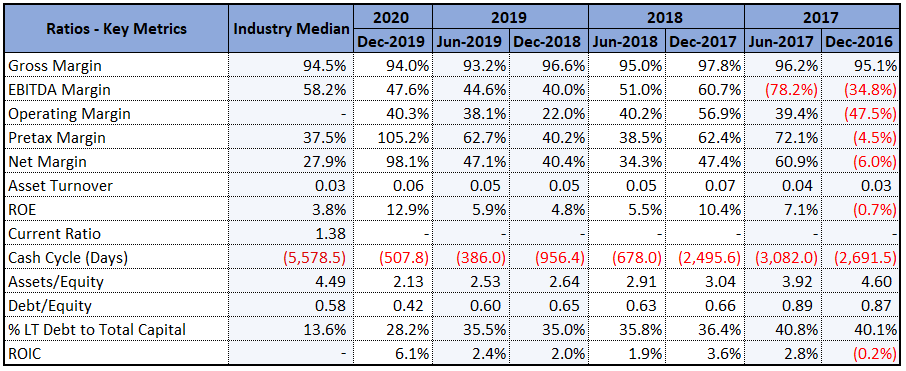

Stable Balance Sheet and Significant Reductions in Costs: Over the past three years, gross margin has been broadly stable and stood at 94% in 1H20. During the half year, EBITDA margin of the company witnessed an improvement over the previous half and stood at 47.6%, up from 44.6% in 2H19, indicating increased profitability. In the same time span, the company reported a net margin of 98.1%, higher than the industry median of 27.9%. Stable Gross margin and increasing net margin indicates that the company is managing its costs well and is able to convert its revenue into profits. During 1H20, Return on Equity of the company stood at 12.9% as compared to the industry median of 3.8%. This indicates that the company is well managing the capital of its shareholders and is capable of generating profits internally. In the same time span, Assets/Equity Ratio of the company was 2.13x, lower than the industry median of 4.49x and Debt/Equity Ratio of the company stood at 0.42x as compared to the industry median of 0.58x. This indicates that the business is financed with a significant proportion of investor funding and a small amount of debt, resulting in a financially stable balance sheet.

Key Margins (Source: Refinitiv, Thomson Reuters)

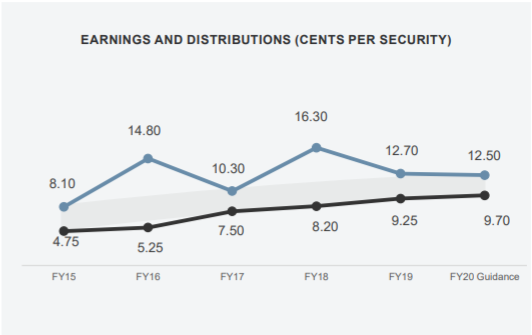

Strong Investor Returns and Growth in AUM: During 1H20, Centuria’s platform was well-positioned and delivered strong growth and created value across the platform. During the half year, the company reported strong growth in AUM, with an increase to $7.3 billion, primarily driven by the growth of 21% in real estate AUM and gross acquisitions. In the same time span, the group reported a statutory profit of $77.0 million and operating NPAT of $33.4 million. This resulted in an EPS of 8.1 cents and distribution per stapled security of 4.5 cents. The company enhanced its asset diversification and delivered strong investor returns. It is on track to become one of the largest fund managers in New Zealand and is focused on a dual strategy of organic and inorganic expansions. During the first half, the company reported a record period with organic real estate acquisitions of $1.2 billion.

Growth in Earnings and Distributions (Source: Company Reports)

Centuria Acquires 19% Stake in NZ Augusta Capital: The company has recently acquired 19% interest in the New Zealand’s leading listed real estate funds manager, Augusta Capital Limited on a fully diluted basis at $0.55 per share. Post-transaction, cash reserves of the company will be around $120 million. This is a unique opportunity for CNI to develop a strong presence in the New Zealand funds management arena.

Future Expectations and Growth Opportunities: Despite the uncertainty surrounding the financial markets due to the outbreak of coronavirus, Centuria is well-equipped to fulfil and maintain business requirements. It remained fully operational and provided continued support to tenants and investors. However, the impacts of rental relief applications because of COVID-19 are likely to impact future distributions. CNI has confirmed forecasted operating earnings of 11.5 cents per share for FY20 and expects FY20 distribution of 9.7 cps.

CNI has entered FY21 with a strong capital position and high recurring revenues. The company is well prepared to face the challenging global financial markets and is expected to benefit from the available growth opportunities. The Australian commercial, industrial and healthcare markets remain compelling and well supported with a strong demand from investors, seeking to deploy into Centuria funds. It retains a strong and healthy balance sheet which will support its platform expansion. CNI also has a strong distribution network and is successfully deploying skills and systems. The company is likely to have a recurring revenue of 80%-85% in FY20. It is aiming to expand from 22 to 30 investment options and has witnessed strong interest from newly established and existing non-aligned adviser groups.

Key Valuation Metrics (Source: Refinitiv, Thomson Reuters)

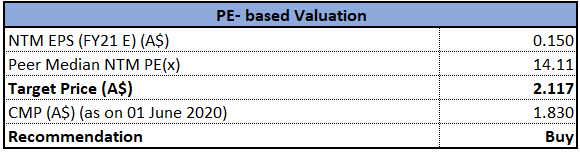

Valuation Methodology: Price to Earnings Multiple Based Relative Valuation Approach (Illustrative)

Price to Earnings Multiple Based Relative Valuation Approach (Source: Refinitiv, Thomson Reuters)

Note: All the forecasted figures are taken from Thomson Reuters, NTM: Next Twelve Months

Stock Recommendation: The company has seen growth in market presence with market capitalization increasing to ~$893.6 million from approximately $80 million at 2016. The total security holder return has also exceeded 20% in the last five years. CNI has shown progressive trends and is supplemented by future growth opportunities, which are likely to complement the group’s platform. As per ASX, the stock of CNI gave a return of 20.52% in the past one month and is inclined towards its 52-weeks’ low level of $1.355, proffering a decent opportunity for the investors to enter the market. We have valued the stock using a price-to-earnings multiple based relative valuation approach and have arrived at a target price, offering an upside of lower double-digit (in percentage terms). For the said purposes, we have considered Navigator Global Investments Ltd, Moelis Australia Ltd and EQT Holdings Ltd as peers. Considering the decent returns in the past one month, current trading levels, increasing market presence and resilient financial position, we recommend a ‘Buy’ rating on the stock at the current market price of $1.83, down by 1.081% on 1 June 2020.

CNI Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.

Past performance is not a reliable indicator of future performance.

AU

.png)

Please wait processing your request...

Please wait processing your request...