Mortgage

Updated on 2023-08-29T11:58:56.078118Z

What is meant by mortgage?

Mortgage refers to a secured loan issued to borrowers against collateral, including assets such as houses, property, etc. Mortgage loans allow borrowers to secure high loan amounts for a long period of time.

The asset that is kept as collateral stays with the lender till the full repayment is made. These loans are usually availed to buy immovable assets. At the time of the purchase of the mortgage, the lender would pay the entire loan amount.

However, the borrower must eventually repay the loan amount in subsequent years. These types of loans also involve interest payments which are paid over the principal amount. The payments are made monthly over the entire duration of the loan.

How does a mortgage work?

Mortgages may also have short term payments or long-term payments. Interest rates are also agreed upon beforehand; they may be same throughout the duration of the loan or they may vary. Additionally, borrowers may be asked to fulfil a certain criterion before they can be issued a mortgage loan.

What is Mortgage? - How does a mortgage work?

Mortgages usually have a long duration such as 20 to 30 years. However, the mortgage repayment process can be made quicker by making larger payments within a lesser amount of time. However, making long-term payments could mean higher interest payments compared to when the repayment is made within a lesser duration of time.

However, each loan repayment procedure can be worked out individually depending on the agreement between the borrower and the lender. The lender owns the property till the total loan amount has not been repaid. However, upon completion of the loan repayment, the lender cannot hold any authority over the asset given as collateral.

What does a mortgage loan entail?

Mortgage loans have different moving parts that make them function. These components include the following:

- Principal and interest: The principal amount refers to the total amount that has been issued by the lender to the borrower. This amount is paid back in full to the lender over a long period of time. However, this is not the only repayment that borrowers must make. Borrowers must pay interest over and above the principal amount repayment.

- Taxes: Lenders may collect a property tax next to the loan repayment. This may be held in a third-party escrow account until the property tax bill is due to pay it on behalf of the lender.

- Insurance: Homeowner insurance offers coverage against damages caused from natural calamities as well as accidents. This may be required by lenders, who would make the insurance bill payments out of the escrow accounts.

- Mortgage Insurance: This insurance is a safety net in case the borrower defaults from the repayments. This insurance may be added to the monthly mortgage statement.

What are the different interest rates offered on mortgage loans?

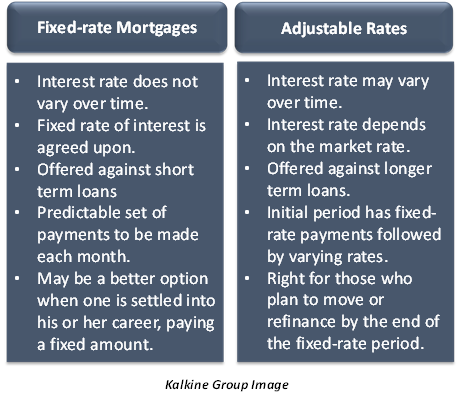

There are two types of mortgages offered based on the type of interest rate charged by the lender. These include:

- Fixed-rate Mortgages: Here, the interest rate does not vary over time. A fixed rate of interest is agreed upon beforehand. Most of the mortgages are fixed-rate mortgages. Fixed interest rates may be offered against short term loans. On the other hand, long term loans may not allow fixed interest rates. The types of mortgages offer predictable set of payments each month. This means that borrowers already know how much they must pay beforehand.

A fixed-rate loan may be a better option when one is settled into his or her career and prefers paying only a fixed amount each month.

- Adjustable Rates: Adjustable rates include a fixed interest rate period that lasts for about 5, 7 or 10 years, followed by varying rates. This short-term period functions like a fixed-rate mortgage. However, once it completes, interest rate must adjust up or down once per year, depending on the market. Thus, these market changes can affect monthly payments.

Adjustable-Rate Mortgages, or ARM, can be right for some borrowers who plan to move or refinance by the end of the fixed-rate period. This type of mortgage may allow access to lower interest rates than one could find on a fixed-rate loan otherwise.

How are mortgages different from a loan?

A loan may also include unsecured loans, which do not require collateral for financing the loan. Thus, any transaction that involves one party lending to another can be termed as a loan.

However, mortgages involve high sums of money and are secure loans involving collateral. They are typically used to finance a property, and it can be considered as a type of loan. But not all loans can be considered mortgages.