Incitec Pivot Ltd

.png)

IPL Dividend Details

Enhancing production and cost benefits to offset adverse market conditions impact: Post its recent initial assessment, Incitec Pivot Ltd (ASX: IPL) announced that the train derailment in North Queensland late December is expected to have an adverse one-off impact to the company's full year net profit after tax of around $14 million. The train, operated by a third party freight operator, was transporting a shipment of sulphuric acid for use at Incitec Pivot's Phosphate Hill fertiliser manufacturing facility in Queensland, Australia. On the other hand, this facility which is expected to resume full plant operations during third week January 2016, is still forecasted to produce 950,000 tonnes of fertiliser during IPL's 2016 financial year. Looking ahead, the company expects 2016 corporate costs to remain in the range of $22 million to $24 million. IPL's business excellence system which is directed to increase productivity and maintain reliable production generated almost $41 million in benefits in 2015 and is expected to rise further in 2016. Meanwhile, Louisiana ammonia plant is on track and its first beneficial production is expected in third quarter 2016. For the full year 2015, the company recorded 12% year on year (yoy) growth in Net profit to $398.6 million with fertilizers EBIT rising 22.1%. Operating cash flow surged 41%.

.png)

Strategy execution (Source: Company reports)

Inicitec has already delivered decent performance and expects a similar momentum despite hurdles persisting in the upcoming months like soft global mining markets, gas shortage in Moranbah ammonium nitrate plant in Queensland, remaining gas cost increase at Phosphate Hill and potential El Nino impact on East Coast of Australia agriculture markets. We still have confidence with regards to IPL’s growth, and rate this dividend yield stock a “Buy" at the current share price of $3.44

IPL Daily Chart (Source: Thomson Reuters)

Sundance Energy Australia Ltd

.png)

SEA Details

Building resource base via acquisitions:Sundance Energy Australia Ltd (ASX: SEA) completed its fourth quarter 2015 borrowing base re-determination resulting in an $8 million decrease in its borrowing base to $67 million. The company’s term loan remains unchanged at $125 million. During 2016, the company expects to drill and complete 5-8 net Eagle Ford wells. Meanwhile, the base case 2016 capital program of around $45 million is expected to be funded with cash flow from operations at current market prices. The capital plan is expected to result in average production of around 6,800-7,400 boe per day during 2016, approximately a 10% decrease over its full year average production during 2015. For its latest third quarter 2015, Sundance recorded production of 6,710 boe per day compared to 6,635 boe per day full year 2014 production. SEA recorded realized adjusted EBITDAX of $11.8 million for the third quarter with EBITDAX margins of 64%, despite approximately 50% decrease in realized pricing period?over?period. For the first nine months of 2015, cash operating costs reduced to $14.50 per boe from $20.39 per boe in the year ago period led bya $3.90 per boe reduction in general and administrative expenses.

.png)

Quarterly production & revenue trend (Source: Company reports)

Besides, Sundance completed acquisition of New Standard Energy Ltd’s (ASX: NSE) U.S. and Cooper Basin assets which includes 5,500 net acres in Atascosa County, 7 gross producing wells with approximately 175 net boe per day of current production and two wells that have been drilled but not yet completed. This acquisition increases Sundance’s Eagle Ford position to approximately 37,000 net acre. We assign a “BUY” rating to this stock at the current share price of $0.15

SEA Daily Chart (Source: Thomson Reuters)

Northern Star Resources Ltd

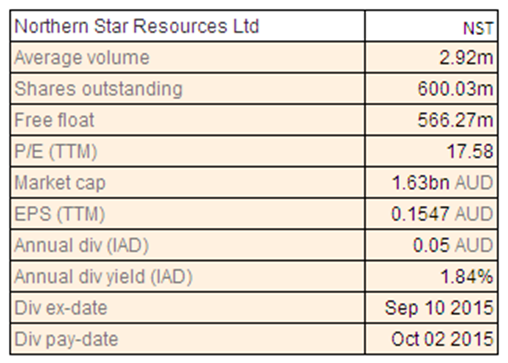

NST Dividend Details

Higher valuations:Northern Star Resources Ltd (ASX: NST) updated that 48,306 ordinary fully paid shares were released from voluntary escrow on January 11, 2016. The company recorded a net profit after tax of A$108.9 million and underlying EBITDA of A$ 331.1 million, a rise of 198% and 220% respectively over the previous year. With no bank debt, cash and equivalents on hand as of June 30, 2015 stood at $178 million while Return on equity reached at 32% for the year. Total resources increased 44% to 8.9 million ounces while measured & indicated resources rose 42%. NST signed a five year agreement with Enerji Limited (ASX: ERJ) to supply and install a heat-to-power plant at the Jundee Power station in the Northern Goldfields of Western Australian. The technology harnesses waste heat to generate electricity producing zero emissions and lowering costs. It’s thefirst Australian deployment of the technology and Enerji’s first commercial contract. The deal has been in the pipeline since mid-2015.

0.

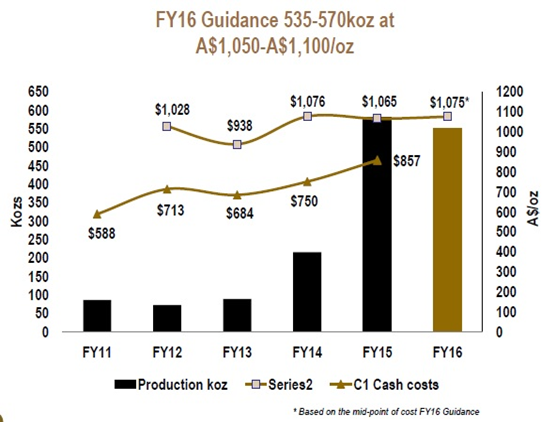

Production and cost guidance (Source: Company reports)

For financial year 2016, total gold production is estimated to be around 535,000 to 570,000 ounces with $74 million to be spent on investing capital related to drilling and investing/expansion.

The investing capital of $39 million has the potential to unlock over 1.5 million ounces of Resources for future mining. The all-in sustaining costs for the year are foreseen to be around $1,050 to $1,100 per ounce. At a high P/E ratio and low dividend yield, we believe that the stock is "Expensive" at the current share price of $2.71

NST Daily Chart (Source: Thomson Reuters)

AMP Ltd

.png)

AMP Dividend Details

Positive results but uncertainties prevail: AMP Ltd (ASX: AMP) recently announced that A$600 million of subordinated debt will be redeemed in March 2016. The company has reported a profit attributable to shareholders of $507 million and an underlying profit of $570 million for the first half of 2015. This result is a 33% increase in profit attributable to shareholders ($382 million for first half 2014) and a 12% increase in underlying profit ($510 million for first half 2014). Led by strong performance, AMP declared an interim dividend of 14 cents per share, an increase of 12% on the 2014 interim dividend. This represents a pay-out of 73% of underlying profit which is within AMP’s target pay-out range of between 70%–80% of underlying profit. Besides, the company is also recovering its insurance business with operating earnings record of a 9% growth through new income protection claims management process, systems and philosophies. AMP expects global investor demand for real assets to continue to strengthen in 2016, with a number of themes like urbanization and infrastructure spend, increased M&A activity and privatization and many others are set to influence the sector.

AMP being in financial sector, the company is prone to both the positive and negative economic factors thus making it a risky investment. With high P/E ratio as compared to its peers, we put an "Expensive" rating to this dividend yield stock at the current price.

AMP Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.