Wesfarmers Ltd

.png)

WES Details

Weak outlook with moderate quarterly result for Curragh and Bengalla: Wesfarmers Ltd(ASX: WES) incurred a net capex in the range of $1.3 billion to $1.4 billion in FY 16 for acquisitions and organic growth which includes growth of Coles & Bunnings. WES is developing pilots for Bunnings Warehouse, while the first is expected to come up later 2016. WES is also progressing with the liquor turnaround with its five-year transformation plan. The group spent $705 million for the acquisition of UK based Homebase and has plans to spend over $1 billion on its restructuring. On the other hand, the investment in the UK is likely to have a negative currency impact, with the value of sterling versus the Aussie dollar declining by over 10% since the EU referendum. For FY 17, WES has high levels of seasonal stock of more than $100 million in the first half and the company has to complete EDLP transition, reduce SKUs & inventory levels. However, with the volatility in coal prices, the group’s Resource segment would continue to be under pressure. Curragh’s coal supply obligations to Stanwell would continue to impact their earnings as well as Curragh’s recoverable value depends upon the future currency and the export coal price assumptions. On the other hand, WES announced that the overburden removal for the quarter ended 30 June 2016 was 11.0 per cent higher than the previous quarter for Curragh at the back of successful commissioning of additional overburden removal equipment during the previous quarter. Coal production was 2,965,000 tonnes which is 61.4 per cent higher than the previous quarter. The increase in coal production reflected the impact of significant rainfall on mine operations in the previous quarter. At Bengalla, Wesfarmers’ share of coal production for the quarter was 786,000 tonnes, 14.4 per cent below the previous quarter owing to a less productive section of the mining sequence.

.png)

Group’s Transactions (Source: Company Reports)

The non-cash impairment of $600 million to $850 million pre-tax is to be recorded in Curragh for FY 2016. In addition, WES has made restructuring costs and provisions of $145 million to significantly rebase Target and expects EBIT loss in Target for FY2016 of approximately $50 million, due to high seasonal clearance activity and lower gross margins. We give an “Expensive” recommendation to this dividend yield stock at the current price of $42.82

WES Daily Chart (Source: Thomson Reuters)

Woolworths Limited

.png)

WOW Details

Rebuilding and reinvesting in the business: Woolworths Limited (ASX: WOW) received a credit rating downgrade by one notch from BBB+ (Outlook Negative) to BBB (Outlook Stable) by Standard and Poor, and reported for softness in third quarter financials. This update coupled with weak consumer sentiment led to the stock decline of over 3.02% during this year to date (as of July 27, 2016). However, WOW is rebuilding and reinvesting a further $150 million in its second half of 2016 on price, service and loyalty in Australian Supermarkets. As per the latest update on operating model review and implementation of the turnaround measures, progress has been made in Australian Supermarkets due to the record voice of the customer scores, the improvement in the team engagement scores and the continued growth in the transaction along with item growth, which is now positive.

The group review has led to the restructuring costs of $959 million ($571 million non -cash) or $766 million after tax which would be recognized in the FY 2016 results. The decisive action would be taken on General Merchandise with restructuring costs of $460 million, including a $309 million for the impairment of EziBuy. In order to focus on renewing the existing stores, the company has slowed down the roll-out of new Australian Supermarkets while the underperforming or unprofitable stores are to be closed. The stock rose 13.25% in the last one month (as at July 27, 2016). We maintain a “Buy” recommendation on the stock at the current price of $23.40

.PNG)

WOW Daily Chart (Source: Thomson Reuters)

JB Hi-Fi Limited

.png)

JBH Details

Exploring acquisition of The Good Guys: JB Hi-Fi Limited (ASX: JBH) is planning to acquire The Good Guys for which the company might launch an $850 million bid for the business, though they did not reach a formal agreement. The Good Guys might raise money through an IPO also. Meanwhile, JBH is projected to have 58 HOME stores at the end of FY16 and 75 HOME stores at the end of FY17. In addition, the group would have over 50 JB HI-FI stores with small appliances by the end of FY16.

.png)

Store expansion (Source: Company Reports)

Moreover, JBH is expected to pick up over $200 million in new sales on the back of fall of competitor Dick Smith earlier this year. Trading at a decent dividend yield, we give a “Hold” recommendation on the stock at the current price of $25.39

.PNG)

JBH Daily Chart (Source: Thomson Reuters)

Metcash Limited

.png)

MTS Details

Divesting non-core business to reduce debt: Metcash Limited (ASX: MTS) group’s EBIT for FY 16 reached $275.4 million which is in line with expectations even though the results were negatively impacted by decline in Convenience earnings. MTS has significantly reduced debt through the sale of Automotive business and has completed the second year of Transformation Plan. Moreover, MTS has reoccupied the Huntingwood site in April 2016 and expects it to be fully operational in second half of 2017. The insurance recovery is progressing well with regard to the Huntingwood Distribution Centre which was damaged by hail, with total recoveries of over $60 million to date.

In addition, for food & grocery segment, MTS would pilot and roll out Core Ranging “Mini DSA” and would launch the new mid-tier private label brand. The group has also got a nod from ACCC on not opposing MTS’ acquisition proposal for Woolworths’ Home Timber and Hardware group. Meanwhile, MTS stock has risen 19.3% in the last six months (as of July 27, 2016) and still trading at a lower P/E. We give a “Hold” recommendation on the stock at the current price of $2.12

.PNG)

MTS Daily Chart (Source: Thomson Reuters)

Myer Holdings Ltd

.png)

MYR Details

Warm Weather affected winter product sales: Myer Holdings Ltd (ASX: MYR) winter product sales are affected due to unseasonably warm weather in recent weeks. Moreover, with the 2016 Federal election campaign occurring at a key trading period, the consumer sentiments have been considered to be volatile. MYR in the third quarter 2016 has reported 2.1% increase in sales to $675.5 million. For FY 2016, the group’s NPAT is expected to be in the range of $66 million and $72 million excluding the impact of implementation costs of $20-$30 million associated with New Myer.

In addition, MYR is exiting its stores located at Wollongong in October 2016 and Orange in New South Wales in January 2017 as a part of New Myer strategy, which is designed to return Myer to profitable growth. Moreover, MYR is accelerating the rollout of New Myer initiatives leading to increased costs and capex which includes the major refurbishment at Warringah that is due to reopen before Christmas 2016. Trading at a high P/E, we give an “Expensive” recommendation on the stock at the current price of $1.305

MYR Daily Chart (Source: Thomson Reuters)

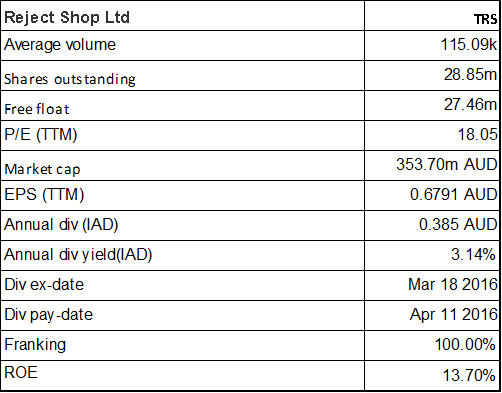

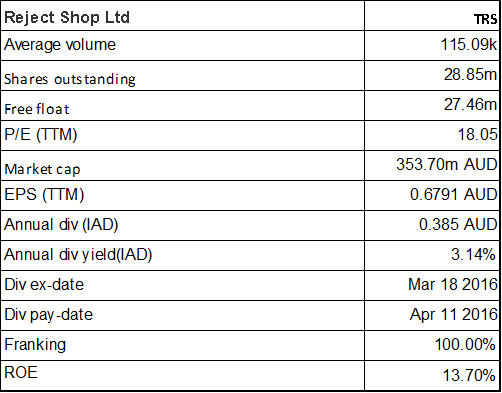

The Reject Shop Ltd

TRS Details

Substantial Redundancy costs: The Reject Shop Ltd (ASX: TRS) has outsourced the management of its new Victorian DC to Toyota Tsusho Logistics, and would close its existing Tullamarine DC. This re-arrangement would cost a substantial amount of $7.3 million as redundancy cost this year. Moreover, Victorian DC is due to start its operation in the first quarter of calendar year 2017. However, TRS has opened eight stores and closed three stores due to the underperformance, center redevelopment or an inability to agree acceptable lease terms during the first half of 2016. But, the group expects to open five stores in the second half of 2016. We give an “Expensive” recommendation on the stock at the current price of $12.40

.PNG)

TRS Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.png)

.PNG)

.png)

.png)

.PNG)

.png)

.PNG)

.png)

.PNG)

Please wait processing your request...

Please wait processing your request...