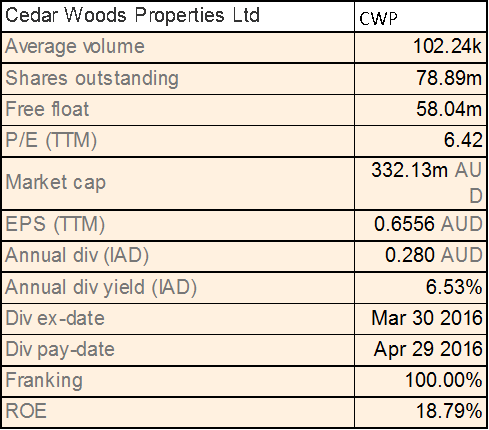

Cedar Woods Properties Ltd

CWP Details

Solid FY16 profit guidance indicating ongoing growth momentum:Cedar Woods Properties Ltd (ASX: CWP) has re-affirmed its FY16 net profit guidance of $43 million backed by positive sentiments at its two properties in Perth and Melbourne. Furthermore, the company has nine new projects which would contribute to the earnings for next three years, and have diversified products for sales across the national portfolio. Moreover, its acquisition and geographic diversification strategy is expected to position Cedar Woods to continue its growth momentum. CWP’s various new projects have been estimated for pre-sales of over $130 million for FY17 and FY18, and we believe the strong growth momentum to continue.

The stock is also trading at an attractive P/E and dividend yield, we thus recommend a “Buy” on the stock at the current market price of $4.35

.PNG)

CWP Daily Chart (Source: Thomson Reuters)

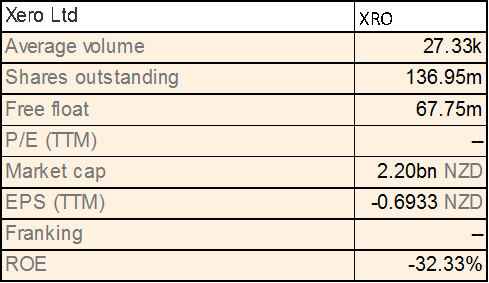

Xero FPO

XRO Details

Product investment to pay off: XERO FPO NZX (ASX: XRO) invested substantially in product team and is focusing on improving scale efficiency and effectiveness of product investments. It is also investing in new products and services to drive future ARPU and growth. XRO has also been in the news that it is planning a price hike from July 4 for UK subscribers, which would drive revenue, and at the same time, will create room for further investment in product and technology.

XRO stock was also added in All ordinaries Index as per the S&P Dow Jones’ Indices for March Quarterly review. We believe the strategic steps taken by company would reap benefits in coming period, and therefore maintain our “Buy” recommendation on the stock at the current market price of $14.64

.PNG)

XRO Daily Chart (Source: Thomson Reuters)

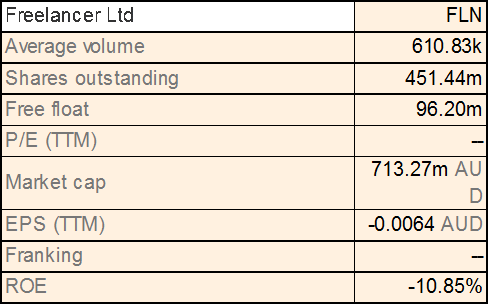

Freelancer Ltd

FLN Details

Acquisition and new launches to drive growth: Freelancer Ltd (ASX: FLN) acquisition, Escrow.com registered 18% constant currency (USD) growth for the business during the first quarter of FY16.

.png)

Solid Freelancer Job Postings Growth (Source: Company Reports)

FLN’s cash receipts for Q1 surged 60% over prior corresponding period. Moreover, the group has developed couple of products including various mobile application including payment gateway, multi-lingual front end, payment and support method for more markets including China, StartCon with new brand and website etc. which would drive its revenues in coming period.

FLN's solid quarter results drove the stock 16.35% higher in the last one month (as of May 05, 2016) and we maintain a “Buy” recommendation at the current price of $1.54

.PNG)

FLN Daily Chart (Source: Thomson Reuters)

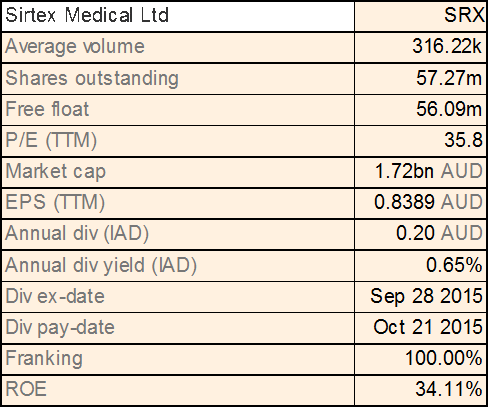

Sirtex Medical Ltd

SRX Details

Receives regulatory clearance in Canada: Sirtex Medical Limited (ASX: SRX) has been granted a Medical Device Licence (MDL) for SIR-Spheres® Y-90 resin microspheres by Health Canada (Santé Canada). The MDL allows Sirtex Medical to supply SIR-Spheres Y-90 resin microspheres, as a Class III medical device for the treatment of patients with advanced non-operable liver cancer in Canada and the device would be launched in the second half of 2016 calendar year. This medical device is approved in key market like United States, European Union and Australian, and thus, the new license will expand the market footprint.

The stock has delivered a negative return of 20.32% (as of May 05, 2016) for last six months but seen the reversal of trend in the last four weeks and recovered over 4.68%. We recommend a “Buy” on the stock at the current price of $30.63

SRX Daily Chart (Source: Thomson Reuters)

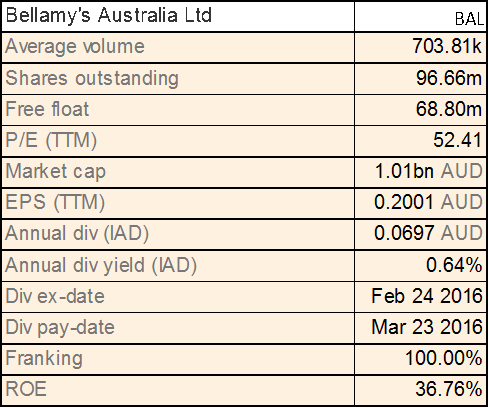

Bellamy’s Australia Ltd

BAL Details

Strong global organic supply chain: Bellamy’s Ltd (ASX: BAL) is addressing global organic milk pool at an estimated size of 4,500 litres pa where pricing is more stable compared with conventional milk pricing. BAL has strong relationship with multiple organic suppliers globally. Moreover, it has flexible production model with 15 contract packing and manufacturing facilities across Australia. Company also has six-year agreement with Tatura Industries till 2021 as well as a five year agreement with Fonterra for infant formula production, which would start production from Q1FY17.

.png)

First half performance (Source: Company Reports)

BAL is well placed to benefit from increasing demand for organic baby food in China through its e-commerce. The company is also strengthening its position in Asia, Singapore, Malaysia and Vietnam. Management expects FY16 revenues to be in the range of $240 million - $260 million. We reiterate “Speculative Buy” on BAL at the current price of $10.65

BAL Daily Chart (Source: Thomson Reuters)

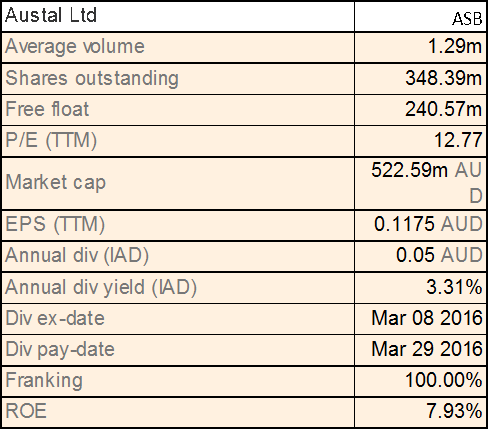

Austal Ltd

ASB Details

Enhancing order book: Austal Limited (ASX: ASB) has been awarded US$11.8m support contract for LCS 8. Recently, the company also reported about being awarded with a US$9.93 million modification contract to LCS to provide procurement and engineering services. Work would be completed by August 2019. ASB also has a separate ten-vessel contract to be delivered to the U.S. navy for US$3.5 billion, which gradually increased to thirteen vessels in April 2016. Additionally, Austal is constructing ten 103-metre Expeditionary Fast Transport (EPF) vessels under a $1.6 billion contract from the U.S. Navy.

.png)

Global Presence (Source: Company Reports)

Austal has been awarded the preferred tenderer status by the Commonwealth of Australia for the Pacific Patrol Boats Replacement (PPBR) Project, which involves the construction of up to 21 steel-hulled patrol vessels at a total government expenditure of up to $900 million. Meanwhile, the stock is trading at an attractive P/E and has a good dividend yield while we maintain our “Buy” recommendation at the current market price of $1.45

.PNG)

ASB Daily Chart (Source: Thomson Reuters)

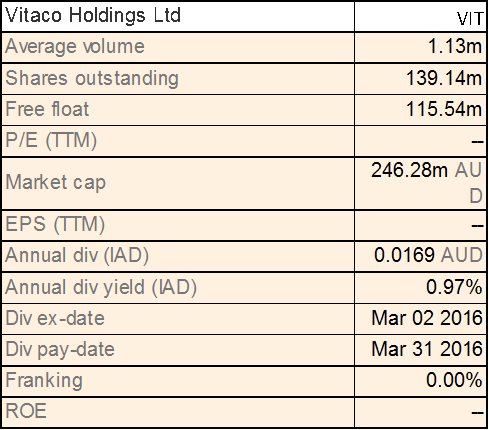

Vitaco Holdings Ltd

VIT Details

Diversified product portfolio and leading market position: Vitaco Holdings Ltd (ASX: VIT) enjoys the leading market position in New Zealand and Australian markets with established brands in Vitamins and Dietary supplements. Recently, the company has launched Aussie Bodies (sport nutrition) in UK with distribution arrangements with Boots – the largest pharmacy chain in the world ensuring the smooth distribution. The Group has also successfully transitioned the Musashi portfolio (acquired in July 2015) of sports powders, amino acid and protein bar products to Vitaco’s in-house manufacturing unit, bringing cost benefits.

.png)

Diversified Product Portfolio (Source: Company Reports)

The company is strengthening its market in China and planning to launch Musashi flagship store in Tmall Global in June. VIT is also added in S&P/ASX 300 index. We believe new launches and expanding market would enhance company’s revenues in the coming period and hence recommend a “Buy” on the stock at the current market price of $1.75 .PNG)

VIT Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.