Insolvency

Updated on 2023-08-29T11:59:38.667181Z

Since time immemorial, business experts believe that any form of debt is the nasty match that lights the fire of every crisis. Having said so, the incapability of meeting financial obligations is perhaps every individual’s and business’ most unpleasant experience. However, there is a silver lining to every problem, and the state of insolvency too can be smartly handled.

Let’s dig deep into the concept of “insolvency”.

What is Insolvency?

Insolvency is the state wherein a company or individual is unable to pay the debts when they are due. The inability to meet financial obligations to lenders causes a state of financial distress.

Insolvency can be expressed as the financial condition in which the sum of an entity’s debts is greater than its entire property/assets, at a fair valuation. However, it should be noted that insolvency only becomes a problem when a creditor pursues to collect the amount, and the debtor is unable to pay his/ her dues.

MUST LISTEN: COVID 19 & Business Insolvency

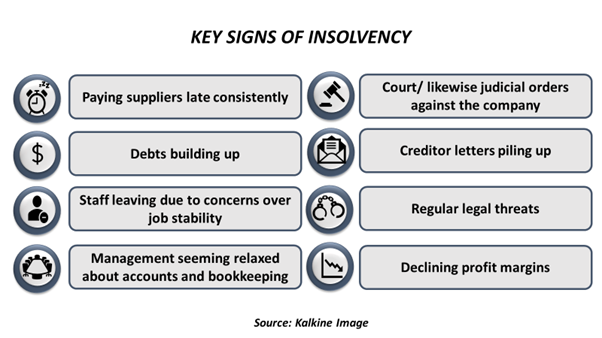

What Are the Signs of Insolvency?

One can contemplate insolvency as the ultimate trigger for financial hardship. If insolvency were a medical problem, doctors might call it an acute condition- as financial trouble is indeed chronic.

What Causes Insolvency?

Insolvency can arise from a number of reasons. These reasons are triggering factors that make a person or a company “insolvent”. Some of these are discussed below-

- Increase in vendor costs may contribute to insolvency. The situation where the company is expected to pay more for goods and services may arise when vendor costs rise. The company may choose to pass this on to the consumer.

In this situation, consumers might choose to take their business somewhere else, so that they pay less for a product or service. In a chain reaction, losing clients may result in losing income- and the inability to pay back to creditors only increases, inviting insolvency.

- Lawsuits from consumers or business associates also cause insolvency. To combat the legal grievances, a company may have to pay huge amounts of money in damages. This may lead to the inability of continuing operations.

The same chain reaction continues- no operations lead to no production, no production leads to no organic sales, no sales leads to no revenue, and no revenue leads to insolvency.

- Another reason that causes a business to turn insolvent is the situation wherein business offerings (products and services) do not fit consumers’ changing needs. Consumers may choose to associate themselves with another peer of the company that offers a larger selection of products and services.

- The hiring process of a company is believed to impact insolvency. The hiring of inadequate accounting or human resources management can propel working inefficiencies and even lead to wrong decision making in the business.

Other reasons include:

What Are the Two Forms of Insolvency?

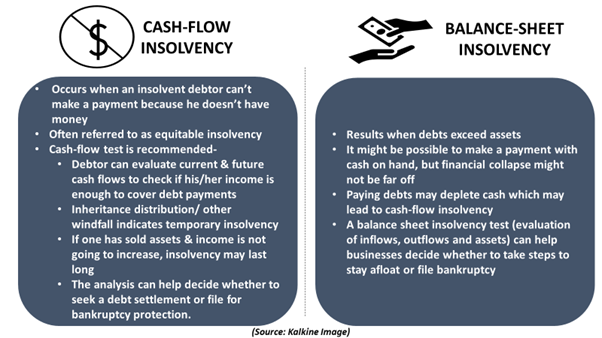

Insolvency comes in two flavours- cash-flow insolvency and balance-sheet insolvency. Let us understand what they denote-

Is Insolvency Different from Bankruptcy?

Insolvency is not the same as bankruptcy. Insolvency is a condition, whereas bankruptcy is a legal process.

Breaking this down further, insolvency is a state of economic distress. Bankruptcy, on the other hand, is a legit court order that decides how an insolvent debtor will deal with unpaid obligations.

Insolvency Vs Liquidation

Besides bankruptcy, the concept of liquidation is an integral subject that should be acknowledged as we discuss insolvency. Liquidation involves shutting down the business and selling the assets to pay all the stakeholders.

Insolvency is a financial state of affairs and does not necessarily indicate that the company may end up in liquidation. However, it should be regarded as the crunch point wherein strong decisions need to be made to pay the claimants.

Sound steps to clear debts and restructure of the company may avoid liquidation altogether.

How Should Insolvency Be Dealt With?

Fortunately, there are solutions for resolving insolvency.

Once a company realizes its insolvency, its ultimate aim should be to prevent further depreciation of assets and depletion of cash. Following are a few guidelines that can help business deal with this crisis -

- The management should speak with a licensed insolvency practitioner. These practitioners explain the process, the company’s rights and responsibilities moving forward.

- The cash-flow test or balance sheet test can be undertaken to understand the exact financial stance of the business.

- Restructuring of the business in an attempt to save it can prove to be a helpful decision.

- Borrowing money or tapping ways to increasing income can help the business pay off debts.

- An agreement can be sought between the company and the creditors.

- Liquidation of all assets and cash accounts can be requested.

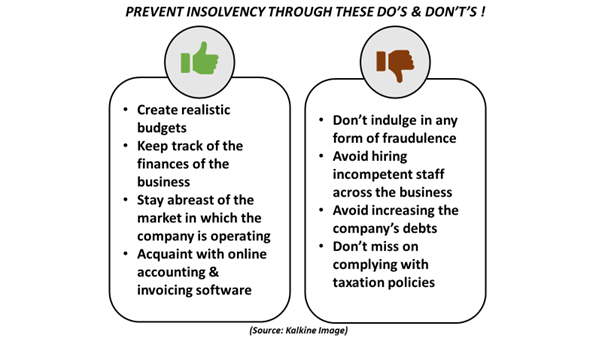

Tips to Prevent Insolvency

Below are a few tips that can help businesses prevent the financial massacre of insolvency.

REMEMBER THIS- Being insolvent does not necessarily indicate the end of a company. There are options for debt relief, company’s rescue and turnaround.