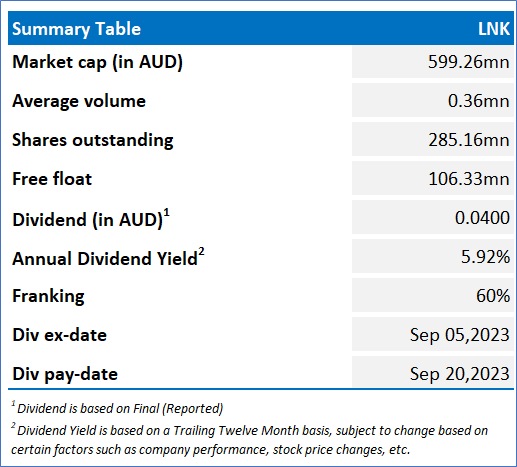

Link Administration Holdings Limited (ASX: LNK)

LNK is a global data and technology-enabled service company administering financial ownership data and driving user engagement. The ASX-listed company offers mission-critical digital infrastructure.

Recommendation Rationale – SELL at AUD 1.435

- Financial Performance: The Company witnessed a healthy financial performance in FY23, where LNK reported revenue from continuing operations of AUD 955.6mn, which increased by 8.2% YoY. Operating EBITDA from continuing operations showed growth of 15% YoY to AUD 248.1mn in FY23, whereas operating EBIT from continuing operations grew by 23.4%YoY and stood at AUD 171mn in FY23.

- Outlook: LNK’s management anticipates 7% to 9% growth in operating EBIT from continuing operations in FY24, Leverage ratio is expected to be in the range of 2.0x to 3.0x in FY24 and expects revenue growth of at least 6.5% in FY24.

- Emerging Risks: The company is exposed to macroeconomic uncertainty, environmental risk, social risk, cybersecurity, and privacy risk. Increased costs related to new regulatory requirements may add to the woes.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/Sales) is higher than the median of Industrial Industry.

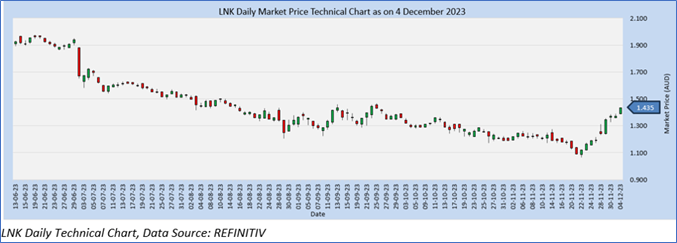

LNK Daily Chart

Considering that the company has breached its R2 level, current trading levels and risks associated, it is prudent to book profits at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 1.435 (as of December 4, 2023, at 10:10 AM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is December 4, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.