Liquidation

Updated on 2023-08-29T11:59:17.714952Z

What is Liquidation?

Liquidation is the method of selling all an organisation's properties, paying off its debts, returning any remaining funds to shareholders, and shutting the company down as a legal entity. Insolvent companies are in this situation because they are unable to meet its obligations on time.

Source: © Clivia | Megapixl.com

Summary

- The process of winding down a business and releasing its assets to claimants is known as liquidation.

- When the process of liquidation process is finished, a bankrupt firm no longer exists.

- Liquidation is the method of selling off excess inventory at a reduced price.

Frequently Asked Questions

What is the significance of liquidation?

When a limited company reaches a stage where it is agreed to shut down all its activities, it is called liquidation. In this case, it is possible to call it a liquidating business because it involves turning assets into cash.

The word "liquidation" also refers to the sale of non-performing products at a reduced cost to the company or at a cheaper price than the company wishes.

Source: © Davidwatmough | Megapixl.com

Assets are converted to cash to pay off a variety of creditors' debts or loans taken out to expand the company. Liquidation entails the company's dissolution and the cessation of all operations.

If a company fails due to something from a lack of visionary management to growing debts; from almost-zero sales inflow to increasing prices of unnecessary properties, liquidation is inevitable. Liquidation is often needed in the absence of benefit planning and control over the continuation of losses over long periods of time.

What are the reasons for a company's liquidation?

Insolvency

In the event of insolvency, a company can choose to liquidate its assets. When an insolvent company can no longer make required payments when they are due, it prefers liquidation, which transforms the company's assets to cash, that would be used to make payments.

The first step in the insolvency resolution process is to make every effort to rebuild and restart the company enterprise by developing and executing a resolution plan.

However, if that does not work out, liquidation is the next step. The Insolvency & Bankruptcy Code (IBC) preamble makes no mention of liquidation, which is only used as a last resort if there is no other option or if the options available are inadequate.

Any remaining assets will be sold to pay off any remaining creditors if the company is declared insolvent, and any money left over after all required payments have been made will be allocated to any shareholders.

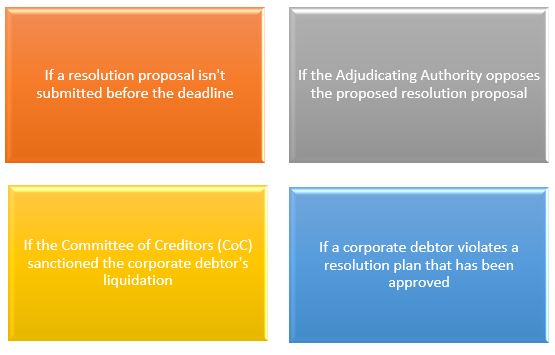

Order of Liquidation

The Adjudicating Authority (AA) may issue a liquidation order under the following cases:

Source: Copyright © 2021 Kalkine Media

The Liquidator's Role

After the adjudicating authority issues a liquidation order, the resolution specialist, also known as the liquidator, who was assigned to handle the corporate insolvency resolution process would commence the liquidation process.

The key duties of the liquidator are to inventory the company's assets and examine all company affairs if they need to retrieve some of the company's assets that have been misplaced or sold for less than market value, since the liquidator has the authority to reverse these transactions.

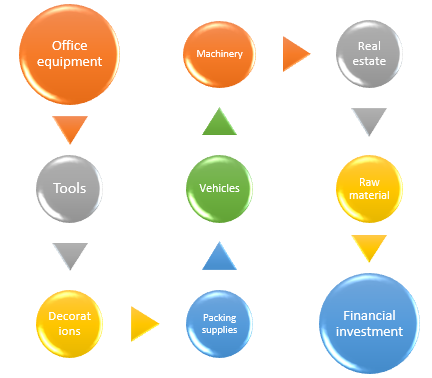

What types of assets are considered liquidated?

An asset is something that has monetary value in the financial world. The following are examples of business assets that could be liquidated:

Source: Copyright © 2021 Kalkine Media

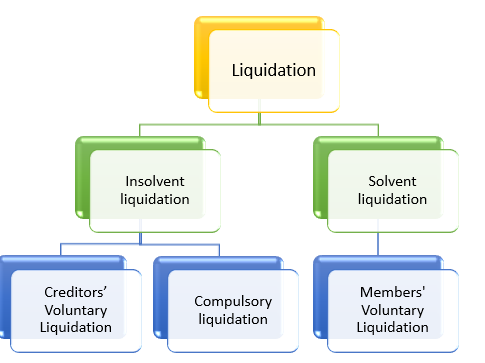

What are the various types of liquidation?

When a corporation goes into liquidation, its assets are sold to pay creditors, and the company closes. On Companies House, the business name remains active, but the status has changed to 'Liquidation.' The name is only removed following dissolution, which takes about three months after the liquidation is completed.

Insolvent and solvent liquidation are the two major forms of liquidation processes.

Solvent liquidation, also known as Members' Voluntary Liquidation (MVL), is a method of closing a company when it no longer serves a useful function.

When a corporation must shut down operations for financial purposes and must pay a dividend to all groups of creditors, it is known as insolvent liquidation.

Solvent liquidation procedure- (MVL)

MVL is a liquidation process that happens when a company's director(s) no longer have any need for it or when it has reached the end of its lifespan and must close its doors.

It also necessitates the involvement of a licenced insolvency solicitor, with the assets being distributed among shareholders and creditors as a result.

In this process creditors are paid in full, and shareholders pass the resolution required to wind up the business and appoint a licensed IP to oversee the process within five weeks.

Insolvent liquidation procedures

Insolvent liquidation can be done in the following ways:

Creditors’ Voluntary Liquidation (CVL)

When creditors threaten legal action against a corporation and there is no realistic chance of rescue or recovery, a Creditors' Voluntary Liquidation is always in everyone's best interests.

As part of the procedure, all the company's properties will be sold in order to maximise creditors' chances of receiving a refund. The designated liquidator, rather than the company directors, would play a key role in collecting and realising all business assets on behalf of all creditors.

Compulsory liquidation

Rather than being liquidated voluntarily by its directors, a corporation would be liquidated by court order. This usually occurs after the company's creditors file a Winding Up Petition (WUP), and the company's bank accounts are frozen to prevent assets from being withdrawn.

The courts may appoint an official receiver to manage the company's winding up, identify the company’s properties, and realise them for the benefit of unpaid creditors.

Source: Copyright © 2021 Kalkine Media

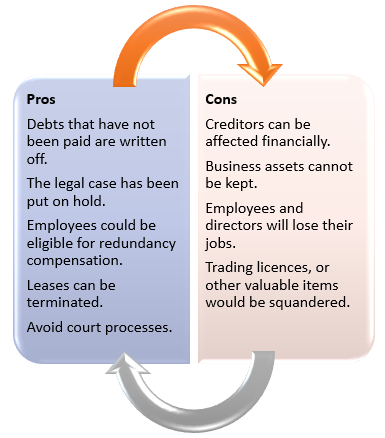

What are the benefits of liquidation?

- It puts an end to a failing insolvent company in a lawful and orderly way, with all creditors being dealt with by the designated insolvency practitioner.

- When a business is in liquidation, all legal actions against it are halted.

- The terms of lease and hire purchase agreements are usually terminated at the time of liquidation, which means no further payments are required.

- The liquidator will make employees redundant, and if they are willing, they will file a petition for redundancy compensation and other statutory benefits.

- By voluntarily agreeing to liquidate the company, they will avoid being sued in court and show the public that the liquidation was a company decision rather than a result of aggressive creditor action.

- The directors will be freed of the burden that comes with managing a struggling company and dealing with creditors who are seeking payment in the case of a CVL.

What are the drawbacks of liquidation?

- Shareholders may be forced to repay fraudulent dividends, and creditors may suffer financial losses.

- Employees and directors will lose their jobs.

- The corporation will be unable to trade.

- Directors' loan accounts that are overdrawn must be paid back.

- Trading licences, or other valuable items would be squandered.

Source: Copyright © 2021 Kalkine Media