Carve-Out

Updated on 2023-08-29T11:57:51.146723Z

What is carve-out?

A carve-out is a type of divestiture where the parent/ holding company sells off a company's stake to other investors. The parent organisation must sell some or all of its shares through an IPO; a minority stake is sold off in particular. It is only a partial sale of the equity stake, and the parent company maintains a major stakeholding. After the carve-out is successful, the company has an altogether new set of shareholders. It is an activity undertaken to separate a business unit from the parent group. It is a strategy mostly used to capitalise on the non-core operations of a child company by its parent company.

Summary

- Carve-out is a type of divestiture done to capitalise on non-core operations.

- If successful, it brings in profitability to both parents and carved out entity.

- Carve-out protects a business from potential takeovers while maintaining the parent's controlling interest.

Frequently Asked Questions (FAQ)

Why does a company go for a carve-out?

Source: © Rummess | Megapixl.com

- A carve-out helps increase a parent company's stock price without losing control in its' business unit.

- It is a restructuring method/strategy. Helpful in adapting to market changes.

- It provides independence and long-term growth scope to the subsidiary.

- Sometimes helps address staffing shortages at appropriate levels.

- The subsidiary can realise synergies of operating with new stakeholders who are often knowledgeable of its core operations.

- Since the parent company maintains its major stakeholding, unwanted takeovers are avoided. Shareholder's value increases when a carve-out takes place.

- Carve-outs offer managerial incentives, which motivates them towards better performance.

What are some well-known examples of a carve-out?

- In the past, Siemens has carved out its stake in a semiconductor subsidiary named Infineon. It reduced its stake from 71% to 50.9%. The share offer was floated to get funding which the subsidiary could not get from Siemens. It had even announced a further stake reduction that time.

- Another example is Palm and 3Com. Palm could close its strategic alliances with AOL, Nokia, and Motorola post-carve-out from the 3Com Corporation. The strategic and funding benefits could be fully captured as a parent was prepared to reduce control over time.

How does a carve-out happen?

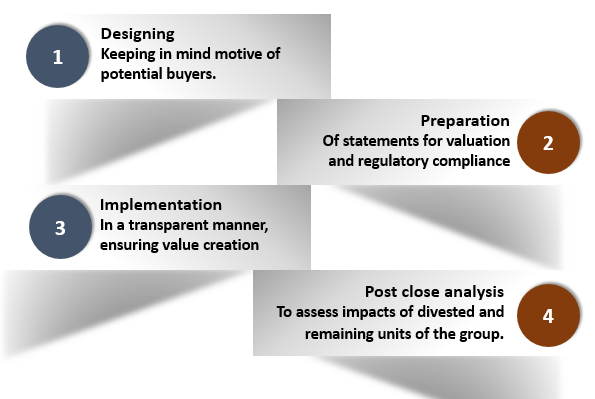

A carve-out usually happens in the following manner-

Source: Copyright © 2021 Kalkine Media

The 4-step carve-out process

- The parent company understands the potential buyer and his motives before the carve-out. It protects from a negative situation where the carve-out later turns into a competitor holding a major stake in the child company undergoing a carve-out. IPO price and other particularsare to be set out accordingly.

- The seller then needs to prepare pro-forma financial statements for the carved-out business unit for valuation. It is in a standalone format and is used for rounds of funding and regulatory compliances. Finally, the seller parent entity needs to indicate costs involved in the process, to give a clear financial picture of the transactions. It is expected that the seller maintains transparency on matters like cost of purchase, financial statements, etc. All factors must be considered for the valuation of the carved-out unit to ensure nothing gets overlooked. The parent seller does this to ensure carve-out assets create valuefor them.

- In the end, the seller needs to assess the impact of carve-out on its' business. Any negative impacts need to analysed to understand how profitable the divestment actually was. A cost profitability comparisonhelps in doing so.

- In the end, the seller needs to assess the impact of carve-out on its' business. Any negative impacts need to analysed to understand how profitable the divestment was. A cost profitability comparison helps in doing so.

What are the areas under focus during a carve-out?

During a carve-out, it is essential to identify areas that require the most attention. Some of these are-

Source: © Iqoncept | Megapixl.com

Employee compensation & payroll: During the carve-out transition, it is essential to keep in mind the continuation of salary payment and other compensations accrued to an employee. It is to be undertaken to ensure that a smooth carve-out takes place. It is essential to keep the ongoing employees motivated towards working in the separated entity. Firing and hiring should not cause a delay in operations of the carved-out unit. Having a solid human resource base is essential to make the carve-out successful.

Best managers for new entity: The right people must handle the helm of operations of the carved-out entity. If the management is not right, no organisation can move on a growth trajectory. Therefore, suitable persons should be retained or hired to make the carve-out successful in future. It will also reduce negative impacts and burdens on the controlling entity.

Setting up accounting systems: Since the carved-out entity is separated and standalone financials are needed, it is important to set up the right accounting system. These needs coordinated efforts with the parent organisation to ensure no accounting issues post-carve-out.

IT setups and communication: While going for a carve-out, it is important to set up IT systems and a working communication system for the new entity. It is required for smooth operations of the separated entity. Ownership and authority responsibility of the setups also needs to be decided.

Since a carve-out result is undertaken to create value for a business, the above factors need to be taken care of initially. All of it will ensure that handling a non-core operation is taken away from the parent entity. The new entity must also provide value for its new shareholder.

What are the benefits of a carve-out?

- It benefits both the parent and the newly formed company.

- Separation of operations streamlines focuses on core operations.

- Deliver long-term growth with newfound independence.

- Parent entity's rights are reserved, and it often is a strategy to improve value on parent entity's stake.

- It helps in blocking unwanted takeovers or increased shareholding of competitors.

- It is better than selling or purchasing an entirely new business unit.

- It is a way of capitalising on business units not aligning to core operations.

- The parent company earns profits even after separating the business from the holding group.

- It sometimes offers taxation benefits to the parent entity as well as the new entity.