Charter Hall Group

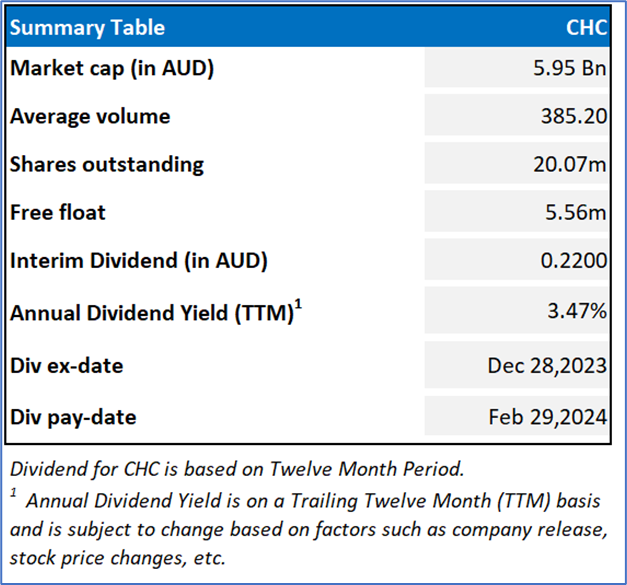

CHC Details

Charter Hall Group (ASX: CHC) is an Australia-based property investment management company.

Financial Results

- CHC announced H1 FY 2024 results for the period ending 31 December 2023. The company’s operating earnings post-tax was $195.1 Mn, which reflects operating earnings per security (OEPS) post-tax of 41.2 cents per security (cps)

- It posted return on contributed equity of 21.4%. At the end of the period, its property investment portfolio value stood at $2.8 Bn, some 4% of the Group’s property platform of ~$68 billion.

- The earnings resilience and diversification of the Property Investment portfolio is the key strength, combined with high-quality tenant covenant profile.

Outlook

Based on the no material adverse change in current market conditions, CHC has reconfirmed that FY 2024 earnings guidance for post-tax operating earnings per security of ~75cps.

Key Risks

The slowdown in global growth, volatility in the equity market, inflation, etc. are some of the risks CHC faces.

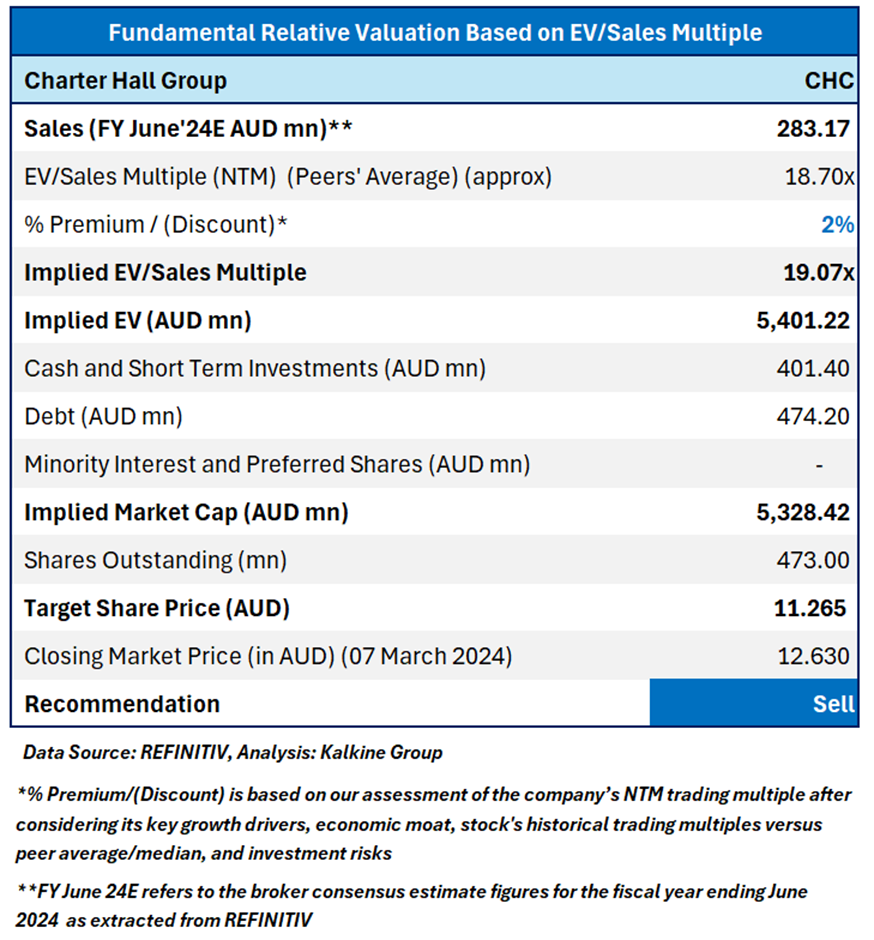

Fundamental Valuation

EV/Sales Based Relative Valuation

Stock Recommendation

During H1 FY 2024, the outflows impacting net inflows were predominantly because of secondary unit sales in the pooled funds, where selling demand was met by inflows from existing as well as new investors. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Moreover, fluctuations in the interest rates can also impact its performance.

Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of AUD 12.63 per share, up by 0.24% as on 7th March 2024.

Technical Overview:

Daily Price Chart

CHC Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on March 7, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.