Healthscope Ltd

.png)

HSO Details

Aggressive expansion efforts:Healthscope (ASX: HSO) continued to report strong financials in the first half of FY16 and delivered 5.5% growth in revenues to $1.15 billion while statutory net profit was up 64% at $95.9 million. HSO also declared interim dividend of 3.5 cents per share. The company has strong pipeline of hospital expansion projects, which would drive its revenue in FY17 and beyond. The Group has completed six projects in FY15 and has a pipeline of 11 projects with facility of 804 beds and 43 operating theatres by end of 2018. Moreover, the company has strong balance sheet to fund the pipeline of projects. During FY16, the company has integrated Hunter Valley and LaTrobe private hospitals.

.png)

Potential pipeline (Source: Company reports)

It has also successfully completed its new Wellington pathology contract in New Zealand. As a result, HSO rallied over 20.52% in the last three months (as of May 19, 2016). We give a “Hold’’ recommendation on the stock at the current market price of $2.84

HSO Daily Chart (Source: Thomson Reuters)

Primary Healthcare Ltd

.png)

PRY Details

Government policy delays: Primary Healthcare Ltd (ASX: PRY) stock surged over 24.48% in the last three months (as of May 19, 2016) driven by the favorable policy drivers by the government. Moreover, PRY’s financial performance have been decent and for the first half of 2016, the company has reported 4.8% growth in revenues to $835.05 million while net profit grew 28.5% to $68.57 million against the same period of last year. The company has also declared an interim dividend of 5.6 cents. PRY’s target industry drivers are also favorable given the rising demand for healthcare and growing elderly populations. The group is also divesting its non-core business and recently finalized its sale of its Medical Director business for $156 million to funds advised by Affinity Equity Partners.

.png)

UNPAT Bridge (Source: Company Reports)

The group intends to use these proceeds to be used to pay down debt.

PRY has Australia- wide network of providers and market leading infrastructure and provides the medical services on bulk billing basis. On the other hand, the government has delayed the bulk-billing changes for three months while it seeks to introduce legislation to ensure pathology centers pay fair market rents. Moreover, we believe that the heavy rally in the stock has placed them at higher levels. Accordingly, we give an “Expensive” recommendation on this dividend yield stock at the current market price of $3.62

.PNG)

PRY Daily Chart (Source: Thomson Reuters)

Capitol Health Ltd

.png)

CAJ Details

Boosting capital position: Capitol Health Ltd (ASX: CAJ) reported an underlying net profit before tax fall by 29% yoy to $5.2 million for the first half of 2016. The group’s performance has been impacted due to ongoing slowdown in the NSW and Victoria markets coupled with regulatory uncertainty and slower than expected referral patterns. Slowdown in CT, Ultrasound and MRI also contributed to the Capitol’s performance pressure. CAJ stock has been removed from S&P/ASX 300 index with effect from March 2016.

.png)

Capitol Health financial performance (Source: Company Reports)

On the other hand, the Group reported about investing in Enlitic with a US$10 million payable over the period of August 2016. This would benefit Capitol with a period of exclusivity in Australia and also international opportunities through Asia Pacific region.

The company has successfully closed its offering of $50 million unsecured 4-years notes at the fixed coupon of 8.5% per annum maturing in 2020. We give a “Hold” recommendation on this dividend yield stock at the current price of $0.18

.PNG)

CAJ Daily Chart (Source: Thomson Reuters)

Ramsay Health Care Ltd

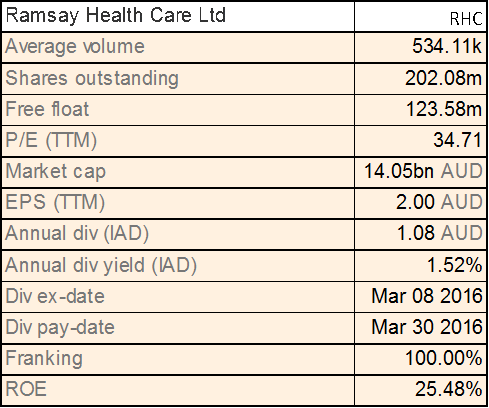

RHC Details

Strong revenue growth and acquisition benefits: Ramsay Health Care Ltd (ASX: RHC) reported a strong 24.9% growth in revenues to $4.2 billion in first half of FY16 while group’s net profit grew 16.2% to $237.4 million. During the period, the company has integrated Ramsay Sante and Generale de Sante and also acquired nine hospitals in Lille, France. Along with inorganic growth, the group has completed $126 million brownfield expansions. The company has also offered dividend of 47 cents per share continuing its trend of rewarding shareholders.

.png)

Balance sheet track record (Source: Company Reports)

Ramsay also sometime back reported that they are not progressing on their joint venture with Chengdu indicating their cautious expansion efforts, given the tough market conditions in China. The industry outlook remains positive on the back of rising healthcare demand driven by ageing population, emerging technology and the rising rate of chronic disease.

The Group has upgraded guidance of core NPAT and core EPS growth to 15% and 17% for full year as compared with previously announced 12% and 14% respectively. We believe the stock is headed for strong growth and hence we recommend a “Hold” on this dividend yield stock at the current market price of $71.20

RHC Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.