W&T Offshore Inc

W&T Offshore, Inc. (NYSE: WTI) is an independent oil and natural gas producer. The Company is engaged in the exploration, development and acquisition of oil and natural gas properties in the Gulf of Mexico. It has a working interest in over 53 offshore producing fields in federal and state waters (which include 44 fields in federal waters and nine in state waters).

Recent Financial and Business Updates:

- Operational Performance: W&T Offshore displayed resilience in Q3 2024, achieving a production rate of 31.0 MBoe/d (52% liquids) despite facing challenges from hurricanes and unplanned downtime. By October 2024, production had rebounded to approximately 34.0 MBoe/d, demonstrating effective operational management. The quarter marked the Company’s 27th consecutive period of positive free cash flow, with USD 14.8 million generated from operating activities and USD 3.9 million in free cash flow.

- Financial Highlights: The Company reported a net loss of USD 36.9 million, or USD (0.25) per diluted share, alongside an adjusted net loss of USD 25.7 million, or USD (0.17) per share. The adjusted net loss excluded unrealized gains on derivative contracts and non-ARO plugging and abandonment costs. Adjusted EBITDA for the quarter stood at USD 26.7 million, reflecting stable cash flow generation. As of September 30, 2024, cash and cash equivalents increased to USD 126.5 million, and net debt was reduced to USD 266.0 million, maintaining a low leverage ratio of 1.6x net debt to trailing twelve months (TTM) adjusted EBITDA.

- Commitment to Shareholder Returns and Cost Management: W&T Offshore reinforced its dedication to shareholder returns by issuing its fourth consecutive quarterly dividend of USD 0.01 per share in August 2024 and declaring a similar dividend for the fourth quarter, payable in November. The Company revised its full-year 2024 capital expenditure guidance to USD 25-35 million from the earlier estimate of USD 35-45 million, reflecting prudent financial management. Lease operating expenses (LOE) for the quarter were USD 72.4 million, significantly below guidance due to synergies derived from recent asset acquisitions.

- ESG Initiatives and Corporate Governance: The Company emphasized its commitment to sustainability with the publication of its 2023 ESG report, highlighting a 26% reduction in Scope 1 greenhouse gas emissions and a 42% reduction in Scope 1 production intensity over the past five years. The report also showcased improvements in waste management practices and shareholder engagement. To strengthen oversight of its sustainability initiatives, W&T established an ESG Committee, chaired by Dr. Nancy Chang. The Company’s transparency efforts earned it recognition as a finalist in the small-cap category for "Best Proxy Statement" at the 18th Annual Corporate Governance Awards.

- Production, Revenue, and Costs: Production during Q3 consisted of 43% oil, 9% NGLs, and 48% natural gas, with an average realized price of USD 41.92 per Boe. Quarterly revenues totaled USD 121.4 million, representing a 15% decline compared to both Q2 2024 and Q3 2023, primarily due to lower realized prices and production volumes. General and administrative (G&A) expenses were USD 19.7 million, reflecting lower non-recurring professional fees but higher non-cash compensation costs. The Company maintained its focus on efficiency, completing one workover and three recompletions, which positively impacted production.

- Financial Position and Liquidity: W&T maintained a robust financial position with total liquidity of USD 176.5 million, including USD 126.5 million in cash and USD 50.0 million in borrowing capacity. Net debt was USD 266.0 million, of which USD 114.2 million was non-recourse. Capital expenditures for Q3 were USD 4.5 million, while asset retirement settlement costs amounted to USD 8.3 million. Year-to-date acquisition investments reached USD 80.6 million, including USD 77.3 million for the Cox acquisition.

- Strategic Vision and Future Outlook: Tracy W. Krohn, Board Chair and CEO, reaffirmed W&T Offshore’s focus on maximizing production margins, generating free cash flow, and integrating newly acquired assets. Despite temporary disruptions, the Company is dedicated to operational excellence and sustainable growth. Efforts to restore two offline fields to production, combined with disciplined cost management and ESG initiatives, position W&T to deliver strong operational and financial results through the remainder of 2024 and into 2025.

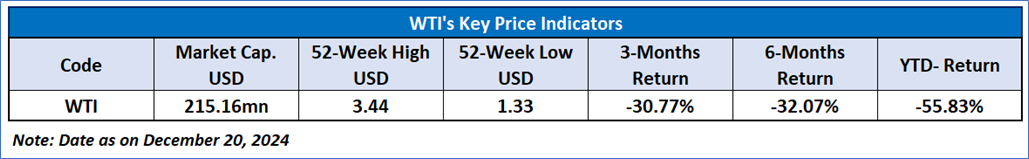

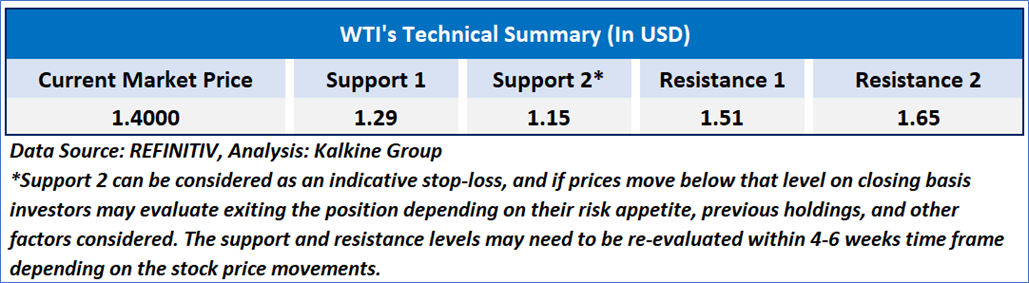

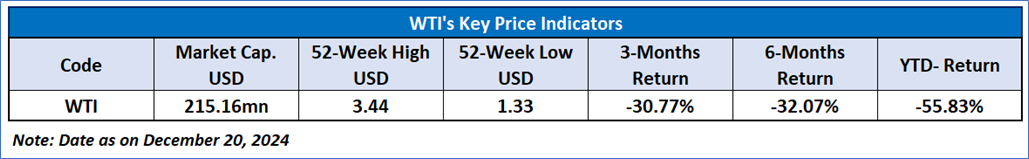

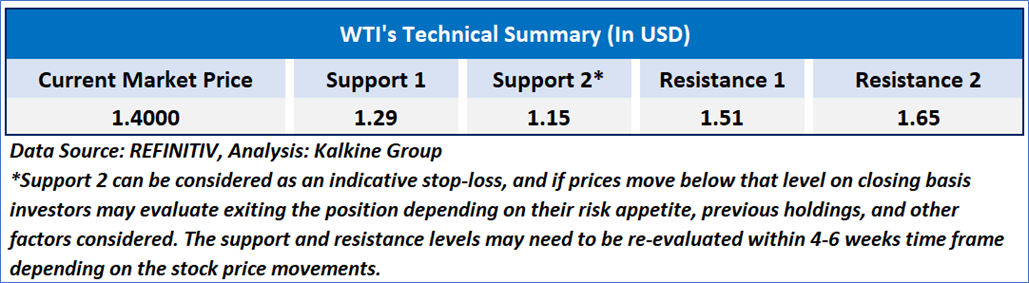

Technical Observation (on the daily chart)

The Relative Strength Index (RSI) over a 14-day period stands at 21.50, downward trending and inside oversold zone, indicating a state of potential consolidation or a short-term upward momentum if the current level of USD 1.20-USD 1.40 hold. Additionally, the stock's current positioning is below both the 50-day Simple Moving Average (SMA) and the 200-day SMA, which may serve as dynamic short-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given to W&T Offshore, Inc. (NYSE: WTI) at the current market price of USD 1.40 as of December 20, 2024, at 06:50 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 20, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...