Intel Corporation

Intel Corporation (NASDAQ: INTC) is engaged in designing and manufacturing of semiconductors. It operates through three segments: Intel Products, Intel Foundry, and All Other. Its Intel Products segment includes Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX).

Key Business & Financial Updates

- Q2 2024 Financial Overview: Intel Corporation reported second-quarter revenue of USD 12.8 billion, a slight 1% decline year-over-year (YoY). The GAAP earnings per share (EPS) attributable to Intel registered a loss of USD (0.38), while the non-GAAP EPS was USD 0.02. Looking ahead, Intel forecasts third-quarter 2024 revenue between USD 12.5 billion and USD 13.5 billion, with an anticipated GAAP EPS of USD (0.24) and non-GAAP EPS of USD (0.03). To address the current market conditions, Intel is implementing a comprehensive cost-reduction strategy, including over a 15% headcount reduction. Additionally, the company has announced the suspension of dividends starting in the fourth quarter of 2024, while reiterating its commitment to a competitive dividend policy as cash flows improve.

- Strategic Milestones and Technological Leadership: Intel continues to make progress toward process technology leadership, achieving significant milestones with the release of Intel 18A 1.0 Process Design Kit (PDK) and the power-on of key products, including Panther Lake and Clearwater Forest on the Intel 18A platform. CEO Pat Gelsinger emphasized that while the financial performance in Q2 2024 was below expectations, Intel has made crucial advances in product and process technologies. The company's IDM 2.0 transformation is progressing, aimed at enhancing operating and capital efficiencies, which will ultimately improve profitability and strengthen Intel’s market position.

- Proactive Cost-Reduction Measures: CFO David Zinsner highlighted the financial pressures from gross margin headwinds, largely driven by the accelerated ramp of AI PC products and higher-than-expected charges from non-core businesses. Intel’s strategic cost-cutting initiatives are designed to improve liquidity and reduce debt, positioning the company for sustainable long-term growth. The planned reductions include a 15% headcount cut and substantial reductions in operating expenses, particularly in R&D and marketing. These initiatives are expected to result in cost savings of over USD 10 billion by 2025.

- Long-Term Investment Strategy and Focus on Efficiency: Intel’s cost-reduction plan is built around four key priorities: reducing operating expenses, capital expenditures, cost of sales, and maintaining core investments. By focusing on capital efficiency, the company aims to reduce its 2024 gross capital expenditures by over 20%, bringing them down to USD 25-27 billion, with further reductions expected in 2025. Intel is also advancing its technological investments, particularly in its semiconductor supply chain, ensuring a sustainable and resilient global presence. The company will continue to prioritize investments in innovative process technologies and products while maintaining a commitment to long-term shareholder value.

- Business Unit Updates: Intel’s business restructuring, which introduced the internal foundry operating model in early 2024, is a significant step toward operational efficiency. The model delineates the roles of Intel Products and Intel Foundry, with a focus on enhancing transparency and accountability. Intel’s AI PC segment has achieved notable success, having shipped over 15 million units since December 2023, far outpacing competitors. The upcoming launch of the next-generation Lunar Lake AI CPU and further advancements in the Intel® Xeon® processor line position Intel as a leader in both AI and data center technologies.

- Third Quarter 2024 Outlook: Intel has provided a cautiously optimistic outlook for Q3 2024, forecasting revenue between USD 12.5 billion and USD 13.5 billion. The company anticipates a GAAP gross margin of 34.5% and a non-GAAP margin of 38.0%, with an estimated tax rate of 34% and 13%, respectively. GAAP EPS is expected to be USD (0.24), while non-GAAP EPS is projected to be USD (0.03). The suspension of dividends in Q4 2024 is a key measure to preserve liquidity, ensuring Intel remains financially agile to execute its strategic objectives.

Technical Observation (on the daily chart):

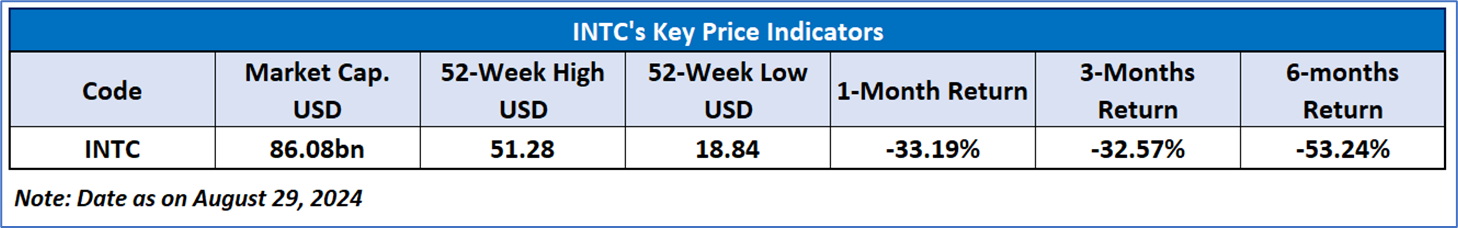

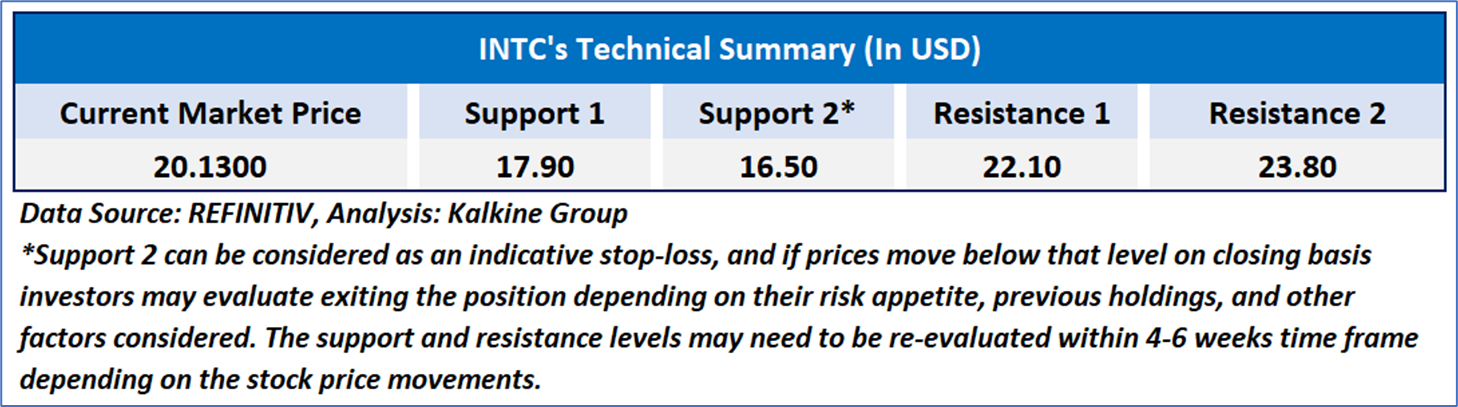

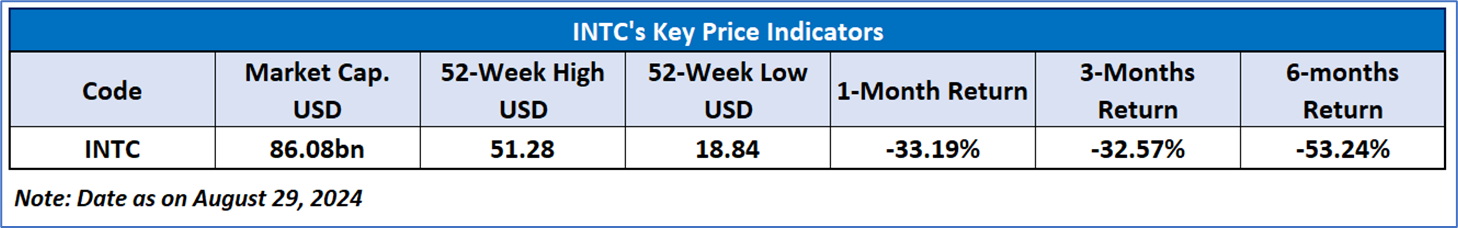

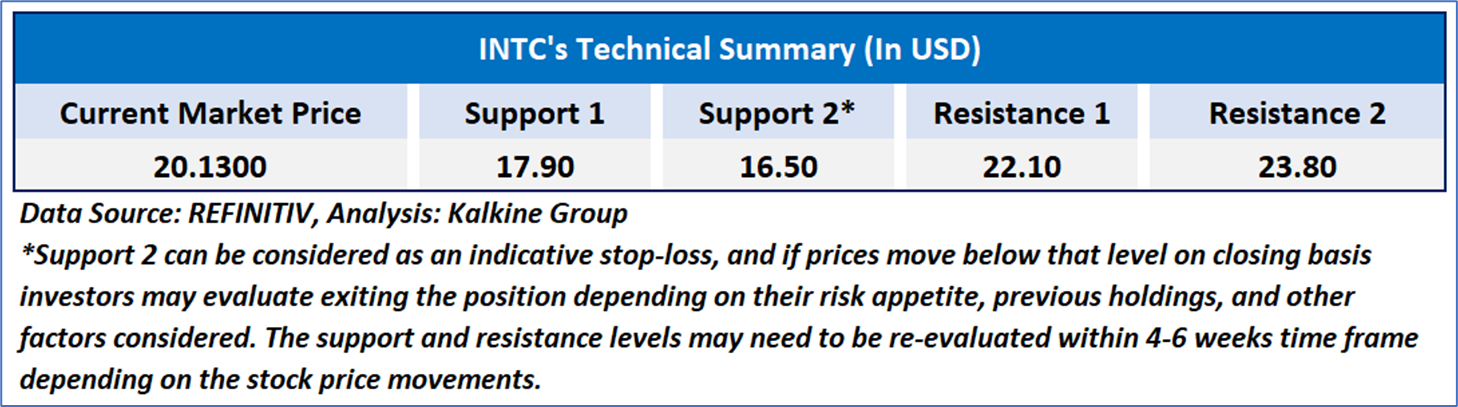

The Relative Strength Index (RSI) for a 14-day period is currently at 35.08, upward trending. There is an expectation of a bullish divergence if the resistance level at USD 22.00 is surpassed. Presently, the stock price is near the support levels between USD 18.00 and USD 20.00. Should these support levels hold, an upward momentum may emerge, potentially leading to higher resistance levels. Furthermore, the stock's current position is below both the 50-Day Simple Moving Average (SMA) and the 200-Day SMA. These moving averages are likely to serve as short- to medium-term resistance levels. The interplay of these factors suggests that a breakout above the resistance at USD 20.00 could signal a more sustained upward trend, provided the support levels continue to hold.

As per the above-mentioned price action, momentum in the stock over the last month, current macroeconomic scenarios, recent business & financial updates, and technical indicators analysis, a ‘Buy’ rating has been given to Intel Corporation (NASDAQ: INTC) at the closing market price of USD 20.13 as of August 29, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 29, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...