Inherited IRA

Updated on 2023-08-29T11:55:00.589833Z

What is an Inherited IRA?

IRA stands for the individual retirement account and is a retirement facility available in the United States. It is an account that is opened when the original owner of the retirement account dies, and an individual inherits the amount. The individual who inherits the IRA is termed the beneficiary and can be a spouse, unrelated entity, or relative.

However, there is a difference in how the inherited IRA is handled by a spouse and a non-spouse entity or individual.

Inherited IRA can also be termed as beneficiary IRA. There are many brokers for IRA who help handle the Inherited IRA's assets, taxation related issues and managing the retirement accounts.

The US tax laws surrounding the Inherited IRA, are complicated and further complications are added by the introduction of the SECURE (Setting Every Community Up for Retirement Enhancement) act of 2019. The act has made significant amendments in the regulations, especially when the beneficiary is a non-spouse.

Image Source: © Karenr| Megapixl.com

Summary

- IRA stands for the individual retirement account is opened when the original owner of the retirement account dies, leaving behind a bequest.

- The individual who can inherit the IRA is termed as beneficiary and it can be anyone, that is, spouse, unrelated entity or any relative.

- There are many brokers for IRA who help handle the Inherited IRA's assets, taxation related issues and managing the retirement accounts.

- The US tax laws surrounding the Inherited IRA are complicated, and further complications are added by the introduction of the SECURE act of 2019.

Frequently Asked Questions (FAQs)

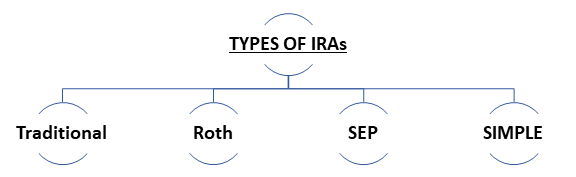

What are the types of IRA?

There are many types of IRAs –

- Traditional IRA: The contribution is tax-deductible when withdrawals are made, it is treated as income. The holder does not pay any tax, until retirement.

- Roth IRA: The contribution in the account is made from the tax-deducted funds. Therefore, the holder is not required to pay tax on the withdrawals and the earnings.

- SEP IRA: This IRA allows an employee or self-employed person to make a contribution to the traditional IRA and the account will be established in the name of the employee.

- SIMPLE IRA: Small companies that do not have any retirement plan can take advantage of the SIMPLE IRA. The cost of administration is low, and the contribution limit is also low.

Image Source: Copyright © 2021 Kalkine Media

What is the working of an Inherited IRA?

Any type of IRA can be converted into an inherited IRA, such as the traditional, Roth, SEP, SIMPLE IRAs. Chiefly, there is no difference in the tax treatment of the original IRA and the inherited IRA. For example, if the IRA was traditional before the inheritance, the tax treatment will be the same after becoming an inherited IRA. This is the only rule which is easy to understand and does not add much complexity to the Inherited IRA.

When an individual becomes the beneficiary of an Inherited IRA, they must make a range of choices and decisions depending upon the situations:

If the beneficiary of the Inherited IRA is the spouse of the owner, chronically ill, disabled, minor child or less than 10 years younger than the owner, they have only one set of choices to make. However, any other person must make numerous choices.

The usage of the IRA amount is also dependent upon the minimum distribution requirements stated by the original holder of the account.

The beneficiary of the Inherited IRA has a range of complex questions to answer, and the SECURE Act of 2019 has further added confusion by creating new amendments in the long-standing practices.

It is advised to the IRA recipient that they should not take any significant step until they receive any advice from the experts of IRA handling, as they will give a better insight about the same. The worst-case scenario is that the beneficiary cashes in all the amount from the account or transfers the same amount to their personal account before visiting the financial advisors.

What are the rules for a spouse in Inherited IRA?

- Spouses have more flexibility in comparison to the non-spouses in handling the IRA. Spouses can roll over complete or the part of the Inherited IRA into their own retirement accounts. The roll over gives an advantage to the beneficiary as the required minimum distributions (RMDs) can be deferred until they achieve the age of 72.

- RMD age was 70.5 earlier, but after introducing the SECURE act of 2019, the age limit was raised to 72.

- The time limit for roll over to the personal IRAs is 60 days after receiving the distribution, and the distribution should not be the required minimum distribution.

- In case the owner of the IRA has started to receive RMDs, then the beneficiary will continue to receive the RMDs as per the calculated life expectancy of the beneficiary. Suppose the original owner has not started receiving the RMD or has not reached the minimum required beginning date, the age at which they will begin to receive the RMD. In that case, the beneficiary can withdraw the whole amount within a 5-year window, and it will be subject to income tax.

What are the rules for non-spouses in an Inherited IRA?

- The non-spouse beneficiaries cannot treat the Inherited IRA as their personal IRA.

- The non-spouse beneficiary cannot make an additional contribution to the account, and the beneficiaries cannot transfer the Inherited IRA into their individual IRA.

- The non-spouse beneficiary must open a new Inherited IRA unless they wish to distribute the assets through lump-sum payments.

- The amendments in the SECURE 2019 act have drastically affected the non-spouse beneficiaries. Earlier, the beneficiaries of the Roth IRAs were not liable to pay taxes and had the responsibility to make distributions. Moreover, no withdrawal penalties were imposed on them. The SECURE Act states that the non-spouse must cash out the amount within ten years after the account holder's demise. The chronically ill, those who are 10 years younger than the original account holder or minor children, are exempted from the regulations. After the minor child reaches the majority's age, they are also liable to pay taxes and withdraw the amount within 10 years.