Recently, a very clear example of corporate tussle over InterOil acquisition came into picture with Oil Search and Exxon Mobil Corp putting their respective bids across the table.

Oil Search’s move: Oil Search is seeking to establish its position in the Asia-Pacific oil and gas market with a proposed USD $ 2.2 billion acquisition of InterOil. The CEO Peter Botten says that this will allow the company to be a huge influence in the further development of its world-class PNG LNG and Papua LNG projects. In addition to this acquisition, Oil Search has entered into a Memorandum of Understanding with French oil major Total SA to sell down 60% of the InterOil interest in the Elk-Antelope gas reserves and 62% of its interest in other exploration assets. In return, Total SA will fund 60% or USD $ 1.2 billion of the acquisition cost. The CFO of Oil Search, Stephen Gardiner commented that the net debt of the company will decrease by USD $ 300 million post the completion of the deal. Also expected are cost savings on capital and operational expenditure accompanied by accelerated production schedules. Analysts believe that Oil Search has paid a full price for the acquisition but has in the process created strategic options for itself.

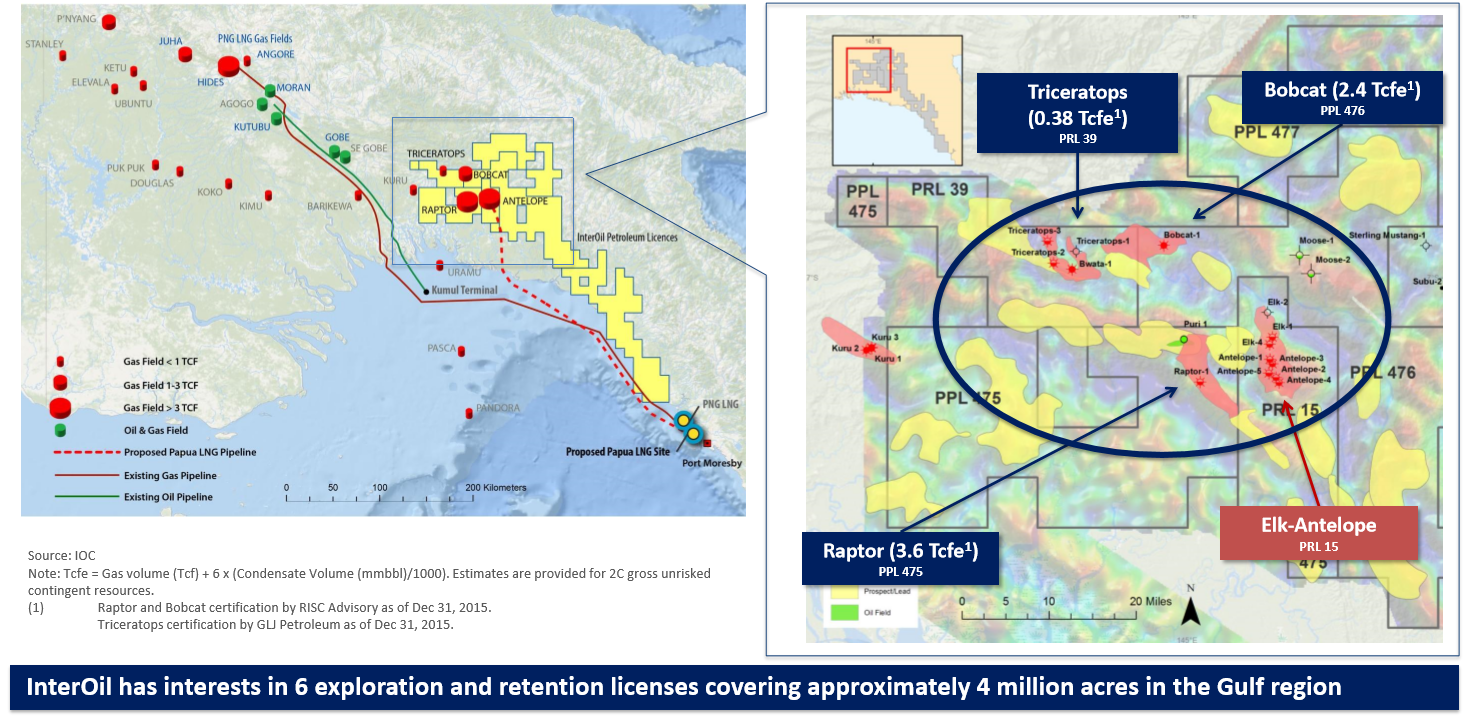

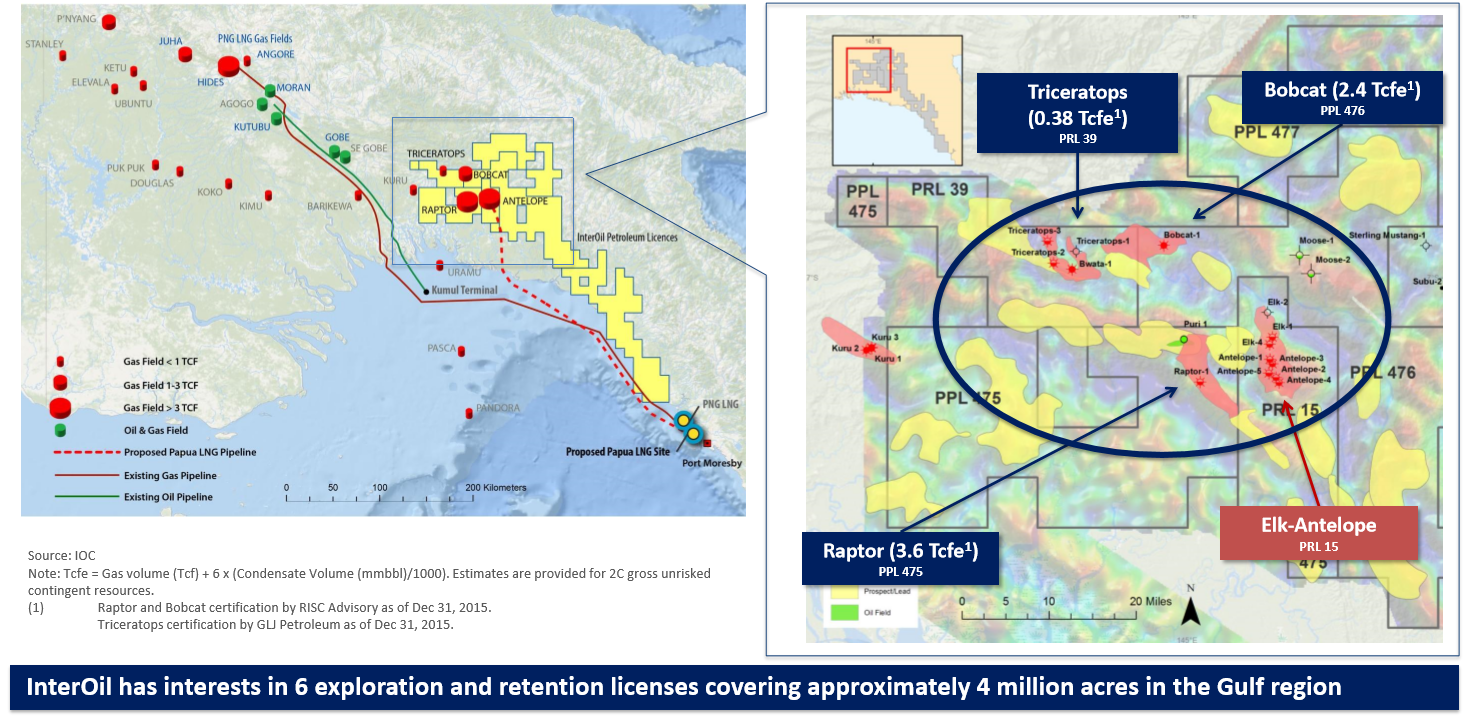

InterOil’s PNG Gas Discoveries (Source: Company Reports)

Superior Bid by Exxon: Meanwhile, Exxon Mobil Corp, which already operates a plant for gas exports in Papua New Guinea has made an indicative proposal for InterOil, which is believed to have been in excess of the competing USD $ 2.2 billion. There are reports that Exxon’s proposal entails $2.5 billion and is roughly 10% higher than Oil Search’s $2.2 billion proposal. The due diligence is still being carried out and a formal offer is yet to be made according to a person with knowledge of the matter. It is certain that any definitive bid by Exxon would be considered better than the existing buyout agreement with Oil Search. In May 2013, Exxon had exclusive talks to acquire a stake in the InterOil Papua discovery, however, the talks fell through for reasons which were not disclosed.

The InterOil gas fields are in close proximity to the coastal site of the proposed LNG plant and the pipeline that would feed it passes through a less densely populated region than the current holdings of Exxon in the country. The proposed acquisition would help Exxon to cover production losses and create reserves in the way of a long USD $ 35 billion bet on US gas and the interruption of a Russian exploration venture because of international sanctions.

Benefits to Oil Search on losing:

Oil Search is entitled to a $60 million breakup fee, 20% of which would go to French oil major Total SA, in case OSH steps back. Some analysts also believe that if Exxon buys InterOil then it is expected to invest in expanding the existing LNG infrastructure co-owned with Oil Search so that natural gas produced in Papua New Guinea could move through a cost-effective project.

Oil Search had been given a period of three calendar days expiring on July 21, 2016 to respond in terms of amending the agreement.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

Please wait processing your request...

Please wait processing your request...