AGL Energy Ltd

.png)

AGL Details

Mixed FY16 results: AGL Energy Ltd (ASX: AGL) has reported 4.4% growth in revenue to $11,150 million on year on year (yoy) basis in FY 16. AGL’s statutory loss after tax is down 287.2% to $408 million for the FY16, primarily reflecting the significant items related to the exit of gas exploration and production assets and due to the changes in the fair value of certain electricity derivatives. On the other hand, the underlying profit was $701 million, which is up 11.3% due to the margin improvement and reduction of cost. But AGL in FY 17 sees a challenging start to the year due to the unseasonably mild July weather on Australia’s east coast.

.png)

Financial Performance for FY 16 (Source: Company Reports)

There would be the impact of a reduction in its gas portfolio margin of at least $100 million as compared with FY16 (as stated on 7th July 2016). The benefit of the stronger wholesale electricity prices would moderate over the medium term, which indicates for the current rising competitive environment. The group would offer formal guidance of its FY17 earnings outlook in 28th September 2016 and has generated over 4.67% in the last six months (as of August 12, 2016).

AGL Daily Chart (Source: Thomson Reuters)

Commonwealth Bank of Australia

.png)

CBA Details

Subdued Outlook: Commonwealth Bank of Australia (ASX: CBA) reported a 3% growth in cash NPAT to $9,450 million in FY 16. But, the cash return on equity of 16.5% is down 170 basis points in FY 16 as compared to FY 15 and cash earnings is $5.55 per share. CBA’s net interest income is up 7% to $16,935 million while the net interest margin is down 2 basis points to 2.07% in FY 16. Moreover, CBA’s CET1 capital ratio is 10.6% on an APRA basis as on 30

th June 2016, up from 9.1% as at 30

th June 2015 and the CET1 capital ratio is 14.4% on an internationally comparable basis up from 12.7% in FY 15.

.png)

Financial Performance for FY 16 (Source: Company Reports)

However, CBA has given subdued outlook while there is underlying GDP growth and stable employment, but the nominal growth is weak and the monetary stimulus given globally is unable to offset the low confidence from weak incomes and instability. Meanwhile, CBA stock has risen 3.65% in the six months (as of August 12, 2016). CBA’s fully franked final dividend of $2.22 per share is set to be paid in September 2016 while the stock trades ex-dividend on 17th August 2016.

CBA Daily Chart (Source: Thomson Reuters)

Fairfax Media Limited

.png)

FXJ Details

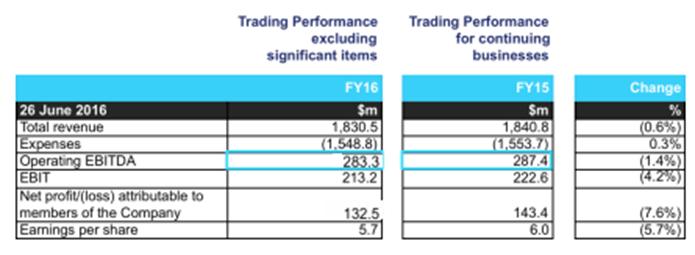

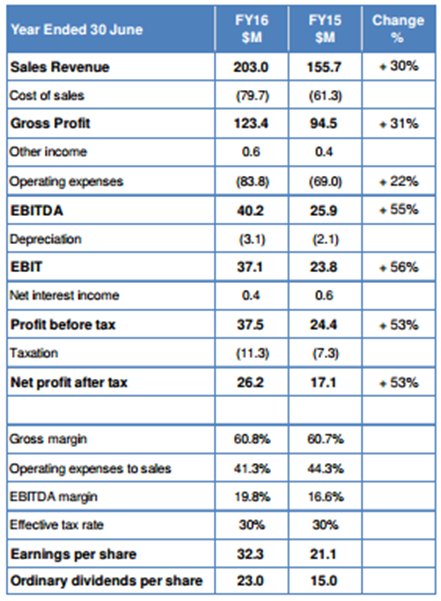

Decline in Profit: Fairfax Media Limited (ASX: FXJ) has reported a decline of 0.6% in the group revenue for continuing businesses for FY16, and delivered a fall of over 7.6% in the net profit and the statutory net loss of $893.5m including the significant items of $1,026.0m after tax. Moreover, the trading in the first five weeks of FY17 saw the revenues 8% to 9% below the last year. The Publishing trends were consistent with second half of FY16 while the new real estate listings in higher value markets in Sydney and Melbourne in July were unusually weak. The Domain business is delivering strong audience growth and yield improvements, with digital revenue growth of 10% in the first five weeks of FY17.

Group Trading Performance for FY 16 (Source: Company Reports)

The July 2016 new listings volumes were impacted by the dampening effect of the longest Federal election campaign in modern history, with new listings volumes down 25% in Sydney and 11% in Melbourne. In addition, FXJ is implementing cost savings measures to maintain earnings stability. Meanwhile, FXJ stock has risen 18.40% in the six months (as of August 12, 2016) and is trading ex-dividend on 19th August 2016.

FXJ Daily Chart (Source: Thomson Reuters)

Telstra Corporation Ltd

.png)

TLS Details

Single Digit Growth Expected in FY 17: Telstra Corporation Ltd (ASX: TLS) has reported 6.3% growth in revenues to $28.3 billion in FY 16 and generated about 36% growth in the net profit to $5.8 billion including $1.8 billion from sale of Autohome shares compared to FY 15. TLS had resorted to the total of $1.5bn of the share buyback in which $1.25 billion was off-market buyback and $250 million was on-market buyback. Moreover, TLS has added 560,000 mobile customers and 235,000 fixed broadband customers in FY 16. TLS’s outlook is ‘mid to high’ single digit revenue growth, and ‘low to mid’ single digit EBITDA growth in 2017. Meanwhile, TLS stock has fallen 3.88% in last one month (as of August 12, 2016).

TLS Daily Chart (Source: Thomson Reuters)

Nick Scali Limited

.png)

NCK Details

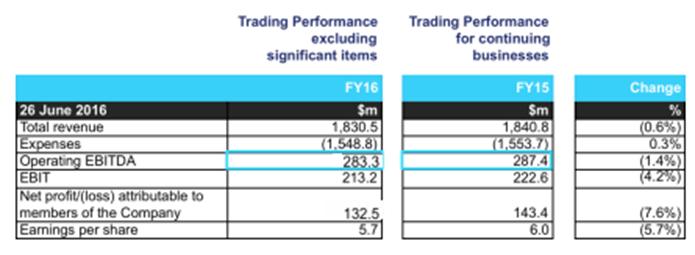

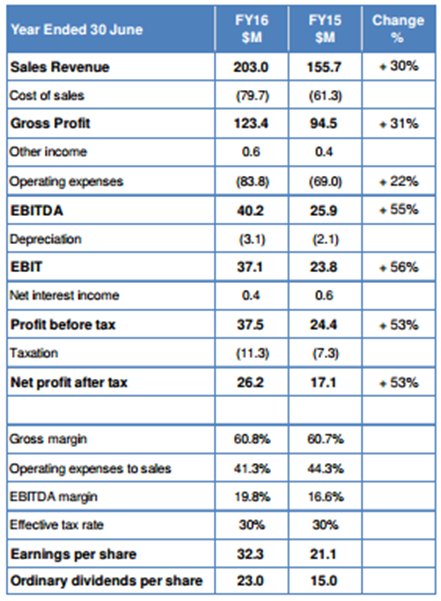

Beaten the Profit Guidance in FY 16: Nick Scali Limited (ASX: NCK) has reported 53.1% increase in net profit after tax (NPAT) to $26.2 million in FY 16, beating its earlier guidance of NPAT between $24-26 million compared to FY 15. NCK’s revenue rose by 30.4% to $203 million in FY 16 on the back of same store sales growth of 11.1%, wherein 7 stores had opened during FY15 and are now trading for the full year FY16. There is some contribution from the 2 new stores opened in early FY16 and got the support from an increased investment in marketing during the period.

Financial Performance for FY 16 (Source: Company Reports)

NCK had further added 3 stores in FY16 which have made a significant contribution to the growth of sales and profit for FY16. Moreover, NCK expects modest sales growth in FY17 as compared with FY16. The warehouse facility for NSW is expected to open in June 2017 to support the growth of the business and improve efficiency. Additionally, NCK would launch Nick Scali Furniture brand into New Zealand with 3-4 stores expected by FY18. NCK’s network target is over 75 stores in Australia/New Zealand. Meanwhile, NCK stock has risen 30.05% in the last six months (as of August 12, 2016).

NCK Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...