Iluka Resources Limited (ASX: ILU)

Iluka Resources Limited (ASX: ILU) is an Australian critical minerals corporation. The company produces zircon, high-grade titanium dioxide feedstocks, rutile, and synthetic rutile. Its mining and processing operations are based in South and Western Australia.

Recommendation Rationale – SELL at AUD 8.28

- Financial Performance: Production of zircon, rutile, and synthetic rutile (Z/R/SR) at ILU rose by nearly 8% YoY to 639.2 kilotons in FY23 vs 591.4 kilotons in FY22. The company’s underlying EBITDA declined by 31% YoY to AUD 609.1mn in FY23, owing to a fall in zircon sales. ILU’s profit for the period (NPAT) was recorded at AUD 342.6mn in FY23, down from AUD 588.5mn in FY22, due to increased expenses towards fuel, labour, consumables, and foreign currency fluctuations.

- Outlook: In FY24, the total production of Zircon/Rutile/Synthetic Rutile (Z/R/SR) is estimated to reach 455 thousand tonnes, with cash production costs totalling AUD 660 million. Capital expenditure, excluding the Eneabba refinery, is estimated to be AUD 450mn in FY24.

- Emerging Risks: Climate Changes, retaining key people, cyber security, project delay, cost inflation and global supply chain constraints remain significant concerns.

ILU Daily Chart

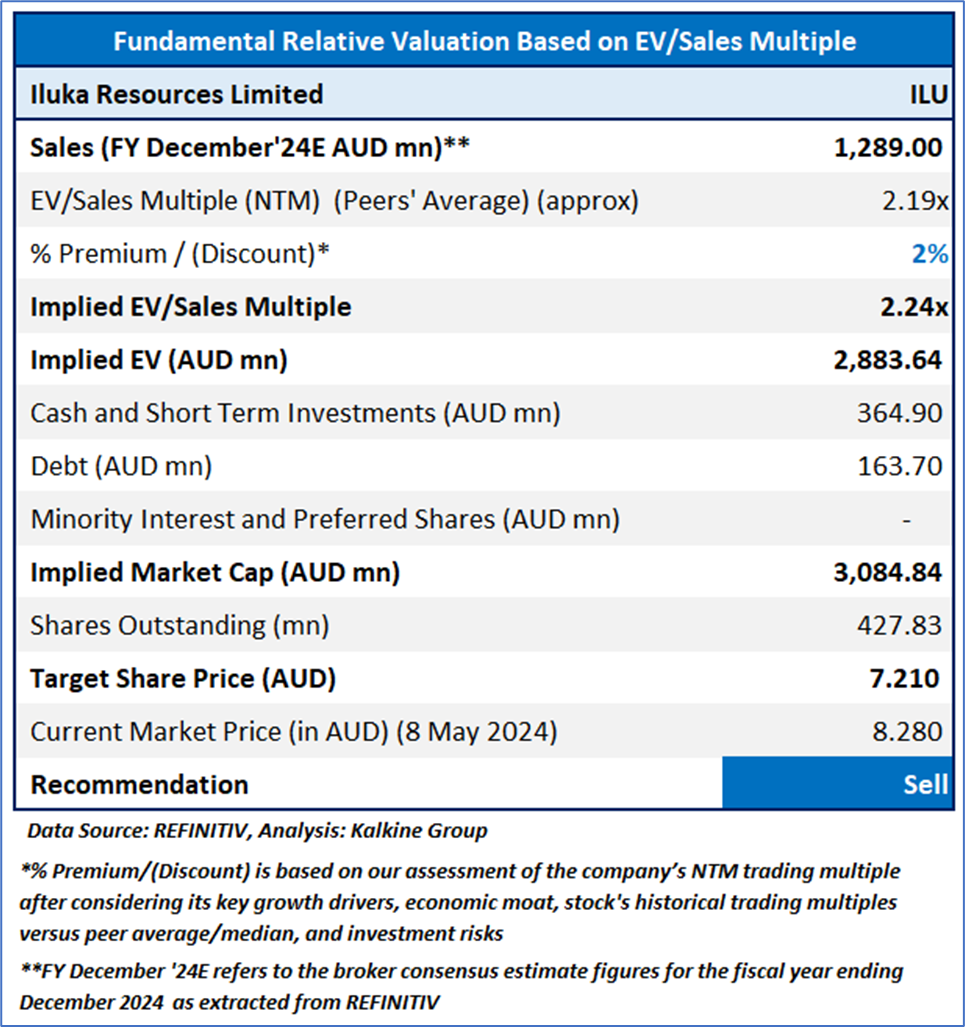

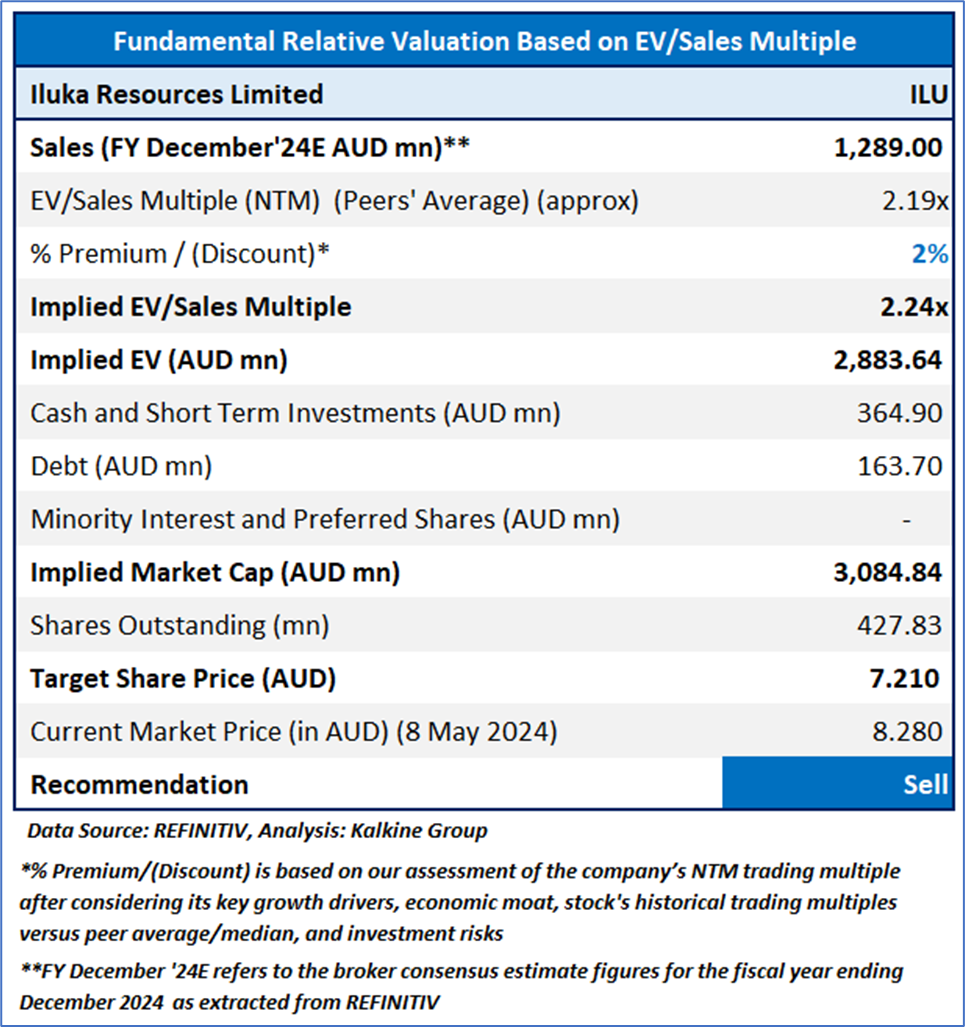

Valuation Methodology: EV/Sales Approach (FY December'24E) (Illustrative)

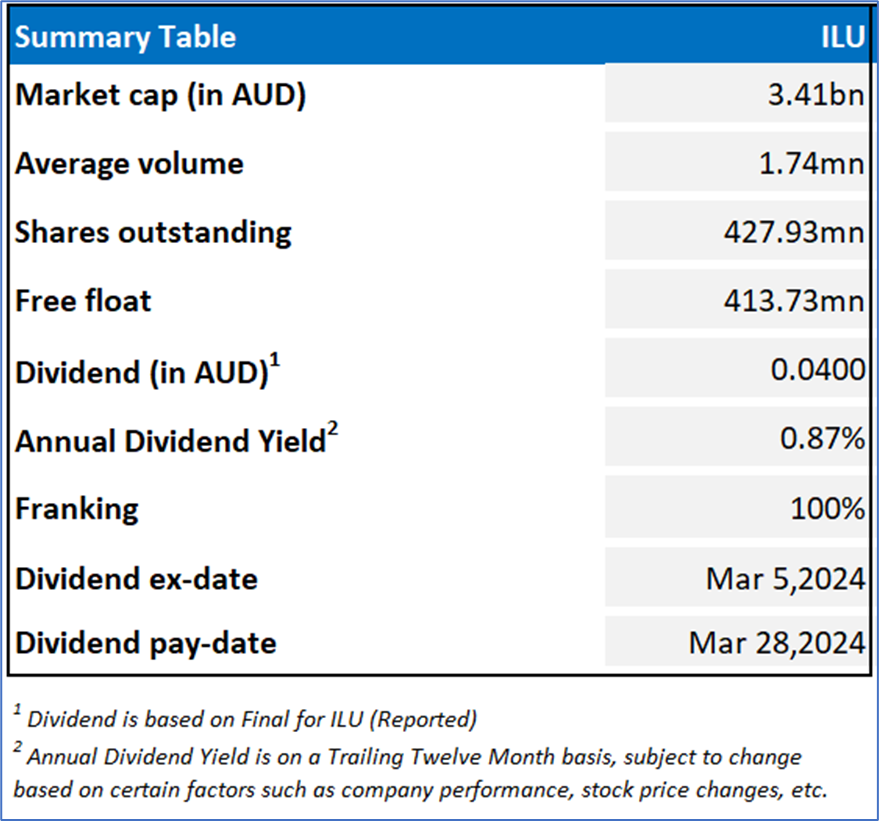

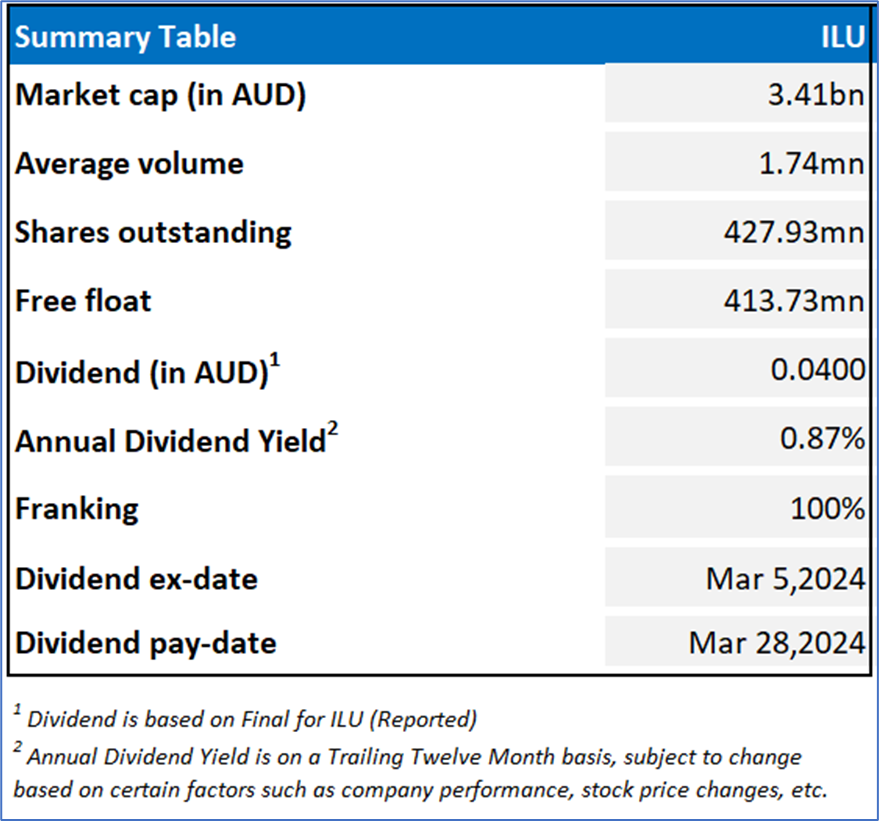

Stock might trade at a slight premium to its peers, considering the expected contracted sand volumes, anticipated improvement in the pigment market in FY24, and other factors. For valuation, few peers like Syrah Resources Ltd (ASX: SYR), BHP Group Ltd (ASX: BHP), South32 Ltd (ASX: S32), and others have been considered. Considering the current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 8.28 (as of May 8, 2024, at 11:55 AM AEST).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 8 May 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...