Company Overview: Target Corporation (NYSE: TGT) is engaged in offering enhanced shopping experiences via its supply chain and technology know-how. The company operates as a single segment, which is aimed to enable customers to buy everyday essentials and fashionable products effortlessly in stores or through TGT’s digital channels. TGT has actively been making a higher investment in technologies, enhancing websites and mobile apps and upgrading supply chain to match the dynamic retail landscape and better compete with industry players. Some of the company's Owned Brands include: A New Day, Cat & Jack, Made By Design, Opalhouse, Stars Above, Prologue, Ava & Viv, Smith & Hawken, Sun Squad and Wine Cube.

.png)

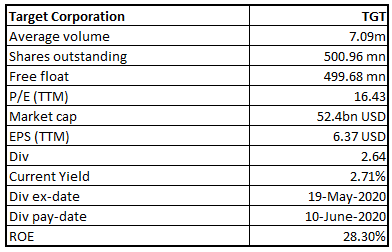

TGT Details

Higher Consumer Demand of Essential Goods Remains a Key Catalyst: Built-in Minnesota and founded in 1902, Target Corporation (NYSE: TGT) provides customers, with everyday necessities and fashionable, distinguished retail products at reduced prices. The company has progressed from just being a pure brick-&-mortar retailer to an omni-channel entity. The company had acquired Shipt, to offer same-day delivery of essentials goods, groceries, electronics along with other products. The company’s bulk of property and equipment is situated within the United States. TGT's stores offer a full line of food items, as compared to traditional supermarkets and are bigger than 170,000 square feet. Whereas, the company’s small format stores are smaller than 50,000 square feet and provide wide-ranging merchandise and food collections.

The fast proliferating novel coronavirus has dislocated economic activities. Amid such misery, retailers are seeing a spike in essential goods’ demand, thanks to consumers’ anxiety-buying trends. This, in turn, has led to higher demand for medicines, groceries, cleaning supplies, and related food staples. Remarkably, Target Corporation remains on track to cope up well with the present scenario and chose to cater to the growing demand for essential supplies. As per the latest update on 25 March 2020, for Month-to-date in March, TGT has witnessed higher traffic and sales, owing to coronavirus-led demand. Consequently, TGT’s comps for the current quarter was boosted >20% year over year, led by Essentials and Food & Beverage comps growth of >50%.

Further, the company has increased the minimum wage by $2 an hour until at least May 2 for its store and distribution center and frontline team members. It has also decided to pay a bonus to lead team executives. In addition, TGT is coming up with a new offer for team members who are 65 and above years of age, pregnant women and who are under medical treatment.

Coming to the financial performance, the company for the first three weeks of the first quarter, stated that the total comparable sales and category mix were in accordance with expectations and prior financial guidance. Notably, for February month, total Company comparable sales went up ~3.8%

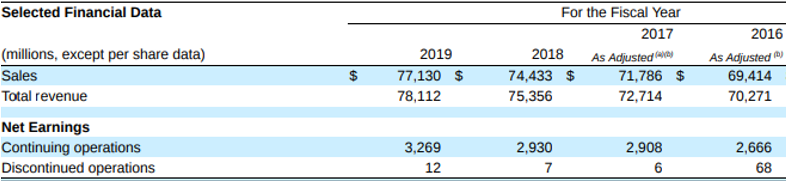

In the fourth quarter of fiscal 2019, both the top and the bottom-line increased year over year. Again, management underlined that this was the 11th consecutive quarter of growth in comparable sales, owing to the modest performance in both stores and digital channels. During FY19, the company witnessed more than 70% of comparable digital sales growth, driven Order Pickup, Drive Up, and delivery. The company witnessed a CAGR of 3.6% and 7.0% in total revenue and net earnings from continued operations, respectively, over the period of FY16-FY19. The company has been investing in new technology and service enhancement, with an enhanced focus on its same-day delivery, store enhancement and customer experience. Operating cash flow increased from $6.86 billion in FY17 to $7.09 million in FY19 and FY19 total revenue was reported at $77.13 billion.

Past Performance Highlights (Source: Thomson Reuters)

With rising victims and delay to find a potential cure for the COVID-19 virus, major cities have been put under lockdown. The ensuing panic is pushing people to store essential goods like daily essentials, canned foods, bathroom tissue, drinking water, and most importantly hand sanitizers. This bodes well for grocery stores and supermarkets. With such a scenario, the company is focusing on new brands, boosting omni-channel capacities, remodeling stores and increasing same-day delivery options, which is likely to support the top-line growth in the coming future. Further, TGT has been undertaking streamlining of the supply chain with technology upgradation and process improvements. Notably, the company expects to tap on its digitization initiatives, going forward.

Additionally, the company’s efforts to make the most of thriving online grocery delivery market is expected to yield encouraging results. In relation to this, TGT’s partnership with Instacart, acquisition of Shipt and Grand Junction, and unveil of Target Restock program are remarkable. Better pricing, efficient management of inventories and enhanced operational initiatives are expected to boost the revenues of TGT in the coming quarters.

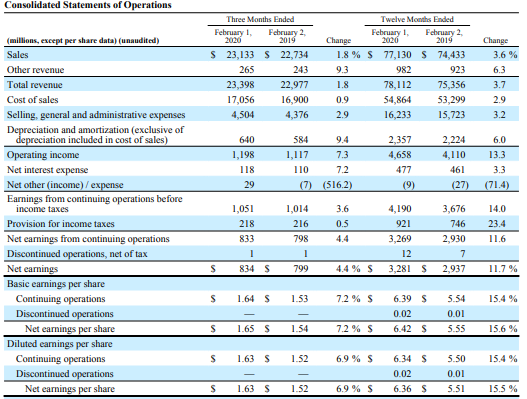

Earnings in 4QFY19 up Year over Year: The company reported adjusted earnings of $1.69 per share, which increased 10.6% year over year, owing to higher sales growth and share repurchase activity. The company’s total revenues went up 1.8% year over year and came in at $23,398 million. Notably, sales during the quarter stood at $23,133 million, up 1.8%, while other revenue climbed 9.3% and came in at $265 million. The company remains on track to implement resources to boost omni-channel capabilities, refurbish stores, open new brands, and increase same-day delivery alternatives. In doing so, the company has commenced restructuring of supply chain with same-day delivery of in-store purchases. Further, in 4QFY19, comparable sales went up 1.5%, down from 5.3% growth witnessed in the year-ago period. During the quarter, the company witnessed a 1.3% increase in the number of transactions, while the average transaction amount improved a marginal 0.2%. During the quarter, comparable digital channel sales increased by 20%, up 2.2 percentage points to comparable sales.

Key Highlights (Source: Company Reports)

4QFY19 Operating Highlights: During the quarter, gross margin stood at 26.3%, an increase of 60 basis points year over year, owing to cost-cutting initiatives, favorable category sales mix, pricing, and promotions. Operating income for the quarter stood at $1,198 million, up 7.3% year over year, whereas operating margin grew 20 basis points to 5.1%. The company’s debit card penetration stood at 12.4%, down 20 basis points year over year, while credit card penetration came in at 10.9%, down 10 basis points.

4QFY19 Key Highlights of Balance Sheet: During the quarter, the company repurchased shares worth $606 million, and had ~$0.1 billion remaining under its $5 billion share buyback program, which was accepted in 2016. Notable dividend paid, during the quarter amounted to $334 million.TGT ended the fourth quarter with cash and cash equivalents of $2,577 million. Long-term debt and other borrowings at the end of the period stood $11,338 million, whereas shareholders’ investment came in at $11,833 million. Operating cash flow for the fourth quarter increased from $5,970 million reported as on 2 February 2019 to $7,099 million.

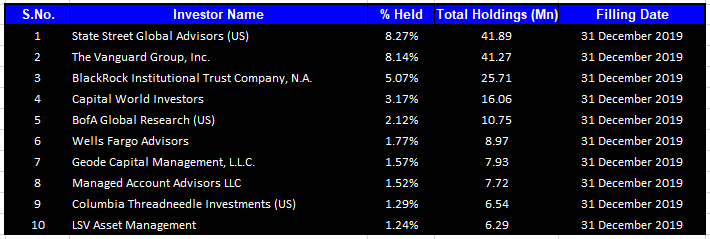

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table, which together forms around 34.17% of the total shareholding. State Street Global Advisors (US) and The Vanguard Group, Inc. hold the maximum interests in the company at 8.27% and 8.14%, respectively.

Top 10 Shareholders (Source: Thomson Reuters)

Key Metrics: The Company reported FY19 gross margin at 29.8%, slightly higher than FY18 figure of 29.3%. EBITDA margin, during FY2019 stood in at 9.3%, higher than FY18 figure of 8.9%. Operating margin during FY19 came in at 6%, higher than FY18 figure of 5.5%. Net margin, in the same time span, stood at 4.2%, in-line with the industry median. FY19 Return on Equity stood at 28.3%, higher than the industry median of 14.1%.

Key Metrics (Source: Thomson Reuters)

Outlook: The company has recently shifted few of its strategic plans, including store remodels and other projects. The company now intends to remodel ~130 stores in FY20, instead of previous guidance of 300. It also plans to open 15-20 small-format stores in FY20, down from its prior plans of 36. Nonetheless, the company will initiate robotics solutions, as part of its supply-chain activities. This, in turn, will enhance specific arranging and help store-team members to load shelves quicker, thereby reducing backroom inventory.

Key Valuation Metrics (Source: Thomson Reuters)

Valuation Methodology- EV/Sales Multiple Based Relative Valuation

EV/Sales Based Valuation (Source: Thomson Reuters)

Note: All forecasted figures and peers have been taken from Thomson Reuters, NTM-Next Twelve Months

Stock Recommendation: The stock of TGT closed at $104.63 with a market capitalization of ~$52.4 billion. The stock made a 52-week low and high of $70.03 and $130.24, respectively, and is currently trading below the average of its 52-week trading range. The stock has corrected by ~20.63% in the last three months. Whereas, in the past one year, the company has given a positive return of 21.4%. The business witnessed decent fourth-quarter results with bottom-line increasing on a year over year basis. TGT remains on track to benefit from robust demand for essential goods amid COVID-19 impact. Considering the above factors, we have valued the stock using EV/Sales multiple based relative valuation method and arrived at a target price with an upside of lower double-digit (in % terms). For the purpose, we have taken peers like Dollar General Corp (NYSE: DG), Best Buy Co Inc (NYSE: BBY), and Dollar Tree Inc (NASDAQ: DLTR), to name few. Hence, we recommend a “Buy” rating on the stock at the current market price of $104.63, up 6.48% on 08 April 2020.

TGT Daily Technical Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as personalised advice.