Jumbo Loan

Updated on 2023-08-29T11:57:30.407722Z

What is a Jumbo Loan?

A jumbo loan, also known as Jumbo Mortgage, is used to finance a loan or a mortgage that is too expensive compared to a conventional loan or exceeds the limit placed by Federal Housing Finance Agency (FHFA).

A jumbo loan allows access to those assets or property spaces which would otherwise not be a feasible purchase option for the borrower. However, jumbo loans are much riskier than conforming loans as they are not insured and should be opted for only after prior consideration.

Conforming loans are mortgage loans that meet the guidelines of Fannie Mae and Freddie Mac, the home mortgage companies that are federally backed. These loans must conform to financing limits set by the Federal Housing Agency.

How are jumbo loans issued?

Jumbo loans are used to finance luxury houses as well as houses priced in more expensive areas. However, to be eligible for a jumbo loan, high credit score of borrowers is required. Borrowers must also fall in the high-income bracket.

How are Jumbo Loans Different from Conforming Loans?

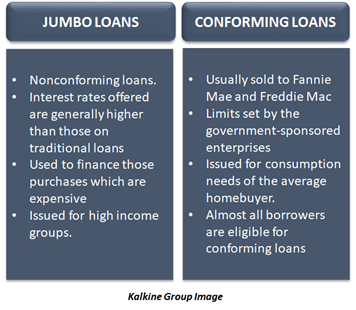

Jumbo loans and conforming loans are both used by individuals to finance their purchasing needs. Both these loans require certain eligibility criteria to be met like minimum credit scores, income thresholds, repayment ability and down payment commitments.

However, despite these similarities, they have differences too. Conforming loans are usually sold to Fannie Mae and Freddie Mac, this mandates them to adhere to the limits set by these federal government-sponsored enterprises. Unlike conforming loans, jumbo loans are not required to follow these restrictions. Thus, they are nonconforming loans.

Additionally, jumbo loans are used to finance those purchases which are expensive but conforming loans can be issued for consumption needs of the average homebuyer.

Another difference is that jumbo loans are issued for high income groups. However, almost all borrowers are eligible for conforming loans, provided they fulfil the requirements set by the issuer.

What are the requirements that must be fulfilled to secure a jumbo loan?

Jumbo loans end up being a riskier borrowing option, thus, lenders may tighten the restrictions that make borrowers eligible. These restrictions include the following:

- Income Proof: Since jumbo loans are only issued to wealthy borrowers, the proof of income is a must to secure the loan. To secure future repayments, lenders may ask the borrowers to present tax documentation as well as proof of assets held by them.

- Credit score: A strong credit score enables lenders to be assured of the fact that the borrower will not default. Most conventional loans can be issued to borrowers holding a “fair” credit rating. However, to be eligible for a jumbo loan, borrowers must hold a credit rating higher than the “fair” rating.

- Debt-to-income Ratio: Consumers may be asked to hold a certain debt-to-income ratio before being able to qualify for a jumbo loan.

Jumbo loans can be a good option when the capital requirement of the borrower exceeds the limits set by conforming loans. Therefore, borrowers in need of high-capital loans can opt for jumbo loans. Another added advantage of jumbo loans is that they can be issued without a down payment.

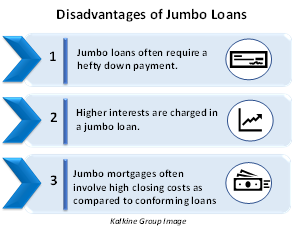

What are the disadvantages of jumbo loans?

- Jumbo loans are more expensive: Jumbo loans often require a hefty down payment, which is considerably higher than the down payment required in the case of conventional loans. Sometimes, the down payments required by jumbo loans may be as high as 20%. However, these down payments may not be necessary always.

- Higher interest rates: Jumbo loans tend to remain expensive throughout all the stages. Higher interests are charged in a jumbo loan, which may seem very daunting to many people. This may make them seem riskier than Fannie Mae and Freddie Mac. This happens because lender expects greater returns for giving out jumbo loans.

- Higher closing costs: Jumbo mortgages often involve high closing costs as compared to conforming loans. Jumbo lenders may also only give out loans for those underlying assets which are valued high enough for them to issue a jumbo loan.