Fund of Funds (FOF)

Updated on 2023-08-29T11:55:36.660026Z

What is Fund of Funds?

A Fund of Funds (FOF) is a pool of funds that invests in a portfolio of professionally managed funds.

Mutual funds invest in a variety of asset types, including bonds, stocks, and other corporate instruments. A fund of funds is a type of investment vehicle that uses its own money to build a portfolio that includes units or stocks from other mutual funds or hedge funds.

The fund-of-funds approach aims to diversify the money across asset classes by investing in several mutual funds or hedge funds, subsequently accumulating returns.

Summary

- A Fund of Funds is an investment tool that invests in mutual funds, exchange-traded funds (ETFs), or even hedge funds.

- FOFs allows diversification of funds while lowering the overall risk.

- Investors who would like to invest in many mutual fund schemes would want to invest in FOFs as they can gain from diversification and management characteristics.

- FOFs have high expense ratio than regular mutual funds as there are extra costs involved.

Frequently Asked Questions (FAQ)-

What are the features of a FOF?

FOFs give substantially more diversity than other investment options since they invest in several schemes with distinct asset types. As a result, FOFs are typically safeguarded against excessive volatility as well as short-term changes.

Below are some of the features of fund of funds:

- Diversified investment and easy-to-track funds.

- It is a large, collective investment plan that offers investors with many alternatives to consider.

- It lowers fund volatility and delivers a higher-than-average return on investment.

- The portfolio is protected against possible market risk by investing in a varied set of schemes.

What are the types of FOFs?

Some of the popular FOFs include the following:

Asset allocation funds: These funds invest across various asset classes ranging from equity, debt or other asset classes like gold and other metals and commodities.

Foreign FOFs: These FOFs invest in bonds or mutual fund schemes. These funds provide investors the benefit of diversifying stocks in foreign funds.

Gold FOFs: These funds invest in gold funds. A FOF in this category may have a portfolio of Mutual Funds or gold trading enterprises depending on the asset management business.

ETF FOFs: FOFs give investors access to ETFs. An ETF invests in equities, bonds, or commodities such as gold and is not offered in the same way as a traditional mutual fund, but rather traded on a continual basis on the stock exchange.

How does a FOF work?

FOFs are actively managed funds. Actively managed funds are ones in which an investing professional regularly modifies underlying money in order to benefit from market volatility. FOF might take the form of a mutual fund, hedge fund, private equity firm, or investment trust.

By investing in multiple mutual funds, the assets of the fund of funds are diversified into all of the asset classes in which an underlying mutual fund invests. This aids portfolio and risk diversification for the fund.

The profits earned by the fund through its investments are dispersed to the fund's unit holders in relation to their holdings. Because fund of funds are multi-manager investment funds, the expense ratio is high because the cost of competently administering and managing the funds is high.

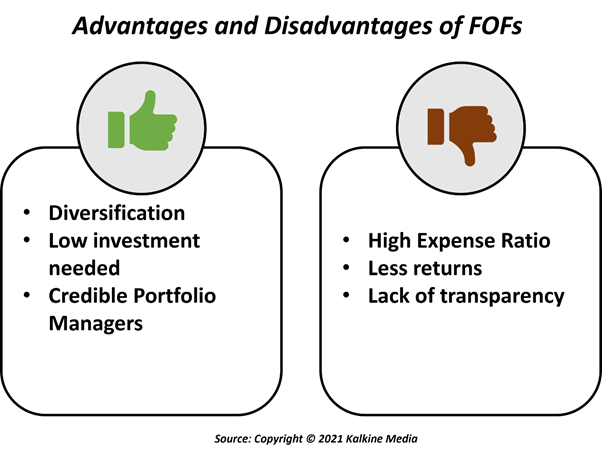

What are advantages and disadvantages of FOF?

Investing in FOFs comes with many advantages. Some of them are as follows:

- Diversified investment lowers the risk of investment.

- Permits an investor to invest with a small amount of money, which would be inaccessible to him traditionally.

- Different hedge funds are also invested in, increasing the likelihood of a larger return on investment.

- A person with limited financial means can easily invest in the best FOFs accessible in order to increase their earnings.

- Manged by highly trained, credible and experienced professionals.

However, investing in FOFs has some disadvantages as well. The expense ratio is high in the case of FOFs since the mutual funds it invests in also pass on their share of annual fund administration costs. An expense ratio measures how much a fund's yearly operating expenditures and management fees compare to its asset value.

High investment costs may reduce returns. Further, FOF might wind up owning the same stock or other investment through many funds, limiting actual diversification.

Who should invest in FOFs?

The fundamental goal of the best fund of funds is to maximise profits while minimising risk by investing in a diverse portfolio. Individuals with a modest pool of financial resources that they can set aside for a longer period of time can invest in a Mutual Fund like this.

This is also a good investment option for an investor who has a limited amount of funds available to invest each month. Furthermore, individuals with a five-year or longer investment horizon might consider investing in this fund.