Macroeconomics

Updated on 2023-08-29T11:54:42.841068Z

Defining Macroeconomics

Macroeconomics is a branch of Economics that evaluates the functioning of an economy as a whole. It studies the performance and behaviour of key economic indicators such as economy’s output of goods and service, exchange rates, the growth of output, the rate of unemployment and inflation, and balance of payments.

Macroeconomics emphasises on the policies and economic behaviour that influence consumption and investment, exchange rates, trade balance, money flow, fiscal and monetary policy, interest rates, national debt, and factors influencing wages and prices.

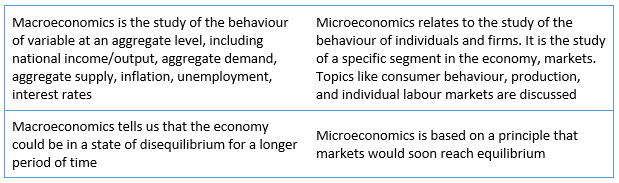

The scope of the subject goes beyond microeconomic topics like the behaviour of individuals, firms, markets, and households.

History of Macroeconomics

Macroeconomics originated with John Maynard Keynes post the great depression when the classical economist failed to explain the great economic fallout. Classical economics mostly comprised theories that studied pricing, distribution, and supply & demand.

In 1936, John Maynard Keynes published – The General Theory of Employment, Interest and Money – effectively changing the perception of how macroeconomic problems should be addressed. The theories of Keynes shifted to focus on aggregate demand from the aggregate supply.

Keynes said: ‘In the long run, we are all dead’. This statement was made to dismiss the notion that the economy would be in full employment in the long run. Later the theories developed by Keynes formed the basis for Keynesian economics, which gained popularity over other schools of thoughts including Neoclassical economics.

Neoclassical economics emerged in the 1900s. It introduced imperfect competition models, which included marginal revenue curves, indifference curves. The theories in neoclassical economics argued about the efficient allocation of limited productive resource.

Neoclassical economists explain consumption, production, pricing of goods and services through supply and demand.

Some assumptions of this thought were an individual’s motive is to maximise utility as companies seek to maximise profits. Individuals make rational choices and act independently on perfect information.

Over the years, many new schools of thought in Macroeconomics have found footing in the economics world. These include monetarist theories, new classical economics, new Keynesian economics, and supply-side macroeconomics.

Difference between Macroeconomics and Microeconomics

Major topics in Macroeconomics

National income and output

The estimation of national income includes the value of goods and services produced by a country in a financial year domestically and internationally. National income essentially means the value of total output generated by an economy in a year.

National income can also be referred as national expenditure, national output or national dividend.

Financial systems

Understanding financial systems is an important concept in macroeconomics. A financial market is a market for financial securities and commodities, including bonds, shares, precious metal, agriculture goods.

It is important for an economy to have markets where buyers and sellers can exchange goods. A financial market helps in the allocation of resources. Financial markets facilitate savings mobilisation, i.e. financial intermediaries channelise funds from savers to borrowers.

Investment remains on the agenda for policymakers to promote growth, and financial markets facilitate funds by allowing individuals to invest in bonds and stocks, which are issued by institutions seeking funds for investments.

Business cycles

A Business cycle or an economic cycle refers to fluctuations in production, trade or economic activities. The upward and downward movement generally indicates the fluctuations in gross domestic product.

A business cycle has four different phases: expansion, peak, contraction, and trough. An expansion in an economy is when economic growth, employment, prices are rising. The peak is achieved when the economy is producing maximum output, inflation is visible, and employment levels are running high.

After a peak, the economy enters into contraction, which leads to a fall in employment, depleting economic activity, and stabilisation in prices. At trough, the economy is at the bottom of the cycle, and the next phase of expansion starts after the trough.

Interest rates

Macroeconomics also deals with interest rates in the economy. Interest rate policy of an economy is formulated and maintained by the central bank. A central bank manages the money supply in the economy.

The intervention by the central bank to propel economic growth is called monetary policy. The monetary policy of an economy seeks to maintain employment and inflation in the economy. The motive of the monetary policy is to achieve full employment and maintain stable prices.