Western Areas Limited (ASX: WSA)

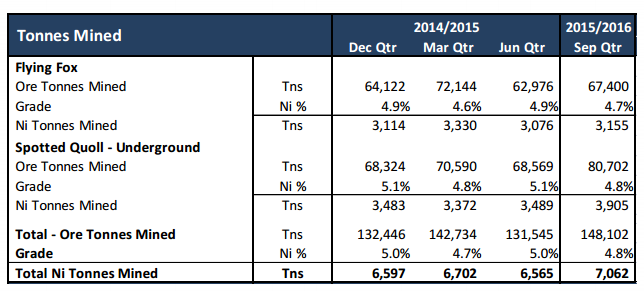

On-track to meet Guidance: Western Areas reported a robust quarterly performance and start to the financial year on safety, production, costs and positive operating cash flows. The company could deliver well despite the problems of the low nickel price environment. Mine production was 148,102 tonnes of ore at an average grade of 4.8% for 7,062 nickel tonnes and this is the highest nickel in ore output since the December 2013 quarter. Spotted Quoll underground production was a record at 3,905 nickel tonnes. Specifically, the company reported record mine production from Spotted Quoll with total ore tonnes mined of 80.7Kt @ 4.8% Ni for 3,905t Ni. Mill production was on track with 6,252 nickel tonnes produced. Further, Flying Fox mined more tonnes but it was achieved the same at slightly lower grades owing to mine scheduling.

Production (Source: Company Reports)

The company reported that the unit cash cost of production commenced the year at A$2.26/lb which is slightly better than the lower end of FY16 guidance of A$2.30/lb to A$2.50/lb. Most importantly, the Company became debt free with the repayment of A$125m of convertible bonds on 2 July 2015. Consolidated cash at bank (which includes FinnAust Mining) was A$60.3m. There were no lost time injuries for the quarter and the company continues to report a lost time injury frequency rate (LTIFR) of ZERO. Financial results for FY15 otherwise also highlighted WSA’s good performance with a 37.5% increase in net profit after tax. A final fully franked dividend of 4 cents per share was declared and subsequently paid in October 2015. The nickel price trended down for the quarter following weaker than anticipated Chinese trade data and stainless steel demand. The company has been coping well with the nickel price environment. Mine development also seems to be ahead of mining reserves based on extensive exploration and development. It also offers a modest annual dividend yield of 2.69%. The stock had fallen over 32% year to date but there has been some recovery in last one month. We would recommend a Buy at the current price of $2.62.

WSA Daily Chart (Source: Thomson Reuters)

Spark New Zealand Limited (ASX: SPK)

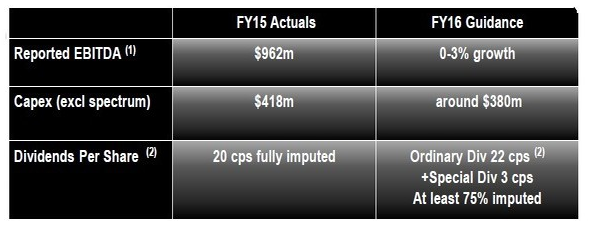

Path to Revenue Growth: The Company has indicated return to revenue growth in FY16/17 in view of announcements made on the investor day. The company aims to have 0-2% revenue CAGR over the FY15-18 period based on revenue market share gains in mobile, holding share in broadband, and attractive share in cloud computing. Further, growth is expected from M&A efforts. We also note that Spark maintained its FY16 EBITDA guidance of 0-3%. This company offers an opportunity for investment given a good presence in its market and a high dividend paying capability (considering the annual dividend yield of 6%). The returns look attractive in the low interest rate environment.

FY15 Actuals and FY16 Guidance (Source: Company Reports)

The company has gone through a period of restructuring, including selling its holding in AAPT Limited and winding down its IT business in Australia. It has also announced its intention to sell its interest in Telecom Cook Islands. Recently, ASX confirmed that SPK has changed the ASX admission category to ASX foreign exempt listing from ASX listing. The current share price is down from its high and the price-to-earnings ratio of 17.6x is not very unreasonable considering the forecasts for earnings growth over the next three years. The stock has moved up in the last one month. We would recommend a Buy at the current price of $3.10.

SPK Daily Chart (Source: Thomson Reuters)

Scentre Group Ltd (ASX: SCG)

Stability with Improving Sales and Development Projects: The recent announcement with regards to retirement of the co-founder of the Westfield Empire, Frank Lowy, from the board of Scentre Group has sparked many speculations. However, this news is expected to hardly impact SCG. In the results announcement for the six months to 30 June 2015, the group announced Funds from Operations of 11.38 cents per security and distribution of 10.45 cents per security which was in line with the forecast. The group also announced the sale of four Australian shopping centres with gross proceeds of $ 783 million in line with their strategy to own and operate a premium retail portfolio which provides the best possible returns. The strong underlying operating performance will offset the dilution caused by the sales and enable the company to meet its 2015 full-year forecast of 22.5 cents per security which would be a growth of 3.5% and the distribution forecast of 20.9 cents per security.

Comparable Retail Sales Growth (Source: Company Reports)

Comparable speciality sales in the Australian portfolio grew by 6.1% with the average speciality sales increasing to $ 10,556 per square metre. Particularly strong growth was seen in fashion, footwear, jewellery, technology and appliances. Average speciality sales in New Zealand increased to NZ $ 10,374 with comparable speciality store sales growing by 6.3%. The group continues to concentrate on the integration of food, fashion, leisure and entertainment experiences at each of its shopping centres connecting shoppers with goods and services within the local community. Considering the stability over a long period of time along with projects in pipeline (examples include Casey, Chatswood and Kotara), we see the business having the potential to deliver long-term capital gains. The Company is also working on strategy to reallocate capital from sale of non-relevant assets (such as Figtree) to reinvestment in development pipeline. Accordingly, we recommend that you

Hold the stock at the current price of $4.16.

SCG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.