Credit

Updated on 2023-08-29T12:00:27.619681Z

What is meant by credit?

In the simplest form, credit refers to the sum of money that is given to the borrower to carry out an immediate purchase/investment and is repaid by the borrower at a later stage. This sum of repayment generally includes interest payments along with the repayment of the principal.

In accounts, the term refers to a bookkeeping entry that either increases liabilities or decreases assets in a balance sheet.

Sometimes, credit may also refer to a person’s creditworthiness. If someone “has credit” then it can mean that he/she has enough creditworthiness to be issued credit from the bank as and when required.

Who issues credit?

Most common issuers of credit are banks, as they act as a mediator between the buyer/borrower and the seller. Such credit comes along with debt that must be repaid later within a specified period. There are other financial players and intermediaries also available in the market who are involved in credit issue.

A large aspect involved in issuing credit is the trust and credit worthiness associated with the borrower.

How is credit different from a loan?

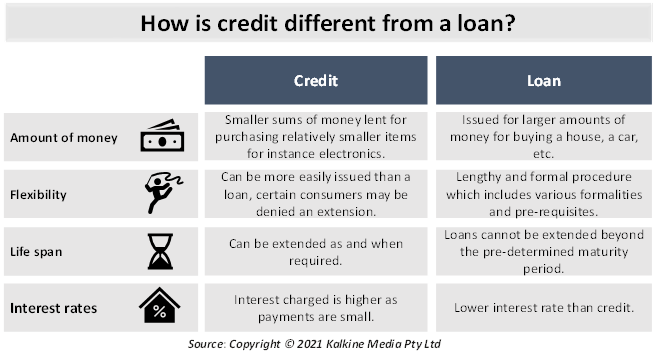

Credit and loan may sometimes be used synonymously as both refer to a sum of money being lent from one party to another. However, both these terminologies hold certain differences.

- Loans are generally issued for bigger sums of money: Banks issue loans for larger amount of money that is used to carry out large transactions, for instance, buying a house or buying a car. On the contrary, credit involves smaller sums of money lent to the borrower for purchasing relatively smaller items for instance electronics, clothes, etc.

- Loans involve a formal procedure: Issuing a loan is a lengthy and formal procedure which includes various formalities and pre-requisites that must be fulfilled. However, buying goods on credit may not be as formal of a procedure as a loan is. Credit cards can be more easily issued than a loan, though certain consumers may be denied an extension on their credit limit if they fail to repay the amount timely.

- Life span of a loan is pre-determined: Loans cannot be extended beyond the pre-determined maturity period. However, credit can be extended as and when required. The credit can be extended onto the next billing cycle.

- Interest rates are higher on credit: Since credit payments are smaller in amount, the interest charged on them is higher. This makes small purchases seem costly as the total amount repaid over the billing cycle is much higher than the actual purchase amount.

What are the benefits of credit?

- Credit allows customers to purchase items they otherwise would not be able to afford with their given income. Items which one may hold up on buying can be accessed using credit.

- Credit helps channelize one’s credit score in the right direction. A customer with a bad credit score can improve it by making timely repayments. This can further make loans more accessible for customers, thus enabling them access to higher amounts of credit.

- Credit eliminates the need to borrow from friends and family and from informal sources. Informal lenders may charge interest rates which are impossible to get out of, leading the borrower into a debt trap.

What are the types of credit?

Broadly, credit can be divided into two forms, namely financial credit and non-financial credit.

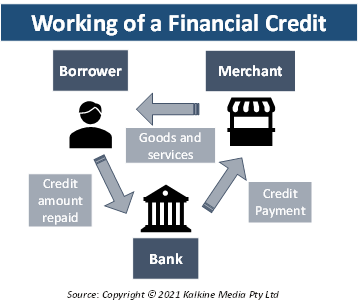

Financial credit refers to that credit which is issued by banks and other financial institutions. This is the more common type of credit availed by consumers. The concerned financial institution is the mediator between the borrower and the lender and is responsible for facilitating the transaction.

Non-financial credit refers to an agreement between two parties that involves an exchange of goods and services with a promise to pay for them in the future. This type of a set up allows a consumer to buy now and make the payment later. For instance, consider a local retailer selling everyday supplies. When he agrees to sell a customer a few supplies, knowing that the customer will make the payment in future, then it is also a type of credit.

Deferred payments are quickly gaining popularity among customers as they allow the easy facility of buying a product with no additional costs. Generally, non-financial credit does not involve interest payments. Thus, it incentivizes the purchase for the customer as he/she would not have to pay any amount in addition to the actual price of the goods or services.

How does credit work?

An agreement between the borrower and lender in exchange of money transfer is called buying on credit. For instance- one of the most common ways of buying on credit in current times is through credit cards. Credit cards are the most common and simplest examples of how credit works.

Banks issue these credit cards with a monetary limit beyond which transactions cannot be made. When a transaction is conducted with a credit card, the bank pays the merchant for the goods and services against which the card has been used. However, the card holder must repay this amount, generally along with interest to the bank.

How does credit card function?

Consider a borrower who is issued a credit card with a USD 700 limit. This means that the borrower cannot make purchases that amount to more than USD 700.

Now assume that the borrower makes purchases worth USD 650. This means that whenever the credit card is used to make a transaction, the merchant need not wait for the payment. The transaction is facilitated by the bank at the same instant.

However, if the borrower is unable to repay the credit amount within the bill cycle then his/her credit score would be affected adversely, along with penalties. The outstanding amount is carried over to the next bill cycle, this time with higher interest. Thus, it would become even more difficult for the borrower to repay the amount in subsequent bill cycles.