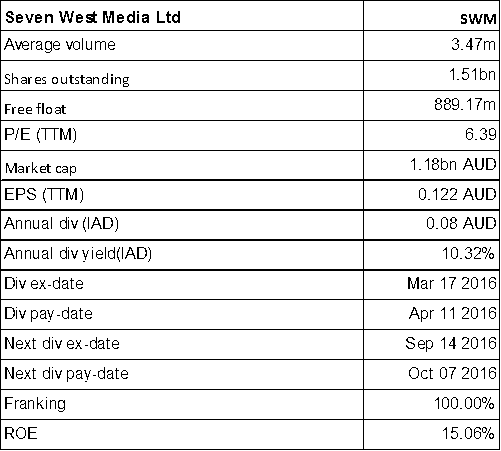

Seven West Media Ltd

SWM Details

Expanding digital portfolio:Seven West Media Ltd (ASX: SWM) has met the FY 16 full year guidance and was able to deliver a profit after tax of $207.3m (excl. significant items) which was down only by 0.9%. Moreover, Olympics is expected to underpin the robust Television market share growth adding a respite to the struggling Television advertising market which is estimated to be flat to down to low single digits year on year. The program sales and 3

rd party productions are expected to deliver greater than 25% growth and the Digital is expected to deliver greater than 150% revenue growth to the group.

Additionally, SWM is expanding its presence in the creation of content in international markets with an investment in a British drama production company, expanding production into New Zealand and is currently progressing with several opportunities in other territories. Meanwhile, SWM stock has fallen 17.99% in the last six months (as of September 02, 2016). The company is having an outstanding dividend yield and is trading at a low P/E. We give a “Hold” recommendation on the stock at the current price of $0.78

SWM Daily Chart (Source: Thomson Reuters)

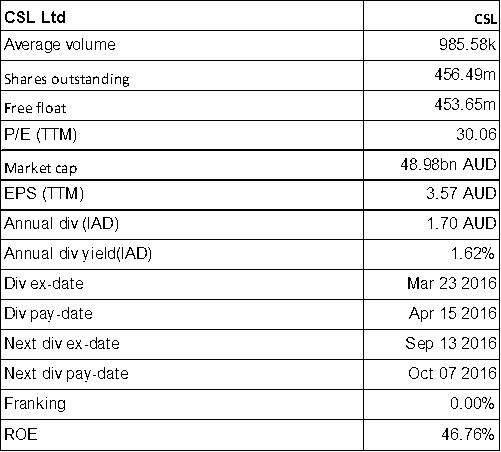

CSL Ltd

CSL Details

FDA accepts BLA for Hereditary Angioedema Therapy: CSL Ltd (ASX: CSL) has announced that the US Food and Drug Administration (FDA) has accepted for review of CSL Behring’s Biologics License Application (BLA) for its low-volume subcutaneous (SC) C1-Esterase Inhibitor (C1-INH) Human replacement therapy, CSL830, as prophylaxis to prevent Hereditary Angioedema (HAE) attacks.

Moreover, CSL in FY 16 has reported earnings per share decline of 8% in fiscal year of 2016. As a result, the stock fell over 10.9% in the last four weeks (as of September 02, 2016). Still the stock is having a low dividend yield and is trading at higher P/E. Accordingly, we give an “Expensive” recommendation on the stock at the current price of $104.92

CSL Daily Chart (Source: Thomson Reuters)

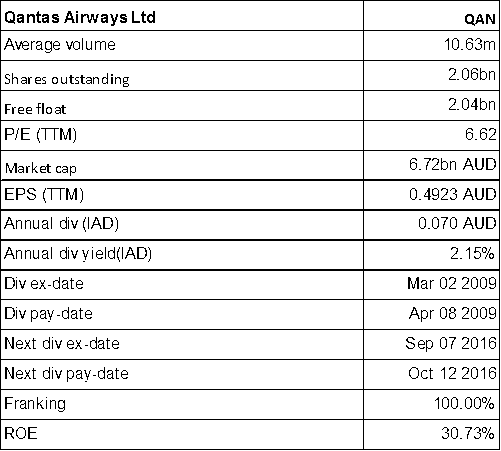

Qantas Airways Limited

QAN Details

Challenging short term outlook:Qantas Airways Limited (ASX: QAN) reported a 57% growth in the underlying profit before tax to $1.53 billion in FY 16 and nearly doubled earnings per share to 49c, up 24c on FY 15. The Qantas Transformation program has unlocked $1.66 billion in permanent cost and revenue benefits since early 2014, including $557 million in financial year 2016, and is expecting to realize $2.1 billion in benefits by June 2017.

FY 16 Financial Performance (Source: Company Reports)

QAN is planning for capacity growth of 2-3 per cent in the first half of financial year 2017, due to the aircraft utilization. However, the short-term outlook remains subject to variable factors, including oil price movements, foreign exchange movements and global market conditions. Further, domestic business still witnesses softness. Accordingly, QAN stock has fallen over 15.98% in the last six months (as of September 02, 2016) and we give an “Expensive” recommendation on the stock at the current price of $3.28

QAN Daily Chart (Source: Thomson Reuters)

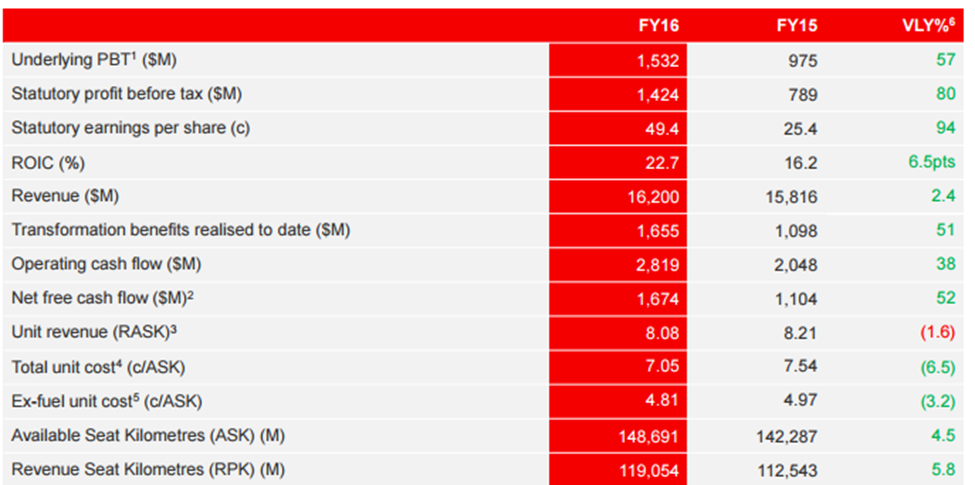

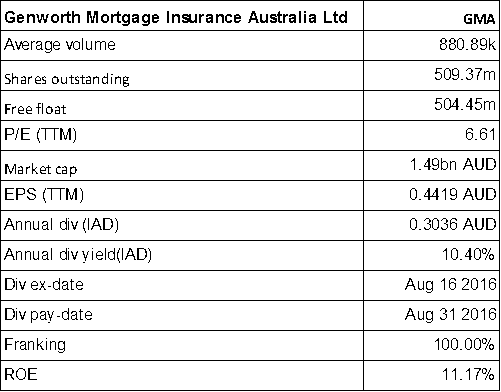

Genworth Mortgage Insurance Australia Ltd

GMA Details

Special dividend in 1H2016: Genworth Mortgage Insurance Australia Ltd (ASX: GMA) has reported statutory net profit after tax (NPAT) of $135.8 million for the first half 2016 and underlying NPAT reached $112.9 million. However, the new business volume, as measured by New Insurance Written (NIW), of $14.0 billion in 1H16, decreased 20.9% against the previous corresponding period (pcp). The GWP fell 33.5% to $189.8 million in 1H16. This reflects a number of factors including reduced high-LVR penetration in the market, a lower LVR mix of business, as well as the full impact of the changes in customers in 1H15. But we believe this is a short term impact and the group is constantly expanding partnerships with retailers to offer better home buyer discounts.

The company has recently highlighted some board changes. GMA had declared a fully franked interim ordinary dividend of 14.0 cents per share and a fully franked special dividend of 12.5 cents per share. The company is having a solid dividend yield and is trading at a cheap P/E. We give a “Hold” recommendation on the stock at the current price of $2.93

GMA Daily Chart (Source: Thomson Reuters)

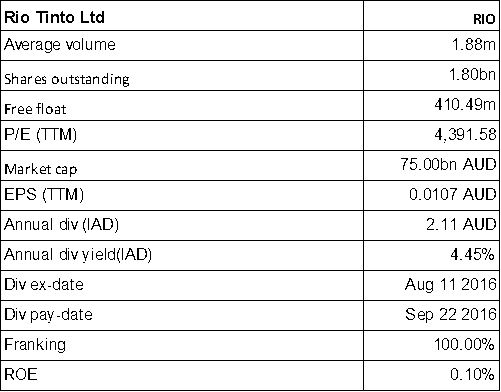

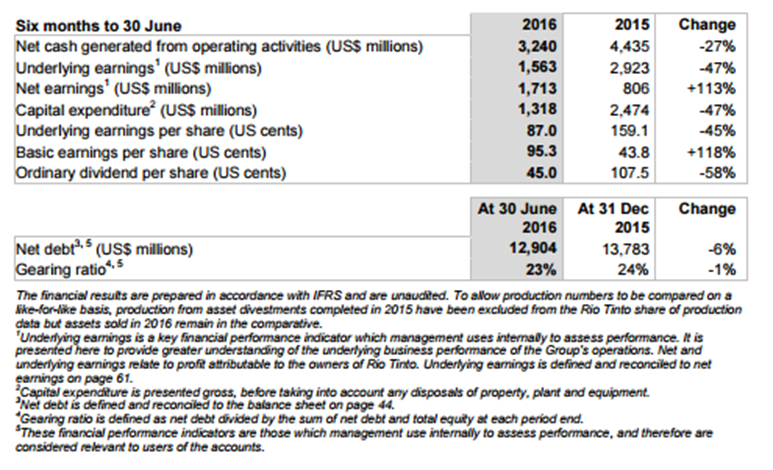

Rio Tinto Limited

RIO Details

Offloading non-core assets, to further focus on core business:Rio Tinto Limited (ASX: RIO) has focused on cost reduction and achieved 33% of EBITDA margins in 1H 2016, and has generated net cash from operating activities of $3.2 billion and reported underlying earnings of $1.6 billion.

1H 16 Financial Performance (Source: Company Reports)

The group offloaded Mount Pleasant thermal coal assets to MACH Energy Australia Pty Ltd for US$220.7 million plus royalties and raised over US$4.7 billion from divestments since January 2013. With these divestments, the group is able to boost its capital position as well as further focus on its core assets. We give a “Buy” recommendation on the stock at the current price of $48.10

RIO Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.