Fail

Updated on 2023-08-29T11:54:57.431142Z

What is a Fail?

If a buyer fails to pay owing funds before the settlement date, or if a seller fails to deliver securities in trading, the transaction is considered a failure. This happens when a stockbroker fails to receive or deliver securities within a specific time after a security buy or sale through a stock exchange.

The term "fail" is also used by technical analysts. However, it usually refers to the price failing to move in the expected direction after a breakthrough or in response to a specific catalyst. This is sometimes referred to as a fail, though it's usually referred to as a false breakout or failed break.

Summary

- When a seller lacks to deliver an asset and a buyer fails to produce payments by the settlement date, the transaction is considered a fail.

- In trade, both the buyer and the seller are obligated to transfer assets or money before the settlement date.

- Delays, mismatching or missing information, inability to pay, or not possessing the asset to deliver are the most typical reasons for a failed transaction.

Frequently Asked Questions (FAQs)

What does the word 'fail' mean?

Both parties to a transaction are contractually bound to transfer assets or money before the settlement date in trading. As a result, if the transaction is not completed within a certain period, one party will be considered to have failed to deliver. It can also happen if there is a technical issue with the clearing house's settlement process.

Companies currently have one to three days following the trade date to complete payments, based on the market. Securities and cash should be handed to the clearinghouse for settlement. If firms are not able to reach this target within this period, they will fail. Different settlement requirements apply to fixed-income instruments, options, stocks, and futures contracts.

However, when a bank cannot pay its debts to other banks, it is referred to as failing. The failure of one bank to pay its debts to other banks can cause a domino effect, resulting in the insolvency of multiple banks.

Source: © Peterjunaidy | Megapixl.com

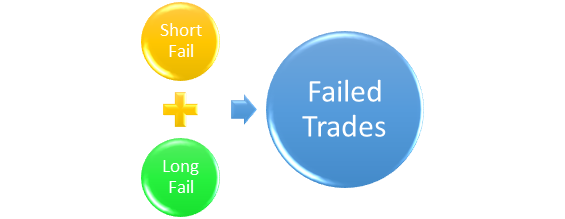

What are the categories of failed trades?

Unsettled deals can be divided into two categories. One is when the seller fails to deliver the securities by a specific date, and the other is when the purchaser fails to pay by the settlement date.

Short fail

A short fail occurs when a seller is not able to deliver securities by the settlement date.

Long fail

The term "long fail" refers to when a buyer cannot pay the money by the settlement deadline.

Source: Kalkine Media

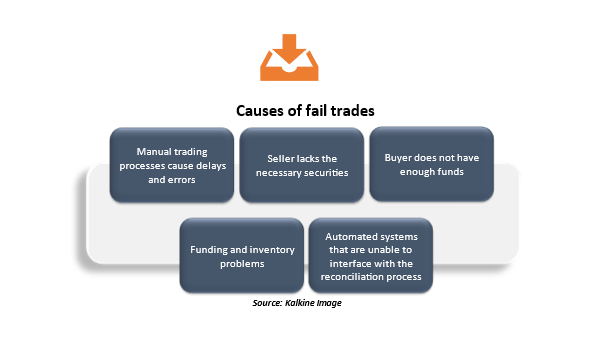

What are the causes of failed trades?

When a buyer or seller is unable to pay their trading commitments on or before the settlement date, the trade is considered a failure. This has ramifications, as failure to deliver securities or cash on one's trade side can result in fines, financial losses, and harm to one's reputation.

It will not end there; if they do not fulfil their trading responsibilities, rating agencies may lower their credit score, restricting their capacity to shop for the finest counterparty agreements.

Source: © Ratch0013 | Megapixl.com

Basically, trades fail for various reasons:

- Before the settlement date, manual trading processes cause delays and errors in verifying, affirming, or matching trades.

- The seller lacks the necessary securities to deliver and must either borrow or purchase securities to do so.

- The buyer does not have enough funds to make a transaction, such as credit or cash.

- Instructions that do not match, instructions that are not delivered on time, or instructions that aren't delivered at all.

- When vendors and purchasers argue over what should be offered and whether the delivered item satisfies the agreed-upon specifications, it may be a messy situation.

- Funding and inventory problems with investment assets.

- Automated systems that are unable to interface with the reconciliation process and produce reliable data.

Both the buyer and the seller may face a variety of challenges.

The buyer would not have enough money in the account to settle trades with the custodian and does not have a netting deal in place with the counterparty due to inventory and funding concerns.

The seller, on the other hand, would not have the security ownership necessary to deliver. When an investment manager's underlying customer participates in securities lending programmes and the security is not in their possession at the time of settlement, a situation like this can emerge.

What are the consequences of failed trades?

When a trade fails, the consequences might include everything from risks and operational expenses to reputational harm and strained relationships with counterparties.

Failure to pay for purchases could tarnish the buyer's reputation, limiting the buyer's future trading opportunities. Failure to deliver also taints the seller's reputation and may restrict how and with whom they can do business in the future.

Moreover, failure to produce the security and make payment may demand compensation for opportunity costs on the deal value until a settlement is reached.