Day Trader

Updated on 2023-08-29T11:54:15.871168Z

What is Day Trading?

Day trading is popular among a section of market participants. It is a type of speculation wherein trades are squared-off before the market close in the same day. An individual or a group is engaged in buying and selling of securities for a short period for profits, the trades could be active for seconds, minutes or hours.

One can engage in day trading of many securities in the market. Anyone who has sufficient capital to fund the purchase can engage in day trading. For a class of people, day trading is a full-time job.

Day traders are agnostic to the long-term implications of the security and motive is to benefit from the price changes on either side and make profit out of the asset price fluctuations within a day. They bet on price movements of the security and are not averse to take short positions to benefit from the fall in price.

Day trading is not only popular among individuals or retail traders but institutional traders as well, therefore the price movements are large sometimes depending on the magnitude of information flow and accessibility.

Everyone wants to make money faster, and many are inclined to speculate in markets, but it comes with considerable risk and potential loss of capital. People engaged in day trading also incur losses, and oftentimes outcomes are disheartening.

Day trading is a risky activity, similar to sports betting and gambling, and it could become addictive just like gambling and sports betting. Since the motive is to earn profits, the profits realised from day trading also tempt people to continue speculating.

People spend considerable time and efforts to make the most out of day trading. They have to continuously absorb and incorporate information flow, which has become increasingly accessible driven by new-age communications systems like Twitter, Facebook, forums etc.

But not only information flows have been favourable, day traders are now equipped with best in class infrastructure to execute trades even on compact devices like mobile phones. The accessibility to markets is at a paramount level and gone are days of phone call trading and lack of information flows.

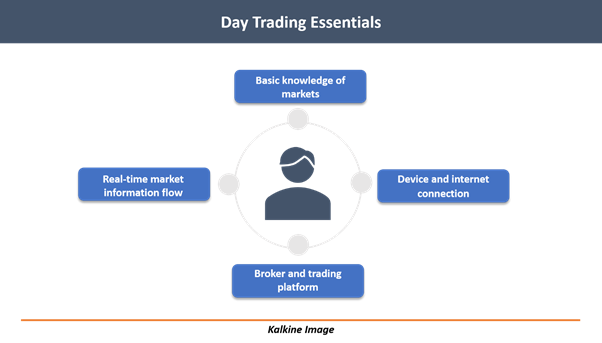

What are the essentials for Day Trading?

Basic knowledge of markets

With lack of basic knowledge of markets, day trading may yield unacceptable outcomes. It becomes imperative for people to know what’s on the stake. Prospective day traders should know about capital markets, and the securities traded in capital markets like bonds, equity and derivatives.

Buying shares and expecting a return from the price movements are on the to-do list for many. However, it is important to know about and risks and potential returns from speculating in capital markets.

After getting some basic knowledge about markets and securities, aspiring day traders should know how to analyse market prices of securities through fundamental analysis and technical analysis. Although day traders don’t practice fundamental analysis extensively, they spend considerable time to apply technical analysis, to formulate a entry and exit strategy.

Device and internet connection

Trading is now possible on mobile applications as well as computer applications or websites. An aspiring day trader will likely begin with mobile phone given the accessibility, and laptops/computers are useful as scale grows larger and complex.

Internet connection is prerequisite to practising day trading, and it is favourable to have a fast internet connection to avoid glitches and potential problems. These perquisites are now available with large sections of societies.

Broker and trading platform

A broker will facilitate a market for potential trades. The security brokerage industry has also seen a profound shift as technology has driven cost lower while competition is ramping up across jurisdictions. Large retail brokerages have moved towards zero commission trading in the U.S., and the same is seen being the trend across other geographies as well.

The entry of discount and online brokerages has perhaps given wings to the retail market participants as well as the retail market for security brokers. Robinhood has grown immensely popular in the United States, but there are many firms like Robinhood in other jurisdictions. Each country has some firms with business model on same lines as Robinhood.

Brokers now offer high-quality mobile applications and web services to clients, and trading security has never been so accessible. They also provide access to the global market along with a range of securities, including commodity derivatives, currency derivatives, CFDs, options, futures, bond futures etc.

Real-time market information flow

On public sources, market price information is at times not live due technical shortcomings, which will not work appropriately, especially for day traders. Brokers not only provide platform and market but several other services, including margin lending, real-time data, research.

Day traders closely track prices of securities and overall information flow to incorporate developments in bidding, and real-time data provides accurate prices throughout market hours.

Information flow largely relates to the news around the company, industry or economy. Day traders now have far better sources of information than the conventional sources, and sometimes these sources could be exclusive to a group.

What are the risks of day trading?

Most of the aspiring day traders end up losing money, given the lack of experience and knowledge. They should rather only bet on capital that they are comfortable to loose, in short, they should avoid risk of ruin. Day trading is sort of pure-play speculation and application of knowledge, information flow, laced with good trading system is paramount.

The only concern of day traders is movement in price, which contradicts from investments. Day traders try to time and ride the momentum in the price and exit the trade before momentum turns otherwise, which can happen frequently.

It consumes considerable time and induces stress on the individuals given the nature of security prices, which can move north and south abruptly throughout the day, hours, minutes and seconds. Day traders should have enough capital to trade in cash instead of margin.

Day trading on margin or borrowed money is extremely risky and has the potential to make a person insolvent, especially in cases of extreme risk-taking. The leverage associated with borrowed money magnifies profits as well as losses.

Aspiring day traders should equip themselves with adequate knowledge, competency and sound risk management process. Although fast money is dear to most, it is better to know what is at stake before jumping into markets with excitement.