Regis Resources Ltd

.png)

RRL Details

-

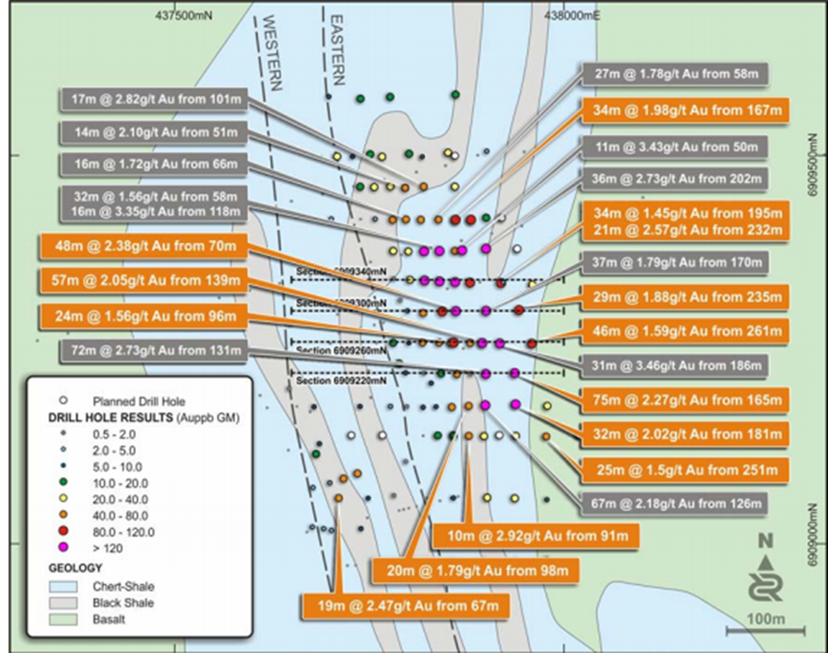

Rising gold prices drove the stock: Regis Resources Ltd (ASX: RRL) surged over 7.9% on June 24, 2016 on the back of rising gold prices as investors were looking for safe haven assets on as Britain chose to exit from the European Union. RRL has been on a bullish trend in the last three months and generated over 35.3% (as of June 23, 2016) driven by the gold prices during the current turmoil in the markets coupled with the group’s efforts of repaying debt and high grade results at Tooheys Well Gold Deposit. RRL has repaid over $20 million of outstanding debt under the Macquarie Bank financing facility making the group debt free apart from the trade creditors and leasing arrangements. RRL has a decent cash position (before debt repayment) of $129 million. Moreover, the group reported fresh rock intercepts with high grade, at Tooheys Well, located at 2.5 kilometers south of the Garden Well Gold Mine.

-

Recommendation: The recent rally in the stock also placed them at a high P/E. We give an “Expensive” recommendation on the stock at the current price of $3.52

Tooheys Well plan with recent drill results in gold and past results in grey (Source: Company Reports)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.