Majority Shareholder

Updated on 2023-08-29T11:54:43.145856Z

What is a majority shareholder?

A majority shareholder, often called a controlling shareholder, is a firm or individual that controls most of the stock in a firm. It owns more than half of the shares and hence has more voting power than other stockholders. These shareholders can sway corporate decisions and can appoint or dismiss the board of directors.

Summary

- Any firm or individual owning more than half of a company's equity is a majority shareholder.

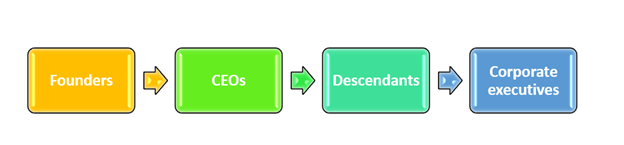

- Individuals with a vested stake in the company's performance, such as the company's founders, or descendants, the company's chief executive officer, and other corporate executives, are often majority shareholders.

- Majority shareholders have the right to vote for and elect members of a corporation's board of directors, giving them a direct influence on how the corporation is governed.

Frequently Asked Questions (FAQs)

Who is eligible to become a majority shareholder?

Source: © Kritchanut | Megapixl.com

The majority of shareholders rarely exercise their entitlement to a say in day-to-day management. A majority shareholder could sell all or portion of his shares in the company, even though the sale is to a direct competitor or a private equity group. The goal of trading stocks in this scenario is to get the most excellent price; nonetheless, dissatisfied shareholders may use it as a means of retaliation.

Individuals with a keen interest in the business are more likely to be the majority shareholder. Chief executive officers have a vested stake in the company's performance and are already in charge of day-to-day practices and activities to assure the company's success. It's why CEOs often wind up as majority shareholders. Moreover, other corporate executives could potentially be majority shareholders in the company.

A majority shareholder could also be the company's founder. In the case of long-established enterprises, the dominant shareholder may also be the founder's descendants.

With more than half of the voting interest, the majority shareholder is a crucial investor and influencer on the company's business activities and strategic direction.

Furthermore, not every company has a majority shareholder, and they are more common in private corporations than in public corporations.

Source: Copyright © 2021 Kalkine Media

What are the rights and privileges of majority shareholders?

Shareholders often enjoy distinct benefits or rights depending on the sort of stock they hold. For example, the majority shareholders have election powers and voting rights. Once again, this implies that they have a say in the company's decisions.

They have absolute authority over the company, including appointing management, serving as management, and making decisions on its direction.

The majority shareholders are kept informed about the company's performance regularly, and if they are dissatisfied, they can call for new board members to be elected.

It's critical to remember that stockholders are not liable for a company's insolvency or collapse. Any private assets held by a majority shareholder outside of the corporation are not a danger. The main difficulty is that if a firm has significant financial commitments, such as existing debts, shareholders will not get dividends or cash until all the firm's liabilities have been handled.

Majority shareholders owe fiduciary duties to the other shareholders, including the obligation to behave in good faith and refrain from misusing company assets or engaging in fraudulent acts. For the most part, they are bound by law if they use their professional judgment to the best of their ability.

What impact do majority shareholders have on a company's decision making?

Because majority shareholders own more than half of the company's stock, they can make decisions. Any corporation that makes large-scale decisions that aren't related to day-to-day operations must seek the permission of its shareholders. As a result, any decision must be approved by the controlling stockholders.

Moreover, they can also determine whether such a decision is beneficial to the organisation. They can assist the organisation by refusing to approve anything in the company's best interests.

How do majority shareholders conduct buyouts?

The majority shareholders who want to get out of a company or lessen their holdings may approach private equity firms or their competitors with the aim of offering their stake or the entire organisation again.

An outside corporation must either purchase over 50% of a target company's outstanding shares or have the votes of at least 50% of present shareholders who will vote in favour of it for a buyout to take place. A buyout is the purchase of a majority stake in a company, and it is frequently used interchangeably with the phrase acquisition.

Based on the corporation's bylaws, even if a majority shareholder owns more than half of its stock, it may not have the right to execute a buyout without additional backing. Therefore, when a takeover requires a supermajority, the majority shareholder can be the single deciding factor. However, it could be possible only if they own enough shares to reach the supermajority threshold and minority shareholders do not have any additional rights to block the endeavour.

Source: © Route66 | Megapixl.com

What's the distinction between minority and majority shareholders?

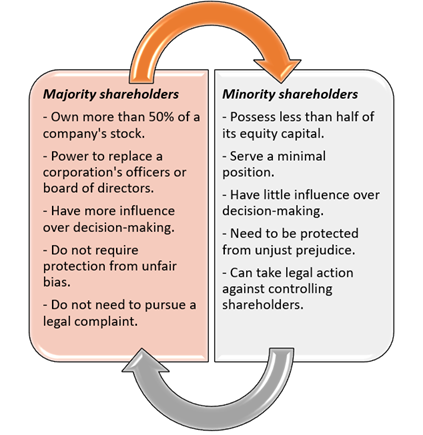

Minority shareholders are equity holders in a business who do not have voting rights because they possess less than half of its equity capital. As a result, they serve a minimal position within the organisation, with little influence over strategic decision-making.

They needed to be protected from unjust prejudice because they could be oppressed. They can even take legal action against controlling shareholders if they believe they are being oppressed.

A majority shareholder is defined as someone who owns more than 50% of a company's stock. A majority shareholder typically has more influence than all other shareholders combined.

They also have the power to replace a corporation's officers or board of directors, which other shareholders do not. Because they are the majority, they do not require protection from unfair bias. They also do not need to pursue a legal complaint because they are not subjected to oppression in the workplace.

Source: Copyright © 2021 Kalkine Media