Sustainable Growth Rate (SGR)

Updated on 2023-08-29T11:58:29.590228Z

The sustainable growth rate (SGR) is a growth rate that showcases the maximum growth a company can sustain without any extra equity or debt. SGR is the rate at which the earnings and dividends of any company can continue to grow forever. The embedded notion in the computation of sustainable growth rate is based on no additional debt or equity being issued, and the capital structure remains unchanged. It is the growth based only on earnings ploughed back in business. Thus, it is an indicator based on only the operational effectiveness of a business. SGR is fundamentally a relation between the current operations of any organisation and its future value.

Summary

- SGR is the rate at which the earnings and dividends of any company can continue to grow forever.

- Sustainable growth rate (SGR) is a function of Return on Equity and Reinvestment rate of earnings or the Retention Rate.

- The SGR tells the growth rate of a company without considering its stock price.

Frequently Assumptions Quality (FAQs)

Which Assumptions is SGR based on?

To compute Sustainable Growth Rate (SGR) for an organisation, the following assumptions are considered–

- The Company maintains a single dividend payout ratio throughout the computation.

- The capital structure of the Company remains stagnant during that period.

- Inventory is managed optimally in the Company.

- The Company is motivated to maximise revenue and profits

- The enterprise focuses on high-margin products

Any organization meeting above criteria shall attain and uphold a high sustainable growth rate, being a positive sign of its operational ability.

Image Source: © Mustangmarshal | Megapixl.com

How is Sustainable Growth Rate (SGR) Computed?

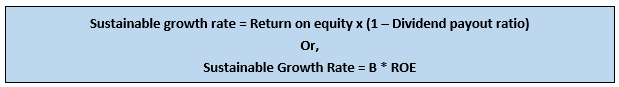

Sustainable growth rate (SGR) is a function of Return on Equity and Reinvestment rate of earnings or the Retention Rate. The Retention Rate is Net Income minus Dividends divided by Net Income, and Return on Equity is the Net Income upon Total Shareholder’s Equity.

Retention rate shows the earnings ploughed back in business, while Return on Equity (ROE) is what investors realised relative to profits generated by a company.

Copyright © 2021 Kalkine Media Pty Ltd.

Where,

B = retention ratio

ROE = Return on Equity

Example

Company ‘Super’ has a 15% return on equity and its’ dividend payout ratio is 50% of earnings. So it’s’ SGR (Sustainable Growth Rate) will be:

15% Return on equity x (1 – 0.50 Dividend payout ratio)

= 0.15 x 0.50

= 0.075 or 7.5% (SGR)

Meaning, ‘Super’ can grow at a sustained rate of 7.5% per annum. To achieve any growth above 7.5%, ‘Super’ would need outside financing in the form of Debt or Equity.

SGR tends to drop over time as an initial market of a product becomes saturated, profitability is reduced. As the firm grows in complexity and size, it incurs more overheads which cut its profits. Competitors also attack profitable firms by reducing prices, thus increasing pricing pressure and dropping profits. This consequently results in a reduced sustainable growth rate over time.

What does Sustainable Growth Rate (SGR) tell?

Sustainable Growth Rate identifies the following things:

- The lifecycle phase of a company. In which stage is it, growth, boom or decline.

- It shows the efficiency of management decision regarding financing or dividend decision.

- It also shows the creditworthiness of a business since it is an indicator of operational efficiency.

- It is a vital indicator of the organisation’s ability to maintain short-term assets and working capital.

- It helps investors gauge the capability of its growth with its available resources.

How is Sustainable Growth Rate (SGR) useful?

For Investors-

A sustainable growth rate is essential because it informs analysts and investors about the organisation's maximum possible rate of growth. SGR can also be used to assess the life cycle stage at which the business is currently. Mature companies usually have a low SGR and can afford to pay a more significant portion of net income as dividends. Growing organisations have a high SGR as they generally cannot produce any bonuses or the payout is comparatively lesser.

For Management-

It gives management estimation of the amount of external capital needed to achieve a predefined level of growth. It helps in managing debtors as a low SGR can force management to question the accounts receivables efficiency. This is because a tighter receivable position reduces earnings potential, in turn reducing SGR. Efficient management of accounts receivable can also remove the need for external financing. Other than this its helps management streamline financial objectives with regards to their economic potential and objectives. It also shows the management how well internal resources are being utilised. The management can thus take steps to identify and correct any hindrances to unlock the full potential.

How is SGR different from PEG?

- The PEG ratio (price to earnings growth) is a company's PE (price-earnings) as compared to its’ Earnings growth rate for the particular time period. The metric compares earnings with the market price.

- The PEG ratio is believed to provide a clearer picture than the P/E ratio of a company. It conveys whether a stock is overvalued or undervalued. It helps compare potential investment options.

- Investors need to study additional indicators and ratios to the PEG of a company to know its worth as an investment.

- The SGR tells the growth rate of a company without considering its stock price.

- PEG ratio computes growth relative to the stock price. Thus, SGR as a metric evaluates the possibility of growth compared to capital structure and operational efficiency.

- It doesn’t reflect even a bit on market valuations but is of higher importance to value-seeking investors.

What are the limitations of using SGR?

- Not all companies can afford to reinvest all their earnings.

- A company may at any time change its payout policy depending on market simulants.

- Sometimes an opportunity of generating higher returns from outside the business can be ignored if only SGR is considered.

- The potential benefits of leverage and debt are ignored when management uses SGR for decision making.

- The company may need outside financing for long-term growth and investment.

- For capital-intensive industries, not using external finance may become a costly affair.

- It is not a confirmative measure of growth sustenance.

- SGR must be compared with similar companies to achieve a fair comparison and an apt yardstick.