Cryptocurrency Trading

Updated on 2023-08-29T12:01:09.655753Z

Summary

- Cryptocurrencies have quickly become investor favourites as they can be used to exchange goods and services and can be traded for profits.

- Many companies also release their own digital currencies which are known as tokens.

- Cryptocurrencies are protected by the blockchain technology which is a decentralised technology used to maintain high security.

What is cryptocurrency?

Cryptocurrency can be used as a form of payment for the exchange of goods and services through digital platforms. Many companies are introducing their own currencies which can be exchanged for the goods and services offered by the industry. These currencies are generally termed as tokens. These tokens resemble the trading tokens used in casinos or arcades. Thus, real money is exchanged to own cryptocurrencies.

Blockchain technology is utilised for the trading of cryptocurrencies. It is a decentralised technology that is generally used to maintain high security in the technology and performs managerial functions as well.

Image source: © Bonekot | Megapixl.com

Why are cryptocurrencies popular?

Cryptocurrencies have become appealing for many reasons such as:

- Cryptocurrencies are seen as the currency for the future and therefore, investors are racing to get its access. They prefer to buy them before it becomes more expensive or not affordable.

- Few supporters presented the view that they like the concept of cryptocurrencies because interference of central banks is removed completely, as these institutions control the money supply during a situation of inflation or deflation.

- Few traders showed interest not only in cryptocurrency but the technology behind it, which is blockchain technology. The technology is highly secured, decentralised and records all the transactions which cannot be changed by anyone.

- Some people only want to take advantage of the changing price of a cryptocurrency, that is, they trade in the crypto and make earnings due to price difference. They do not want to hold the currency for the long term.

How to trade in cryptocurrencies?

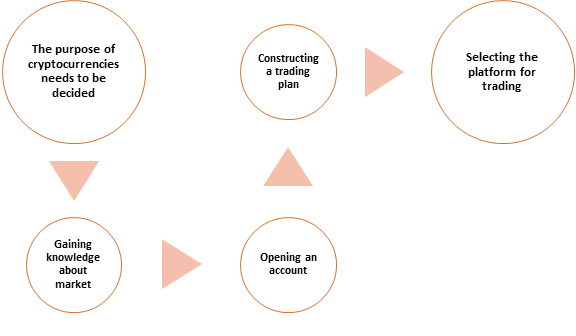

Firstly, the purpose of cryptocurrencies needs to be decided by the trader or investor. There are two ways in which trading can be done in cryptocurrencies that are, speculation and buying digital currencies.

- Speculation on the crypto prices by utilising CFDs – A CFD is a contract in which the trader agrees to exchange the price difference when the position is opened and closed by the traders. Entering a CFD contract does not give the ownership of the cryptocurrencies, rather speculation is conducted on the prices of cryptocurrency. If a long position is taken in the cryptocurrency market and the prices move upward, then the trader will make a profit. However, if the prices move in another direction, then the trader will make losses.

- Purchasing cryptocurrencies through exchanges – When the investor wants to buy a cryptocurrency and hold the same for the long term, then the investor must open a cryptocurrency wallet along with an account that needs to be opened in a cryptocurrency exchange. A list of steps must be followed to complete the process as there is a huge waiting list for opening an account.

Source: Copyright © 2021 Kalkine Media

Secondly, it is important to gain basic knowledge about the cryptocurrency market. The working of the cryptocurrency market is different from the stock market; therefore, it is necessary to understand the technical jargons used in the crypto market.

The cryptocurrency market operates through peer-to-peer transaction; therefore it is called a decentralised market. When any transaction is conducted in the crypto market, then the transaction is added to the blockchain technology through a process termed mining. It is a ledger that records all the data related to the cryptocurrency market.

The market is highly volatile, that is, any new information, change in government policies or regulations and so on have a large impact on the currencies price movement.

Thirdly, an account needs to be opened. When the trader does not wish to hold the currency for the long term, then it is easy to take a position in the crypto market. The need for opening a digital wallet or account is not required anymore. Moreover, there are innumerable brokers that help traders in opening an account in the crypto market.

Fourthly, a trading plan needs to be constructed. It is important to have a trading strategy before undertaking any transaction, especially in the case of the crypto market as it is highly volatile which makes it difficult to trade in the market. The trading plan must have a risk management tool, outlining the goals, and methodology for taking a position or trading in the market.

The trading strategy should also include the methodology to be adopted for market analysis such as fundamental and technical analysis. Furthermore, it is crucial that the investors and traders are updated with the cryptocurrency market and the economy.

Fifthly, the platform for cryptocurrency trading should be selected. For example, the investor and trader can enter the market with the help of a broker, or online applications, or themselves by gaining all the knowledge in the field. Presently, there are a wide range of applications that allows the investors to track their investment value and take a long position and short position through their mobile applications only.

Source: Copyright © 2021 Kalkine Media

How to protect oneself while trading in cryptocurrencies?

When the investor is entering in the crypto market through broker or any mobile application then the investor should investigate the following aspects.

- The owner of the company: If the owner of the company is well-known person, then it is a positive sign.

- The investors who are investing in through the company: While choosing the currency, it is important to determine the investors who are investing in the currency. If large investors are investing in the currency, then it is a positive sign.

- Investor should know the difference between owning the stake in company and owning tokens: Owning a stake means that the individual gains the right to participate in the company’s decision making. Owning a token means that the tokens can be used for limited uses like in casinos.

- The contract details: These should be studied carefully, as higher the clarity in the contract, higher will be the legitimacy. Also, higher legitimacy does not mean that the currency will succeed in the future.

- Awareness about the risks involved: Investors should know that they are exposed to several kinds of risks such as identity theft, loss of personal id and password details, and hacking.