Guzman Y Gomez Ltd (ASX: GYG)

Guzman Y Gomez Ltd is an ASX listed Quick Service Restaurant business, delivering clean, fresh, made to order, Mexican-inspired food to guests. Since opening its first restaurant in Sydney in 2006, GYG has expanded its network to 210 restaurants across four countries, including 185 in Australia, 16 in Singapore, 5 in Japan, and 4 in the United States.

Key Updates

- Interim Results: During H1 FY24 (for the half-year ended 31 December 2023), Revenue increased to AU$167.52 million from AU$121.19 million in H1 FY23. Similarly, operating profit also jumped from AU$1.97 million in H1 FY23 to AU$3.00 million in H1 FY24. However, it reported net losses, primarily due to high finance costs.

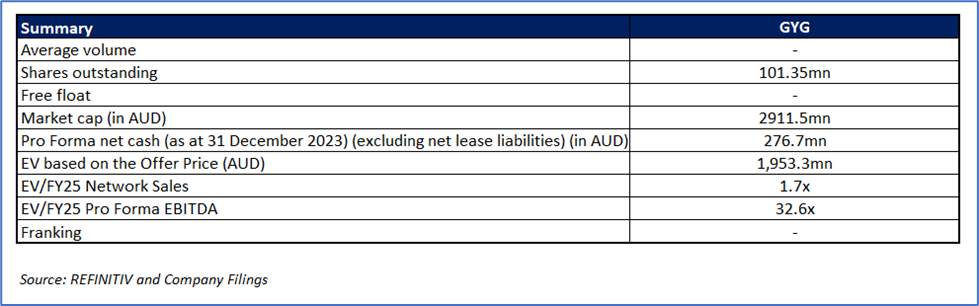

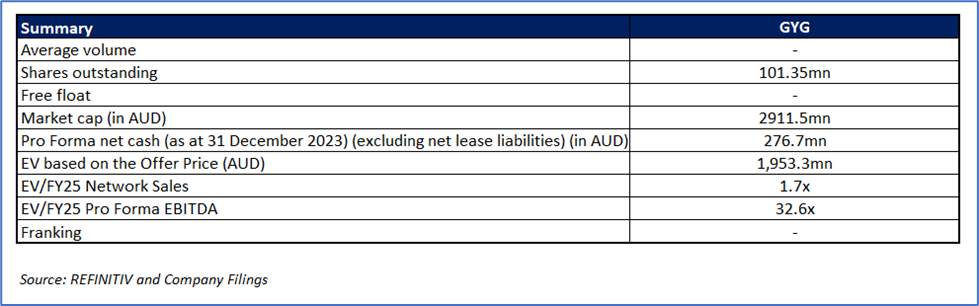

- Outlook: For FY24, GYG estimates that it can deliver pro forma (underlying) EBITDA of AU$43 million and pro forma (underlying) EBIT of AU$12 million. For FY25, statutory EBITDA and EBIT are projected to be $59.9 million and $19.7 million, respectively.

- IPO Price Momentum: The share price of GYG jumped over 30% on its first day of trading. The offer price for each new share was AUD 22, and price soared to around AUD 30 per share on the first day of trading. Clearly, the Company’s growth plans, earnings estimations, and double-digit growth projections in FY25 led to a surge in share price. Subsequently, IPO raised AU$3.35 billion and established a market capitalization of nearly AU$3.00 billion. At this market capitalization, it is readily getting compared with Domino's Pizza Enterprises Ltd (ASX: DMP), which is in similar business domain. It is noteworthy that, DMP posted 5.3% YoY decline in EBIT during H1 FY24 whereas GYG delivered growth in H1 FY24 operating profit. It was also observed that, GYG’s share price fell about 5% next day as some investors might have booked profit since shares were trading at high multiple of EV/EBIT (based on FY25 estimates).

- Network Expansion Plans: GYG has invested heavily in infrastructure to expand the restaurant network. The Company also believes that it has a potential to grow its network to over 1,000 restaurants over the next 20 years. GYG is expected to open 30 new restaurants in FY25.

- Key Risks: The Company’s performance is exposed to macroeconomic pressures, subdued consumer spending, persistent inflation, uncertainties around franchisee business, and supply chain snags.

- Holders’ Summary: As per the top holder’s summary released by the Company on 24 June 2024, GYG’s top three holders were TDM Custodian Services PTY Ltd, Barrenjoey Trevally No 1 PTY Ltd, and Evan Jason PTY Ltd, holding the stake of 28.23%, 10.36%, and 7.41%, respectively. There is total 42 holders, possessing above 100,000 ordinary fully paid shares.

GYG Daily Chart

(Source: REFINITIV; Analysis by Kalkine Group)

Guzman Y Gomez Ltd’s stock was trading at the current market price of AUD 28.960, at 11:33 AM AEST, as of 25 June 2024.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings.

AU

Please wait processing your request...

Please wait processing your request...