Crown Resorts Ltd

.png)

CWN Details

Subdued Profit: Crown Resorts Ltd (ASX: CWN) reported a 22.7% fall in net profit for the FY16 due to the subdued turnover at its resorts in the Asian gambling hub of Macau, while Australian operations reported small gains. The normalized net profit for the company fell short of analysts’ estimates and declined to A$406.2 million ($312.57 million) for FY 16, as compared to A$525.5 million in FY 15. But, the actual net profit rose 146.4% on the back of gains of >A$600 million from the sale of shares in Macau venture Melco Crown. The normalized revenue grew 5.1% to A$3,598.1 million.

.png)

Financial Performance for FY 16 (Source: Company Reports)

But, the CWN’s traffic has slowed with the rise of cheaper gambling destinations like the Philippines and Vietnam. Macau continues to face challenges arising from softer gaming demand, which has adversely affected all casino operators, but the group divested this business which is relief to a certain extent. Meanwhile, CWN stock has risen 17.91% in the last six months (as of August 17, 2016).

.PNG)

CWN Daily Chart (Source: Thomson Reuters)

National Australia Bank Ltd

.png)

NAB Details

Creation of Australia’s largest retail super fund: National Australia Bank Ltd (ASX: NAB) reported 3% fall in unaudited cash earnings for continuing operations to approximately $1.6 billion for the third quarter 2016 against corresponding period of 2015. The revenue is flat for the quarter as the growth in lending is offset by a lower net interest margin which was lower due to higher funding costs. This higher funding costs is due to recent RBA interest rate cut to home loan borrowers, while asset quality remained strong and cost control was effective. The Group’s Common Equity Tier 1 (CET1) ratio was 9.5% at 30 June 2016, compared with 9.7% at 31 March 2016 mainly reflecting the impact of the interim 2016 dividend declaration. Additionally, the branch rollout from the Personal Banking Origination Platform has now been completed in every state except New South Wales, which recently started. NAB’s initiative, NAB Labs are supporting the small business sector including NAB QuickBiz loans, NAB Business Start-up and new digital marketplace Proquo in partnership with Telstra. In addition, the sale of 80% of the life insurance business to Nippon Life would be finished during the second half of calendar year 2016 after the merger of five super funds to create Australia’s largest retail super fund with over $70 billion in funds under management.

NAB Daily Chart (Source: Thomson Reuters)

Orora Ltd

.png)

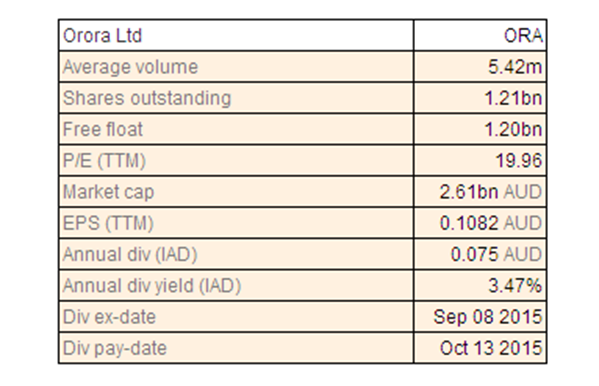

ORA Details

Expects higher earnings in FY 17: Orora Ltd (ASX: ORA) reported a 28.3% growth in NPAT to $168.6 million in FY 16 which comprised sale of Petrie land for $5.9 million. Earnings per share grew 29.4% to 14.1 cents including Petrie as compared to the corresponding period. Operating cash flow increased to $313.8M (excludes proceeds on sale of Petrie), from $260.8M in pcp. The cash conversion was 76%, in line with pcp and in excess of 70% target.

Financial Performance for FY 16 (Source: Company Reports)

Meanwhile, the group expects to continue to drive organic growth and invest in innovation and growth during FY17, with earnings expected to be higher than reported in FY16, subject to the global economic conditions. In addition, ORA has completed a bank debt refinancing in April 2016 and has replaced A$350M multicurrency debt maturing in December 2016. ORA has also extended maturity of Tranche B (A$400M multi-currency) facility from December 2018 to December 2019. Overall, there was minimal impact on the interest cost from extending maturity profile. Meanwhile, ORA stock has risen 29.4% in the last six months (as of August 17, 2016).

ORA Daily Chart (Source: Thomson Reuters)

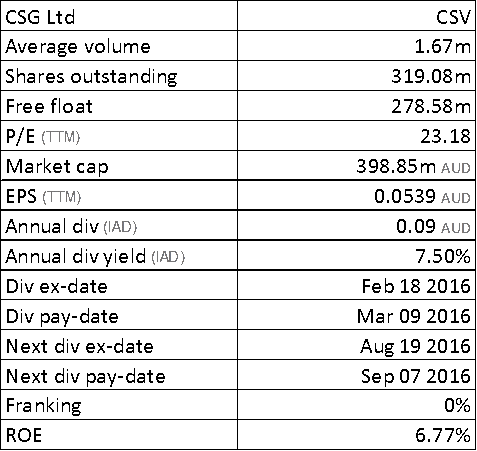

CSG Ltd

CSV Details

One-off investment impact in FY17:CSG Limited (ASX: CSV) reported a 10% growth in the revenue to $246.6m for FY 16, while the underlying NPAT grew 20% to $25.6 million. CSG Finance lease receivables grew 24% against corresponding period last year. FY 16 was a transition year for both the Business Solutions and Enterprise Solutions. Moreover, for FY 17 the company expects the underlying EBITDA (excluding LTIP expense) to be in the range of $44-$48m which means about 15% to 26% growth on FY2016 and excludes any impact of the launch of the Direct Sales Channel. The launch of Direct Sales Channel in Business Solutions would lead to a one-off investment of $3.0m which will be expensed in FY2017. The revenue is expected to be greater than $300 million. This represents about 22% growth on FY2016. The capital expenditure is expected to be in between $6.0 - $6.5m and the company would maintain dividend at 9 cents per share. The stock is trading ex-dividend on August 19, 2016.

CSV Daily Chart (Source: Thomson Reuters)

Mirvac Group

.png)

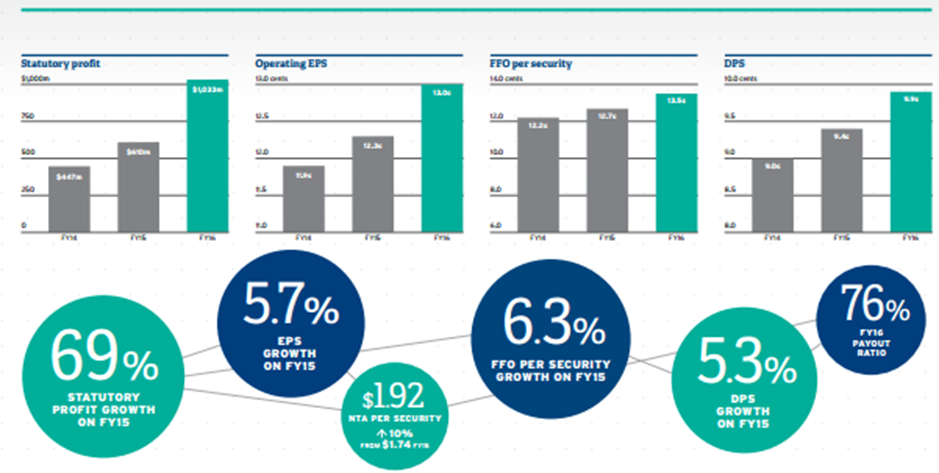

MGR Details

Delivered FY 16 result at the top of the guidance: Mirvac Group (ASX: MGR) reported statutory profit after tax growth of 69 per cent to $1.03 billion in the FY 16, while operating profit after tax grew 6% to $482 million against corresponding period of 2015. The earnings per share for FY 16 grew 5.7% to 13.0 cps as compared to 12.33 cps in FY 15 which is at the top end of guidance. Additionally, MGR has acquired around $370 million of acquisitions in key urban locations across the office, industrial and retail sectors in FY 16. MGR has achieved non-aligned office asset sales of about $787 million at a 7% premium to book value.

Financial Performance for FY 16 (Source: Company Reports)

In FY 17, MGR expects operating EPS to have 8- 11% growth to 14.0 -14.4 cps. MGR has potential to deliver more than 9% three-year average group ROIC but expects less than 15% residential ROIC target. Meanwhile, MGR stock has risen 18.92% in the last six months (as of August 17, 2016). The company is paying final dividends on August 30, 2016.

MGR Daily Chart (Source: Thomson Reuters)

Challenger Ltd

.png)

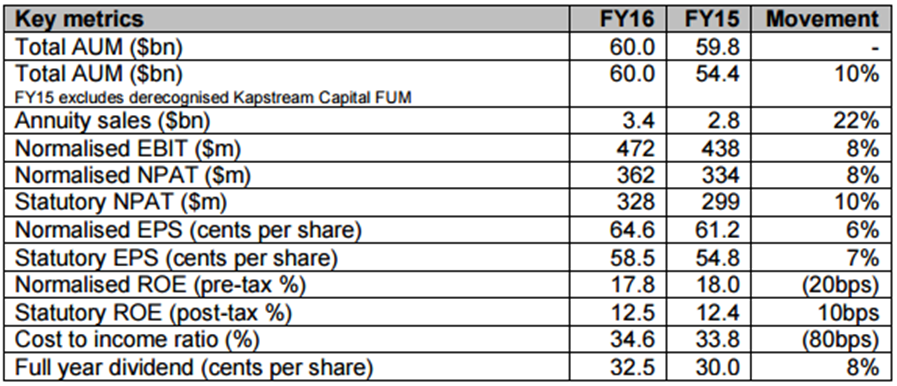

CGF Details

Strong annuity sales: Challenger Ltd (ASX: CGF) reported 8% growth in normalized net profit of $362 million in FY 16 over the prior year driven by total annuity sales of $3.4 billion which generated 22% rise against the prior year. This rise is due to the fact that the superannuation industry moves to include Challenger annuities on investment and administration platforms. The normalized earnings per share grew 6 per cent to 64.6 cents per share while normalized profit after tax increased 8% to $362 million over the prior year. The sales had accelerated in the second half with annuity sales up 45% on the prior corresponding period.

Financial Performance for FY 16 (source: Company Reports)

However, the normalized return on equity (ROE) was 17.8% pre-tax, down slightly due to the impact of Brexit and market disruption affecting Fidante Partners Europe earnings. But, CGF’s Funds Management business is achieving double digit organic growth in FUM, from the strong underlying flows of $2.4 billion in FY16. CGF’s total AUM is up 10% excluding Kapstream sale to $60.1 billion and the Life AUM is up 10%. Moreover, CGF is launching five new annuity partnerships in 1H17 including teaming up with Suncorp to white-label Challenger term and lifetime annuities.

CGF Daily Chart (Source: Thomson Reuters)

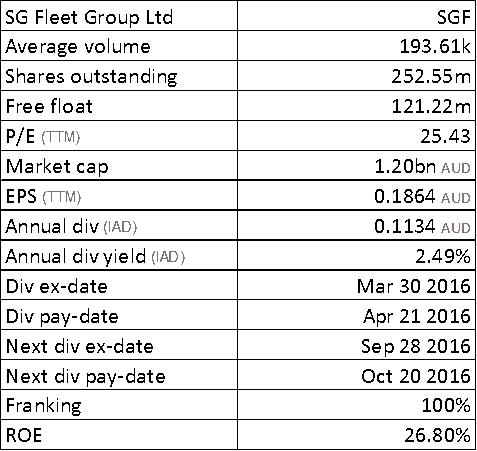

SG Fleet Group Ltd

SGF Details

New Zealand achieved maiden profit: SG Fleet Group Ltd (ASX: SGF) reported a revenue growth of 23.7% to $212 million in the FY 16 and net profit after tax (NPAT) rose 16.1% to $47 million. New Zealand has achieved the maiden profit in FY 16. The underlying cash earnings per share (EPS) increased 29.2% to 21.8 cents. The revenue growth occurred across all business lines as a result of further customer wins, coupled with better services offerings to existing customers and the impact of acquisitions. SGF acquired leading novated lease provider nlc for $211.4 million in November 2015 which contributed $10.4 million to NPBT. Moreover, the full year contribution from nlc business will improve group profits in 2017 as they would enhance major contract that SGF won in March 2016.

SGF Daily Chart (Source: Thomson Reuters)

Domino's Pizza Enterprises Ltd

.png)

DMP Details

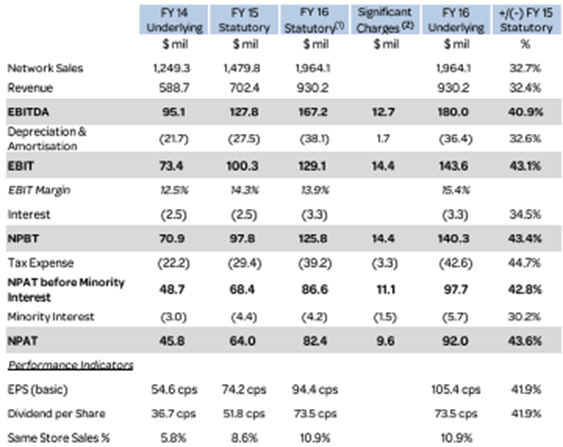

FY16 results met guidance:Domino's Pizza Enterprises Ltd (ASX: DMP) reported a net profit growth of 43.6% to $92 million in FY16 on network sales growth of 32.7% to $1,964 million against prior corresponding period. DMP reported earnings per share of 105.4 cents per share, a growth of 41.9% over the year. The results were driven by solid organic growth which drove Same Store Sales (SSS), leveraging sophisticated digital platforms while adding 484 stores to the Group. DMP posted the double digital SSS of 10.9%, with Australia and New Zealand (ANZ) recording its second consecutive year of double digit SSS of 14.8%. Europe reported strong Europe SSS of 8.2%, indicating the group’s ability to withstand tough conditions in the region.

Financial Performance for FY 16 (Source: Company Reports)

DMP is a big beneficiary of the digital shift with orders commonly placed on mobile apps by text message or emoji, with fast delivery times guaranteed. DMP has achieved all the guidance given by the company. Moreover, for FY 17 the company expects NPAT growth to be in the region of +30% and EBITDA growth to be in the region of +25%. DMP will also open between 175-195 new stores across the Group. The stock is trading ex-dividend on August 22, 2016.

DMP Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.