Coca-Cola Amatil Ltd

.png)

CCL Dividend Details

Drive from warmer summer and strong Australian volume growth: Market senses that beverage producers such as Coca-Cola Amatil (ASX: CCL) may benefit from the upcoming climate pattern with a warmer than usual summer in Australia (as predicted by the Australian Bureau of Meteorology). The result for the half year ended 3 July 2015 was modest and illustrates that earnings are consistent with the expectations and guidance provided earlier and that cost savings are on track and weighted to the second half of the year. Concrete progress has been made in the implementation of strategies designed to strengthen the market leading position of the company. Trading revenue increased by 4.9% to $ 2.4 billion and EBIT by 0.1% to $ 316.9 million. Net profit attributable to members increased by 0.9% to $ 183.9 million on the basis of a net profit which increased by 2.6% to $ 187.3 million. EPS grew by 0.9% to 24.1 cents per share and the strength of the balance sheet supported the payment of an interim dividend of 20 cents per share franked at 75% which is in line with the interim dividend payment in the previous year and represents a payout of 83% of net profits for the half year.

The Australian beverage business reported an increase in both volumes and trading revenues because of the investment in pricing, brand building and improvements in route to market. These investments will be financed by the cost savings to be delivered in the second half of the year. The CSD market stabilised despite the difficult conditions which saw the overall market continuing to decline. This was owing to factors such as new product launches in non-alcoholic and alcoholic beverages, launch of Coke Life, and smaller $2 cans of Coke for teenage market that stabilized volumes. An overall reduction in rate was due to targeted pricing and a shift in product mix to lower value categories including value water and Frozen. The business remains on track to deliver the target of its three-year cost savings of over $ 100 million annually.

.png)

Implementation of Strategic Review (Source: Company Reports)

Earnings in Fiji and New Zealand grew by 9.9% on the back of the strong performance in CSD’s and water, and both businesses benefited from buoyant domestic economic conditions especially in the first quarter. In New Zealand, strong market activation led to growth in market share in energy and sports drinks while CSD market share was maintained. Indonesia and PNG reported improved earnings with Indonesia reporting good volume growth and gains in market share in CSD. This was because of improved product availability and affordability though economic growth in Indonesia is slowing which is having an impact on overall consumer purchasing power. Alcohol and Coffee earnings grew by 30.4% because of improved market share for the Beam portfolio and the relationship with Beam Suntory has been strengthened with a new 10-year agreement which will fully integrate the expanded spirits range with the company’s portfolio.

Outlook: The company is targeting a return to mid single digit growth in EPS over the next few years with no further decline expected. CCL is confident of achieving this with the combination of revenue and cost initiatives. The balance sheet continues to be strong and with the anticipated cash generation, there should be no problem maintaining a good dividend pay-out over the next three years. Changes in management (with John Borghetti joining CCL’s Board of Directors) may also bring in some changes on a positive note.

The stock has corrected over 12% in the last six months (as at 02 November 2015) and over 2% in the last one month. We believe that CCL has surpassed the trough and we can look forward to stock price growth along with an attractive dividend. Accordingly, we put a

BUY recommendation for the stock at the current price of $9.06

.png)

CCL Daily Chart (Source: Thomson Reuters)

Village Roadshow Ltd

.png)

VRL Dividend Details

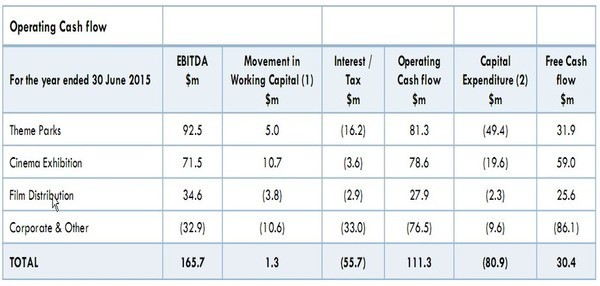

Full year Performance steered by Cinema Exhibition: The full-year results for 2015 for Village Roadshow Limited (ASX: VRL) reported an all-time record year for Cinema Exhibition heading into The Hunger Games-Mockingjay part 2, James Bond’s Spectre and Star Wars: The Force Awakens!, with a 14.3% rise in EBITDA over previous year. The theme parks were hit by record rain and extremely poor weather conditions prevailed during Christmas/January/Easter holidays. Record rainfall was recorded on the Gold Coast and Sydney reported the wettest summer/January in 50 years. However, the results show how resilient the business is as shareholders were rewarded with interim dividend of 14 cents per share in April 2015 and final dividend of 14 cents per share both of which were fully franked. Operating results (PBT) were $ 71.2 million ($ 79.4 million of previous year), reported EBIT was $ 97.7 million ($ 105.5 million of previous year) and reported EBITDA $ 165.7 million ($ 170.9 million of previous year). On balance sheet, debt was $ 497.5 million.

Operating Cash Flow (Source: Company Reports)

Contribution of additional debt into Village Roadshow Entertainment Group (VREG): Village Roadshow Entertainment Group announced the completion of new corporate debt facilities totalling USD 325 million, refinancing its existing debt and providing additional capital. The Village Roadshow Pictures (VRP) division has also launched a renewal of its film production facility of USD 750 million which finances the library of titles coproduced with major film distributors such as Warner Bros. and Sony. Part of the corporate debt financing is subordinated debt financing of USD 25 million payable by September 2021 of which Village Roadshow has contributed USD 15 million. The subordinated debt is entitled to cash interest of 6% per annum plus non-cash interest of 9.5% per annum payable upon repayment of the debt. Accounting standards along with VREG’s accounting losses will require VRL to immediately write of its subordinated debt investment in VREG and the accounting loss of approximately $ 20 million will be dealt with in the FY 2016 results. As part of the refinancing, VRL’s existing nonvoting redeemable shares in VREG with the current redemption value of roughly USD148 million have been converted into preferred equity with a 14% per annum non-cash dividend with redemption by March 2022. The ordinary share capital will not change and VRL will retain 47.12% of the ordinary shares.

Way forward: The company has identified the building blocks on which it is going to build its future growth. For Australian theme parks, it has approximately 100 acres of freehold land available for building new opportunities and other opportunities for theme parks include the CITIC Fund and theme parks in China. New cinema development is focusing on population growth corridors to maximise revenues and profitability. There are the IPic Gold Class Cinemas in the United States. Finally, there is FilmNation Entertainment which is a production and international film sales company based in the US along with the expansion of Edge Loyalty to add to future growth. For groups like this which cater to the tourism industry, we believe that there are several favourable factors operating at the moment. Prospects for the industry look good with the rapidly expanding Chinese middle class looking for tourism destinations and Australia’s image as a safe and exciting destination. Moreover, the decline in the value of the AUD has meant that Australia delivers far more value for money than it has in the past. The stock has rallied over 25% in the last six months (as at 02 November, 2015). We have no hesitation in recommending the stock as a

Buy at the current price of $7.60

VRL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.