Riot Platforms Inc

Riot Platforms, Inc. (NASDAQ: RIOT) is a vertically integrated bitcoin mining company. The Company is engaged in enhancing its capabilities to mine bitcoin in support of the bitcoin blockchain. It also provides comprehensive and critical mining infrastructure for institutional-scale hosted clients to mine bitcoin at its Rockdale Facility.

Recent Business Highlights

- Expansive Facility Development: Riot Blockchain's Corsicana Facility progresses with Phase 1 development, targeting a robust mining capacity of 400 megawatts (MW) upon completion. This initial phase paves the way for a grand total of 1 gigawatt (1,000 MW) mining capacity upon full development.

- Milestone Achievements: March saw significant strides in facility construction, with immersion system installation in Building A1 signaling the start of miner installation. Anticipated energization of the 400 MW substation in April 2024 sets the stage for operational commencement in Building A1. Simultaneously, groundwork for Building A2, with a 100 MW capacity, has been successfully laid, with construction already underway.

- Strategic Hash Rate Expansion: Riot forecasts a remarkable total self-mining hash rate capacity of 31 exahashes per second (EH/s) by the end of 2024. Integral to this expansion are strategic partnerships with MicroBT, resulting in substantial orders for immersion and air-cooled miners earmarked for deployment across Riot's mining facilities.

- Financial Fortitude and Liquidity: Riot maintains a robust financial position, closing March 2024 with approximately USD685 million in cash reserves and 8,490 unencumbered Bitcoins, reflecting a total liquidity of approximately USD1.3 billion based on prevailing market prices. As of March 2024, the company boasts approximately 268.0 million outstanding shares.

- Forward-Looking Engagements: Riot is poised to engage in a series of high-profile conferences, including the Bitcoin Policy Summit, Riot Platforms Analyst Day, and the AIM Summit. These platforms offer invaluable opportunities to engage with stakeholders and provide insights into Riot's operational trajectory and future endeavors.

- Financial Performance and Bitcoin Production: The fiscal year 2023 marked significant milestones for the company, particularly in revenue generation and Bitcoin production. Total revenue surged to USD 280.7 million, representing a notable increase from USD 259.2 million in 2022. This uptick was primarily fueled by heightened Bitcoin production and the upward trajectory of Bitcoin prices. Impressively, the company produced 6,626 Bitcoin during the fiscal year, marking a substantial 19% increase compared to the preceding period in 2022.

- Revenue Streams and Operational Dynamics: The company's revenue streams were diversified, with substantial earnings attributed to power credits and Bitcoin mining revenue. Notably, USD 71.2 million was earned in power credits, showcasing the company's support of the ERCOT grid in Texas during supply/demand issues. Meanwhile, Bitcoin Mining revenue amounted to USD 189.0 million, driven by enhanced Bitcoin values and expanded mining capacity. Despite these gains, Data Center Hosting revenue experienced a slight decline to USD 27.3 million due to terminated hosting agreements, while Engineering revenue remained relatively steady at USD 64.3 million.

- Financial Resilience and Cost Management: Despite reporting a net loss of USD 49.5 million, significantly lower than the previous year's USD 509.6 million loss, the company demonstrated robust financial resilience. With USD 887.6 million in net working capital and USD 597.2 million in cash, Riot maintained a strong financial footing. Notably, the cost to mine Bitcoin decreased by 33% year-over-year to USD 7,539 per Bitcoin, reflecting prudent cost management strategies.

- Adjusted EBITDA and Growth Initiatives: Non-GAAP Adjusted EBITDA for the fiscal year 2023 soared to USD 214.0 million, a marked improvement from USD (67.2) million in 2022. Additionally, the company expanded its hash rate capacity by 28% to 12.4 exahash per second. These achievements underscore Riot's commitment to operational excellence and strategic expansion in the cryptocurrency mining sector.

- Financial Adjustments and Market Impacts: The impact of power credits on Bitcoin Mining and Data Center Hosting costs, alongside adjustments based on proportional power consumption, underscores the complexity of Riot's financial operations. Despite increased expenses, including rising selling, general, and administrative costs, the company's net loss was mitigated by prudent financial management. The early adoption of ASU 2023-08, issued by FASB, further influenced the company's financial reporting, highlighting the dynamic nature of the cryptocurrency market. Overall, the fiscal year 2023 showcased Riot's resilience and strategic foresight, positioning the company for sustained growth and success amidst evolving market dynamics.

Technical Observation (on the daily chart)

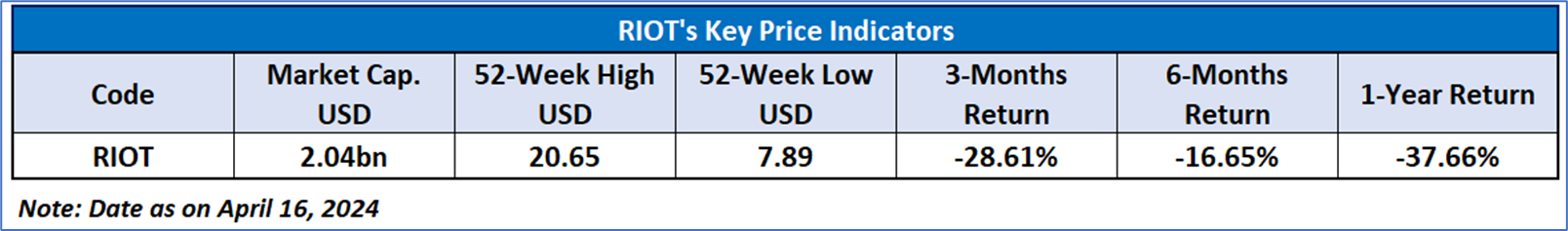

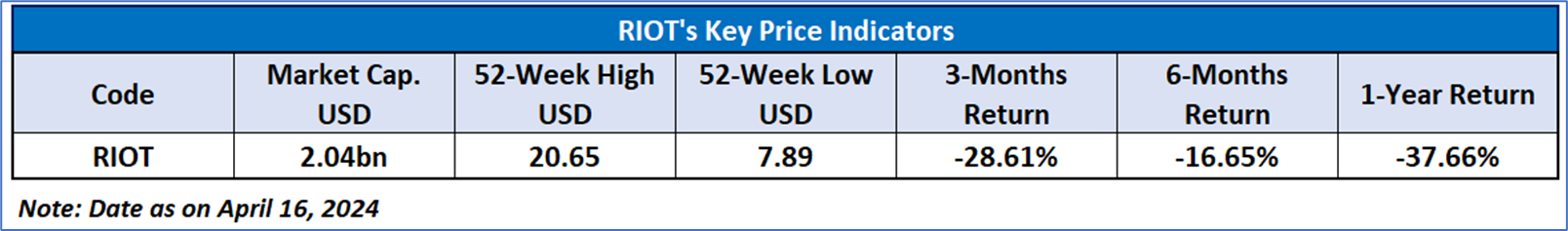

The Relative Strength Index (RSI) over a 14-day period stands at oversold level of 25.88, indicating a state of potential consolidation before a trend reversal or further continuation. Additionally, the stock's current positioning is below both the 21-day Simple Moving Average (SMA) and the 50-day SMA, which may serve as dynamic short-term resistance levels. The stock is expected to take support near next major support zone of USD 6.50-USD 7.00.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is April 16, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

AU

Please wait processing your request...

Please wait processing your request...