Public Limited Company

Updated on 2023-08-29T12:01:29.341190Z

What is a public limited company (PLC)?

A public limited company, often known as a PLC or a publicly held company, is owned by shareholders and controlled by directors. It is available to businesses in numerous Commonwealth countries and the United Kingdom. Unlike other business forms like partnerships and sole traders, the business operates as a distinct entity from the owners, protecting debt and liabilities.

On the other hand, PLC is the same as a publicly traded firm in the United States that uses the corporation or Inc. designation. Therefore, the usage of the PLC acronym following a firm's name is required, and it notifies investors and anybody else engaging with the firm that it is a publicly-traded company.

Summary

- A public limited company is a type of organisation that is owned by shareholders and controlled by directors.

- A public limited company is the legal status of any company that has issued shares to members of the general public and holds a limited number of its own shares.

- Shares in a firm can be freely transferred without the approval of other shareholders or prior notice to the firm.

Frequently Asked Questions (FAQs)

What are the functions of a public limited company?

A public limited company is the legal status of any company that has issued shares to members of the general public and holds a limited number of its own shares.

What is a Public Limited Company (PLC) ?

Any individual can buy or demand a PLC's stock or company share on a confidential basis during the initial public offering process or through trades on the stock exchange market when it is presented to the general public.

PLC share buyers have limited liability, which means they cannot be held liable for any financial loss over the price they paid for the shares.

A PLC in the United Kingdom functions similarly to a public corporation in the United States. Accordingly, the activities of a PLC are monitored, and it is essential to distribute periodic financial reports to potential shareholders and stockholders.

Source: © Djbobus | Megapixl.com

What are the main characteristics of a public limited company?

- The firm has a distinct legal identity apart from the individuals who make it up.

- A firm must have at least seven members, but there are no restrictions on the maximum number.

- The firm raises capital by selling its shares, and those who purchase the shares are known as members, and the amount raised is known as the share capital.

- Shares in a firm can be freely transferred without the approval of other shareholders or prior notice to the firm.

- Shareholders have no right to be involved in a firm's day-to-day operations. This ensures that ownership and management are kept separate. The Board of Directors has ultimate control over the decision-making process in an organisation. The majority rule governs all strategic choices made by the Board, which guarantees management coherence.

- Its activities, including its structure, operating, and winding up, are strictly regulated by laws, rules, and regulations.

- The liability of a firm's member is restricted to the face value of the shares he possesses. He is under no obligation to contribute to anything to repay the firm's lenders once he has paid the total face value.

What are the distinctions between a private limited company and a public limited company?

Minimum and Maximum number

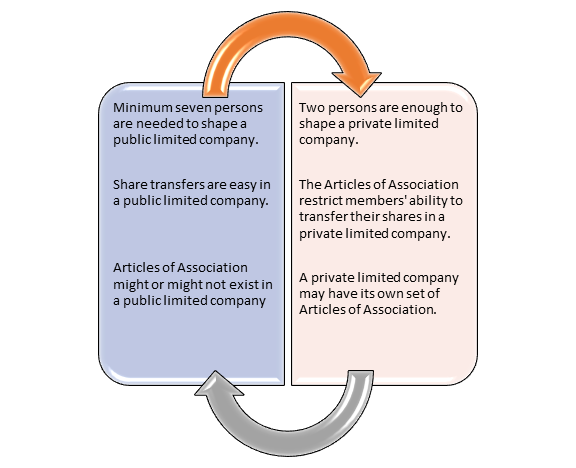

Minimum seven persons are needed to shape a public limited company; while two persons are enough in a private limited company.

The number of stockholders in a public limited company is unrestricted. However, in a private limited corporation, the highest number of shareholders is limited to 50, except the firm's former staff.

Beginning of Business

In the case of a public limited company, the certificate of starting of business must be received in addition to the certificate of incorporation to begin operations.

On the other hand, a private limited company will start doing business with just a certificate of incorporation.

Subscription

A public limited company must have a specified amount of capital before releasing shares. Private limited companies are not subject to these restrictions, and they will be free to distribute shares.

Prospectus distribution

A public limited company may invite the general public to consider subscribing to its stock. However, it must either issue a prospectus or file a statement in lieu of a prospectus before offering stock.

According to the law, a private limited company has no right to invite the public and hence cannot issue a prospectus. As a result, they haven't been able to get the public to subscribe to its share capital.

Share transfer

Share transfers are easy in a public limited company. However, the Articles of Association restrict members' ability to transfer their shares in a private limited company.

Statutory meeting

A public limited company must convene a statutory meeting within six months of starting a business and file a statutory report with the Registrar of Companies. A private limited company does not need to hold a statutory meeting.

Articles of Association

Articles of Association might or might not exist in a public limited company. On the other hand, a private limited company may have its own set of Articles of Association.

Source: Copyright @2021 Kalkine Media

What are the benefits and drawbacks of forming a public limited company?

Companies seek to convert to a public limited company because the benefits outweigh the risks. If a firm decides to go public, it will reap various benefits, but it will also necessitate significant changes in the management structure.

Benefits of a public limited company

- One of the most significant advantages is that the firm can raise funds by selling shares, which can be used to fund development and new possibilities and repay debt.

- A stock market listing can help a firm's reputation and prominence.

- A sense of transparency can enhance a brand's impression among consumers.

- Brand recognition is boosted via an advertising campaign.

Drawbacks of a public limited company

- Shareholders can be anyone who wishes to buy, which can damage an integrated corporate strategy. It's also more vulnerable since the more stockholders there are, the more power is dispersed.

- A PLC requires two directors, but a Limited requires only one.

- Companies House and taxes are more tightly regulated. For example, the tax deadlines for public companies are shortened by HMRC.

- Unlike company secretaries in limited companies, a PLC's company secretary must be adequately qualified.