Absolute Return

Updated on 2023-08-29T11:54:06.621142Z

In the recent past, the absolute return approach of Investing has turned out to be one of the fastest-growing investment strategies worldwide. A lot of financial advisors talk about such investments providing absolute returns. So, what exactly are the “Absolute Returns” and are they are promising?

What is meant by Absolute return?

Absolute return computes the increase or decrease, in an asset over a period of time, as a proportion of the original investment amount. The focus here is only on that specific asset or portfolio and not related market events. Absolute returns only consider the price movement for any specified time period. Absolute return, reckons an investment’s performance without considering the expanse of time for which investment was committed. Absolute returns can be computed for a quarter, semi- annual, annual period, 3-year duration or more. Absolute Returns are independent of Market movements and thus do not draw relative comparisons. It is one of the most commonly used investment performance metric in Hedge Funds and Mutual Funds.

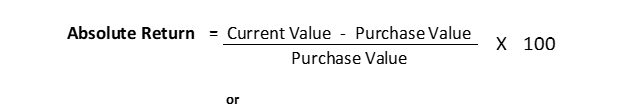

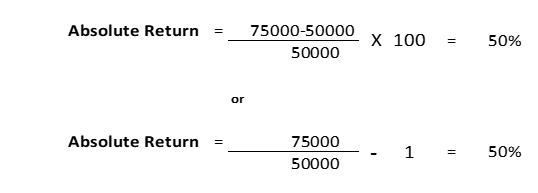

How to compute Absolute return?

Suppose an investor Mr. Rich, invested AUD 50,000 5 years back, and the current value of his investment is AUD 75,000. The Absolute return on Mr. Rich’s investment would be 50%, calculated using -

Copyright © 2021 Kalkine Media Pty Ltd

Copyright © 2021 Kalkine Media Pty Ltd

So,

Copyright © 2021 Kalkine Media Pty Ltd

Absolute returns are just returns from point of time to other. The notion of an 'absolute return' seems very attractive to get investors’ attention as it ignores the relative market movement and promises an appreciation with zero correlation to markets. Anyhow, Absolute Return technique of computing investment yields is an apt way of calculating return on investment, predominantly in the early stages. There are numerous other types of return metrics an investor can look for later on. Major 4 types mattering most to investors being – Absolute Return, Relative Return, Total Return & CAGR.

What is the difference between Absolute Return, Relative Return, Total Return & CAGR?

Absolute return refers to the gain/ loss in a single investment asset/ portfolio but to comprehend how their investments are acting relative to various market yardsticks, relative return is taken into consideration.

Relative return is the excess or deficit an asset achieves over a timeframe matched to a market index. Benchmark Return – Absolute return, gives the Relative return also called sometimes as alpha. Example, if S&P index gives a 10% return during a given period and one’s investment portfolio gives an absolute return of 12% then relative return on investment is positive/ excess 2%.

Total returns take into account the effect of intermittent incomes as well as dividends. For example, in an equity investment of AUD 200 having current value AUD 240, the company also declares a dividend of AUD 10 during the year. Total returns will take into account this $10 dividend too. Thus, Total returns on the investment of AUD 200 now will be 25.00% = {(240+10-200)/200} x 100

Absolute and Total returns are easy to calculate as performance metrics, but the real challenge is when comparisons are drawn based on time period of return. Here comes in CAGR, it takes into account the term of the investment too, thus giving a more correct and comparable picture. It is computed as:

CAGR (%) = Absolute Return/Investment period (equated in years)

Consider for example, two investment options: One where investor earns absolute returns of 10% in 24 months and another where investor earns 5% absolute returns in 9-month duration. So, CAGR would be-

For option one: CAGR = 5.00% i.e. 10%/2 (24 months/12 months is equals to 2 years)

For option two: CAGR = 6.66% i.e. 5%/0.75 (9 months/12 months is equals to 0.75 years)

What’s wrong with just measuring investment performance using Absolute Returns?

Absolute returns will only tell an investor how much his/her investments grew by; they do not tell anything about the speed at which investments grew. When people talk about their real estate investments and say, “I bought that house for X in the year 2004. It’s worth 4X today! It has quadrupled in 17 years.” This is an application of absolute return. The drawback here is that it takes into account only the capital appreciation and doesn’t draw comparison with options having different time horizons. Investors can rely on this measure of investment performance only if they are looking for higher returns, without bothering how fast they were generated. Absolute return also doesn’t convey much about an investment compared to relative markets.

Then, why do Hedge Fund/ Mutual Fund Managers choose an Investment strategy based on Absolute returns?

Absolute returns should be used at times when investors are willing to shoulder some risk in exchange for a prospective to earn excess returns. This is irrespective of the timeframe and Fund administrators who measure portfolio performance in relation of an absolute return typically aim to develop a portfolio that is spread across asset categories, topography, and economic phases. They are looking for below mentioned points in their portfolios-

- Positive returns- An absolute returns approach of investment targets at producing positive returns at all costs, irrespective of the upside & downside market movements.

- Independent of yardsticks- The returns are in absolute terms and not in comparison to a benchmark yield or a market index.

- Diversification of portfolio- With the intention of distribution of risk, among different investment options producing positive returns in diverse ways a mixed bag of absolute return assets give a diversified investment portfolio.

- Less volatility- The total risk of investment is spread across the different asset held in such a portfolio. Ensuring less overall volatility in collective returns.

- Actively adjustable to market movements– Usually, investments look for positive returns with zero market correlation. Market shares a negative correlation with absolute return investments and vice versa.

In any investment atmosphere, there are varied investment strategies and goals. Absolute return investment strategies are looking to avoid systemic risks using unconventional assets and derivatives, short selling, arbitrage and leverage. It is appropriate for investors who are prepared to bear risk for short and long-term gains.